Today we published our latest Economic Commentary.

Alongside our analysis of the Scottish, UK and global economies, we include the following articles:

- Reappraising Scotland’s exports and their geographies: Brexit and beyond, Ronald V. Kalafsky (University of Tennessee) and Ross Brown (University of Strathclyde)

- Monetary and fiscal policy in a newly independent Scotland: lessons from the dissolution of Czechoslovakia?, Frantisek Brocek (University of Strathclyde)

- Highlighting the need for policy coordination: the economic impacts of UK trade-enhancing industrial policies and their spill-over effects on the energy system, Andrew Ross et al. (University of Strathclyde)

Today’s Commentary also includes an examination of the hot topic of regional inclusive growth.

In this blog, we summarise some of the key points from our latest outlook.

- After a sustained period of weak growth and despite ongoing political uncertainty, the Scottish economy has been showing some signs of strengthening. Activity has picked up through 2017 and early 2018.

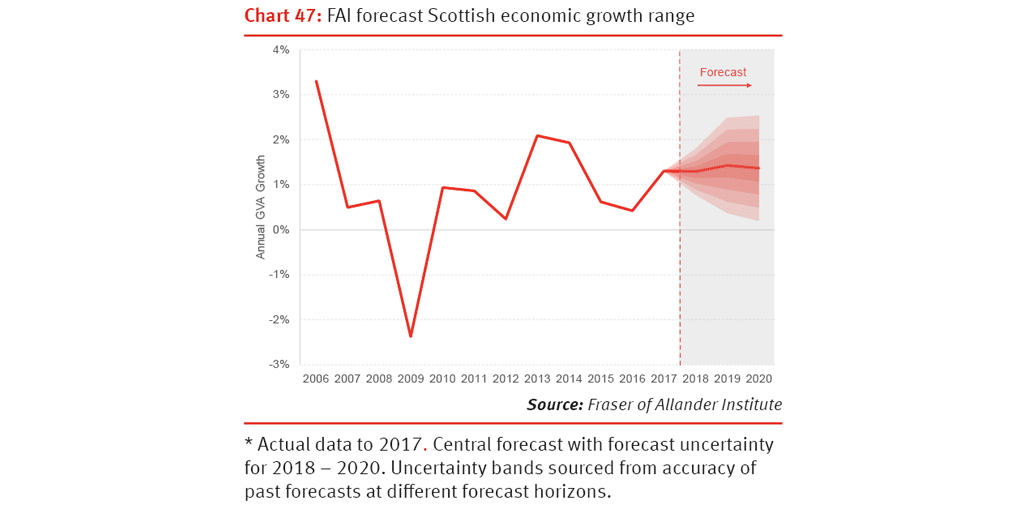

- On balance, we are cautiously optimistic that 2018 will mark a continued improvement in the Scottish economy, although growth is likely to remain below trend.

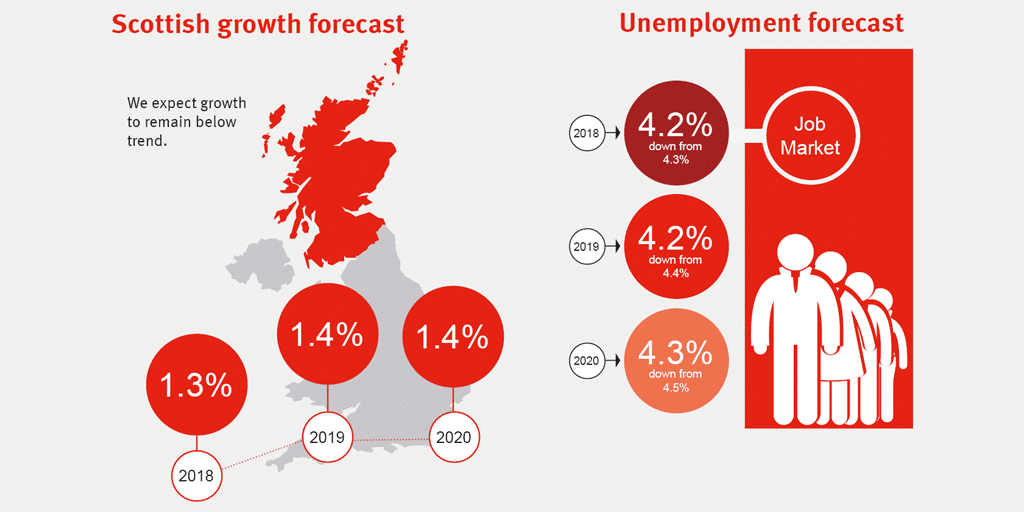

Our latest forecast is for growth of 1.3% in 2018 and 1.4% in 2019 and 2020.

There is an important caveat with these forecasts.

They are based upon a broad-based agreement between the UK and the EU being reached before March 2019.

Should this not happen, then our forecasts are likely to change significantly. However, with so many different factors – both economic and political – about what a ‘no-deal’ may look like, we have not forecast this scenario at this stage. An update will be provided in December when more details are known.

Our latest forecast puts us slightly more optimistic than the government’s own official forecaster the Scottish Fiscal Commission, who will update their forecasts this autumn.

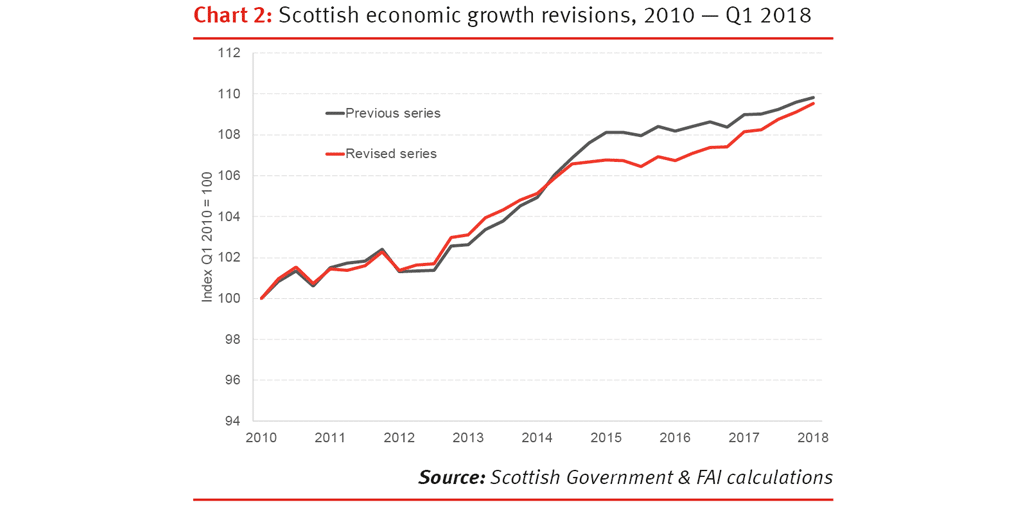

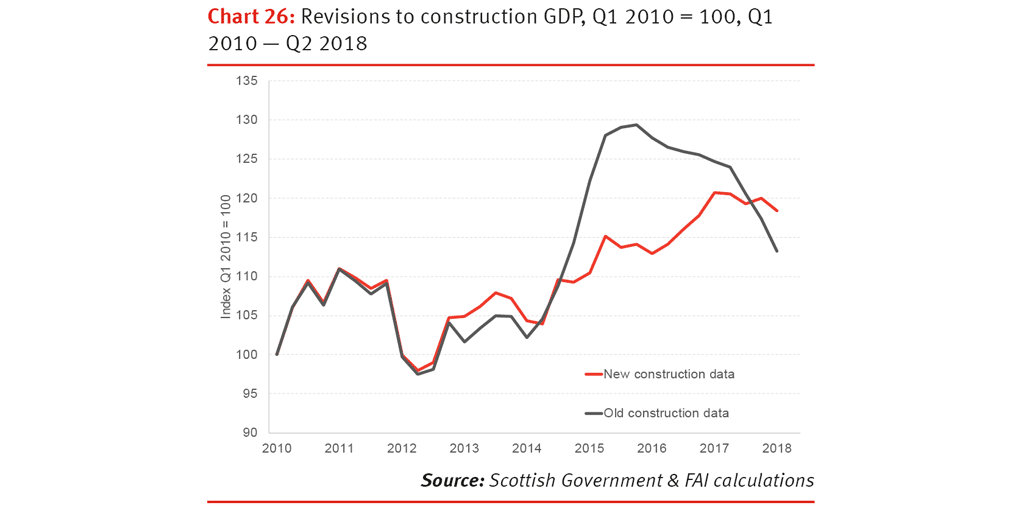

- Significant revisions – particularly to the Scottish Government’s official estimate of construction activity in Scotland – have changed the time profile of Scotland’s recent economic performance.

In particular, faster growth in 2016 and 2017 has been compensated by slower growth in 2014 and 2015.

In June, the Scottish Government published growth estimates for 2017 of just 0.8%. Now that figure is 1.3%.

That being said, the changes do not alter Scotland’s long-term growth profile (with GDP per head still rising by just under 2% over the decade).

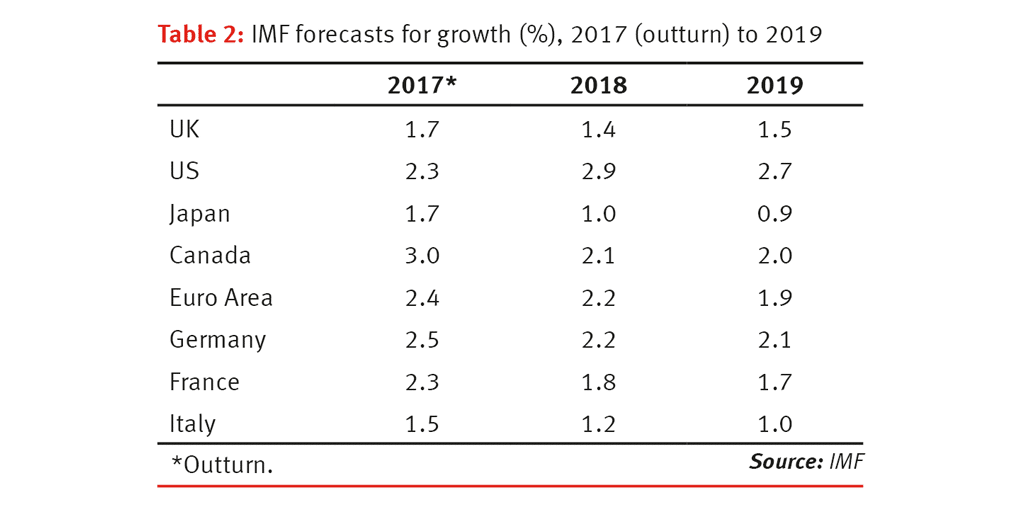

- The global economy remains relatively robust, with the slight easing in recent growth rates appearing to reflect a movement toward a more balanced type of growth, rather than a more significant slowdown.

Overall, there has been a gradual shift toward more sustainable drivers of growth such as trade, investment and wages across most major economies.

And whilst structural problems remain in Europe, overall sentiment and demand remains high.

Across the Atlantic, the US continues to power ahead driven by more confident households and increasing investment. US unemployment is on track to fall to its lowest rate in around 50 years.

Of course, there are risks to this outlook.

The Trump administration’s decision to increase tariffs on some European and Chinese imports, has escalated trade tensions.

The short-run impact of a trade war may be more modest than one might expect (relative to the geo-political consequences). But the potential damage to long-run prospects for growth is a concern.

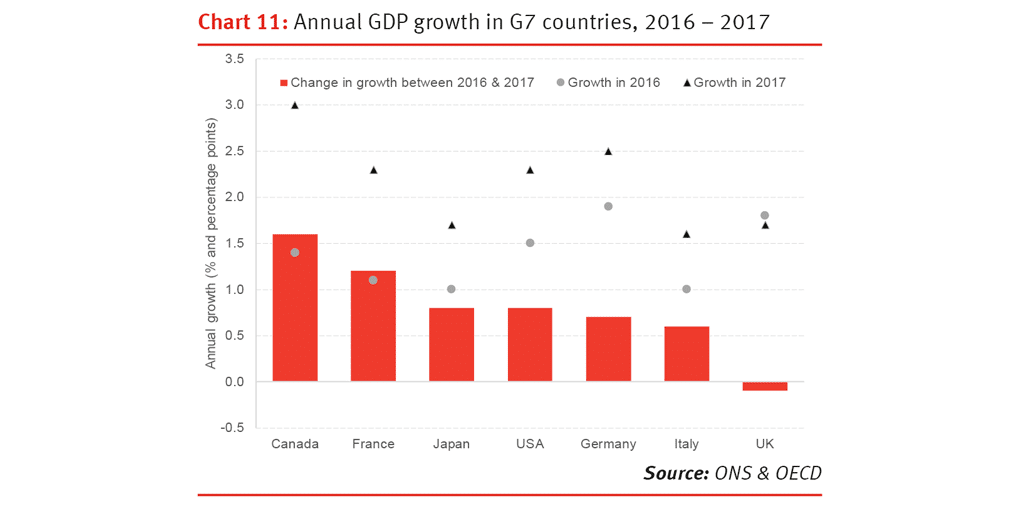

- UK growth has picked up over the summer – boosted in part by the summer weather encouraging households to spend more

Up to July, rolling 3-month growth of 0.6% was the highest since last summer

This pick-up follows a challenging start to 2018, and weak growth through 2017, when the UK lagged behind other G7 economies.

The growth in consumer activity has also been boosted by an upturn in real earnings. Over the year to July, real terms regular earnings increased by 0.5%. That being said, average regular pay remains around £11 per week lower than prior to the financial crisis.

As a result of this squeeze, the UK savings ratio (the proportion of income not spent each quarter) is at its lowest level in over 50 years.

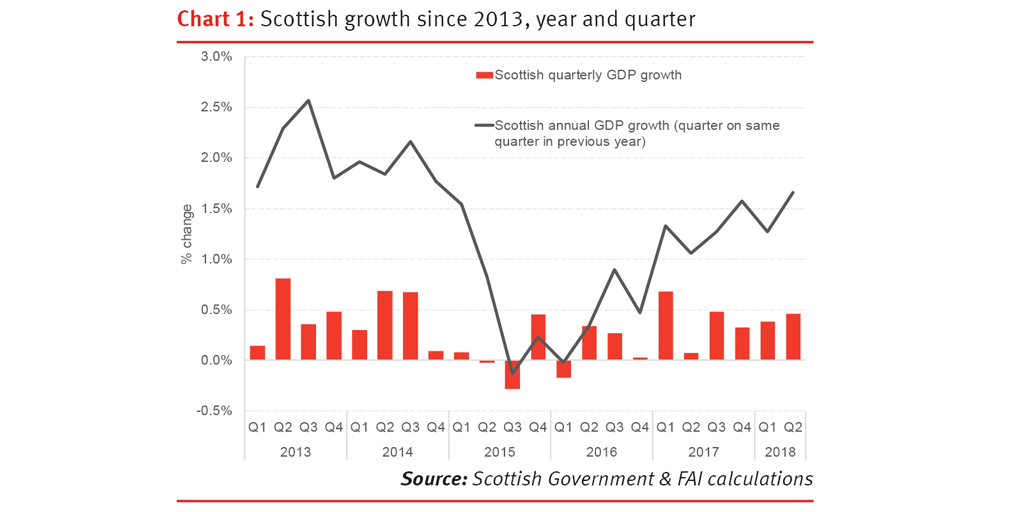

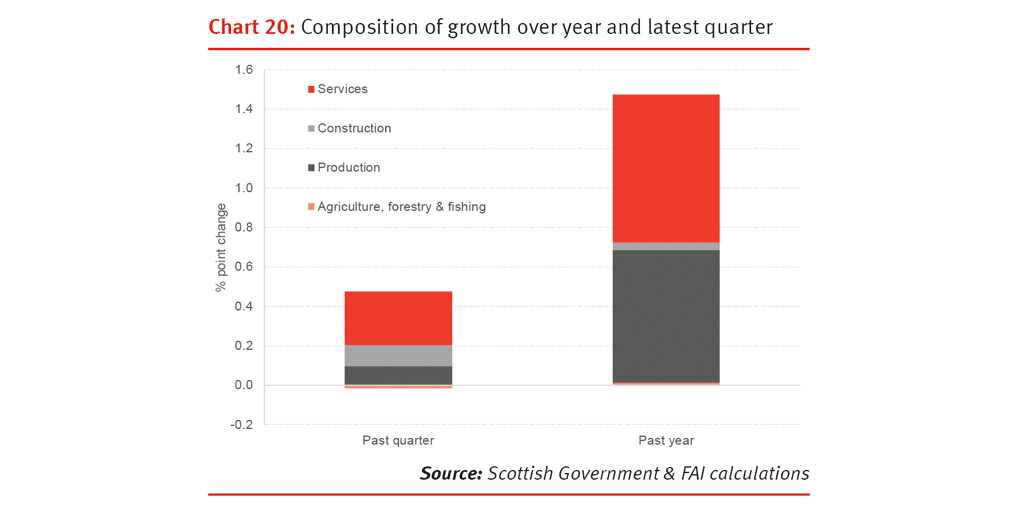

- Growth in Scotland over the last year has been relatively broad based.

Over Q2, there was growth of 0.6% in production activities, 1.8% in construction and 0.4% in services.

Some of this reflects a degree of cyclical catch-up with the UK having grown much more quickly than Scotland since 2014.

It also reflects the fact that the outlook for oil and gas – and its all-important supply chain – remains more positive than it has been in almost three years.

At the same time, whilst there is undoubtedly heightened uncertainty around Brexit, many businesses appear to be ‘looking-through’ such concerns and are getting on with day-to-day activities. But this is clearly fragile. And the apparent lack of contingency planning by many firms is a concern.

- Unemployment in Scotland remains low. But over the last year, there has been a weakening in labour market outcomes. Employment has fallen by around 40,000, whilst there has been a rise 7,000 in unemployment.

- Over the summer, indicators of day-to-day activity in the Scottish economy have held up relatively well.

This backs up the assessment we made in June that, despite Brexit uncertainty, underlying economic conditions have strengthened a little. We retain that cautious optimism.

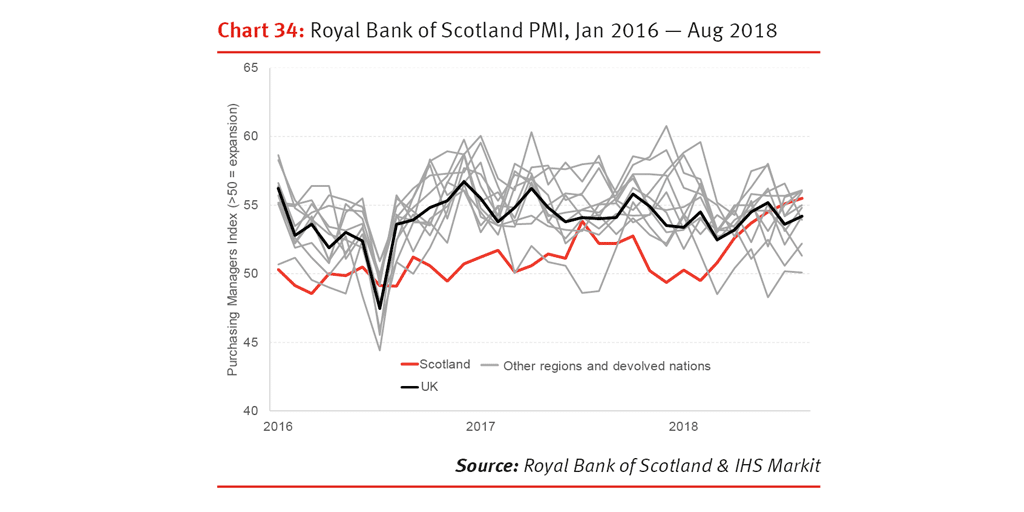

For example, at 55.5, the RBS Purchasing Managers Index (where >50 marks expansion; <50 marks contraction) is the strongest it has been in four years. Indeed last month’s figure was the first time since July 2016 that Scotland outpaced the UK average.

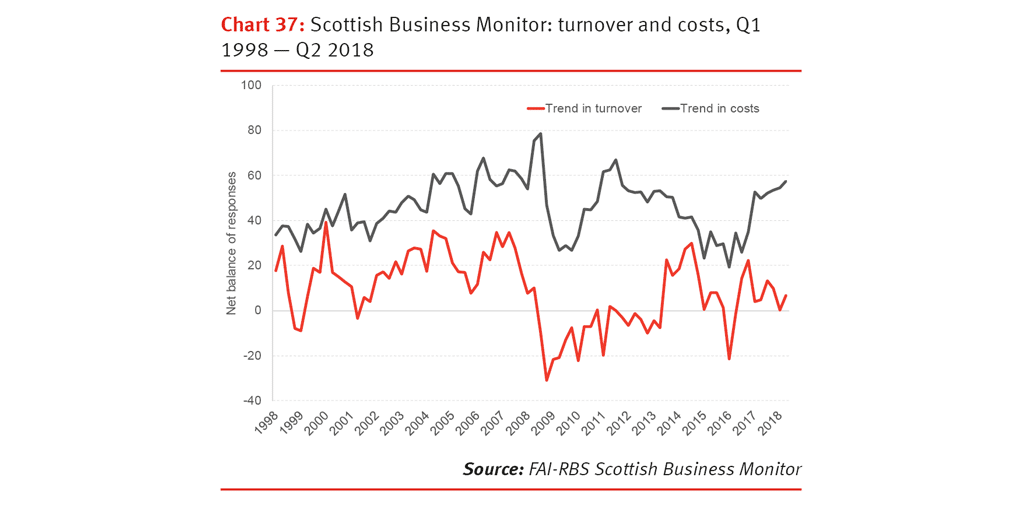

- Our Scottish Business monitor can track trends over time – having been published since 1998 – and therefore provides a valuable record of conditions in the Scottish economy.

Over time, we find that – on balance – when the gap between turnover and costs expectations becomes more negative, growth slows (and vice versa).

This suggests that we should remain cautious about the ongoing fragile nature of Scotland’s current economic conditions.

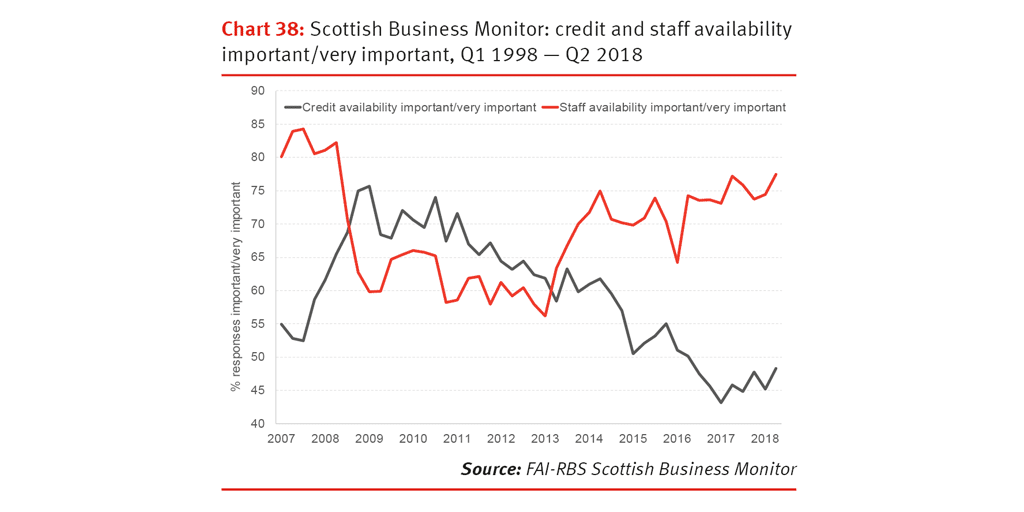

Another advantage of our Business Monitor, is the ability to track key issues over time.

Access to finance and access to workers is just one element. We find a sustained fall in the number of firms citing credit availability as an important issue for them (but rise in concerns over staff availability).

One interpretation of these data is that the current period of heightened uncertainty is leading businesses to meet any increase in demand by taking on more workers, rather than investing in new plant and machinery.

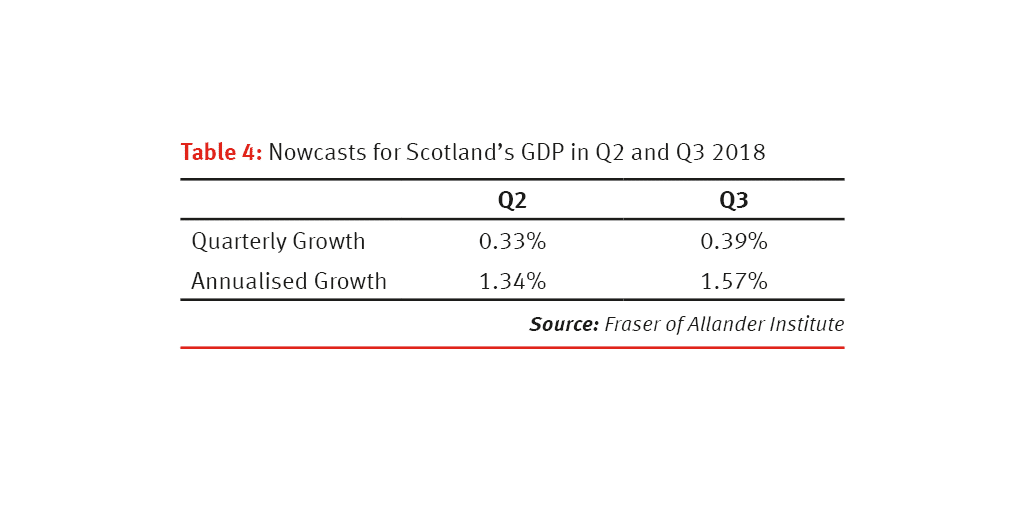

- Our latest nowcasts are consistent with the view that growth will continue at its current rate (and may even surprise on the upside), provided that a broad based agreement on Brexit can be secured.

Overall, our base forecasts are very similar to June. In short, we believe that the Scottish economy will grow this year, will quicken slightly over the forecast horizon, but growth will remain below trend.

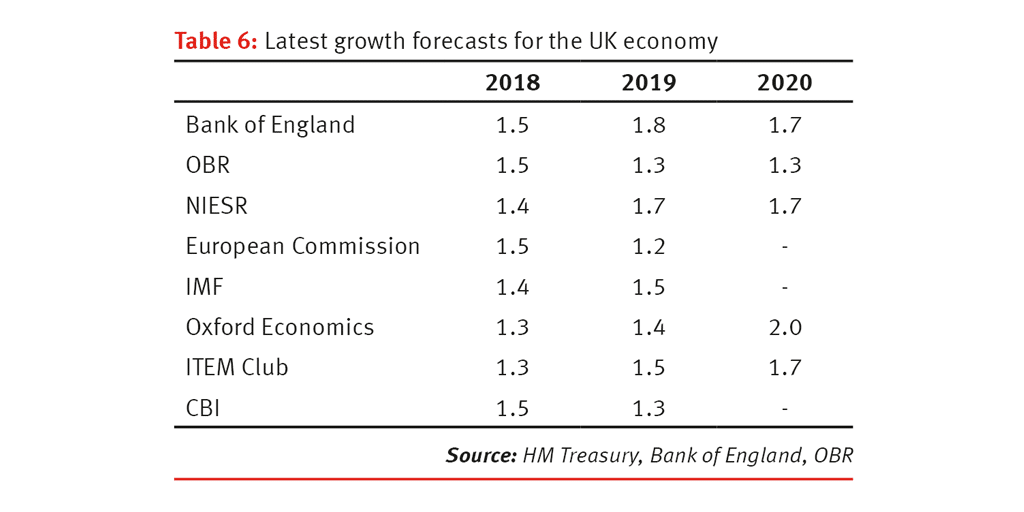

Our latest forecasts for Scotland put us broadly in line behind the consensus forecasts for the UK.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.