Today we had figures for GDP growth in Scotland for Q2 2017.

On the one hand, continued growth is clearly welcome. And on the back of the strong growth in Q1 2017, we always said that holding on to some of these gains would be a success in its own right.

But growth of just +0.1% is still disappointing.

As we said on a number of occasions, it is important not to get too carried away with one quarter’s set of results (positive or negative). The Scottish series can be volatile so focussing on longer-term trends – at least over the year – is much more relevant if you are to reach a proper conclusion about the relative health of the Scottish economy.

This blog provides a brief summary of today’s key results.

The headline trends

Today’s Q2 GDP figures for Scotland continue to point to a relative fragile Scottish economy.

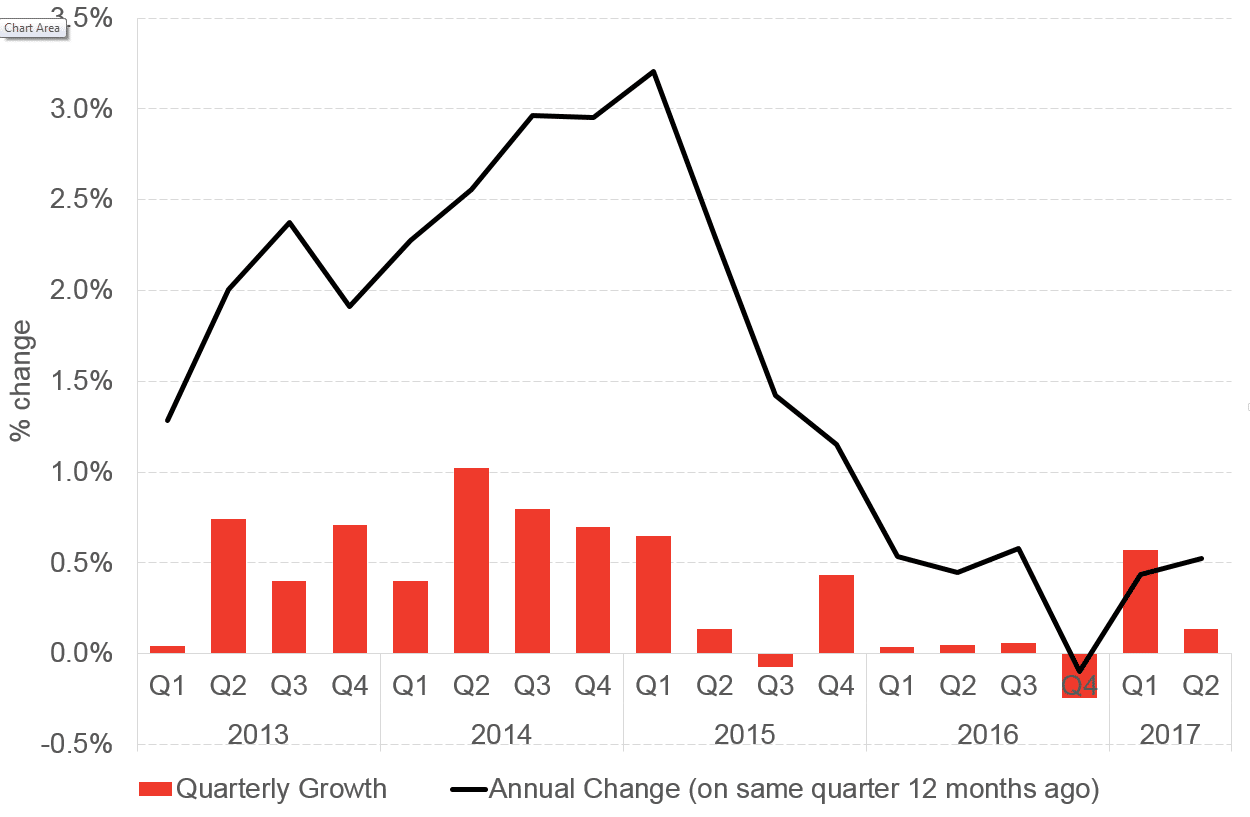

Growth of 0.1% is clearly well below trend.

As the chart highlights, in five of the last six quarters, Scottish growth has been just 0.1% or lower. At the same time, the strong growth witnessed in Q1 has been revised down from an initial estimate of 0.8% (in July) to 0.6% today.

Scottish annual and quarterly GDP growth since 2013

Q1’s results were driven by strong growth in three relatively small sectors – which together accounted for over half the growth in that quarter despite making up around 6% of the entire Scottish economy.

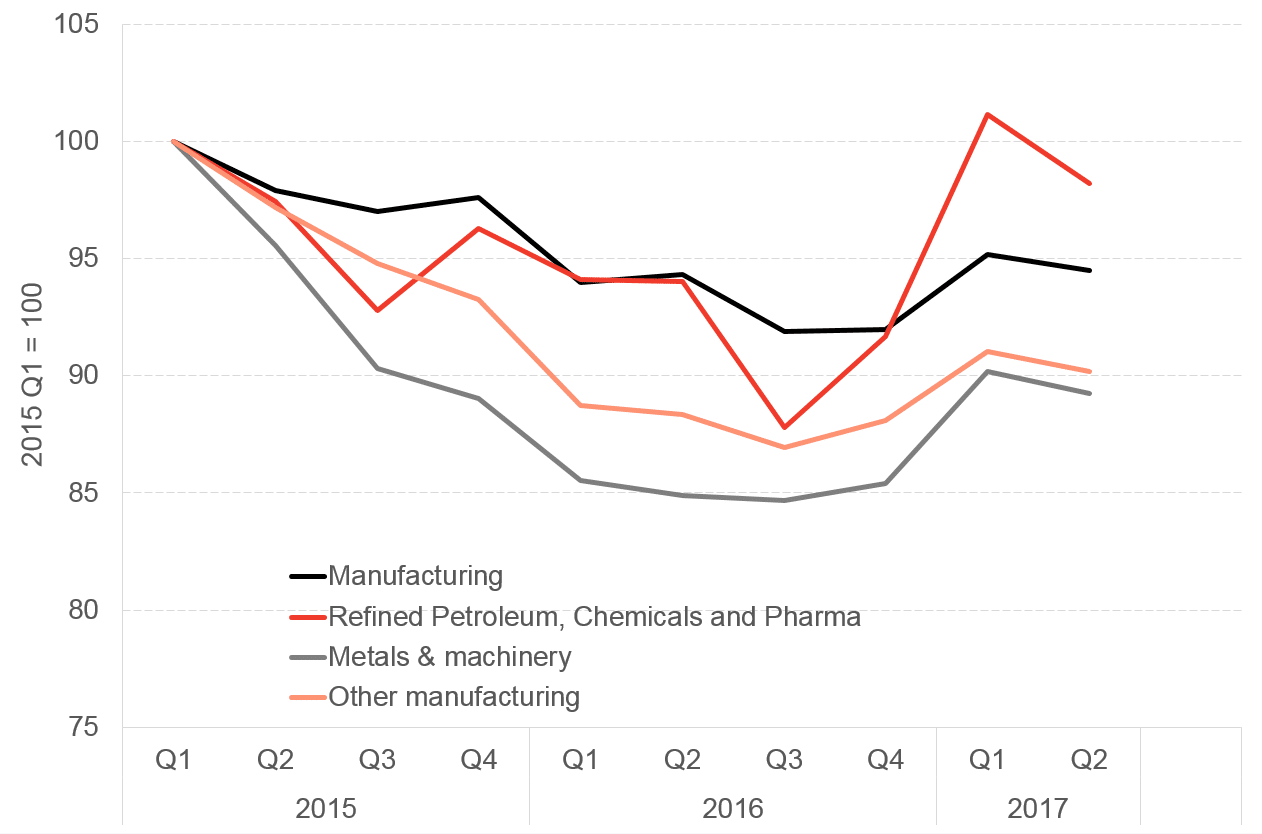

As the chart shows, it is not surprising that these same sectors have fallen back a little – but the fact that they are still better off than where they were six months ago is welcome. All three are still smaller than back at the start of 2015.

Performance of sectors that drove strong growth in last quarter (Q1 2017)

Longer-term trends

As we cautioned in July when these Q1 figures were first published, it is particularly important to look at longer-term trends given the inherent volatility in the Scottish GDP series.

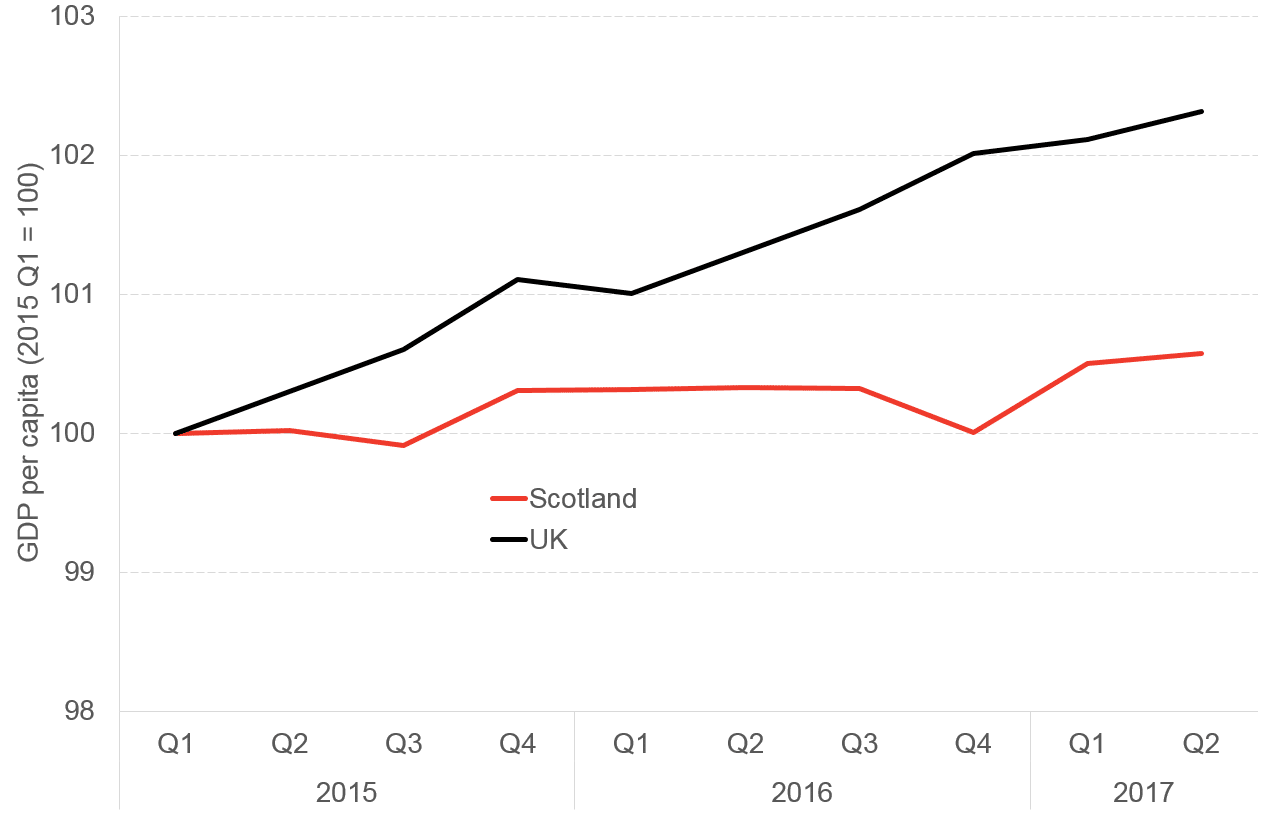

Over the year, the Scottish economy has grown around 1/3 of the equivalent UK rate.

Of greater concern to policymakers will be the fact that today’s results are consistent with a trend that has been evident for over two years now.

Scottish and UK growth in GDP per head since 2015

The downturn in the oil and gas industry has clearly had a significant impact, although other factors are clearly having an impact including low levels of consumer confidence.

They will also have concerns about the even longer-term relatively weak growth record of our economy. Since 2007, GDP per head in Scotland has grown by just under 2% (that’s in total not an average growth rate)

Performance by Sector

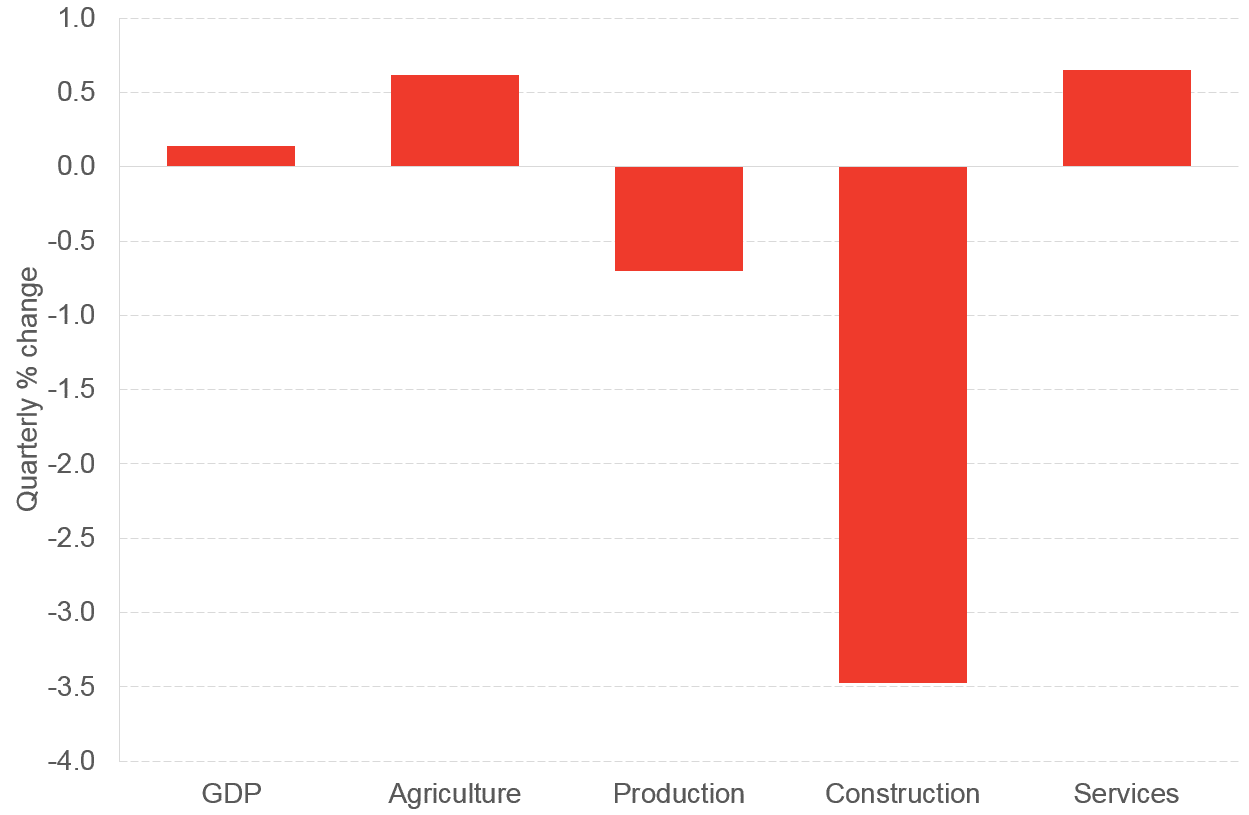

The one significant bright spot was the strength of Scotland’s services sector which grew +0.7% over the quarter with financial and business services growing strongly both over the quarter and the year.

Scottish Q2 2017 growth by sector

In most instances, such strong growth in services would be sufficient to power faster growth in the overall economy given that it accounts for 75% of our overall economy.

But this was offset by activity declining in the construction sector – for the sixth consecutive quarter – and activity in the production sector slipping back.

Therefore, whilst we argued that care should be taken in viewing Q1’s results too positively, similarly Q2’s figures are also a mixed bag with some positive developments evident in some parts of the economy.

The implications of today’s figures

As we discussed in our most recent Economic Commentary, it seems that the Scottish Government is open to new ideas about how to change the support that they provide for the economy – evident in the First Minister’s recent speech in Prestwick (with more of an emphasis on technology and innovation).

If the government is serious about a change in emphasis, we could see the policy landscape become much more dynamic. Today’s figures only serve to heighten the urgency behind a fresh look.

Most importantly, these figures come just as the Scottish Fiscal Commission (SFC) will be starting to prepare their forecasts for Scottish tax revenues in advance of December’s Budget. Indeed they are the last set of official GDP figures the SFC will have to base their forecasts upon.

Today’s results will increase the likelihood that they will be relatively cautious in how much revenue they think the Scottish economy will raise for the budget next year. As we highlighted in our Scotland’s Budget report published last week, this will only add to the squeeze many parts of the public sector will face in 2018/19.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.