In each edition of the Commentary since the start of the pandemic, we have discussed that the impact of the pandemic and associated lockdowns has not impacted equally across sectors.

As we move further into 2022, despite the economy as a whole moving past pre-pandemic levels, there are concerns that those sectors which have been most affected may well be those who will also suffer due to the cost-of-living crisis.

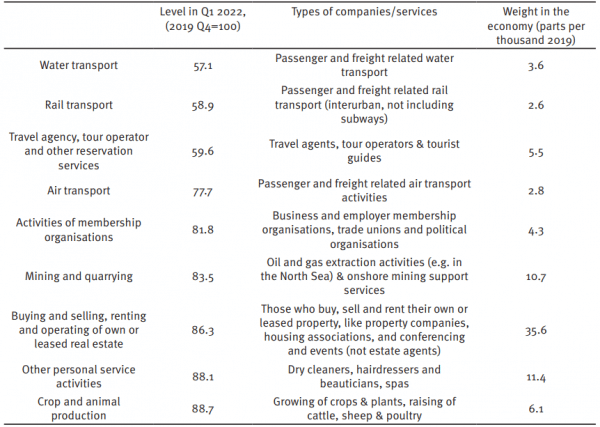

We use detailed sectoral data in this section (only available for the UK) to analyse where detailed sectors are in comparison to pre-pandemic levels (at the end of 2019). The figures in Q1 2022 are compared with Q4 2019 (100 would be a sector which is back to Q4 2019 levels).

Table 1: Level of detailed sectors, UK, 2019 Q4=100, poorest performers

Source: ONS low-level aggregates

As may be expected, transport related services (as at Q1 2022), are those furthest behind their pre-pandemic levels. As working from home and travel restrictions have continued to ease over the course of quarter 2, it will be interesting to see how these sectors further recover.

Sectors related to the North Sea continue to operate below pre-pandemic levels, which has some of the fiscal consequences (in terms of the outlook for income tax, given the relatively high wages in the sector) discussed in the previous section. Conferencing and Events related activities are still not back to pre-pandemic levels, but again this is likely to have improved during Q2.

Of concern related to discretionary spending by consumers is “Other personal services”, which includes businesses like hairdressers and beauticians, which could be cut back on by consumers if they need to divert their spending to essentials.

We also analysed those sectors who are best performing compared to pre-pandemic levels.

Table 2: Level of detailed sectors, UK, 2019 Q4=100, top performers

Source: ONS low-level aggregates

Postal and courier services continue to do very well compared to pre-pandemic levels, related to the ways we have changed how we work and shop. Related to this is the strong performance of the warehousing sector.

Professional services related to accountancy, tax and auditing are one of the best performers. In a tight labour market, it is perhaps not surprising that employment agencies are doing well compared to pre-pandemic levels.

We will continue to produce this analysis as we move through 2022 to understand what is happening to the detailed sectors of the economy.

This article is part of our Fraser of Allander Economic Commentary Q2 2022.

Authors

Mairi is the Director of the Fraser of Allander Institute. Previously, she was the Deputy Chief Executive of the Scottish Fiscal Commission and the Head of National Accounts at the Scottish Government and has over a decade of experience working in different areas of statistics and analysis.