This update provides a snapshot of new data on the Scottish economy and households based on data released in the last fortnight.

Last month we had official confirmation that Scotland, like the UK, was in a recession in the first half of the year. Today’s GDP figures for the UK highlight strong growth at the start of the third quarter in July of 6.6%. However, the economy is still 12% smaller than in February and this magnitude of growth should be expected as the economy is recovering from a very low base. For example, output in the accommodation and food services industry grew by 140% in July but is producing 40% of what it was in February.

Economic recovery from this pandemic is therefore unlikely going to be ‘V-shaped’. Instead, we are likely to see a ‘K-shaped‘ recovery with different sectors experiencing varied recovery times. The accommodation & food services sector remains the most notably affected by the pandemic. The Eat Out to Help Out scheme has provided some support for this sector; however, the degree of support has varied across UK regions. Eat Out to Help Out ended on the 31st August however, many restaurants are still running similar discounts in September to attract customers. We await to see how demand will respond once these discounts come to an end.

Additionally, the number of vacancies remains below trend, but improvements can be seen month-on-month. The government’s furlough scheme now only covers 70% of employee wages, dropping to 60% in October, and is due to close at the end of next month. The real impact of Covid-19 on the labour market is expected to be seen in the coming months once this scheme comes to an end.

Last week we spoke with economist Jeremy Peat to discuss the current economic situation and how things are looking over the next few months and years. You can listen to our podcast with Jeremy here.

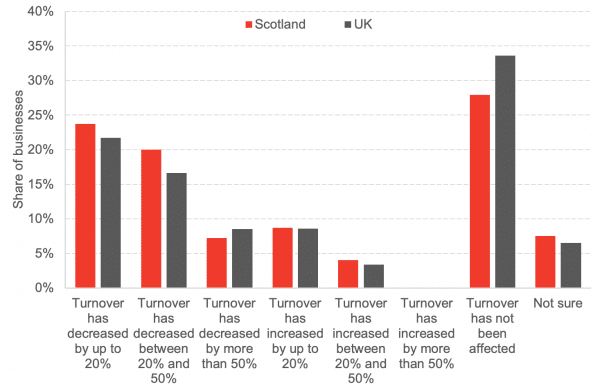

Chart 1: Answers to the question ‘In the last two weeks, how has the coronavirus (COVID-19) pandemic affected your business’s turnover, compared to what is normally expected for this time of year?’, 10th August – 23rd August 2020: Scottish businesses continue to report lower turnover than usual compared to the UK overall, with over half of businesses reporting decreased turnover compared to what is normally expected at this time of the year.

Source: ONS BICS

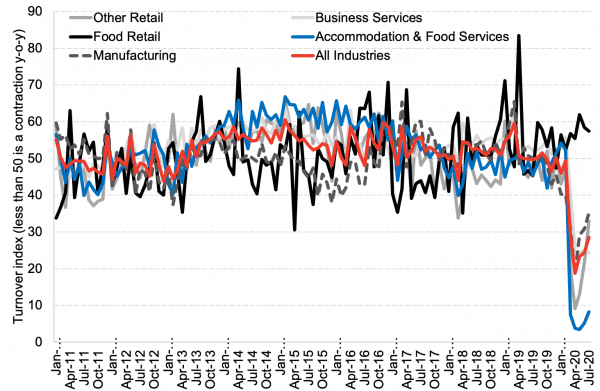

Chart 2: Monthly business turnover index for Scotland, January 2011 – July 2020: the Scottish Government’s monthly business turnover index shows that most sectors of the Scottish economy experienced lower turnover in July compared to last year. The only exception was food retail where turnover increased year-on-year.

Source: Scottish Government

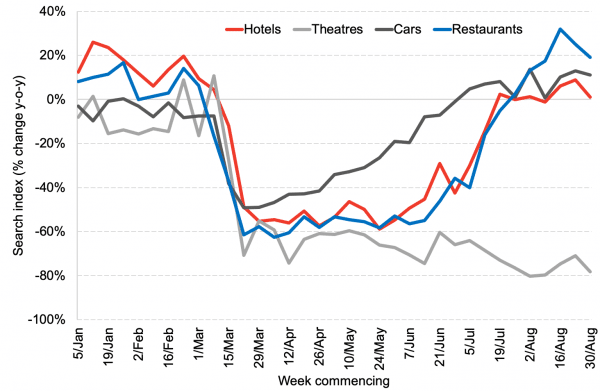

Chart 3: Google searches for products and services in Scotland, week commencing 5th January – 30th August: interest in cars, hotels, and restaurants remained above last year’s levels throughout most of the summer, but interest in theatres is yet to show any signs of recovery.

Source: Google Trends

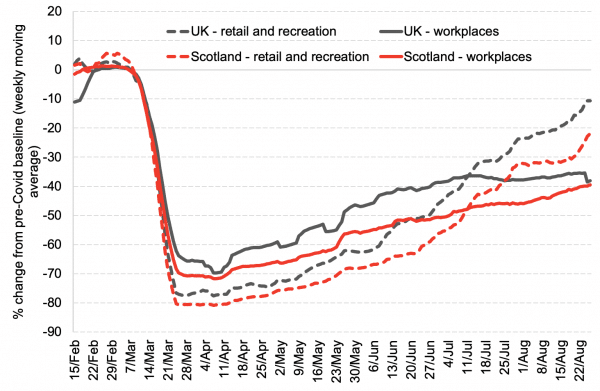

Chart 4: Mobility to retail and recreational venues and workplaces, Scotland and the UK: mobility to retail and recreational venues continued to increase during the final weeks of August and is now edging back towards pre-Covid levels. Mobility to workplaces has been recovering gradually and the difference between Scotland and the UK has narrowed in recent weeks.

Source: Google Covid Mobility Trends Report

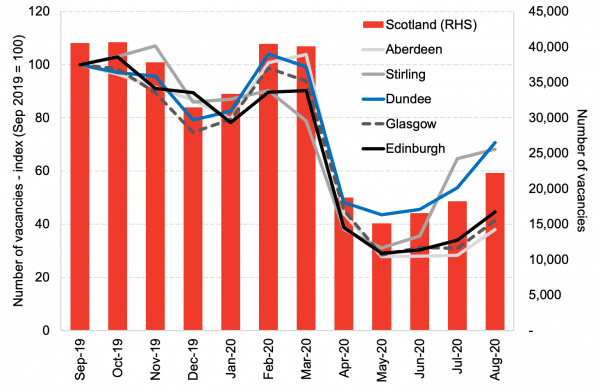

Chart 5: Number of vacancies, Scottish cities and Scotland, September 2019 – August 2020: the number of advertised vacancies in Scotland continued to increase slightly in August on previous months but remained 45% lower compared to September 2019. The pace of recovery in vacancies has differed amongst Scottish cities – smaller cities like Dundee and Stirling saw their number of vacancies fall less during the height of the lockdown and are recovering faster compared to the bigger cities (Edinburgh, Glasgow, Aberdeen).

Source: Adzuna Labour Market Stats

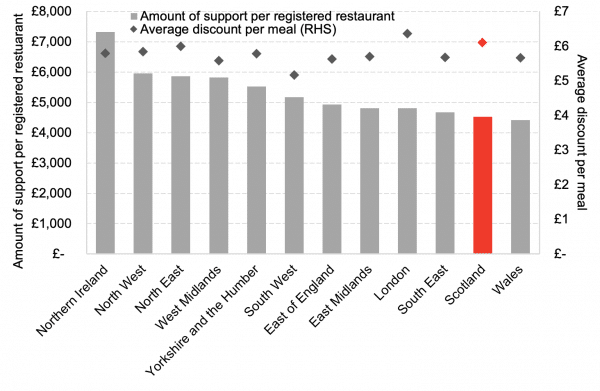

Chart 6: Claims under the Eat Out to Help Out scheme, English regions and devolved nations of the UK, up to 27th August 2020: Over £360m has been provided by the UK government for discounted meals across the UK but the degree of support has varied across regions. Overall, Scotland received around £38m from the scheme. Northern Ireland saw the highest volume of support per registered restaurant. Scotland and Wales received the lowest amount of support per registered restaurant. However, Scotland received the second-highest amount of support per meal amongst UK regions.

Source: HMRC

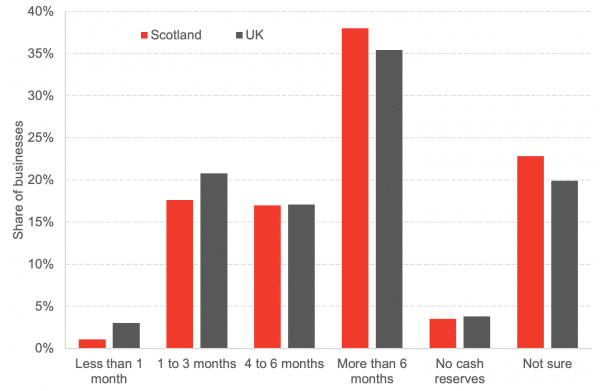

Chart 7: Answers to the question ‘How long do you think your enterprise’s cash reserves will last?’, 10th August – 23rd August 2020: A larger share of businesses in Scotland have cash reserves expected to last more than 6 months than the UK overall. Additionally, a much smaller share have reserves that would last less than 1 month. As some government support is wound down in the coming months, businesses will be increasingly reliant upon their cash reserves. While Scottish businesses have more reserves than UK businesses overall, there is still a significant share of businesses with reserves lasting under 6 months; or no cash reserves at all.

Source: ONS BICS

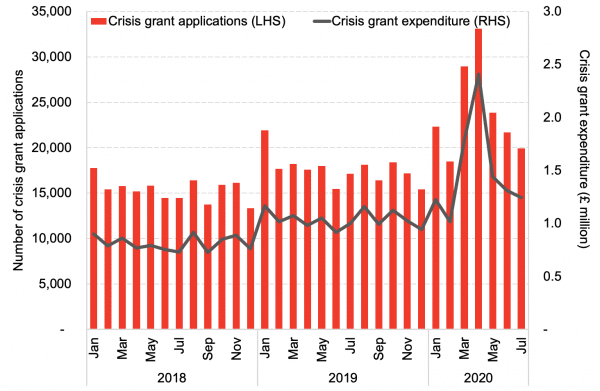

Chart 8: Number of applications and expenditure on crisis grants from the Scottish Welfare Fund, January 2018 – July 2020: the number of crisis grant applications and volume of expenditure continued to fall in July compared to previous months but remained around 16% higher compared to July 2019.

Source: Scottish Government

Note on our real-term indicators analysis:

We review newly available data each fortnight and provide a regularly updated snapshot of indicators that can provide information on how the economy and household finances are changing. This allows us to monitor changes in advance of official data on the economy being released and also to capture key trends that will be missed by measures such as GDP. Each fortnight we investigate new sources from known data sources and use publicly available data.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.