So, following up from last week’s news that the UK is in recession, we’ve had official confirmation that Scotland is also. Monthly GDP statistics published this morning by the Scottish Government confirm that the economy contracted by 19.7% in Q2, following a contraction in Q1 of 2.5%.

These figures are very similar to the contractions at the UK level. Two quarterly contractions in a row mean a recession is confirmed. Given the similarity to the UK contraction, this also means that Scotland is not performing well when compared internationally, with Spain the only country in the EU or G7 to see a bigger contraction since the end of last year.

What does this tell us about how the economy is faring, and crucially, recovering?

Monthly figures

Underneath the quarterly figures, the monthly figures allow us to better track the path of the pandemic and associated lockdown.

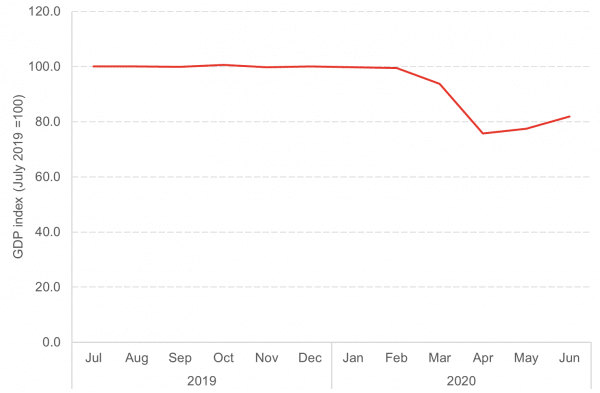

Chart: GDP index, July 2019 =100

Source: Scottish Government

We can see that after falls in March and April, when the restrictions were at their peak, the economy started to expand slightly in May, and slightly faster in June, as more businesses were able to operate. The Scottish economy expanded 5.7% in June as a result of easing of restrictions. Interestingly, this was less than the 8% at the UK level.

We can see from the chart above the any recovery from the pandemic is likely to be slow, and not very reminiscent of the “V” shape that some optimists talked about at the beginning of the pandemic. Our expectation is that this shape of recovery is likely to continue into next quarter.

How are different sectors doing?

Digging under these numbers shows the sectors that have been hit the hardest by the pandemic, highlighting the scale of the challenge and how slowly they are recovering.

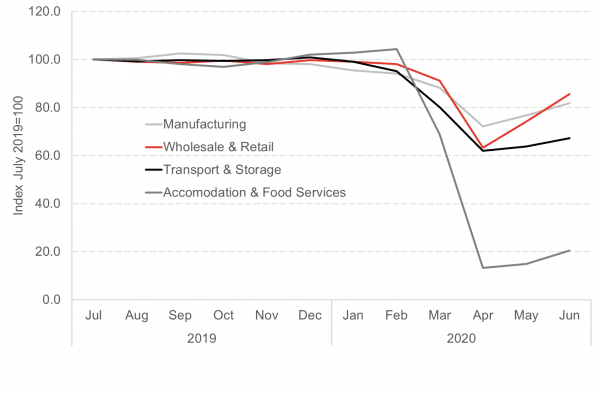

Chart: GDP index, selected sectors, July 2019=100

Source: Scottish Government

Accommodation and Food Services has been the hardest hit sector, with output falling 87% between February and April 2020. We can see that all of these hard hit sectors are recovering slowly, A&F and Transport and Comms in particular are going to take many months and probably years to get back to pre-crisis levels.

A combination of fragile business and consumer confidence, changing consumer behaviour, and capacity constraints to protect public health will continue to act as a drag on these sectors in the months to come.

So what next?

Our article from last week, which covers the latest data on the Scottish economy, highlights that a large number of businesses have reopened in recent weeks, so we are likely to see growth continue in the economy.

Our recently released Scottish Business Monitor, which we discuss here, also highlights the issues that businesses are facing as they start to try to operate again. Concern over the unwinding of the Job Retention Scheme, precarious cash flow position and increased indebtedness all point to a more fragile business base.

Conclusion

The economy has started to grow during May and June, just as we have official confirmation that Scotland is in recession. We will continue to see growth in the economy through July and August, as more businesses open up. The impact of local lockdowns, at their current scale at least, will act as a drag on growth but is unlikely to outweigh the activity of businesses starting up again.

However, despite the growth numbers we are likely to see, it is important to remember what this is actually measuring, and not allow it to hide to human cost that is coming as a result of this economic crisis. Coming down the track is a wave of unemployment, once the furlough scheme is removed and employers have to make tough decisions about their staffing levels in this new environment.

So – when we come out of recession next quarter – which we almost certainly will – let’s not celebrate too much. Any commentator who suggests that this means we are well on the road to recovery will simply be wrong.

Authors

Mairi is the Director of the Fraser of Allander Institute. Previously, she was the Deputy Chief Executive of the Scottish Fiscal Commission and the Head of National Accounts at the Scottish Government and has over a decade of experience working in different areas of statistics and analysis.

Adam McGeoch

Adam is an Economist Fellow at the FAI who works closely with FAI partners and specialises in business analysis. Adam's research typically involves an assessment of business strategies and policies on economic, societal and environmental impacts. Adam also leads the FAI's quarterly Scottish Business Monitor.

Find out more about Adam.

James is a Fellow at the Fraser of Allander Institute. He specialises in economic policy, modelling, trade and climate change. His work includes the production of economic statistics to improve our understanding of the economy, economic modelling and analysis to enhance the use of these statistics for policymaking, data visualisation to communicate results impactfully, and economic policy to understand how data can be used to drive decisions in Government.