This morning the ONS released the latest data from the Labour Force Survey. This is the main source for high quality data about what is happening in the labour market in the UK, and the regions and nations.

Today’s data cover the period up to the end of March, and so include the initial period of lockdown in the UK following in late March.

Data from DWP on new claims and new starters onto the main out of work benefit, Universal Credit (UC), were also released this morning. They cover broadly the period to mid-April and give us an indication of those turning to the social security system for support following a drop in their earnings in the first few weeks of the lockdown.

This article provides an overview of what this data tells us so far. Overall, we have seen a fall in employment, hours and pay and this has fed through to Universal Credit claims. As charts later on in this article show, some of the shifts that have happened in these data are unlike anything seen before. Undoubtedly, these figures would have been a lot worse without UK Government schemes, such as the Coronavirus Job Retention Scheme (CJRS), but even so, it appears that many households in Scotland are facing a significant financial impact.

Employment, hours and pay

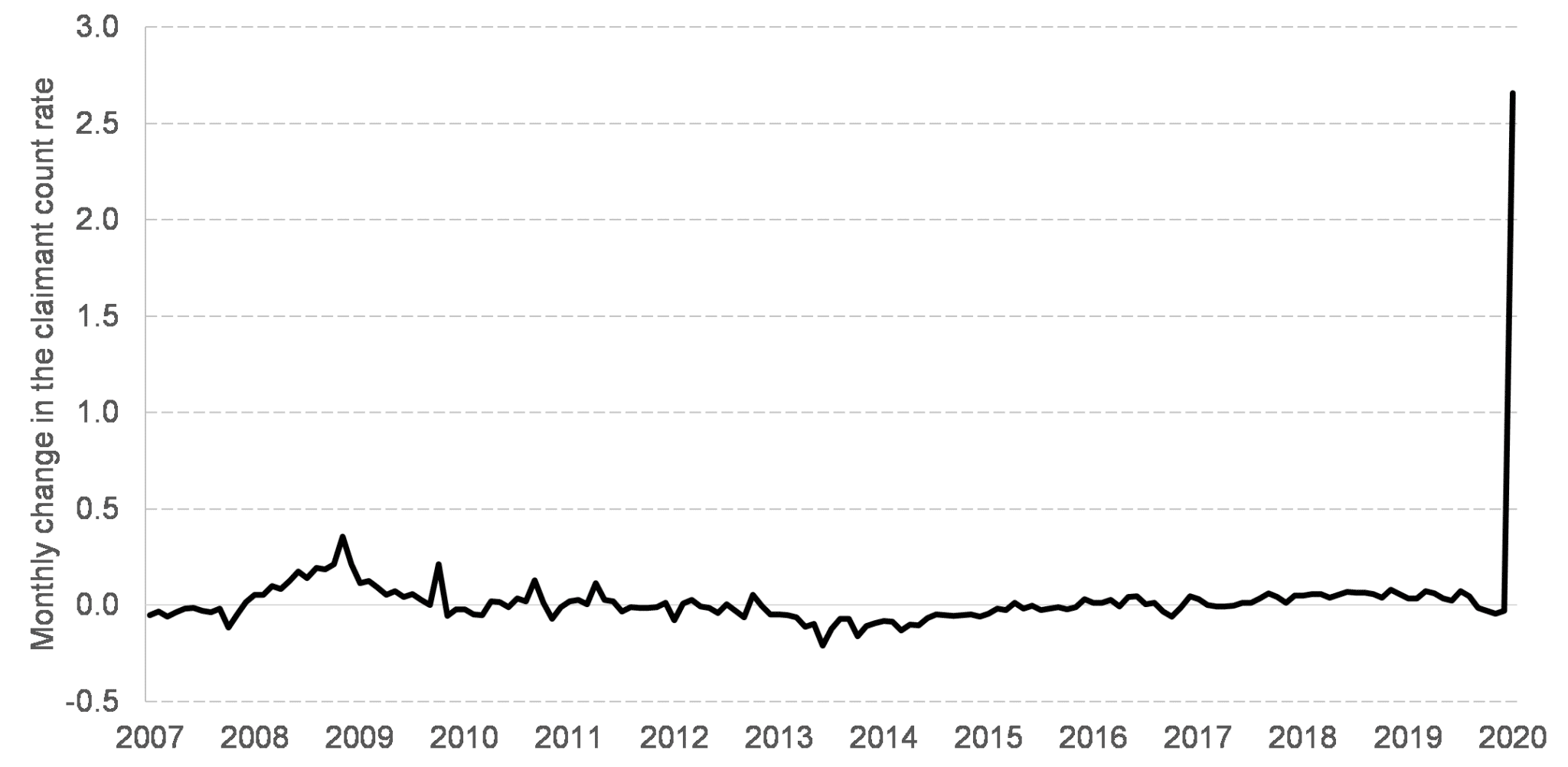

The most startling data that was released from the ONS today was on the Claimant Count. This is experimental data for Scotland capturing those who are claiming some form of out of work support. Month to month changes in this measure are summarised in Chart 1. This serves to underline the substantial change in the labour market that we are seeing.

Chart 1: Monthly changes in the claimant count rate to April 2020, Scotland (experimental statistics)

Source: ONS

Most headline labour market statistics from the Labour Force Survey are based on a rolling three month average – meaning that the latest statistics, for January to March only catch a glimpse of the economic disruption caused by the start of the shutdown.

This is part of the reason for the rather mixed bag of headline statistics in Scotland and the rest of the UK.

Unemployment rate in Scotland rose by +0.6% to 4.1% in the three months to the end of March, at the same time UK unemployment rose +0.1% to 3.9%.

The employment rate in Scotland dipped by -0.3% over the same period – and now sits at 74.7%. This is still lower than that of the UK as a whole which sits at 76.6%, up +0.2% this quarter.

The other reason is that those employees who are furloughed, or those who are self-employed and claiming the self-employment support that has been put in place, are classed as still being in employment. Albeit they are recorded as being away from work and hence their hours worked are zero.

This applies to both this quarterly data and the monthly claimant count data. Without the support put in place by the UK Government, the claimant count statistics would look even worse.

The excellent briefing paper on the effect of CoVid on labour market statistics produced by the ONS (see here), has more details on how these support schemes have been treated in the data.

As yet, we do not have data on any changes in hours worked in Scotland. Data for the UK shows a dip in hours over the three month period to the end of March, but this may be explained by the introduction of the furlough scheme and hence the number of people recording zero hours worked.

However, there are likely to be others in the workforce who are remaining at work, but being required to work fewer hours and hence will have lower pay.

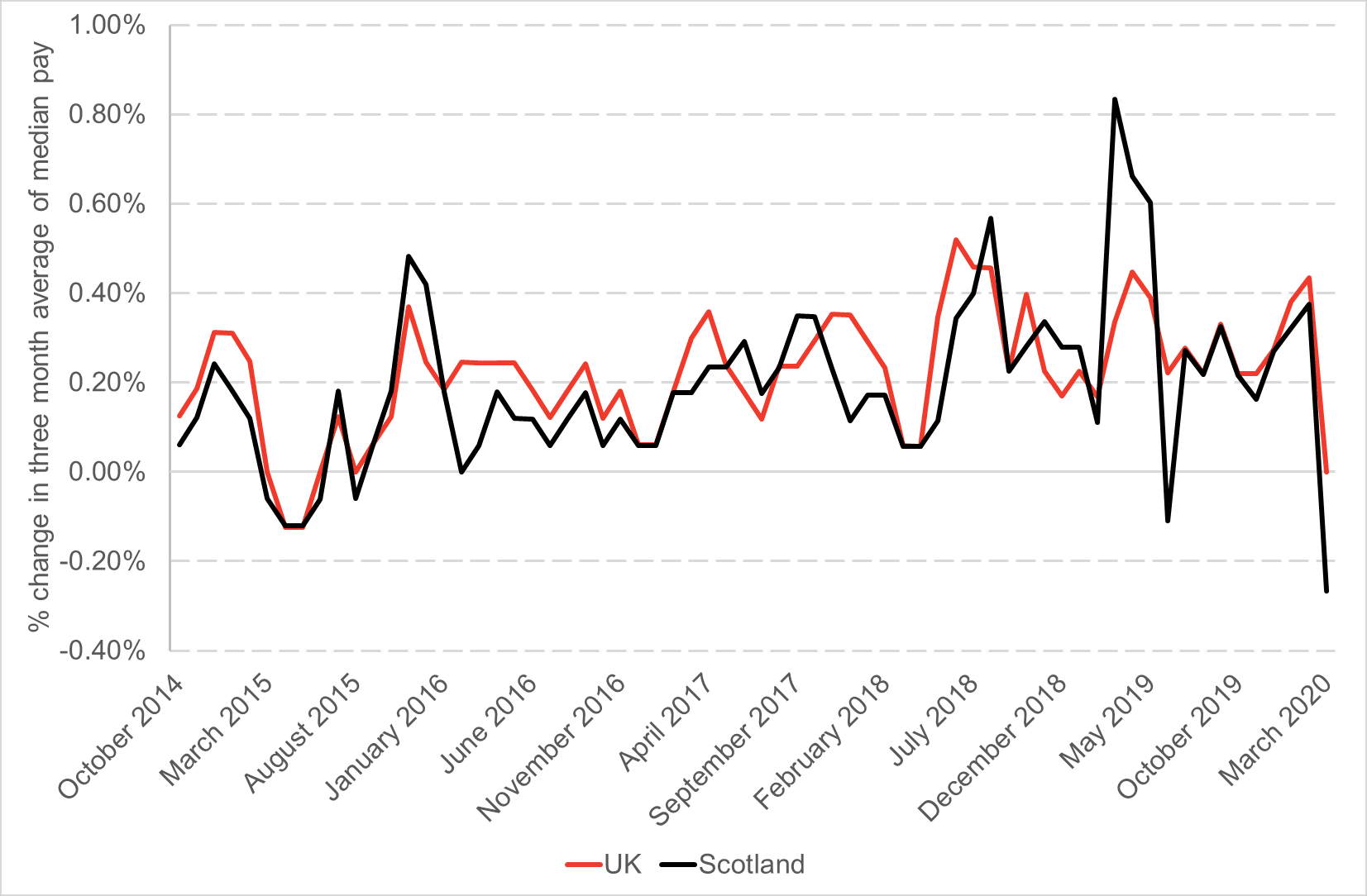

Data released by HMRC based on their Real Time Information system show that there has been a fall in median pay in the three month period to March compared to the three month period to February for Scotland. This data is not simple to interpret as it does not tell you how many workers there are – so for example, a fall in median pay may be a fall in pay for the average worker, or a big reduction in the number of higher earners (or indeed a big rise in the number of low earners).

Chart 2 shows the monthly series over time for Scotland and the UK as a whole. Although often volatile, the fall in the three months to March is notable.

Chart 2: Three month rolling average of median pay – Scotland and UK

Source: HMRC

Universal Credit

So how are these trends in employment, hours and pay feeding through to household finances? From looking at new claims to Universal Credit, it is clear that many people need additional help from the state to get by. These may be those that have lost all their earnings and have fallen between the cracks of the government income replacement schemes, for example newly self-employed, directors of company who are paid via dividends and indeed any employee whose company has not made use of the furlough scheme.

There may also be a number of self-employed people, who are eligible for the Self Employment Income Support Scheme, but are (legitimately) applying to Universal Credit as a stop gap until that money comes through in June. This means we may see an outflow from UC by these people in a couple of months time.

As well as those who have become unemployed, we may be seeing new claims from those who have seen a drop in hours meaning they have become eligible for ‘top-up’ support from the Universal Credit system.

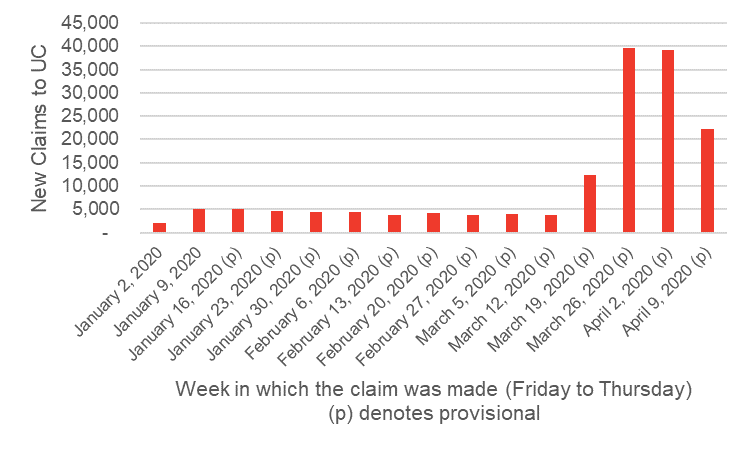

Chart 3 shows new claims to Universal Credit. For reference, the lockdown was announced on the evening of March 23rd (although restrictions on some businesses were put in place before this) and it is during this first week and the next week that claims were at their highest, falling a little lower (albeit still much higher than ‘normal’) in the third week of lockdown.

Chart 3: New claims to Universal Credit up to April 9th 2020 – Scotland

Source: DWP

*Note these figures are compiled by summing postcode district data (based on claimant addresses) published by DWP. This is the only geographical basis on which this data is made available for Scotland.

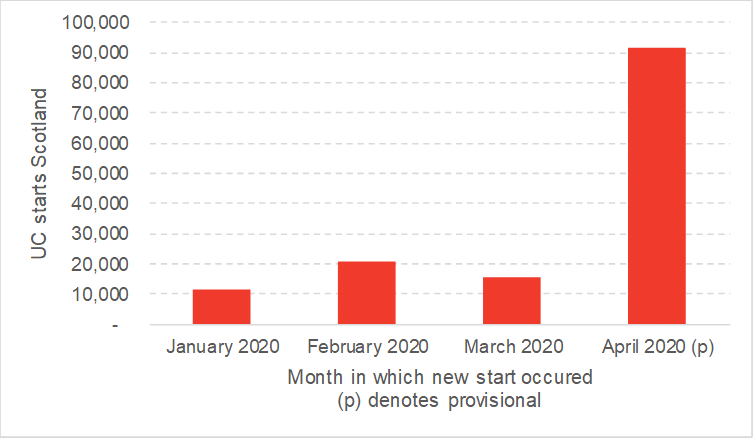

Not all initial claims to Universal Credit are successful. Chart 4 shows how these new claims have filtered through to new starts on universal credit. According to the DWP definition, a starter to Universal Credit is defined as an individual who has completed the Universal Credit claim process and accepted their Claimant Commitment. It does not mean that the first payment has been received.

The reporting month in relation to starts to Universal Credit relates to a period from the Friday following the second Thursday in the previous month to the second Thursday in the current month and therefore not all the claims shown in Chart 3 will have been necessarily processed. Even so, new starts are up by over 90,000 in April 2020, clearly far above ‘normal’ caseloads.

Chart 4: New Starts to Universal Credit – Scotland

Source: DWP

*Note these figures are compiled by summing postcode district data (based on claimant addresses) published by DWP. The figures differ from the figure published by DWP for JobCentre Plus districts in Scotland which is the other geographical basis on which these data are available.

Concluding thoughts

Despite the unprecedented support put in place by the UK Government, it was always expected that we would see some detrimental impacts on employment and household incomes.

The fact that large parts of the economy was shut down overnight means that a sharp increase in unemployment is also not unexpected, and this in turn has translated into a spike in Universal Credit claims and new starts. Data for UC claims into April show that the rate of increase in claimants has slowed, albeit it remains far above normal.

The data next month will tell us more still, but it will only be when we see more substantial unwinding of the employment support packages later in the year that the full effect of CoVid-19 on the labour market will be realised.

Given we now know the scale of some of the initial impacts, governments will need to be thinking carefully about what else needs to be in place to give those people who are really struggling financially adequate support and to help people back into the labour market when conditions allow.

We will produce further analysis this week looking at some of today’s data in more detail.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.