A range of new social security powers have been devolved to the Scottish Parliament in the last few years relating to disability and carer benefits. The transfer of administrative responsibility to the Scottish Social Security Agency has been staggered in order to try to ensure it all works smoothly but, over the course of the next parliament, it is expected that that transfer will be complete. As well new names, it is expected that other changes in how they operate will be made although at the moment.

The 2021 election may see different parties talking about elements of these new benefits, and how they could be changed over the course of the next parliament.

In this briefing, we set out the main benefits in Scotland that have been devolved and are relevant for working age adults with a disability and those who care for them. These are Personal Independence Payment, due to be renamed as Adult Disability Payment, and Carer’s Allowance which will be renamed Carer’s Assistance. We also illustrate how Universal Credit works for people with a disability and their carers as, although a reserved benefit, top-up powers mean that the Scottish Government could increase payments if they chose to.

Here we take a look at the benefits themselves rather than the funding complexities and the interactions with the fiscal framework. See here for previous FAI briefing looking at this.

Personal Independence Payment/Disability Assistance for Adults

How it works at the moment

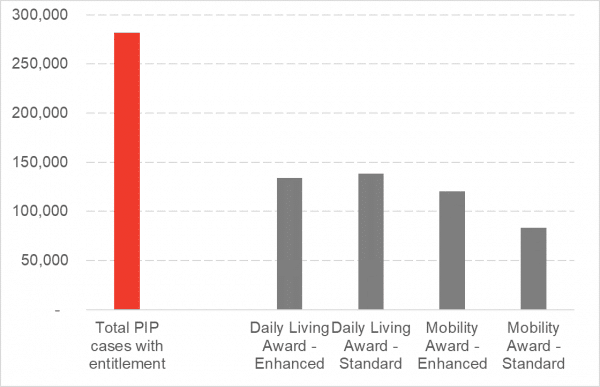

Personal Independence Payment (PIP) is paid to adults who have a disability and have difficulty in carrying out everyday living activities. There are currently around 280,000 people in Scotland who are entitled to PIP. It has two components – one for daily living and another for mobility, and it is possible to qualify for one or both components.

Chart 1: PIP cases with entitlement in Scotland (Jan 2021)

Source: DWP Stat Xplore

PIP itself is a fairly new benefit, which in 2013 started replacing the previous Disability Living Allowance (DLA) for working age people. Roll out is ongoing and the latest data from the DWP suggests there are still around 40,000 working age people on DLA who are yet to transfer over.

Eligibility is determined depending on points scored for different activities. There are ten daily living activities that are assessed. There are different ‘scores’ depending on whether or not it is possible to complete the activity unaided, and if not, what type of help is required. A score of 0 corresponds to being able to do so without any assistance, and 10 if the person requires someone else to complete the activity for them, with scores in between varying depending on the level of assistance required.

The daily tasks that are scored cover a range of activities including household tasks, being able to take care of health and hygiene and being able to communicate effectively with others. The mobility activities relate to planning and following journeys and moving around.

There are two rates available: the standard rate if you score eight points of more; or the enhanced rate if you score 12 points or more. These rates are applied for each component.

In 2020/21 the weekly rates were as follows:

- Daily living component standard rate: £59.70 and enhanced rate £89.15

- Mobility component standard rate; £23.60 and enhanced rate £62.25

PIP is not taxable, and is not considered in the calculation of other means tested benefits, nor does it count towards the benefit cap. However, it can mean that you are entitled additional elements in other benefits (for example Christmas bonus).

What is expected to change over the next Parliament?

PIP will be replaced in Scotland by Adult Disability Payment, administered by Social Security Scotland. The payment is due to be introduced from spring 2022, with all recipients transferred to the new benefit by 2025.

Adult Disability Payment will impact a large number of disabled people in Scotland. The Scottish Fiscal Commission has forecasted that in 2021-22, 305,000 people in Scotland will be on PIP, with the overall caseload for Adult Disability Payment likely to be higher due to the legacy DLA caseload. PIP is forecasted to cost the Scottish Government £1.6 billion in 2021-22[i].

In the last parliament, the Scottish Government signalled that it did not intend to change the rates away from those available under PIP but there are more likely to be changes around the assessment process.

Many disabled groups have argued that the process of assessing a person’s entitlement for PIP causes undue stress and anxiety for disabled people. In 2017 the Scottish Commission for People with Learning Disabilities (SCLD) consulted about the future of social security in Scotland and found the PIP assessment process to be “embarrassing and degrading” and that assessments “can make people feel vulnerable”[ii].

Social Security Scotland have stated their intention to change the assessment process to reduce face-to-face assessments as much as possible. However, consultation is still ongoing over how to determine the circumstances under which a face-to-face assessment is necessary.

Another change that might occur is around the accessibility of the process and communications to claimants, which is particularly relevant for people with learning disabilities. The SCLD report referenced above also found concern around a “difficult and complex … application process” and “written communication which is complicated, difficult to understand and sometimes does not make sense”. Social Security Scotland have committed to “embed inclusive communication in everything we do, so that all materials are accessible”.

Carer’s Allowance/Carer’s Assistance

How it works at the moment

Carer’s allowance is paid to people who care for someone who is severely disabled (which is determined by eligibility for a range of other benefits including the daily living component of PIP).

Although it is non-means-tested (so not in theory dependent on income) you can’t earn more than £128 a week if you are claiming it and the expectation is that caring will be your full-time (unpaid) job. The maximum claim was £67.25 per week in 2020-21.

Eligibility for Carers Allowance does not mean payment. The existence of the ‘overlapping benefit rule’ means the same person cannot be paid more than one non means-tested benefit in full at the same time. If the overlapping benefit is less than Carer’s Allowance, then the payment can be topped up to the level of Carer’s Allowance. This is particularly true for pensioners who may be caring for working age adults. If you state pension is claimed, this will count against the amount of Carer’s Allowance that will be received.

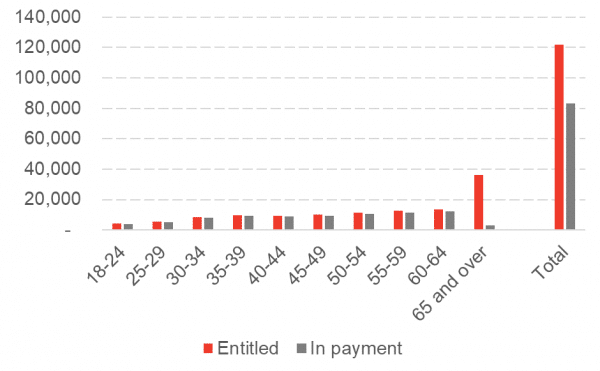

Chart 2: Entitlement and Receipt of Carers Allowance in Scotland (August 2020)

Source: DWP Stat Xplore

Anyone who has an entitlement to Carer’s Allowance, but is in receipt of another means-tested benefit (for example, Income Support or Pension Credit could be entitled to an additional payment (£34.60 a week in 2020-21).

There is also an important interplay between Carer’s Allowance and other benefits. A person in receipt of a disability benefit may lose entitlement to the severe disability premium if their carer claims Carer’s Allowance. The premium is included in the disabled person’s ‘applicable amount’ for means-tested benefits, or the equivalent amount used in Pension Credit. As a result, it is not always advisable for a carer to claim Carer’s Allowance.

In 2021-22, the cost of Carer’s Allowance is forecasted to be £306m with an expected caseload of 90,000[i].

Changes made during the last Parliament

Carer’s Allowance is to be replaced in Scotland (see below) in 2022. During the interim period, the Scottish Government implemented the Carer’s Allowance Supplement in September 2018. This has been paid in the form of two lump sum payments throughout the year with a forecasted cost of £42 million in 2021-22 according to the Scottish Fiscal Commission [i]. Claimants receive this uplift if they are in receipt of Carer’s Allowance on specific dates (i.e. around the dates of the lump sum payments). Unlike Carer’s Allowance, Carer’s Allowance Supplement is disregarded as income for means-tested benefits although it is taxable.

What is expected to change over the next Parliament?

Carer’s Allowance will be replaced in Scotland by Carer’s Assistance with the intention of paying it at the (higher) rate of Job Seeker’s Allowance. The current timeframe is for new applications for the devolved Carer’s Allowance in early 2022. As a temporary measure at the moment, as explained above, the Scottish Government pays a Carers Allowance Supplement which increases the amount to this JSA level via two lump sums each year.

A consultation has been planned for 2021 on the roll out of Carer’s Assistance. A key question will be over eligability and whether further uplifts to rates will be applied.

Universal Credit

Universal credit is included here for completeness as it is a significant benefit paid out to people in Scotland. Although the benefit itself remains reserved, there are disability and carer components within this. Using top-up powers, the Scottish Government could in effect increase the amounts paid through Universal Credit to people in Scotland, in a similar way as is being done with the Scottish Child Payment (which is legislated as a top-up benefit to UC).

How it works

Universal Credit is a means tested benefit, meaning that you are only eligible for it if your household income is below a certain amount. UC is an income replacement benefit for people who are not in paid work and is a replacement for a range of legacy benefits (including Income Support and Employment and Support Allowance). There are a number of people who remain on those legacy benefits who are yet to transfer over to UC.

For people who cannot work (as opposed to being temporarily unemployed) a ‘Limited Capability for Work Related Activity’ assessment is made to determine eligibility for an additional element on top of the standard allowance. The standard allowance varies depending on age and whether you are a single or a joint claimant, but as an example, in 2020-21, the standard allowance for a single claimant aged 25 or over was £409.89 a month. There are additional elements for children as well as the elements covered below: limited capability for work related activity element and the carer element.

Limited capability for work related activity (LCWRA)

To qualify for the LCWRA component, usually an assessment is made. One or more of the qualifying ‘descriptors’ must be met in order to qualify for this element. These descriptors describe physical and cognitive disabilities which would make work, or the process of taking part in work related activity (such as training) extremely difficult or impossible.

The assessment is different to the assessment carried out for Personal Independence Payment and this was the case even before PIP was devolved. They are similar assessments, but reflect the different purposes of each benefit. PIP is paid to help cover the additional costs of being disabled. The additional element in UC is to determine whether or not your ability to carry out paid work is limited due to the disability you have.

For those who are assessed has having limited capability for work related activity (LCWRA): an additional element of £341.92 a month (in 2020/21) is included. Unlike the legacy benefits that UC replaced, UC has no severe disability premium included[iii].

Carer element

If you are a carer for a severely disabled person, you may be able to claim the carer element. The eligibility for this is linked to Carer’s Allowance. If you are entitled to Carer’s Allowance, or would be if your earnings were within allowed parameters, then you are entitled to the carer element. There are some limitations – for example, if the person you care for is entitled to a severe disability premium in guarantee Pension Credit (and some legacy benefits) then the carer element in UC is not available.

The carer element for someone caring for a severely disabled person was £162.92 a month for 2020/21.

Conclusion

As can be seen, there are a number of key benefits that make up social security support for people in Scotland who have a disability and for those who care for them. Some (PIP and Carer’s Allowance) have been devolved and administrative responsibility will be transferred over the next parliament. The Scottish Government will be able to change eligibility and generosity of these benefits if they so choose, and some plans are already underway.

Universal Credit also has disability and carer elements, and this benefit will remain reserved. However, the Scottish Government does have top up powers that could increase the generosity of the payments currently made.

The election debate may well refer to possible future changes, which could affect up to around 400,000 working age disabled recipients and their carers, and potentially more if eligibility is widened or t0p-up benefits are considered. .

We will look at the benefits available for children and pensioners with a disability in an article coming soon.

[i] https://www.fiscalcommission.scot/wp-content/uploads/2021/01/Scotlands-Economic-and-Fiscal-Forecasts-January-2021.pdf

[i] https://www.scld.org.uk/wp-content/uploads/2016/08/social-security-report-1.pdf

[iii] https://disabilitybenefitsconsortium.files.wordpress.com/2019/10/mending-the-holes-restoring-lost-disability-elements-to-universal-credit.pdf

Authors

Emma Congreve is Principal Knowledge Exchange Fellow and Deputy Director at the Fraser of Allander Institute. Emma's work at the Institute is focussed on policy analysis, covering a wide range of areas of social and economic policy. Emma is an experienced economist and has previously held roles as a senior economist at the Joseph Rowntree Foundation and as an economic adviser within the Scottish Government.

Rob Watts

Knowledge Exchange Associate at the Fraser of Allander Institute