The Chancellor may have tried to portray it otherwise, but her words in the Commons and the length of the scorecard of measures published by the OBR betray a different story: this really was a fiscal event, and a significant one at that.

It was also one where the forecasting process was nowhere as smooth as we hoped it might be given how much hay the Chancellor made out of strengthening the role of the OBR in the Autumn. Instead, we have seen a number of measures either uncertified or included only on a provisional basis, and with no time to evaluate their supply-side effects.

Given how long these measures have been speculated about, the last-minute tweaks and the scramble to announce further welfare reforms to make the sums add up to the £5bn in savings are pretty disheartening. It also makes us wonder about the reasons for announcing the headline amounts last week, before ultimate certification by the OBR.

It is not credible that the Chancellor or the Work and Pensions Secretary were not aware of the OBR’s concerns at the time of the announcement, and so we are left to wonder why figures that weren’t final were bandied about beforehand instead of being left for the appropriate fiscal event.

The underlying picture deteriorated significantly, and so spending cuts have filled the gap

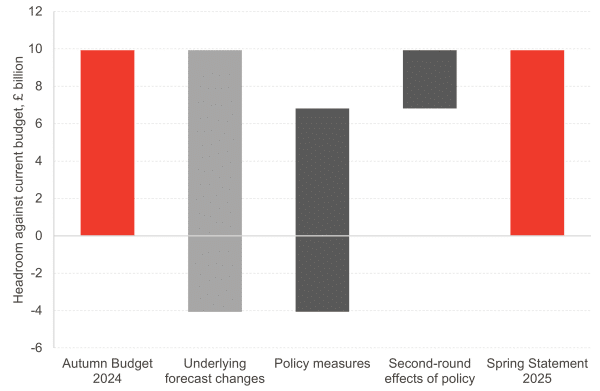

As widely predicted, the Chancellor would have seen her fiscal rules broken had she not made significantly policy decisions, which collectively cut current spending by nearly £9 billion a year by 2029-30.

Chart: How the Chancellor restored her headroom

Source: OBR

Debt servicing costs are the main reason for the deterioration. Higher market interest rates raised the cost of servicing government by just over £10 billion by the end of the decade, more than wiping the starting headroom. Faced with this, and after staking her credibility on complying with the fiscal rules, the Chancellor decided to mostly lean on the spending side of the ledger to essentially get back to where she started.

This means a heavily backloaded set of policy decisions, with spending cuts coming from 2027-28 onwards. Changes to incapacity and disability benefits mostly affect spending from then on, by £1.8 billion in that year and rising to £4.6 billion by 2029-30.

Changes to the path of day-to-day departmental spending also rise to over £5 billion by 2029-30, although some of that is offset by specific investment programmes such as employment support, DWP delivery and HMRC compliance. On net, current departmental spending has been cut by £3.6 billion by 2029-30 relative to plans.

There have also been some increasing in the tax take. Much of it is from compliance activity and tax debt collection, although there are also additional council tax increases allowed in England and increases to passport and visa fees. Receipts are higher by £2.3 billion by 2029-30 because of measures.

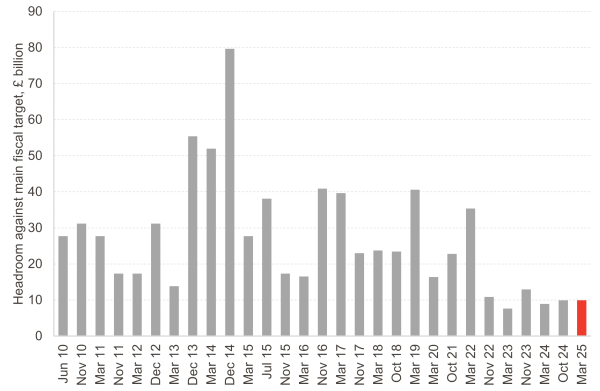

But the Chancellor has had to run just to stand still. She is just as close to missing her fiscal rule as she was in October, and that leaves her exposed to any weaknesses or market movements between now and the Autumn. Things may well turn out for the better – but that is far from guaranteed, and it’s as close to a 50-50 bet as it gets.

Chart: Headroom against the main fiscal target since 2010

Source: OBR

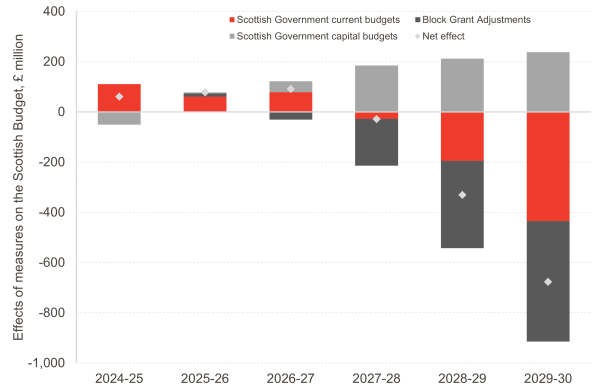

What do the announcements mean for the Scottish Budget?

In the very short-term, there is a small amount of additional funding (£28 million) for the Scottish Government in 2025-26 due to a small increase in departmental spending at UK Government level.

Towards the end of the forecast, however, the picture is significantly more challenging in terms of what it means for Holyrood’s finances. The cuts in departmental budgets announced by the UK Government – even after accounting for some consequentials from employment support programmes and DWP delivery of welfare reforms – mean significant reductions in funding for the Scottish Government relative to what was previously included in the forecasts. Of particular significance are the £200 million and £435 million cuts in implied funding for the Scottish Budget in 2028-29 and 2029-30.

The current forecast points to the PIP reforms reducing the block grant adjustment for social security devolution by increasing amounts, from £177 million in 2027-28 to £455 million in 2029-30. This is in line with what we discussed in recent blogs.

Put together, and in the absence of any other changes, the Scottish Budget would be around £900 million worse off on the current side in 2029-30 than previously projected. On the other hand, some additional capital spending on areas which are devolved in Scotland – so aside from the defence spending increases – are expected to raise the Scottish Government’s capital budget by nearly £250 million by 2029-30 relative to current plans.

Chart: Effects of the Spring Statement measures on the Scottish Budget

Source: OBR

There’s still much we don’t know about the welfare reforms

One key policy change from last week’s Green Paper that the OBR have not been able to cost is the removal of the Work Capability Assessment (WCA) that currently determines whether a person is eligible for the Universal Credit (UC) health element. The UK Government have proposed that the PIP assessment will be used instead.

The OBR note the absence of key policy detail, including how entitlement will operate in Scotland where PIP is being phased out. They do state that they expect the policy to have a “material” fiscal impact, both on spending on UC but this could be offset by an increase in people claiming PIP. The labour market response of this (as with most of the other Green Paper policies) is also yet to be analysed by the OBR.

These changes will directly impact on people in Scotland as UC is a reserved policy, but as already noted, how this will happen given that PIP will soon not exist in Scotland, is unknown. The number of people impacted could be significant. The Scottish Government could mitigate this impact through its own social security top up powers but, as with the recently announced mitigation of the two-child limit in UC, would need to be able to find the money to do so from within its own budget.

But distributional analysis shows significant numbers of people will be worse off

Alongside the Spring Statement documents, the UK Government also update their distributional analysis (the differential impact of policies on poorer, middle, and higher income households). The impact of the Spring Statement, the policies from the Spring Statement are added to the policies from the Autumn Statement, making it difficult to isolate the impact of the Spring Statement, although the regressive nature of the welfare measures is clear to see: those in the lower half of the income distribution are facing most of the cuts.

Separately, the UK Government has produced a statement on the impact of the health and disability reforms.

This makes for sobering reading. The impact of changes to the eligibility for PIP will affect 800,000 people who will no longer be eligible for the Daily Living component. They note a further 150,000 people will not receive Carer’s Allowance of the UC Carer element as a result. These numbers are for England and Wales only given that disability benefits are devolved.

These results, on their own, will increase the number of working age people in poverty by 250,000 and 50,000 children. The UK Government are careful to say that these estimates do not account for any employment impact of those who lose benefits subsequently moving into work, and we will need to wait for the OBR to judge on the strength of these employment effects to understand the potential for offsetting of these numbers.

The reduction and or freezing of the UC health element will affect Scottish claimants as well as those in England and Wales. 2.25 million people who are current claimants will be affected by the freeze and 730,000 new claimants will receive the new lower rate and freeze. A further 50,000 working age people will be in poverty as a result of these changes.

There is as yet no analysis of the impact of the abolition of the Work Capability Assessment in UC, and the only impact that is shown is the reversal of a 2023 change to the descriptors in the Work Capability Assessment, which will not apply given the decision to abolish it.

We’ll have to wait until the OBR has been able to look at the whole policy package in aggregate before we understand the full scale of the impact both on the UK and Scotland. But it is clear from what we know so far that this is a package of measures that will raise poverty across the UK.

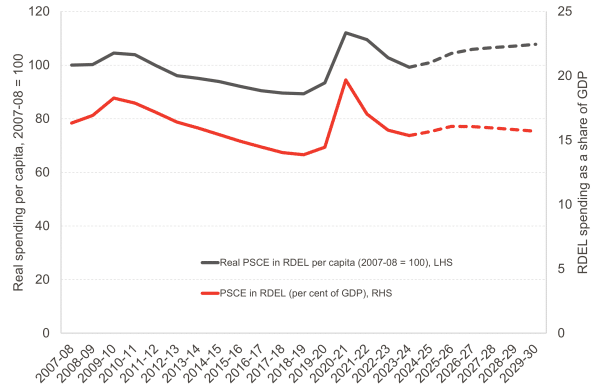

How does departmental spending look in historical context?

In October, the Chancellor announced significant increases in departmental spending. But we and others also noticed how frontloaded some of those announcements were.

This has been made even more so by the changes at this forecast to the latter years of the projections. Day-to-day departmental spending per person is now forecast to grow by a strong 3.4% in real terms in 2025-26, slowing to 1.5% in 2026-27 and remaining at 0.6% a year for the rest of the decade.

We’ll leave others to decide on words to characterise this path of spending. We’ll instead note that this leaves spending per person only 8% higher than it was in 2007-08. And as a share of national income – a better measure of affordability and of the Government’s prioritisation of the country’s resources – there is a slight increase in spending in the short-term. But day-to-day departmental spending then falls back by 0.4 percentage points by the end of the decade relative to its peak of 16.1 per cent of GDP in 2025-26 and 2026-27.

Chart: Resource departmental spending per person in real terms and as a share of GDP since 2007-08

Source: OBR, FAI analysis

Look out for more analysis

Tomorrow we’ll be focussed on the release of the child poverty statistics. We’ll have reaction to them, as well as a technical report on issues about how the Scottish Child Payment is captured in the data.

On Friday, we’ll also round up reactions to the Spring Statement, so stay tuned as we navigate this busy week of announcements!

Authors

João is Deputy Director and Senior Knowledge Exchange Fellow at the Fraser of Allander Institute. Previously, he was a Senior Fiscal Analyst at the Office for Budget Responsibility, where he led on analysis of long-term sustainability of the UK's public finances and on the effect of economic developments and fiscal policy on the UK's medium-term outlook.

Mairi is the Director of the Fraser of Allander Institute. Previously, she was the Deputy Chief Executive of the Scottish Fiscal Commission and the Head of National Accounts at the Scottish Government and has over a decade of experience working in different areas of statistics and analysis.

Emma Congreve is Principal Knowledge Exchange Fellow and Deputy Director at the Fraser of Allander Institute. Emma's work at the Institute is focussed on policy analysis, covering a wide range of areas of social and economic policy. Emma is an experienced economist and has previously held roles as a senior economist at the Joseph Rowntree Foundation and as an economic adviser within the Scottish Government.