One of the sectors currently most affected by the Coronavirus response has been tourism and hospitality. This sector was an early casualty of social distancing guidance, and in all likelihood, will be one of the last to go back to anything like normal.

Quite how this sector will look in a year’s time is very uncertain. People will still want to go out for meals and go on holiday after this crisis has subsided, but some business will be unable to survive until then. The financial implications for business owners and their employees will therefore be significant. This article looks at what we knew about the characteristics of people working in the sector before the crisis hit.

Here, we look in detail at the accommodation and food services sector (AFS), which covers a large proportion (over 80%) of tourism related employment in Scotland.

The Labour Force Survey (LFS) gives us relatively timely information on individuals who work in the sector. From this we can look at characteristics such as age, gender, as well as hours and pay*. We have used the LFS to compare the accommodation and food services sector with other industry sectors, as defined by the 1 digit Standard Industrial Classification (SIC).

AFS itself accounts for around 3% of total Scottish GDP and the most recent data from the LFS estimates that it employs just over 155,000 people (around 6% of the total workforce). The characteristics of workers in this sector gives us an insight into some of the people likely to be facing severe uncertainty around their work and earnings.

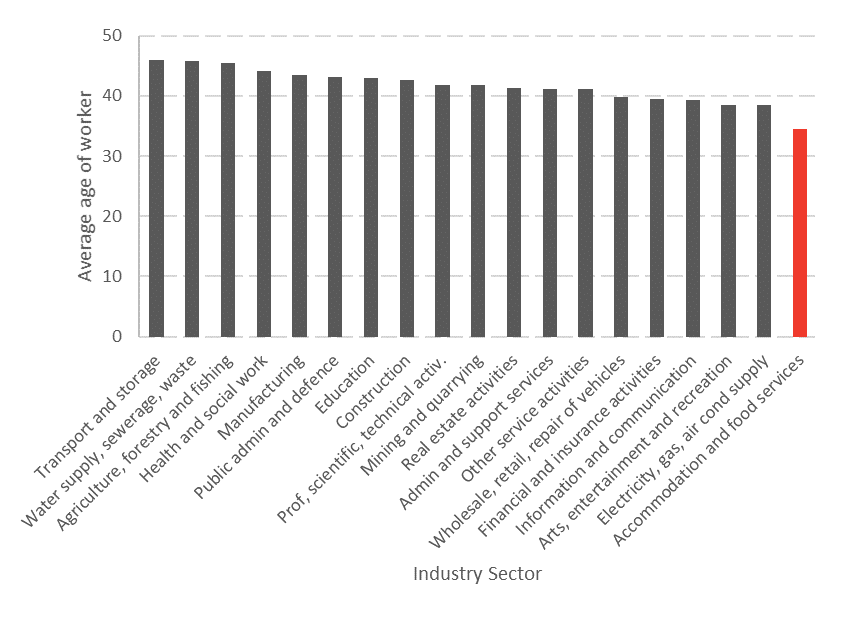

Age

Those that work in this sector are, on average, much younger than those who work in any other (Chart 1), with an average age of 34. This is 4 years younger than the next ‘youngest’ sector.

Chart 1 – Average age within industry sector in Scotland

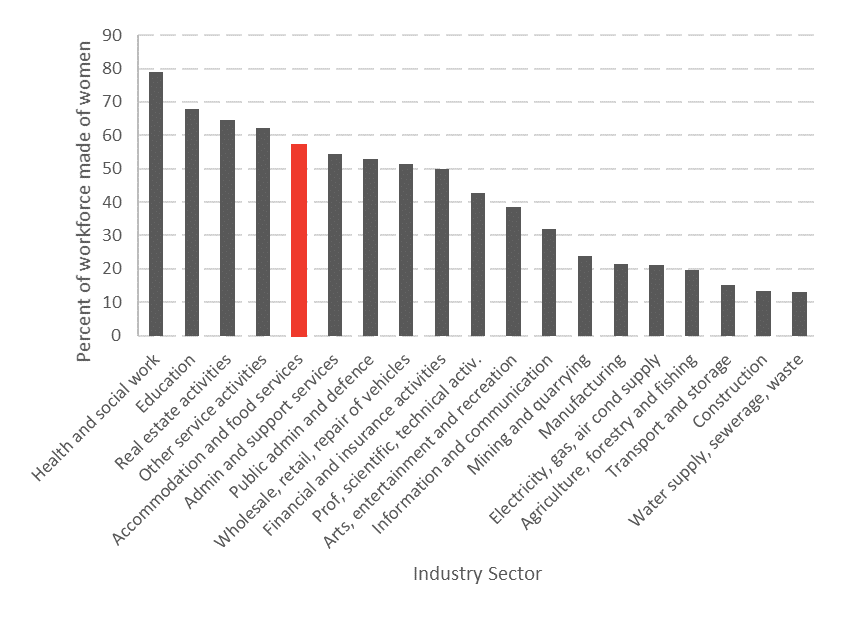

Gender

Over 50% of employment in the AFS sector is made up of women, and it is among the sectors with the highest proportion of women, compared to men, in its workforce (Chart 2).

Chart 2 – Gender share across industry sector in Scotland

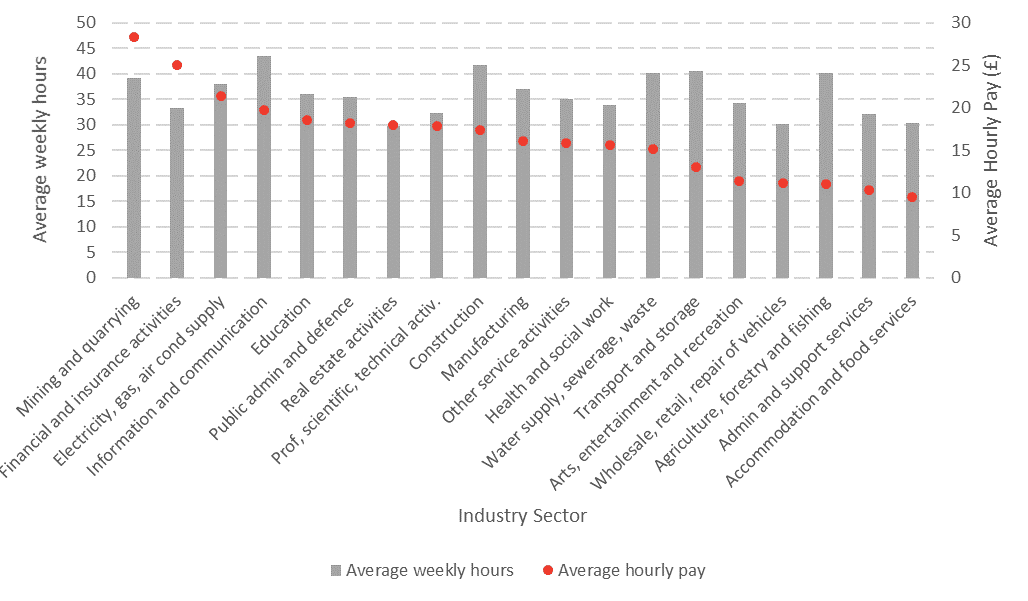

Hours and Pay

On average, AFS has the lowest hourly pay of all industry sectors and has among the lowest number of weekly hours (Chart 3).

Chart 3 – Average hourly pay and weekly hours by industry sector in Scotland

Using data from the Family Resources Survey (FRS) it is possible to see how many people live in households where there is an AFS worker. The latest detailed data available is for the period 2015 – 2018, during which it is estimated there were 130,000 household units where at least one adult worked in the sector with 250,000 people living within these households.

Although these figures are from a few years ago, trends in this sector have been fairly stable in recent years. The total number of workers in the sector according to this data is close to that reported in Q4 2019 LFS. So although they are not directly comparable, we can be somewhat confident that this data gives us a reasonable idea of the characteristics of households with a worker in this sector pre-crisis.

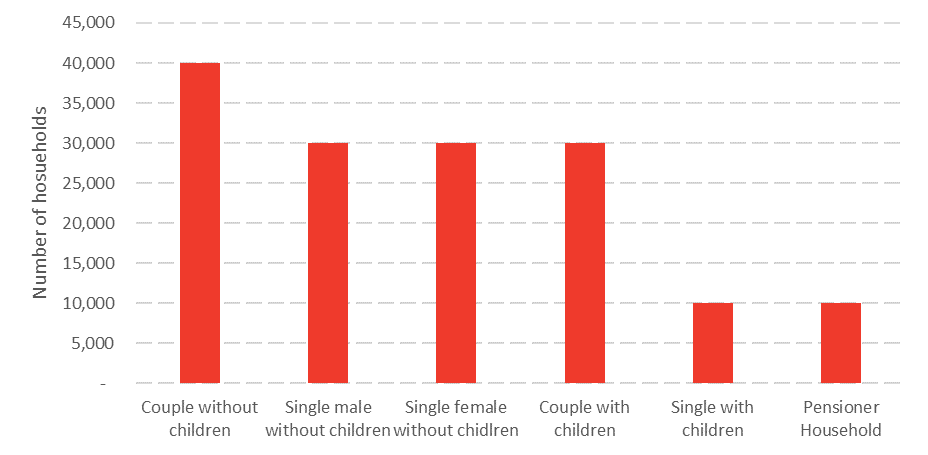

Household Characteristics

Around 70,000 working age households in Scotland were single adult households with the sole adult working in the AFS sector. Over 50,000 of working age households with a worker in the sector were couples, and in at least two thirds of these households the partner was also in paid work (less than 10% have two workers in the same sector) (Chart 5).

Chart 4 – Household characteristics of workers in Accommodation and Food Services in Scotland

Perhaps due the relatively lower average age of workers in this sector, we also see that most workers are in families without children. However, the number of children is not insignificant.

There were 40,000 families with children with an adult that works in this sector. Within these families there were 50,000 children (around 5% of all children in Scotland).

Household income

Reflecting the fact that earnings are on average low for this sector, weekly average household income for households with an AFS worker (the combination of net earnings, social security payments minus housing costs) was around 15% lower than the Scottish average.

Poverty

The poverty rate is higher than the Scottish average for households with a worker in this sector: 28% of all people who are in a household with a worker in this sector were in poverty (Scottish average is 19%). The figure for children was 41% (Scottish average is 24%).

Implications for policy

What do all these statistics tell us. The fact that the average age is lower means it is of little surprise perhaps that earnings and household income are lower than the Scottish average. We also know that women, who make up over 50% of the workforce, are lower paid on average and at higher risk of poverty.

However, even if not surprising, these statistics are troubling. The fact that the majority of workers live in single adult households mean there is less resilience, in the form of another income, to help make ends meet. However, even a second income is no guarantee of financial security given that most sectors will be impacted in some way by this crisis.

Policy makers will need to think carefully about workers in the accommodation and food services sector given that it was the first hit and likely to be the one of the last to recover. The peak tourist season could well have come and gone before restrictions are eased to a level that allows the sector to even start to think about reopening.

Whilst not a huge part of either GDP or the overall workforce, the industry makes up a significant contribution to economic activity in some parts of Scotland – the Highlands and Islands in particular. As well as an issue for the Scottish Government to consider, the UK Government may need to be reminded of this when determining what happens with the winding down of Coronavirus support measures such as the job retention scheme. It may be that support will need to continue for this sector for a long time to come, and perhaps be increased, to ensure communities don’t face economic collapse, with potential for permanent scaring from depopulation and the loss of amenities.

There is also the question of where and when the workers themselves would find alternative employment, and given lower average age of people in this sector, whether a long period of unemployment will damage longer term labour market prospects. The fact that people in this sector are already at higher risk of poverty than the average population means that they are likely to have less of a buffer to survive long periods of low or no earnings. Whether or not these individuals and households are given sufficient support once Coronavirus starts to subside from the headlines will be an early test of whether the system that emerges from this crisis is able to look after those who suffered considerably because of it.

* We use the Scottish Government Growth Sector definition of Sustainable Tourism industries and the Labour Force Survey. Other sources of data on employment in the tourism sector include the Business Register and Employment Survey, which is used by the Scottish Government to compile statistics on the sector. The most recent data available is for 2018. See here for more information.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.