Today we published our latest economic commentary – you can read the full commentary here.

In this article, we summarise 10 key bullet points:

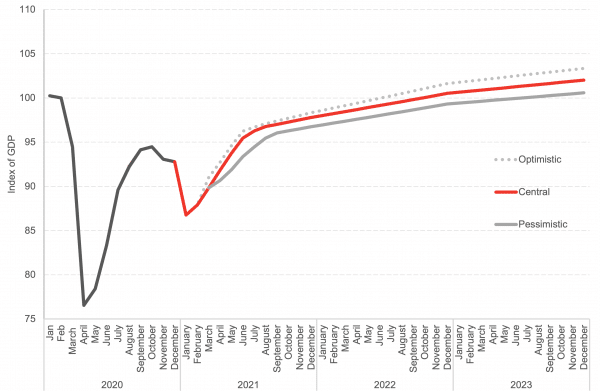

1. There is still huge uncertainty in the economy and forecasting continues to be difficult, therefore we provide scenarios instead.

The outlook for the next few months and years looks incredibly uncertain. Once again, given such uncertainties, we have avoided providing a specific point estimate or a central forecast for the next few years. Instead, we highlight different scenarios.

The optimistic scenario sees the economy recovering fully by next summer. Given the drag on economic recovery that the current national lockdown is having on the Scottish economy, this is a few months later than previously thought.

The central scenario sees the economy recovering by Autumn 2022.

The pessimistic scenario sees Scotland recovering to its pre-pandemic levels by Summer 2023, over 2 years from now and over 3 years from the trough of this economic crisis.

Chart: Scottish Economic Growth scenarios: 2020 to 2025 based upon return to ‘pre-crisis level’

Source: FAI

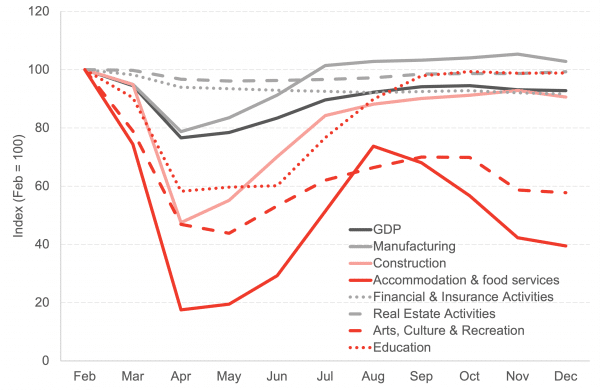

2. The accommodation & food services; and the Arts, Culture & Recreation Sector continue to be the hardest hit sectors.

Scottish GDP across all industries fell by 1.5% in November, followed by a 0.3% decline in the month of December. In December, the Scottish economy was 7.2% below pre-pandemic levels; this compares to 6.2% in the UK economy. Data published last week showed that the UK economy contracted by 2.9% in January 2021, meaning it is 9.0% below pre-pandemic levels.

The hospitality industry in December was producing just 40% of its pre-pandemic output; levels similar to that in June/July of last year.

Despite tightening lockdown restrictions, the manufacturing sector remains above pre-pandemic levels and policies such as the Stamp Duty relief have kept industries like real estate close to pre-pandemic output levels.

Real estate activities actually experienced growth of 0.6% in December. Given that this sector makes up a significant 12% of the Scottish economy, it has been an important driver of economic growth in the economy.

Chart: Monthly GDP index, Scotland, Feb – Dec 2020

Source: Scottish Government

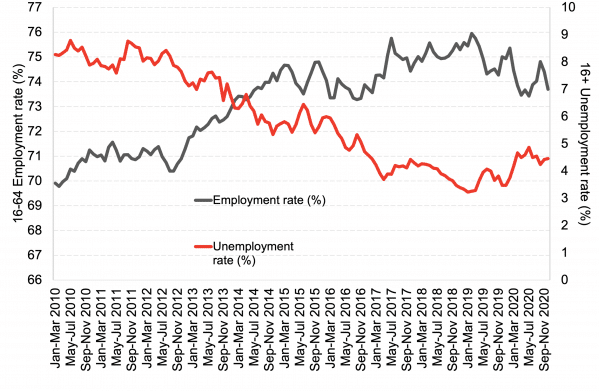

3. With the government furlough scheme extended until September, the full effects of the pandemic on the labour market remain to be seen.

The extension to the UL’s furlough support scheme announced in the Budget earlier this month will likely ensure that there remain modest movements in headline labour market measures through much of 2021.

Chart: Unemployment and employment rate, Scotland, Jan 2010 – Dec 2020

Source: ONS; LFS

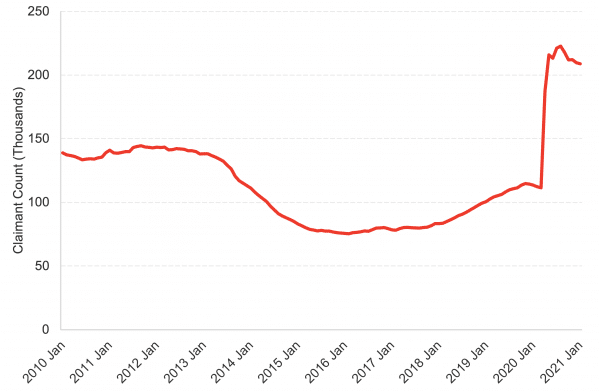

4. Despite this furlough support, wider indicators of the health of the labour market continue to paint a worrying picture.

We’ve seen the number of people claiming unemployment related benefits in Scotland drop back slightly, and now sits 87% higher than it was March 2020.

This represents an increase of over 97,000 people – and despite furlough support remaining in place.

UK wide data can provide timelier, and sometimes additional, indicators of labour market indicators than those available for Scotland.

From these data we can see that the recovery in hours worked witnessed since last summer began to taper off at the end of 2020. There were still 7% fewer hours being worked in the UK economy at the end of 2020 compared to the same period in 2019.

Chart: Claimant count, Scotland, Jan 2010 – Jan 2021

Source: ONS; LFS

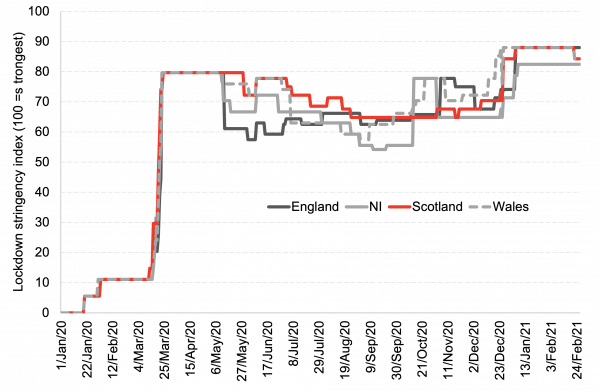

5. Scotland has mostly maintained the strictest lockdown restrictions across the UK – with the exception of England’s November national lockdown.

During the first lockdown UK nations followed a similar policy response however, approaches to containing the virus diverged in summer months as economies opened back up.

However, since the start of 2021 lockdown, restrictions across the UK have been more consistent – and similar to that seen in the first lockdown last spring – with a clear stay at home message from UK governments.

Chart: Lockdown stringency index, UK, 1st January 2020 – 26th February 2021

Source: University of Oxford

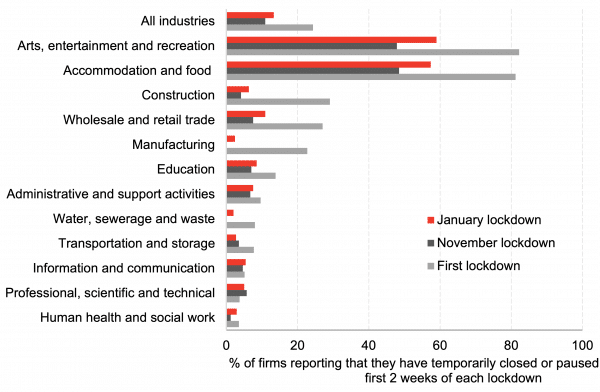

6. Businesses experienced more widespread closures in the first lockdown in spring last year compared to the most recent lockdown.

The ONS’s Business Impact of COVID-19 Survey (BICS) shows that businesses experienced more widespread closures in the first lockdown in spring last year, with 24% reporting they had temporarily closed. This compares to just 11% and 13% in November and January respectively.

These figures highlight the adaptability of businesses throughout the past year – many businesses have implemented COVID-safe measures, i.e. plastic screens, social distancing markers, etc., which have allowed them to be better equipped to operating throughout a lockdown.

Accommodation and food services has been the most significantly impacted sector across the UK however, firms have been able to adapt and move towards takeaway services and contactless deliveries which have allowed more businesses to operate during the past two lockdowns compared to the first.

Chart: Share of firms closing or pausing trading at the start of each lockdown, UK

Source: OBR; ONS

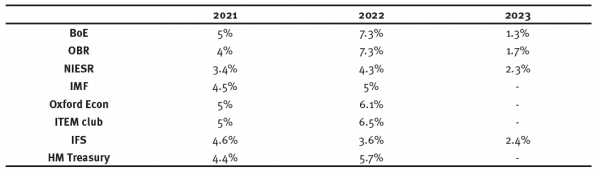

7. With the recent UK budget including a range of support for businesses and households, the forecasts of growth in the UK are more optimistic.

The UK Government’s budget, published earlier this month, included a range of support for businesses and households. In particular, the budget includes a temporary tax break, worth £12bn a year, to stimulate business investment.

Given this month’s budget, some forecasts of the UK economy are slightly more optimistic; economic growth projections for 2021 range from around 4-5%.

Table: UK GDP growth projections, 2021 – 2023

Source: BoE, OBR, NIESR, IMF, Oxford Economics, ITEM club, IFS, HM Treasury

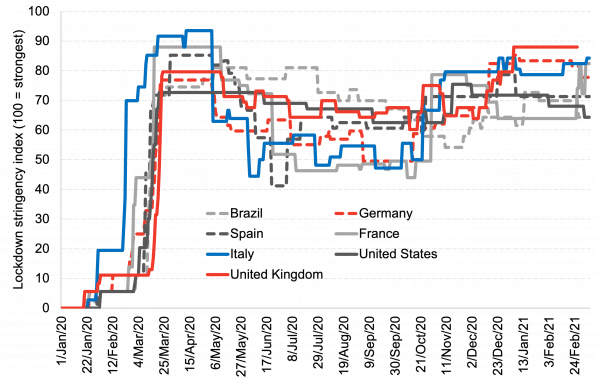

8. The differences in lockdown restrictions are evident when comparing the UK to other European countries.

The UK, like most countries, enforced a strict national lockdown last spring which eased in the summer months. However, the current national lockdown in place across the UK is amongst the strictest of major economies.

The US has had more relaxed COVID-19 containment policies in place over the past year however, it has remained at roughly the same level of restrictions since.

Chart: Lockdown stringency index, 1st January 2020 – 8th March 2021

Source: University of Oxford

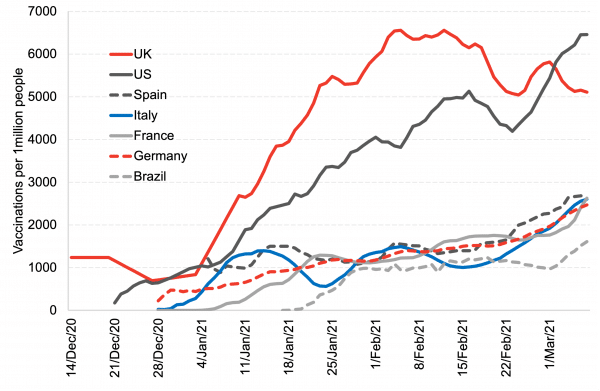

9. The UK has been one of the countries leading the way in terms of a vaccination programme.

The UK has given first doses of COVID-19 vaccines to almost 24 million people in the population.

That is, around a third of the UK population have been vaccinated with their first dose so far.

As the UK begins to vaccinate younger age groups within population, and provides second doses of the vaccine, in the coming months, this will support the reopening of the economy, allowing (hopefully) the economic recovery from this crisis to truly begin.

Chart: Covid-19 vaccinations administered per 1 million people, 14th December 2020 – 8th March 2021

Source: Our World in Data

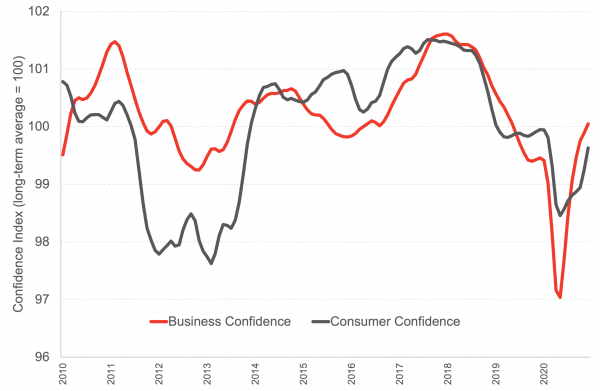

10. Although the winter has been difficult for many people around the world, there appeared to be some optimism across businesses and consumers in December.

Confidence across OECD countries improved significantly towards the end of 2020, particularly among businesses. Business confidence has remained above pre-pandemic levels since August however, consumer confidence remains below February 2020 levels. Chart 23.

Despite a long winter, businesses have proven resilient and the rollout of COVID-19 vaccinations coupled with business adaptability provides optimism during a difficult time for households and businesses.

Chart: OECD business and consumer confidence indices, Jan 2010 – Dec 2020

Source: OECD

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.