Today GDP figures for Q2 2016 were published by the Scottish Government.

This blog summarises the key results and provides some insight into what this tells us about the overall health of the Scottish economy.

The first point to note is that today’s figures cover the period immediately prior to the EU referendum. We won’t have official data for the Scottish economy for the post-referendum period until January 2017.

Nevertheless, given the relatively fragile nature of Scottish growth over the last 18 months today’s figures are a useful barometer of the strength of the economy.

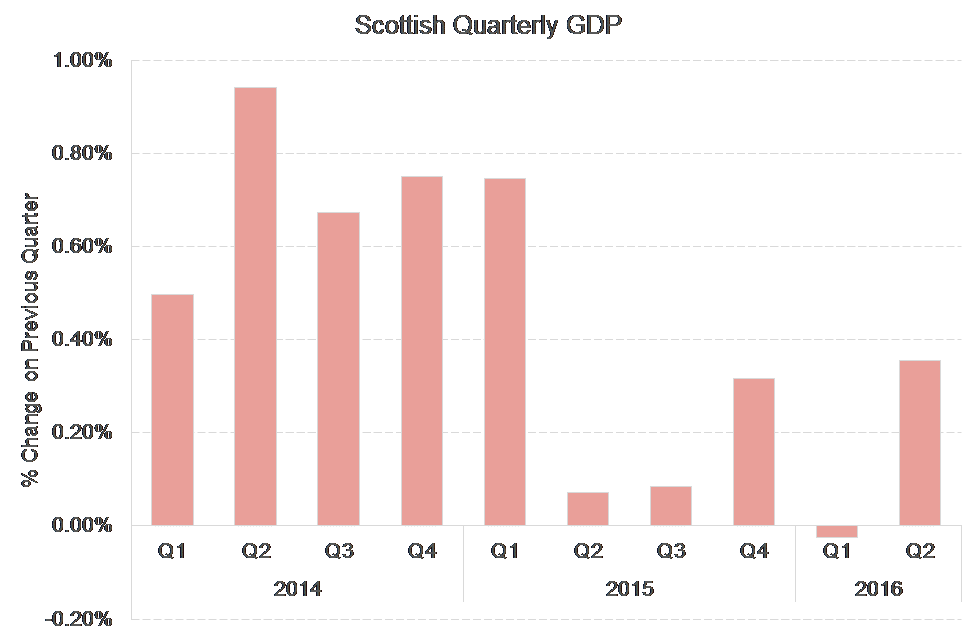

The first conclusion is that at the aggregate level, the quarterly results are an improvement on recent quarters and more positive than anticipated.

- Scottish GDP grew by 0.4% over the quarter, compared to flat growth (i.e. 0.0%, although, see below on un-rounded Q1 GDP) during the first 3 months of 2016.

- In fact, the underlying growth in the economy is likely to have been even stronger. Longannet power-station closed at the end of March and Scottish Government statisticians estimate that this will have reduced overall growth by around 0.2%. Without the impact of Longannet, output would have been even higher – closer to 0.6%.

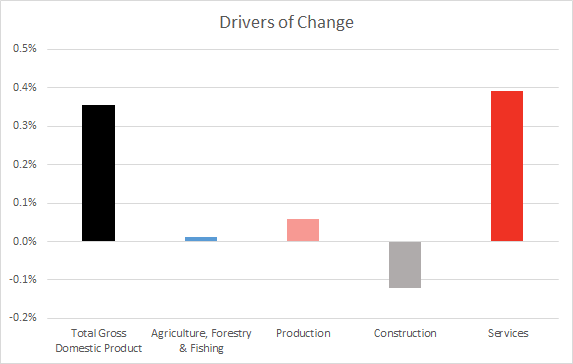

- Production was up 0.3% over the quarter (but down 2.9% over the year), construction was down 1.9% over the quarter (and down 4.5% over the year) whilst services were up 0.5% over the quarter (and up 2.0% over the year).

Taken together, today’s numbers show the Scottish economy returning to growth. At 0.4% – albeit a weak 0.4% as the unrounded data shows it was 0.35%! – this is the fastest quarterly growth in over a year.

The figures today are relatively more positive than some key business surveys would normally predict. For example, PMI data over the same period reported output down in the first two months of the quarter with only a modest rise in the third month. Our own Nowcasting prediction was for growth of around 0.3% but that was before accounting for Longannet.

On this basis, today’s figures are positive.

However with growth actually slightly negative in Q1 (see the un-rounded data published today in the accompanying excel spreadsheet published alongside the news release!), overall growth in the first 6 months of 2016 of around 0.4% is clearly weak.

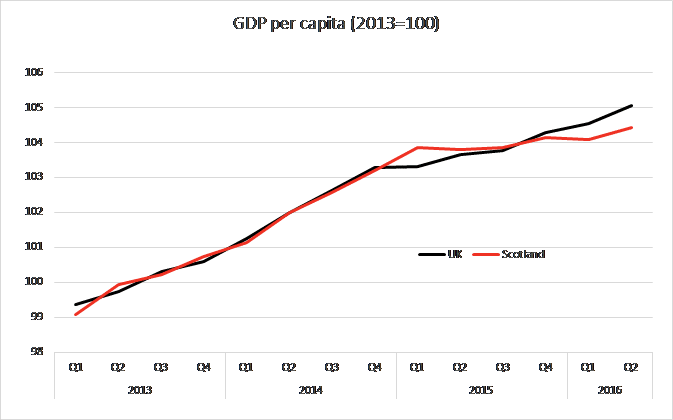

Moreover, the gap between Scotland and the UK continues. Over the last year, Scotland’s economy grew by just 0.7% compared to UK growth of over 2.2% (excluding oil and gas). Over the last two years, Scotland has grown by 3.0% compared to 4.8% for the UK as a whole.

From April, Scotland’s Budget will increasingly depend upon our relative economic performance vis-à-vis the rest of the UK. For this, growth per head (as a proxy for tax revenues per head) is a crucial indicator. On this basis (i.e. GDP per head), the UK grew by 1.4% over the last year – more than double the equivalent Scottish rate of 0.6%. Closing that gap will be crucial, failure to do so will squeeze Scotland’s public finances even more.

Changes by Sector

Analysing the performance of individual sectors is useful as it helps both to unpick the performance of different components of the economy and to identify those sectors that are contributing the most to the overall growth (or contraction) in output.

Today’s figures are especially interesting. We’d highlight a few interesting points.

Firstly, the production figures show a mixed-bag of results. On the one hand, overall manufacturing grew by 0.8% over the quarter but it remains down 3.6% over the year and over 5% since early 2015. The sectors most directly tied to the downturn in the North Sea remain weak.

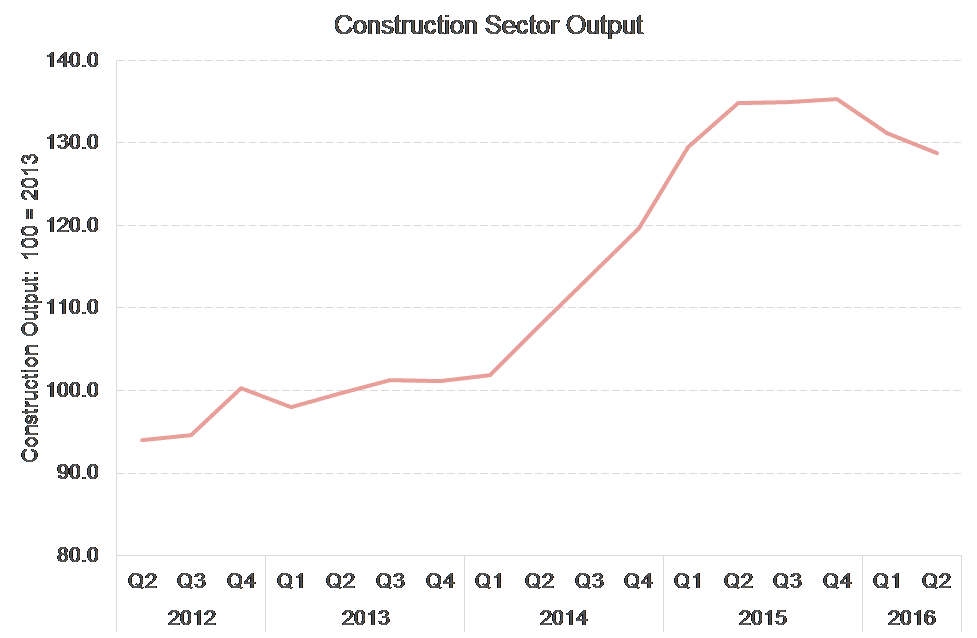

Secondly, construction continues to return to more normal levels. As we highlighted in our July Economic Commentary, according to the official statistics, construction grew by 35% between Q2 2013 and Q2 2015. Setting aside any concerns we have about the data, growth of this scale clearly cannot continue indefinitely. Unsurprisingly therefore, output has fallen by 3.0% in Q1 and by a further 1.9% in Q2.

Thirdly, despite the recent challenges in the Scottish economy, the all-important services sector has continued to grow. Today’s 0.5% figure for Q2 2016, comes on the back of growth of 0.5% in Q1 2016; 0.4% in Q4 2015; and, 0.5% in Q3 2015. However, this is much slower than the equivalent growth for the UK as a whole – which grew 2.7% over the year compared to growth of 2.0% in Scotland.

A final thought

On closer inspection, we find that – in addition to the Longannet effect – two other sectors had a particularly disproportionate impact on the overall Scottish results this time.

Firstly, the Professional, Scientific, Administrative & Support Services sector grew by over 3.5% over the quarter. This alone added 0.4% to the headline GDP figures. The data appears to be relatively volatile with the 3.5% growth this quarter reversing a 3.8% fall in the previous quarter!

Secondly, there is a (huge) 7% increase in the output of the Water Supply & Waste Management sector in Q2 – with growth of 12.1% relative to the same quarter in 2015. This is a very small component of the overall economy (just 1.3% of total output) so normally changes here have little or no impact on the overall rate of growth. But on this occasion it added 0.1% to overall GDP.

Taken together, these two sub-sectors added around 0.5% to the overall growth rate of the entire Scottish economy this quarter. In effect, equivalent to the entire measured growth in the economy as a whole – without them the economy would have been virtually flat (or negative) once again!! It’s not entirely clear what drove these sharp increases in both sectors, although at the very least, it highlights a continued fragility in the overall Scottish economy.

In conclusion, you can look at today’s GDP data through either a ‘glass-half full’ lens (i.e. the economy has returned to growth) or via a ‘glass-half empty’ lens (i.e. the Scottish economy continues to lag behind the UK as a whole and remains relatively fragile).

We’ll leave it to our readers to decide which camp they are in!

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.