The fight against the coronavirus is continuing to take its toll on economic activity in Scotland. Official data capturing the direct impact of the pandemic on the Scottish economy is beginning to be released (see our article from earlier this week on labour market and Universal Credit data), but at the moment it only covers the first few weeks of the lockdown. In this week’s article we continue to look at some regular and new indicators on business activity/sentiment, the labour market, consumer demand, and prices to provide us with an indication of where we might be heading.

With the First Minister’s announcement yesterday about the easing in lockdown restrictions, there may be changes afoot but these won’t be captured in these statistics given the timing of her statement. However, there may have been some spillover from the Prime Minister’s announcements relating to England on the 10th May and a sense that change was on its way. By all accounts, conditions clearly remain challenging, and will no doubt continue to be so even as we move into the next ‘restart’ phase.

Business activity

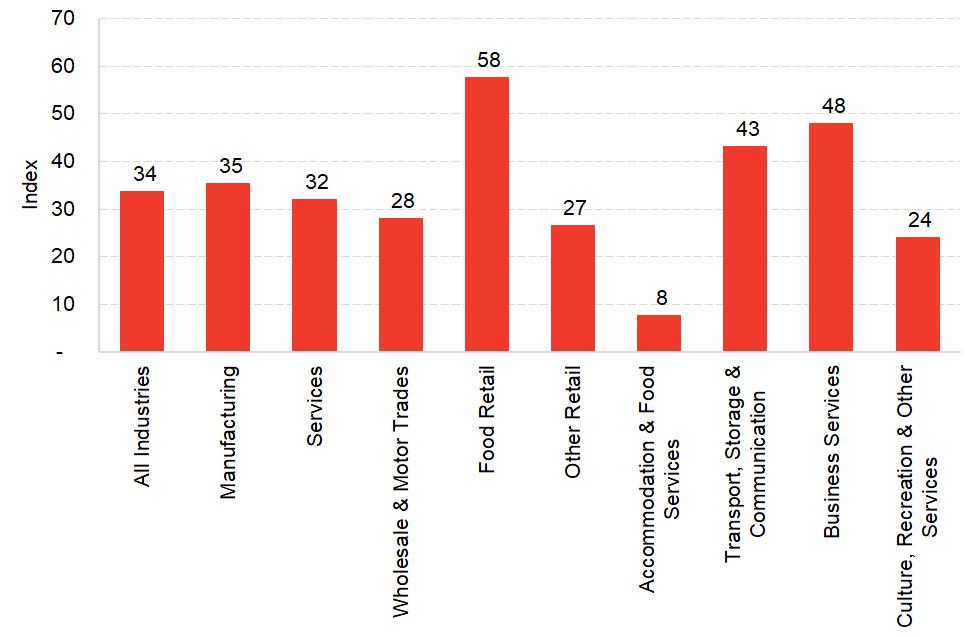

Surveys of businesses continue to tell us a familiar story – activity has fallen and certain sectors (non-food retail, accommodation and food services and recreation) are being affected more than others. The Scottish Government recently published its Monthly Business Turnover Index which allows us to track the impact the start of the lockdown had on firms’ revenues in the first quarter across different sectors. The index shows the net balance of firms reporting increasing or decreasing turnover compared to 12 months ago (values below 50 indicate that more companies are showing decreased turnover than increased turnover).

Chart 1: Scottish Government’s Monthly Business Turnover Index – March 2020

Source: Scottish Government

The index indicates that the slowdown in economic activity has been shared across most sectors of the Scottish economy. The increase in revenues in the food retail sector can be explained by stockpiling and panic buying during the start of the pandemic. The decline in turnover was sharpest in accommodation and food services, since social distancing rules forced most businesses in the sector to temporarily cease operating.

A recent survey carried out by the FSB found that the impact is particularly marked amongst small businesses. Over 60% of small businesses experienced a decline in turnover during the first quarter and nearly three in ten anticipate reducing employment in the upcoming months.

The most recent Scottish Chambers of Commerce (SCC) Coronavirus Business Recovery Survey was published this week based on surveys carried out between the 6th and the 14th May. It found that 87% of firms said lost income is their highest concern if the economy does not begin to open back up over the next two months.

On a more encouraging note, more than half of businesses (58%) surveyed by the SCC said they would need a week or less to get back up and running under a partial or complete end of the lockdown. 33% of firms have responded they would need 1-3 weeks to resume operations.

The FSB further found that 89.8% of Scottish businesses who continue to operate expect to have spare capacity in the next three months, compared to 81% in the UK. This suggests that businesses will be able to utilise this spare capacity to fulfil new orders relatively quickly once lockdown measures are eased, although this of course depends on whether demand for their goods and service picks up.

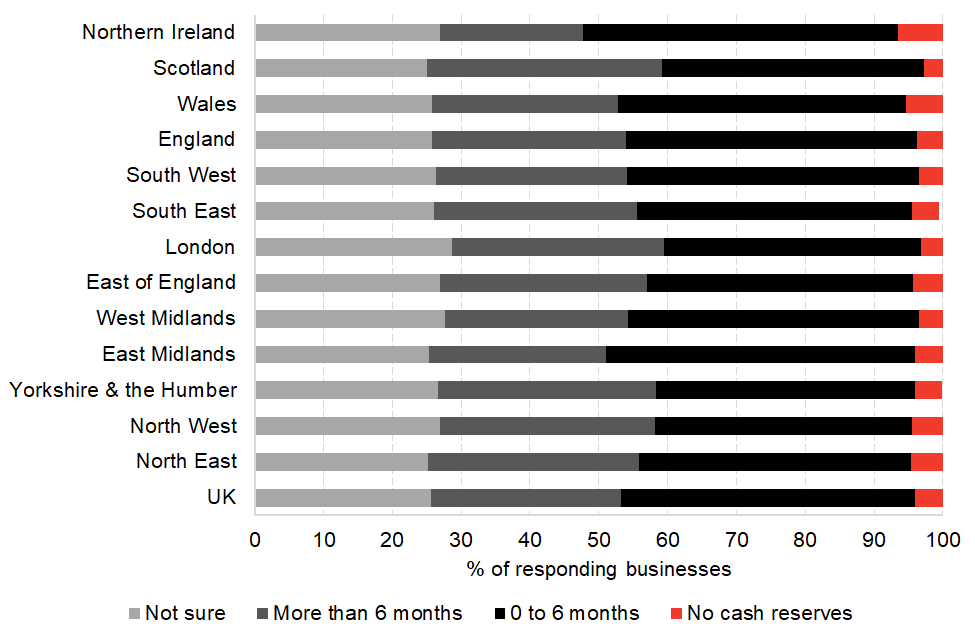

The decline in turnover has forced many businesses to rely on their cash reserves to finance their operations. The ONS BICS survey, carried out between 20th April and 3rd May, shows that 2.8% of businesses in Scotland have no cash reserves and 38.1% have cash reserves to allow them to operate only for between 0 and 6 months. Scottish businesses have a marginally better cash position compared to other regions of the UK.

Chart 2: Cash reserves of businesses, broken down by country and region (surveyed between 20th April – 3rd May)

Source: ONS Business Impact of Coronavirus Survey

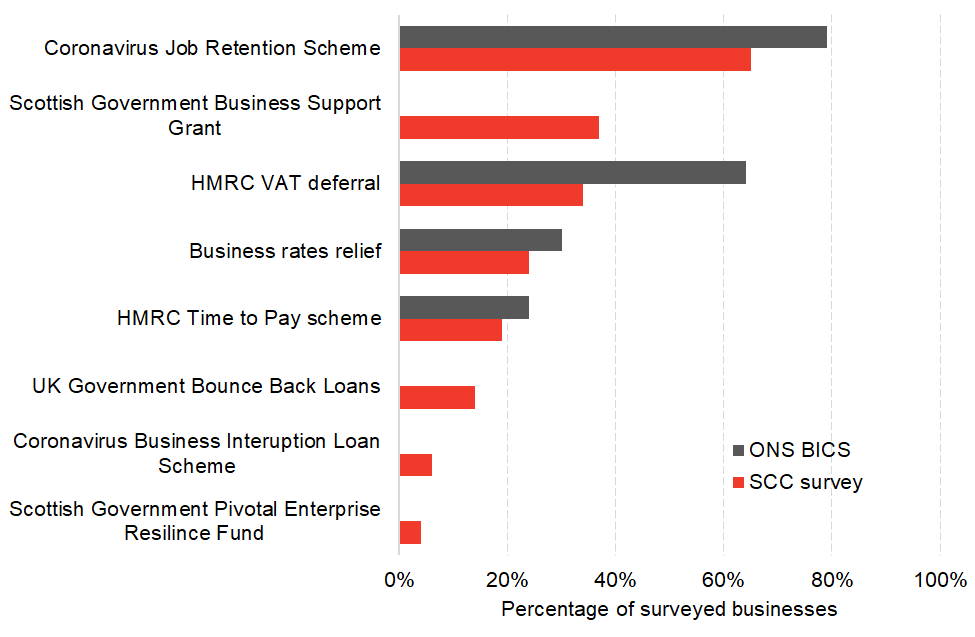

Many businesses have turned to government support schemes, but this will have been even more important for those with little or no cash returns in order to gain liquidity to allow them to continue operating. The SCC and an earlier ONS BICS survey asked respondents whether they have applied for the Scottish and UK governments’ support schemes.

Chart 3: Take-up of government support measures by businesses operating in Scotland

Source: SCC Coronavirus Business Recovery Survey, ONS Business Impact of Coronavirus Survey

Note: The SCC survey took place between 6th – 14th May and the ONS BICS between 20th April – 3rd May.

Looking at these two surveys together, the UK government’s job retention scheme has seen the highest take-up (between 60 – 80% of firms) and the Scottish Government Business Support Grants have also been a popular scheme used by over a third of the businesses.

According to the SCC, close to 40% of businesses have applied for a Business Support Grant (this question wasn’t asked by ONS).

The option of deferring VAT payments has also been used widely, although the two surveys found quite different results in terms of the share of firms using the scheme. This may have been due to the nature of the firms surveyed – for example in terms of how many are VAT registered.

The UK government has also started providing government-backed loans via private sector lenders under the Bounce Back Loan and Coronavirus Business Interruption Loan schemes.

Table 1: Loan funding support from the UK government as of 10th May

| Number UK approvals | Amount approved | Average amount approved | Estimated Scottish number approvals | Estimated Scottish amount approved | |

| Bounce back loans | 268,173 | £8.4 billion | £31,200 | 17,468 | £0.55 billion |

| CBILS | 35,919 | £6.1 billion | £169,700 | 2,340 | £0.40 billion |

| Large co CBILS | 59 | £359 million | £6.1m | 4 | £21.6 million |

Source: Scottish Enterprise estimates based on UK Government data

Scottish Enterprise has carried out some estimates of the total number of loans approved under the schemes. It found that circa £0.55 billion and £0.40 billion was awarded in total to Scottish businesses under the two schemes to date.

The data on businesses points to the fact that the decline in activity is indeed the largest in recent history and has been shared across almost all sectors, although it has affected some more than others. Government support appears to be widely taken up. As already noted, it will continue to be a challenging environment for the economy in the months ahead, even as the lock down starts to ease. As well as physical restrictions on opening continuing for many businesses, others will be dependent on consumer behaviour and demand.

Consumer demand

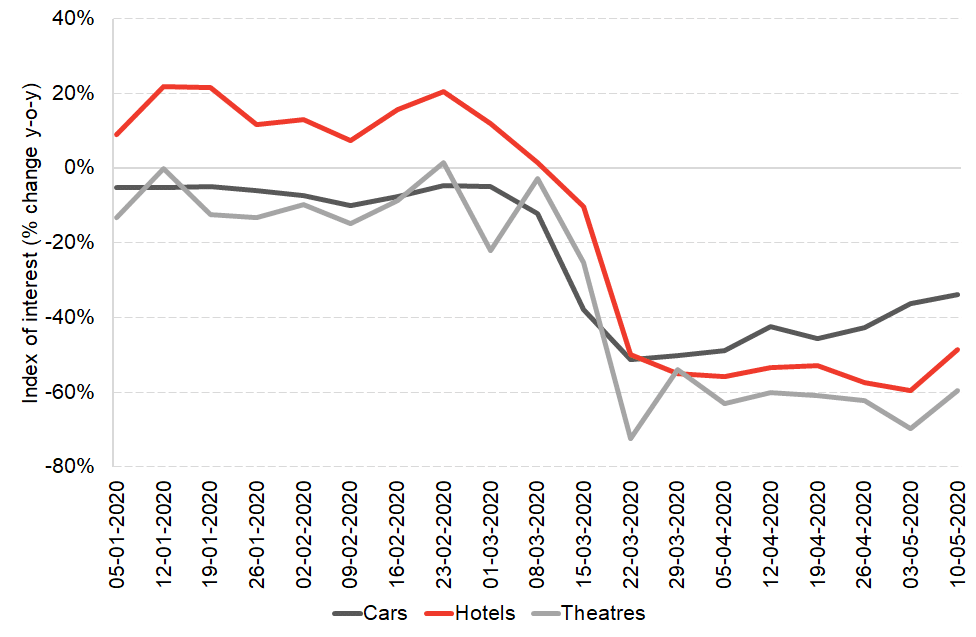

Consumer confidence has taken a hit as household finances have come under a strain and people are limited in where they can spend money even if they would like to. Here we look at data on Google searches for cars, hotels, and theatres as a possible timely indicator of consumer sentiment.

Chart 4: Google searches for various products and services in Scotland

Source: Google Trends

Note: For cars the reported value is the average of the search index for UK’s top 6 most sold car brands.

The data shows that between 10th and 16th May interest in cars remained 34% lower compared to the same week last year. Interest in hotels was 49% lower and interest in theatres was down 60%. Despite being very low by historical standards, the index of interest was highest for both cars and hotels since the beginning of the lockdown. This cannot be viewed as a sign of anything like a recovery yet but indicates that consumers may be thinking about future purchases as signs of lockdown easing come into view.

Labour market and household finances

The fall in consumer demand and business confidence has translated into a slowdown in the labour market. Earlier this week we published an article providing preliminary analysis of the recent labour market data released by the ONS. The data shows that we have seen a fall in employment, hours and pay and this has fed through to Universal Credit claims. However, the LFS only covers the period up until the end of March and the DWP data on universal credit claims for Scotland only runs up until mid-April.

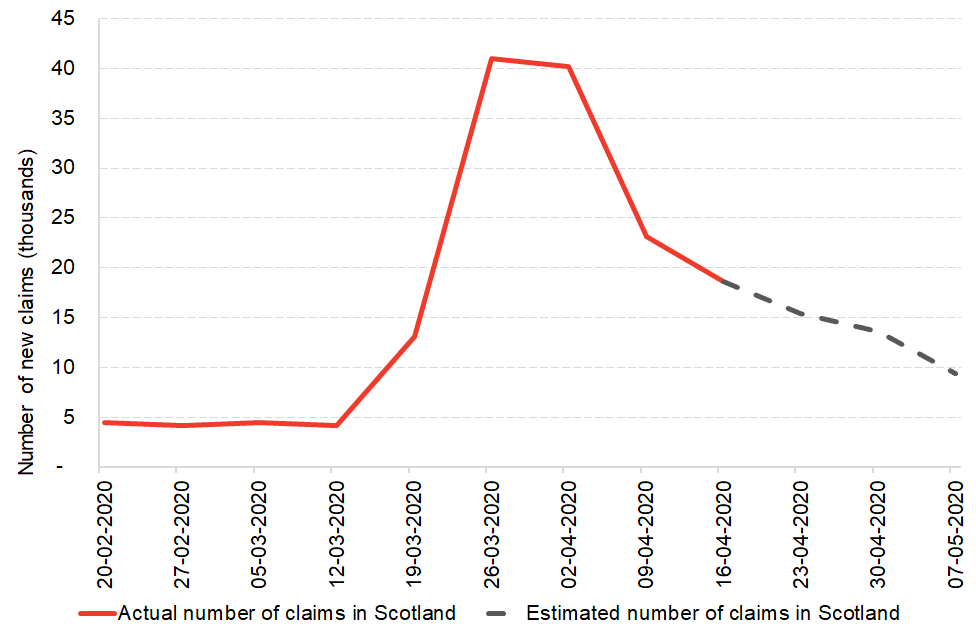

Loss of income will translate into claims for support from the social security system for those that don’t have significant earnings or other income in the household to fall back on. Chart 5 shows that the number of universal credit claims peaked in w/c 26th March and 2nd April. Afterwards the weekly number of new claims has been decreasing, despite remaining above the levels seen prior to the lockdown.

The DWP publishes weekly management information on universal credit claims for the UK. The latest release covers data up until 12th May. This UK level data shows that new claims are continuing to ease, and if we applied this to Scotland (by applying the average share of claims made in Scotland from the outturn data to the weekly management data for the UK) we can get a very rough estimate of what the number of claims may have looked like in Scotland from w/c 16th April.

Chart 5: Weekly number of universal credit claims in Scotland

Source: DWP

Note: The final data point for w/c 7th May only covers 6 days for which data is available (7th – 12th May). For the actual number of claims in Scotland the figures are compiled by summing postcode district data (based on claimant addresses) published by DWP. This is the only geographical basis on which this data is made available for Scotland. The estimate for claims after 16th April is obtained by multiplying the average share of actual claims in Scotland between 20th February and 16th April by the total number of claims made in the UK each week from the DWP management information.

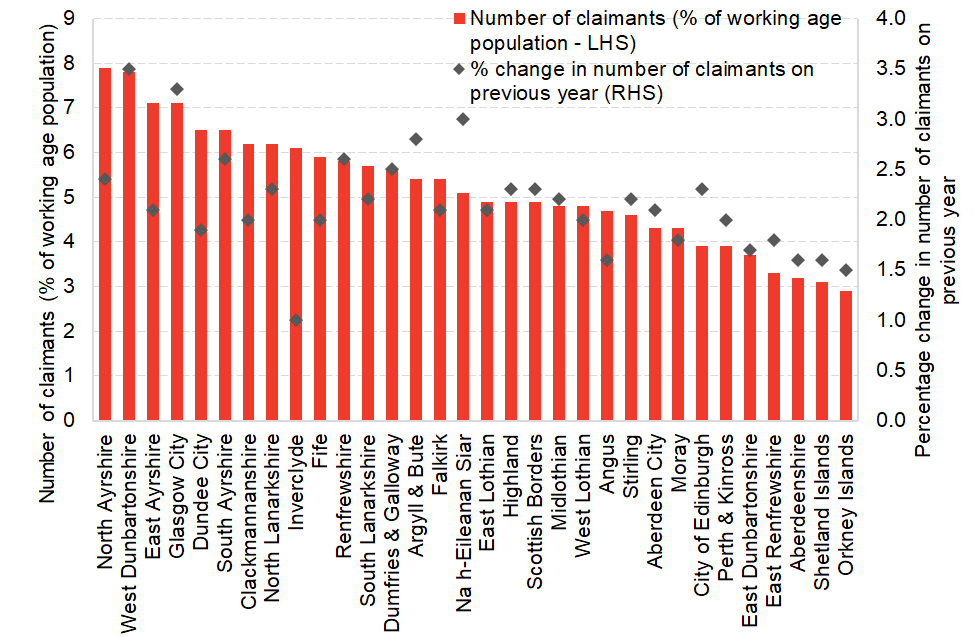

Experimental data from the ONS on Universal Credit claimants who are out of work, and the legacy Job Seekers Allowance benefit (no longer open to new claimants), can be used to provide an indication of which regions have been most affected by the deterioration in the labour market.

Chart 6: Claimant count across local authorities in Scotland as at 9th April 2020

Source: ONS

Note: The experimental Claimant Count consists of claimants of Jobseekers Allowance (JSA) and some Universal Credit (UC) Claimants. The UC claimants that are included are 1) those that were recorded as not in employment (May 2013-April 2015), and 2) those claimants of Universal Credit who are required to search for work, i.e. within the Searching for Work conditionality regime as defined by the Department for Work & Pensions (from April 2015 onwards). Percentages of population aged from 16 to 64 based on mid-year 2017 population estimates.

We can see that during the first 3 weeks of the lockdown (the period when the number of Universal Credit claims rose the most) Glasgow City and West Dunbartonshire saw the highest increase in new claimants for out of work benefits compared to last year. West Dunbartonshire and North Ayrshire had the highest number of claimants as a share of the working age population. Angus, Aberdeenshire, the Orkney Islands, South Ayrshire, and Inverclyde have been the least affected so far in terms of recourse to out of work benefits.

These data show that despite the rise in the number of people out of work in Scotland, the magnitude of the effect has varied somewhat across different regions. We have discussed this issue in greater detail in our article yesterday.

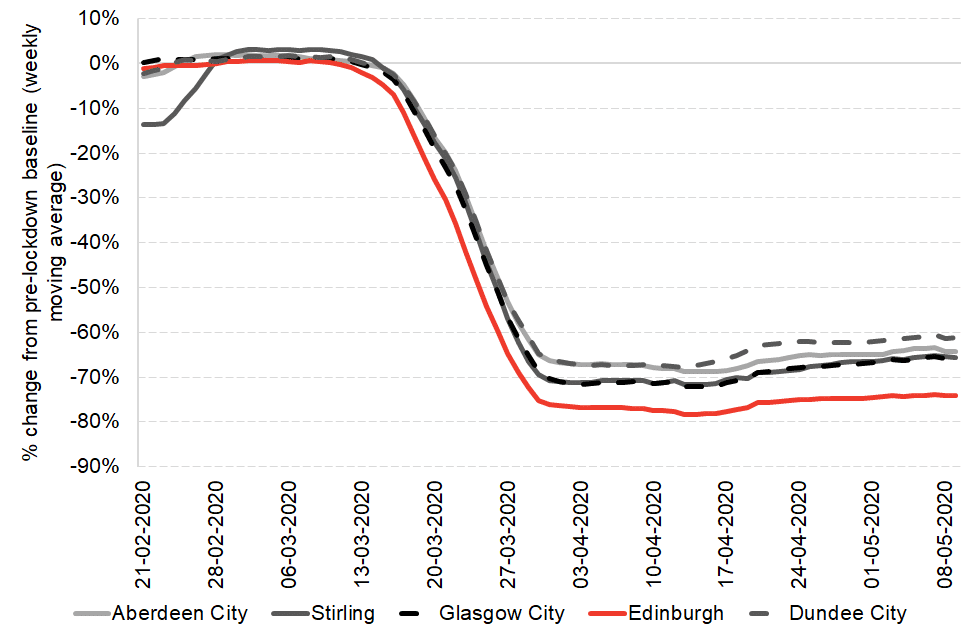

No significant change could be seen in travel to workplaces during the first week of May across major Scottish cities. This is in line with expectations as Scotland has still not changed any of its guidelines with respect to working from home. As a result, no significant changes to hours worked and labour supply can be expected yet.

Chart 7: Visits to workplaces in major Scottish cities

Source: Google Mobility Trends Report

Note: Pre-lockdown baseline is the median value for the corresponding day of the week during 3rd Jan – 6th Feb 2020)

Inflation and the housing market

Lower consumer demand for products and services and a fall in households’ purchasing power since the start of the lockdown has put downward pressure on prices. This week the ONS published data on inflation showing that prices in the UK only grew by 0.9% in April, compared to 1.5% in March. According to the ONS, the major factors contributing to the lower growth rate between March and April were a fall in household and housing services and transport costs. The fall in transport costs was driven by lower demand for oil (an estimated 70% decline globally due to Covid-19) which has forced oil prices to reach a 21-year low. This is of relevance to Scotland due to its share of oil revenue from the North Sea.

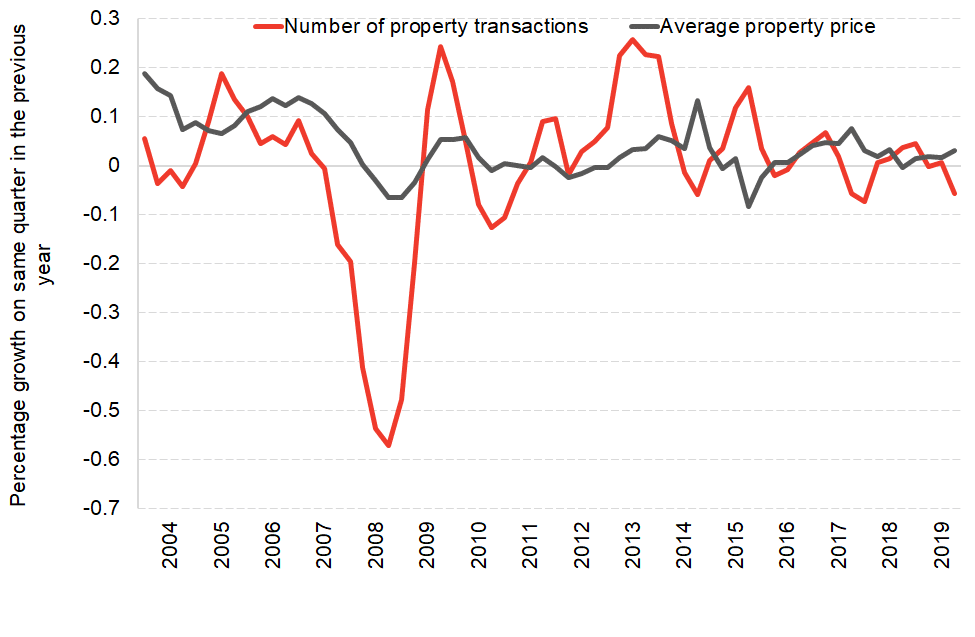

This week Registers of Scotland published data on house prices and the number of transactions in Scotland. The data covers the first quarter of the year and since transactions take 6-8 weeks to complete, the data reflects the situation in the housing market in the weeks prior to the lockdown.

Chart 8: House prices and transactions in Scotland

Source: Registers of Scotland

House prices in Scotland grew by 3% in the first quarter of 2020 compared to the first quarter of last year. The number of transactions fell by 6% year on year, indicating that the Scottish housing market was already slowing down slightly prior to the lockdown.

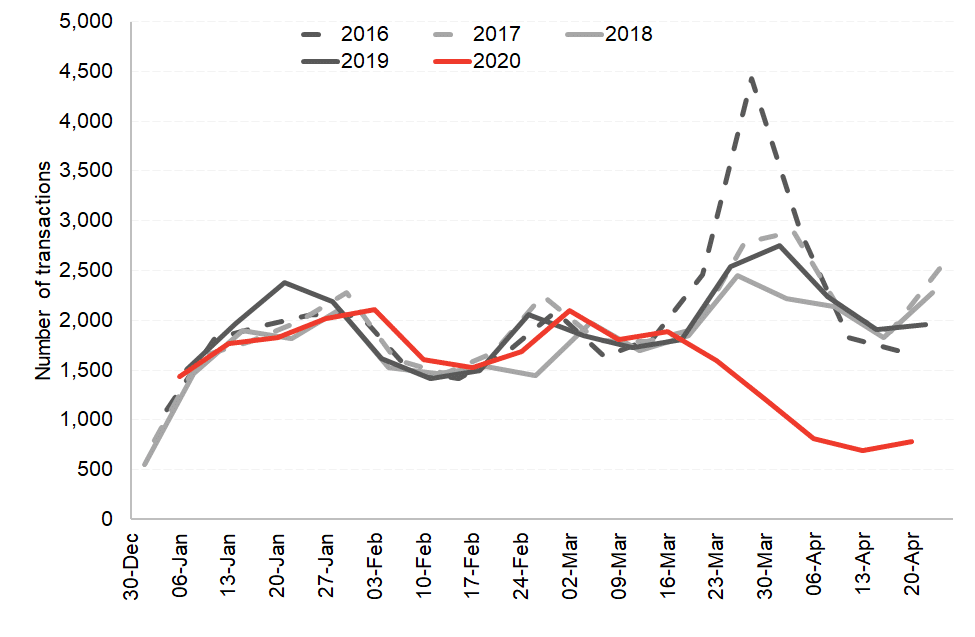

Chart 9: Number of LBTT returns submitted in Scotland by week

Source: Revenue Scotland

Data from Revenue Scotland indicates that the number of property transactions in Scotland fell by over 60% towards the end of April compared to the same week last year. Since the lockdown was put in place housing demand in the UK fell by 70% from early March according to Zoopla. 373,000 property purchases worth £82bn were put on hold since the start of the pandemic. Some have started go through, and many of these transactions should proceed once lockdown measures are eased. However, England reopened its housing market last week, but a full-scale lockdown still remains in place for the Scottish housing market for now. This could cause a divergence in developments between the two countries.

Summary

This week’s labour market data shows that the UK economy has experienced a significant increase in the number of people having to rely on the welfare system due to job losses in the weeks immediately after the lockdown was put in place. In subsequent weeks the number of new claims remained well above trend, but it has slowly started to decrease. Economic activity, as we would expect, does not appear to be changing. Most Scottish businesses are continuing to take up support in the form of grants from the Scottish Government and emergency loan funding from the UK Government. It is worth reiterating how important these schemes have been in preventing further job losses.

Consumer and business sentiment obviously remain well below what they were compared to last year and prior to the lockdown. The fact that there are a number of firms that are reporting that they will able to resume production relatively quickly once lockdown measures are eased means that there is hope for economic activity starting to stir once the lockdown starts to be eased from Thursday 28th but many won’t survive. The current situation of the economy operating well below capacity and remaining on life support from the government is likely to continue for some time. The First Minister’s cautious tone continues, and we will expect this to feed through into the guidance for businesses due to be published in the next few days. Although the pulse is still there, it will still be a while before the economy can be revived.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.