The latest data confirms that businesses across most sectors of the Scottish economy are currently trading, with tourism-facing industries continuing to be hit the hardest by the ongoing tiered lockdown system.

However, with 11 local authorities confirmed to be moving into tier 4 of the Covid lockdown restrictions, more businesses, including restaurants, cafes and non-essential retail will now be forced to close from 6pm tonight for a minimum of 3 weeks. This means tougher restrictions will be effective across most of the west of Scotland until the 11th of December.

Further to this, the 3-week lockdown for large parts of the country comes at a time where many households are already reporting deteriorated mental health, and with more people now reverting back to working from home, and some not working at all, the outlook for businesses, jobs, and wellbeing are highly uncertain.

However, the decision to extend furlough will have saved a number of jobs – two-fifths of firms were planning redundancies before the furlough extension was announced at the end of October. We discussed this and our other main findings from our Scottish Business Monitor in our podcast last week.

Last week we also published two articles on the impact of hours worked on poverty and the effects of underemployment on things like wellbeing.

While news of further restrictions feels like a step back on the path towards economic recovery, recent positive news of a Covid-19 vaccine has boosted optimism across the world. The Economics Observatory recently published an article on how stock markets responded to the vaccine update. They found that shares in firms hardest hit by the pandemic, such as oil companies and airlines like British Airways, benefitted from the news.

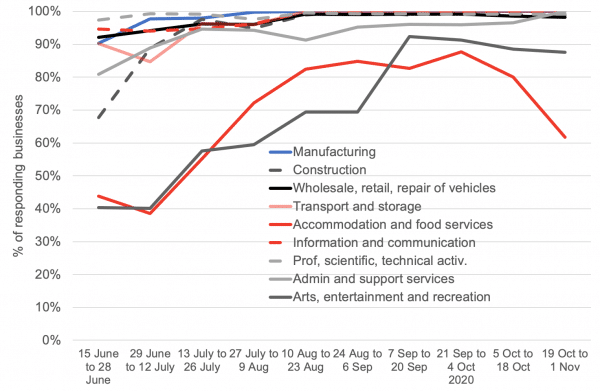

Chart 1: Estimated share of businesses that are currently trading, broken down by industry, Scotland, 15th June – 1st November 2020: The share of businesses in most sectors has returned to near-normal levels of trading, with the admin and support services seeing an increase on the share of trading businesses since our last update. However, the share of accommodation and food services businesses trading continues to fall, with just over 60% of businesses in this sector currently trading. Given that 11 local authorities, from 6pm tonight, will be under level 4 restrictions, the immediate outlook for this sector has worsened.

Source: Scottish Government

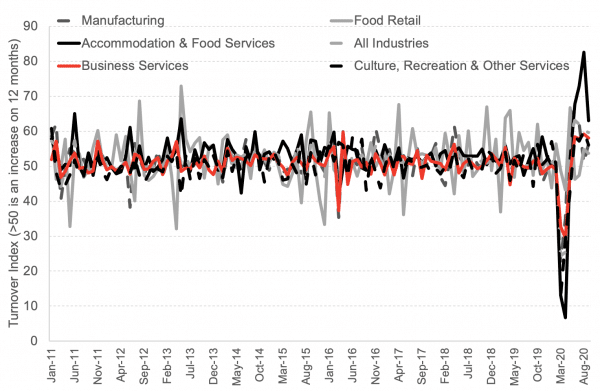

Chart 2: Business turnover index by sector, Scotland, January 2011 – September 2020: Most sectors are reporting an increase in turnover compared to the same time last year. The shutdown of many businesses in the accommodation and food services comes at a time when the sector was just starting to see growth in turnover for the first time in many months.

Source: Scottish Government

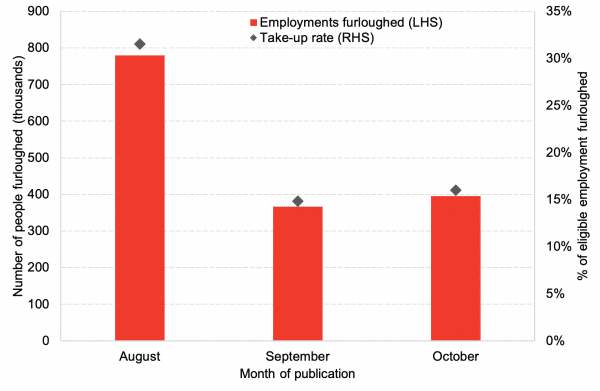

Chart 3: Revisions to estimated number and share of employments furloughed in Scotland up to 31st July, by date of publication of data: HMRC have been producing estimates of the number of furloughed jobs across regions of the UK which are published on a monthly basis. In most of our updates, we report these estimates. However, it must be noted that these estimates, like most national statistics, have been subject to a degree of error and subsequent revisions over the past few months. Between August and September HMRC has revised the number of estimated jobs on furlough in Scotland downwards by 412,800 people (16.7 percentage points). HMRC then made a subsequent upward revision between September and October by 29,100 (1.2 percentage points).

Source: HMRC

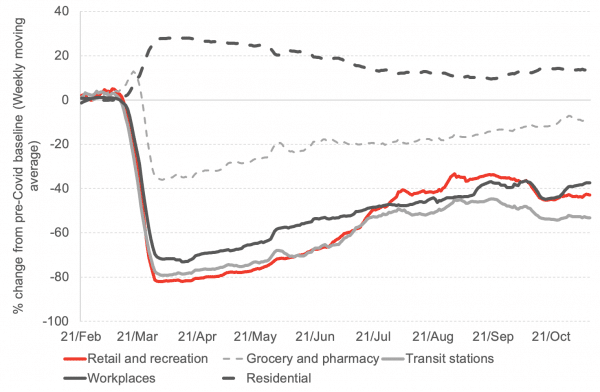

Chart 4: Mobility to different venues, Scottish cities, 21st February – 10th November: Mobility to most amenities has fluctuated over the past few weeks as many Local authorities find themselves in different tiers of lockdown restrictions. Mobility to retail and recreational venues and transit stations has declined, with further reductions expected as national travel restrictions are enforced and non-essential retail and gyms close in 11 council areas, including Glasgow and Stirling.

Source: Google Covid Mobility Trends

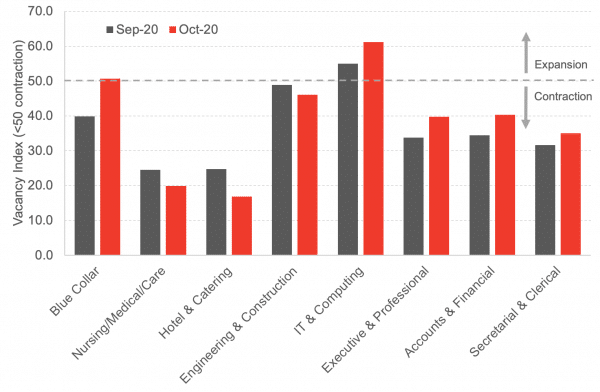

Chart 5: Index of permanent vacancies by sector in Scotland, September, and October 2020: The number of permanent vacancies reported by recruitment consultancies continued to fall in October across most sectors, with small increases seen in the Blue Collar and IT & computing sectors.

Source: Royal Bank of Scotland Report on Jobs

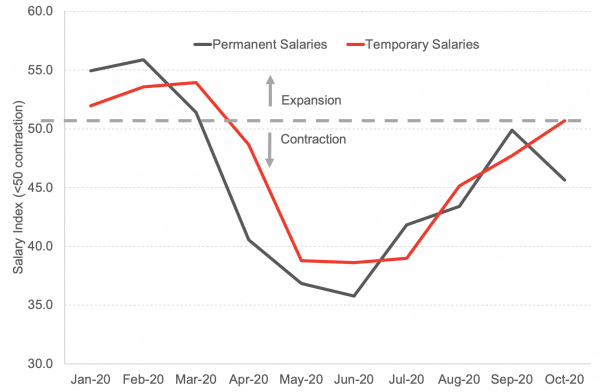

Chart 6: Salary index in Scotland, January – October 2020: After a gradual pick up in the salaries of new permanent workers, salaries have begun to fall again. There has been no expansion in the salaries of permanent workers since March. Salaries of new temporary staff saw a rise in October, bringing it closer to the expansionary threshold for the first time since March.

Source: Royal Bank of Scotland Report on Jobs

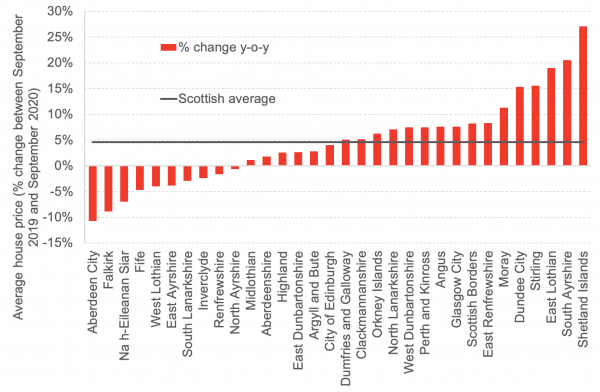

Chart 7: Average house price growth, Scottish local authorities, September 2019 – September 2020: Average house prices in Scotland grew by over 4.5% in the year to September 2020, however, this growth has varied across the 32 local authorities. Aberdeen and Falkirk saw house prices fall by around 10%, while prices in the Shetland Islands and South Ayrshire rose by more than 20%.

Source: Registers of Scotland

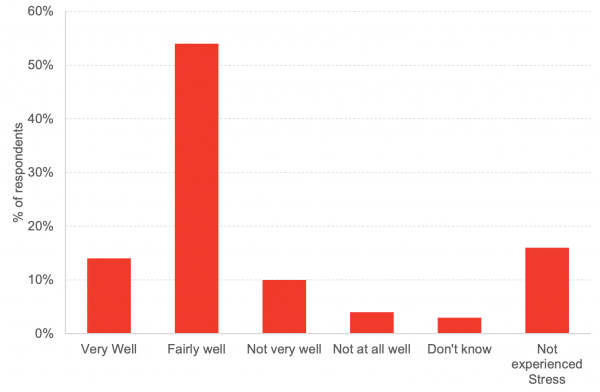

Chart 8: Overall, how well do you think you are coping with stress related to the Coronavirus (COVID-19) pandemic? As of the end of August 2020: More than 80% of people in Scotland reported that they were coping fairly or very well with the ongoing pandemic. However, just under 15% of respondents reported that they were not dealing well with the stress. With a new set of restrictions coming in tonight for nearly 2.3 million people in Scotland, the next few months will be crucial for supporting those struggling with their mental health.

Source: Mental Health Foundation Scotland

Note on our real-term indicators analysis:

We review newly available data each fortnight and provide a regularly updated snapshot of indicators that can provide information on how the economy and household finances are changing. This allows us to monitor changes in advance of official data on the economy being released and also to capture key trends that will be missed by measures such as GDP. Each fortnight we investigate new sources from known data sources and use publicly available data.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.