This update provides a snapshot of new data on the Scottish economy and households.

Consumer interest exceeded last year’s levels concurrently for most products and services for the first time since the start of the lockdown. Scotland has also seen a large number of businesses re-open in recent weeks and it now has the lowest share of temporarily closed businesses across the UK. However, Scottish GDP data, which are to be released next week, are likely to show that Scotland was in a recession during the first half of 2020. This comes in the face of a high degree of labour market slack as the number of vacancies continued to decline across most sectors in July. Salaries and wages for new positions also continued to decline for the 4th consecutive month. The large increase in people claiming universal credit (see our labour market update from earlier this week) appears to be translating into more families hitting the ceiling on benefit support set by UK Government (the Benefit Cap). The outlook for households facing financial difficulties due to the economic fallout from Coronavirus remains extremely challenging.

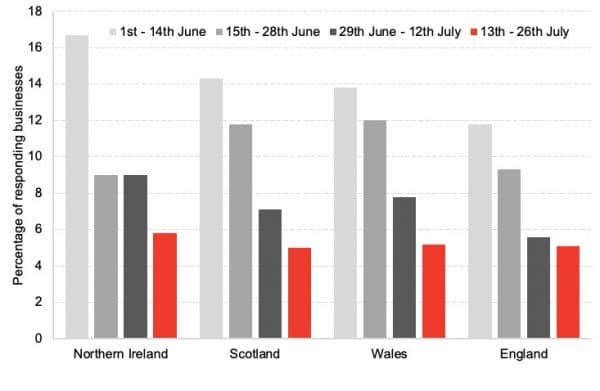

Chart 1: Share of businesses who are temporarily closed or have paused trading, UK nations, 1st June – 26th July 2020: the share of Scottish businesses reporting temporary closure fell to 5.0% in the second half of July. Scotland had the lowest share of closed businesses across all UK nations for the first time since the start of the lockdown.

Source: ONS BICS

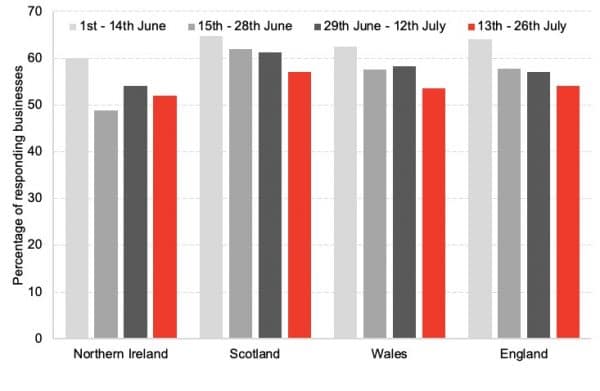

Chart 2: Share of businesses reporting decreased turnover, UK nations, 1st June – 26th July: the share of Scottish businesses reporting decreased turnover has fallen again in the second half of June, but remained the highest out of all UK nations at 57%, compared to 54.1% in England, 51.9% in Northern Ireland, and 53.5% in Wales.

Source: ONS BICS

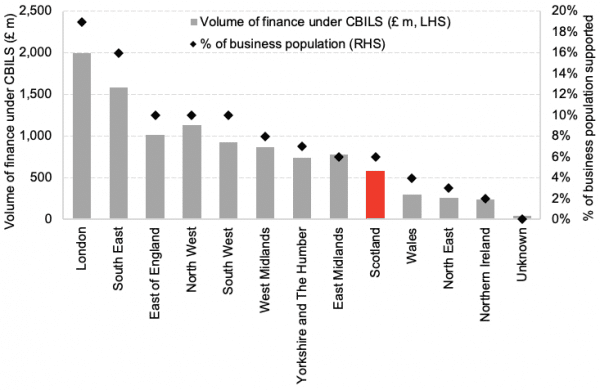

Chart 3: Volume of funds and percentage of businesses supported through the UK Government’s Coronavirus Business Interruption Loan Scheme (CBILS), UK regions & nations, up to 2nd August 2020: a total of £10.85 billion in loans have been provided across the UK under the CBILS scheme. Businesses in London have received the greatest number of loans with 19% of eligible businesses receiving a loan. In Scotland, a total of £588 million has been loaned to around 6% of the business population. The take-up of CBILS appears to be more prevalent among businesses in English regions than the other UK nations.

Source: British Business Bank

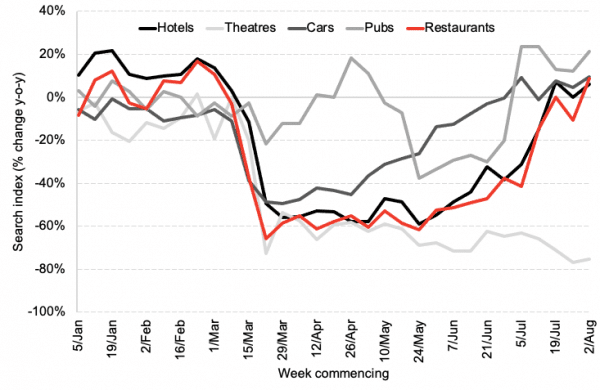

Chart 4: Searches for products and services in Scotland, 5th January – 9th August 2020: consumer interest in cars, pubs, restaurants, and hotels in the week commencing 2nd August exceeded the levels seen during the same week last year. However, interest in live entertainment venues remains low.

Source: Google Trends

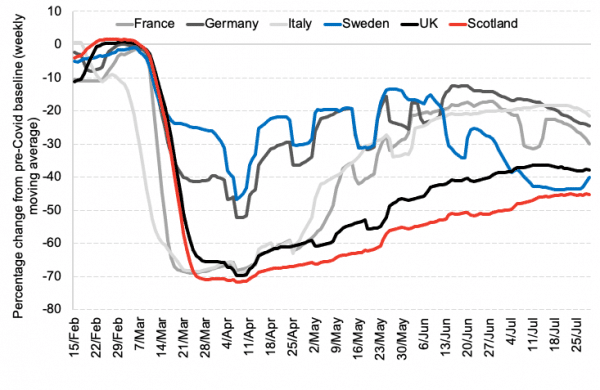

Chart 5: Mobility to workplaces, Scotland, UK, and European countries, 15th February – 29th July 2020: mobility to workplaces in Scotland has remained 45% below pre-Covid levels and lower than for the UK and most European countries. The pace at which people have started returning to work has been much slower in Scotland and the UK compared to other large European economies that saw a similar scale of fall in workplace mobility (note recent declines in some countries may be due to summer holidays – for example, Swedish summer holidays commence early/mid-June and run till mid-August).

Sources: Google Mobility Trends

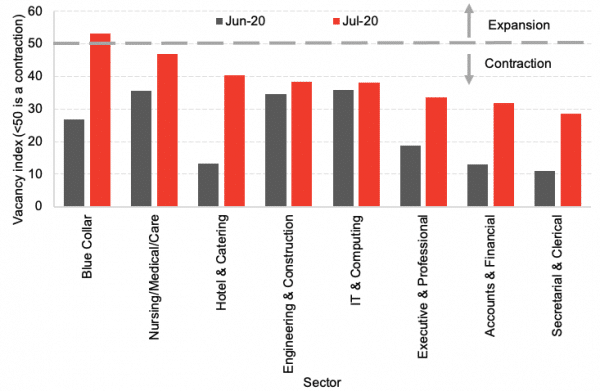

Chart 6: Index of permanent vacancies by sector in Scotland, June, and July 2020: the number of permanent vacancies reported by recruitment consultancies continued to decline in July across most sectors of the Scottish economy, however, at a slower pace than in June. Blue-collar jobs were the exception with increased vacancies in July.

Source: Royal Bank of Scotland Report on Jobs

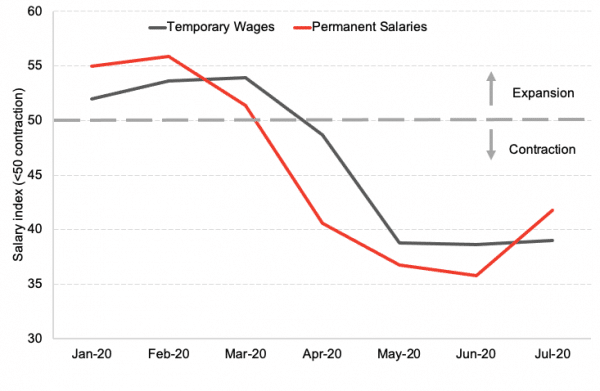

Chart 7: Salary index in Scotland, January – July 2020: salaries of new permanent workers continued to fall in July. However, the rate of decline slowed after the biggest slump on record since 2003 was experienced in June. Hourly wages for temporary workers also continued to decline in July.

Source: Royal Bank of Scotland Report on Jobs

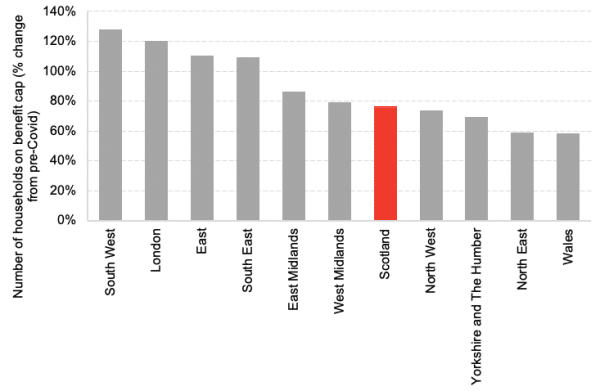

Chart 8: Change in number of households affected by the Benefit Cap (housing benefits and universal credit) between February and May 2020, UK regions & devolved nations: the number of Scottish households affected by the Benefit Cap rose by 76% from pre-Covid levels in Scotland. This is less than in most English regions, but more than in Yorkshire, the North East, and Wales. The Benefit Cap is a limit on the total amount of benefits that working-age people can receive and is set at different levels by the UK Government. The rise in the number of people hitting the benefit cap stems from the increased number of people seeking help form the social security system since the start of the crisis.

Source: DWP

Note on our real-term indicators analysis:

We review newly available data each week and provide a regularly updated snapshot of indicators that can provide information on how the economy and household finances are changing week to week. This allows us to monitor changes in advance of official data on the economy being released and also to capture key trends that will be missed by measures such as GDP. Each week we investigate new sources from known data sources and use publicly available data.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.