From the 1st of January 2021, the New Protocol (NP) on Northern Ireland (NI) plays a fundamental role in regulating NI’s trade with the European Union (EU) and Great Britain (GB). The NP aims to prevent a hard border between the Republic of Ireland and Northern Ireland and to safeguard the so-called Good Friday Agreement whilst preserving economic stability in both islands as well as the EU single market. However, almost a year after its introduction, the protocol is still the object of debate and political tension between the EU and the UK Government as the implementation of checks on goods such as animal, dairy products and medicines have caused delays in deliveries of essential goods.

In a recent article published in the policy debates section of Regional Studies, we study the impact that the implementation of the NP, in conjunction with Brexit, is expected to have on the economy of NI in the long term. We reflect on the initial claims that the NP could allow NI to enjoy the best of both worlds as it gives the region access to both the EU and the GB markets by taking a closer look at what potential impacts the new trading regulations may have.

We find that the introduction of trade frictions between NI and GB (the region’s main trading partner) has a significantly negative impact on the NI economy, relatively to a no-Brexit counterfactual. Industries that rely on imports of intermediate goods from GB are expected to suffer the most when compared to industries with largely domestic supply chains or that trade primarily with the rest of the World. However, we also show that negative impacts can be mitigated if imports of intermediate inputs from GB are substituted for EU intermediate imports. Finally, we find that none of the scenarios that we explore deliver an economic improvement when compared to a pre-Brexit scenario.

The Northern Ireland Protocol and other rules

To ensure free circulation of goods in the Island of Ireland, the NP disposes that NI will continue to follow many of the EU’s customs rules and remain part of the EU’s single market for goods whereas GB will no longer have access to it. For the first time, two regions of the same country will trade under different rules with countries in the EU block. In addition, the divergence of rules between the two regions imply that trade barriers (checks, paperwork) are imposed on trade between GB and NI. This is because for NI to be part of the EU customs union, the region must still follow EU regulations on goods production. Crucially, if goods transiting in NI are at risk of being exported to the EU, even as a part of another good, following processing, these are subject to tariffs in the cases where tariffs are applied on goods traded between the UK and the EU.

The story is even more complex if we consider the United Kingdom Internal Market Act 2020, which allows NI firms to have unfettered access to GB markets and the EU-UK Trade and Cooperation Agreement (TCA) that allows goods to be traded between the EU and the UK with no tariffs and quotas provided that firms trading can demonstrate that the products traded meet specific rules of origin. Essentially, this implies that goods moving from GB to NI are subject to checks (non-tariff Barriers) and potentially tariffs if not compliant with rules of origin and if at risk of being re-exported to the EU. However, goods moving from NI to GB are not subject to checks or tariffs.

Who are the trading partners of Northern Ireland?

In 2018, before Brexit, 29.5% of NI’s total purchases of goods came from GB and 13.6% from the EU. These include the purchase of intermediate goods, that are used in production processes to produce other goods. In addition, in 2018, NI purchased 5.7% of its services from the EU and sold 6.8% of its total services sales to the EU. Clearly, the introduction of new regulations exposes this trade to additional costs.

Table 1: Percentage of NI sales and purchases of goods and services by destination 2018

| Region | EU | ROW | GB | NI | |

| Goods | % Sales | 11.2% | 7.6% | 14.0% | 67.2% |

| % Purchases | 13.6% | 5.9% | 29.5% | 51.0% | |

| Services | % Sales | 6.8% | 4.5% | 18.1% | 70.6% |

| % Purchases | 5.7% | 2.8% | 28.3% | 62.3% |

Source: Northern Ireland Statistics and Research Agency, 2018 (NISRA)

The impact of the new trade arrangements

To understand the impact of these new costs, in the paper, we combine trade data and information on potential non-tariff barriers and tariffs. Then we use a multi-sectoral economic model of NI to estimate the impact of these shocks on the whole economy. The multi-sectoral model captures both the direct impacts of these additional costs on the industries that are facing them and the impacts on the wider economy, as industries pass some of the costs to consumers under the form of increased prices. It also considers the impact that these changes have on NI households’ income and purchasing power originating from changes in real wages and capital income.

We report in table 2, the results from our central case scenario simulation, where only the impact of non-tariff barriers is considered.

Table 2: Long-term economic impact on NI compared to a no Brexit baseline

| GDP | CPI | Consumption | Real wage |

| -2.6% | 2.3% | -2.5% | -3.9% |

| Employment | Investment | Imports | Exports |

| -1.2% | -3.3% | -4.4% | -7.4% |

| Exports | Intermediate Imports | ||

| GB | ROW | GB | ROW |

| -6.1% | -8.6% | -5.9% | 0.5% |

Source: Author’s simulation results.

Households purchasing power is reduced by the higher prices. In addition, wage income is eroded, as firms need fewer workers to produce. Thus, employment falls by 1.2%, and workers’ bargaining power is reduced, reflected in a 3.9% fall in the real wage. Due to the reduction in investment, households earn less from their capital investment and overall consumption is expected to fall by 2.5%.

The rise in the cost of imports, even if dampened partially by the reduced labour costs, makes NI less competitive in international markets, and this exacerbates the impact of new trade barriers. Thus, exports are expected to fall by 7.4%. Overall, our modelling simulates a long-term NI GDP fall of 2.6%. Note that this excludes eventual spillover from GB as our model isolates the impacts on NI only.

Export to GB decrease by 6.1% due to the increased output prices in NI. Exports to the rest of the world (ROW) decrease by a greater proportion (-8.6%) reflecting both the increase in output prices and the additional costs (NTBs) in the trade of services with the EU. As the price of GB imports increases by more than that of ROW imports, both firms and households respond by substituting a proportion of GB imports with ROW imports. For firms, this is displayed in Table 7 where intermediate import demand of GB inputs decreases by 5.9% whereas that for ROW intermediate imports increases by 0.5%.

What industries are likely to be most impacted?

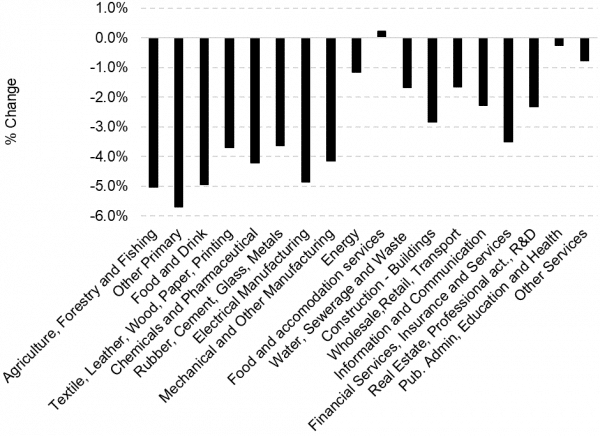

The macroeconomic impacts presented can be decomposed to see the effect on GVA of 18 aggregated industries.

Figure 3: Percentage change in long run value added

Source: Author’s simulation results.

As can be seen in Figure 3, the most impacted sectors are agriculture forestry and fishing, other primary and food and drink, followed by electrical and other manufacturing. These are export intensive sectors, or sectors that rely on imports of intermediate inputs from GB. Sectors with limited exposure to international trade, such as public administration, health and defence are only marginally impacted. Interestingly, food and accommodation services expand marginally, due to the reduction in the cost of domestic inputs including labour.

What is driving these results and can increased trade with the EU help?

To determine what proportion of these impacts is driven by barriers between NI and GB and NI and the EU, we run scenarios where barriers are only applied to trade from GB or to trade to and from the EU in isolation. Our calculations show that non-tariff barriers between NI and GB are responsible for 82% of the economic impact. It should be noted that this is based on the assumption that given that NI remains part of the EU customs territory, trade barriers between GB and NI have the same magnitude as trade barriers between the UK and the EU as NI will follow EU regulations. However, it is likely that the UK Government will do everything in its power to reduce the extent of trade frictions between the two UK regions. Thus, the impact of potentially lower NTBs is discussed in our paper and in the associated supplementary material.

Finally, we explore what will happen if trade between NI and the EU increases by simulating a scenario where it is easier for NI firms to substitute GB imports of intermediate goods for EU imports. We find that our central estimate of a 2.4% reduction in NI GDP can be reduced to up to 1.3% where NI firms massively switch to EU supply chains. Whilst this is no evidence that the NP allows NI to enjoy the best of both worlds, as the region is still worse-off than pre-Brexit, it demonstrates how NI can take advantage of the new trading regulations to mitigate the negative impacts of Brexit.

For further information about the modelling and methodological discussion please see the full paper and supplementary material by following this link https://doi.org/10.1080/00343404.2021.1994547

Authors

Economics PhD student at the University of Strathclyde.

Gioele is a Senior Lecturer in the Department of Economics, University of Strathclyde.