As usual, Wednesday’s labour market figures grabbed the attention of most people with the focus once again on the sustained rise in employment and fall in unemployment over the year.

However with Scotland’s labour market close to ‘record’ levels but more fragile growth in the economy overall, another set of statistics also published on Wednesday laid out the ongoing productivity challenge facing our economy.

Wednesday’s labour market statistics showed an increase in employment of 46,000 in Scotland over the year to September 2017. At the same time, unemployment fell by around 20,000.

Strong labour market outcomes are clearly welcome. Whilst there are concerns about the nature of some of the work being created recently, the overall trend has – on the whole – undoubtedly been positive.

That being said, this is only one dimension of the wider health of the economy.

With relatively weak economic growth, more people in work implies that the average contribution of each person to national output is either growing very slowly or falling. How this productivity performance evolves over time is crucial. It is productivity that has the greatest impact on sustainable economic growth and is key to boosting earnings and growing the tax base over the long run.

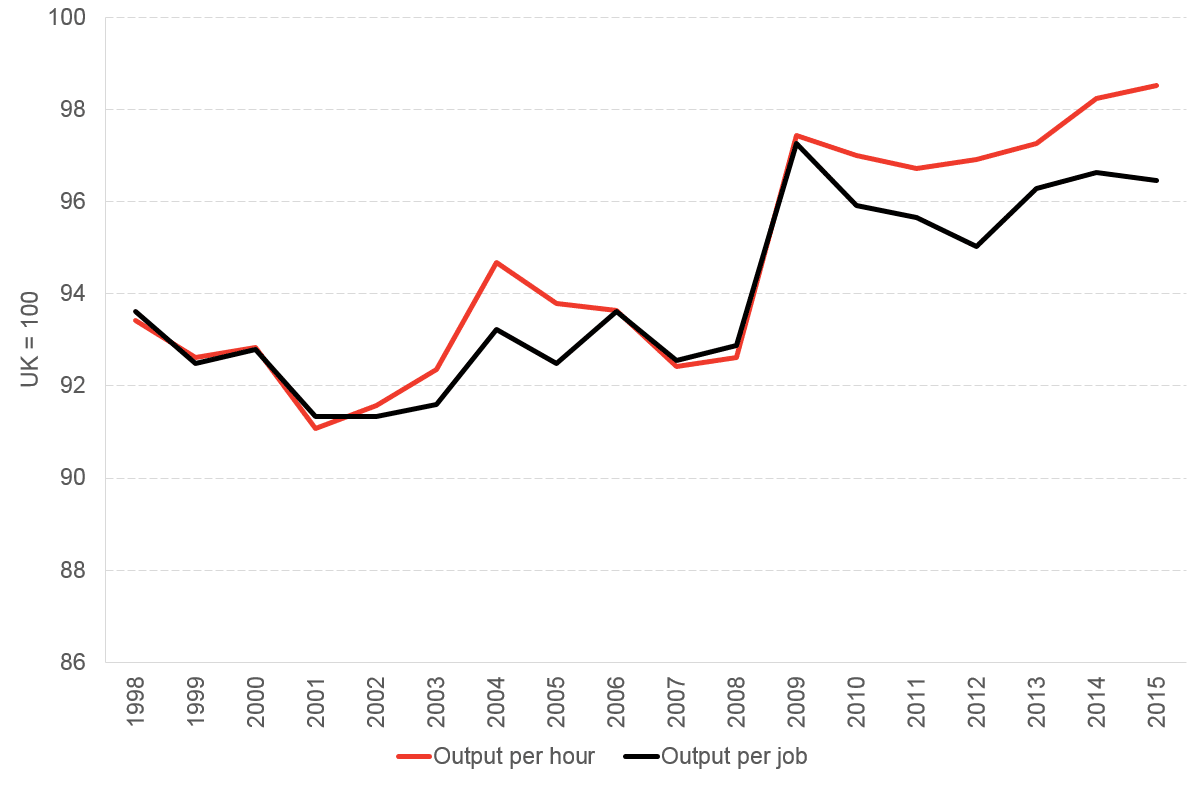

Productivity growth figures for Q2 2017

The Scottish Government now publishes labour productivity indicators on a quarterly basis.

The latest figures published on Wednesday showed that productivity as measured by output per hour (the preferred measure economists’ use) was down 2.2% over the year.

Scottish productivity had been catching up with the UK – new figures on the relative performance will be published in January.

Scotland catching up with UK productivity

Whilst closing the productivity gap with the UK is clearly positive, it would be overly optimistic to interpret this as a ‘strong’ performance.

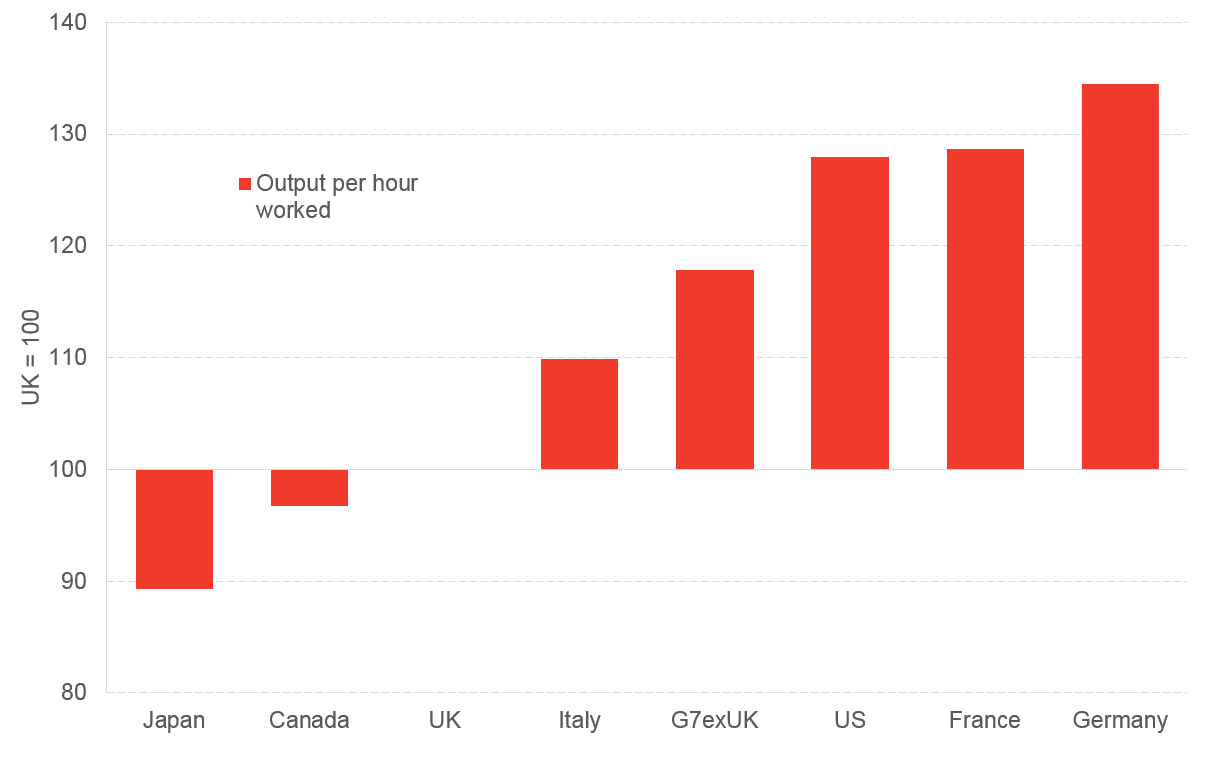

Firstly, UK productivity still lags behind many of our major competitors.

Recent research by the Bank of England estimates that around 1/3 of UK companies have seen no rise in their productivity this century.

As the chart below highlights, many other countries in the G7 are more productive than the UK (and therefore Scotland).

International productivity comparisons (G7 in 2016)

Of course, many of these countries also have higher unemployment in Scotland. And there can often be a trade-off between short-term movements in productivity and unemployment.

Secondly, productivity growth in Scotland has now been negative for seven consecutive quarters.

As with Scottish GDP data, one reason for this is the downturn in the oil and gas industry spilling over onto the onshore economy. Capital investment in the North Sea is down 50%.

With many of the sectors in the North Sea supply chain – e.g. in advanced engineering – highly productive, the potential drag on overall Scottish productivity should the sector continue to operate on a smaller scale could be that bit greater.

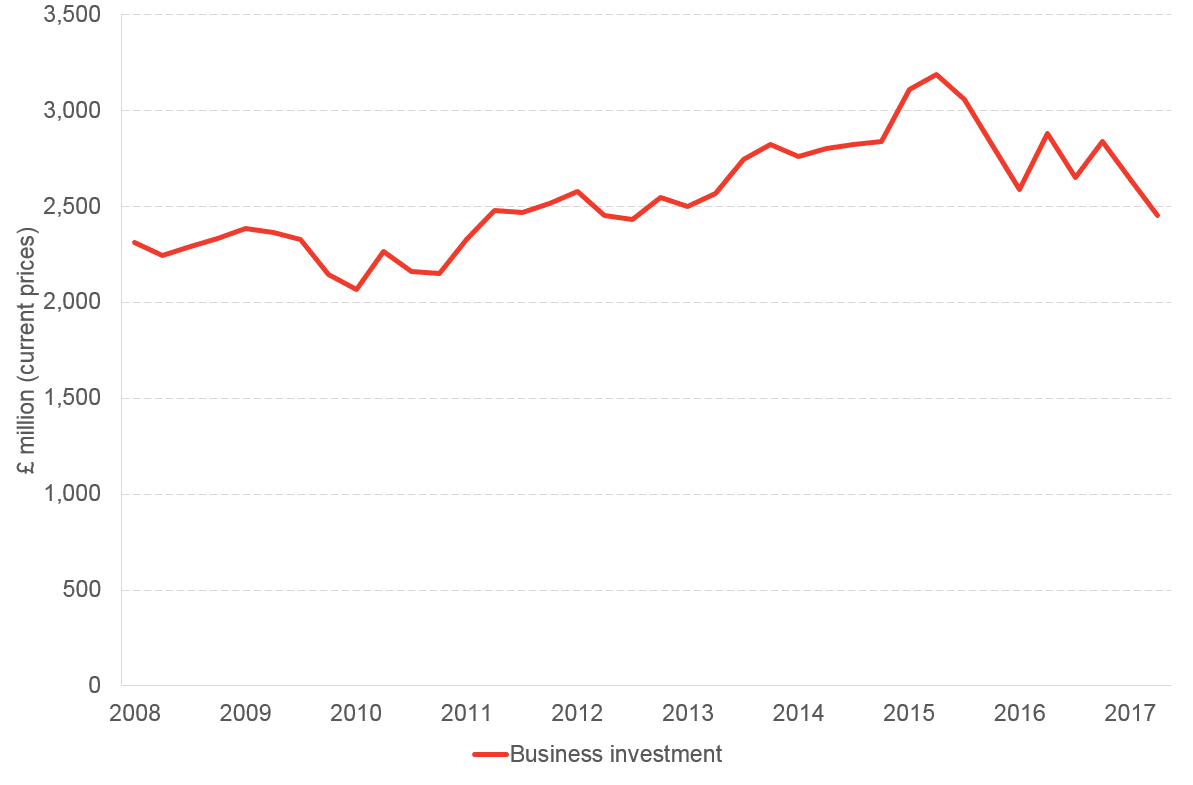

Thirdly, this downturn in productivity has coincided with a fall in business investment. Last week, new figures were released which showed investment in Scotland has fallen nearly 15% over the last year.

And this is on the back of business investment levels which have been broadly flat for the best part of a decade – even before accounting for inflation.

Business investment in Scotland

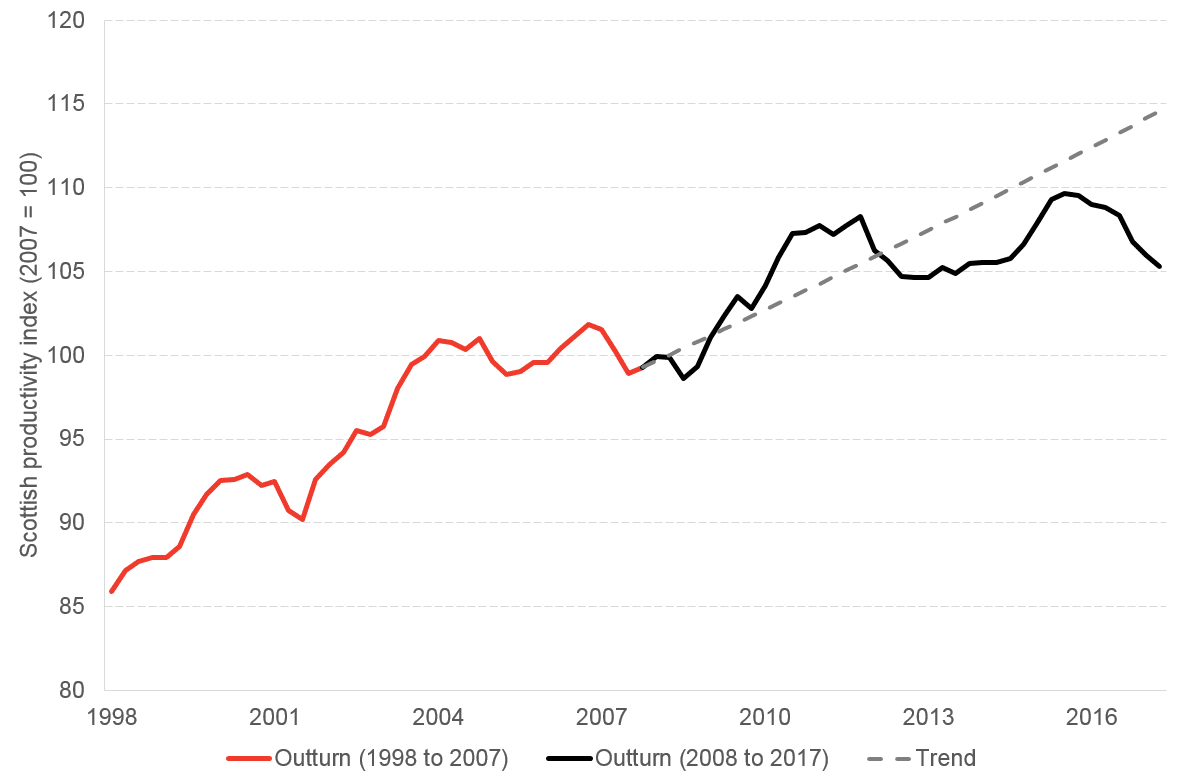

Fourthly, looking over a slightly longer horizon we see that Scotland’s productivity performance – while better than the UK – has been below its own historical standards.

Scotland’s productivity over time

Indeed, had productivity in Scotland grown at its pre-financial crisis average from 2008 onwards, we’d now be nearly 10% more productive.

What does all this mean for the upcoming UK and Scottish budgets?

The assumptions that both the Office of Budget Responsibility (OBR) and the Scottish Fiscal Commission (SFC) will make about future productivity growth will have a significant bearing on the revenue forecasts published by both bodies.

Poor productivity growth is, in part, why the Chancellor is now nowhere near delivering on George Osborne’s plan to balance the budget by 2018-19.

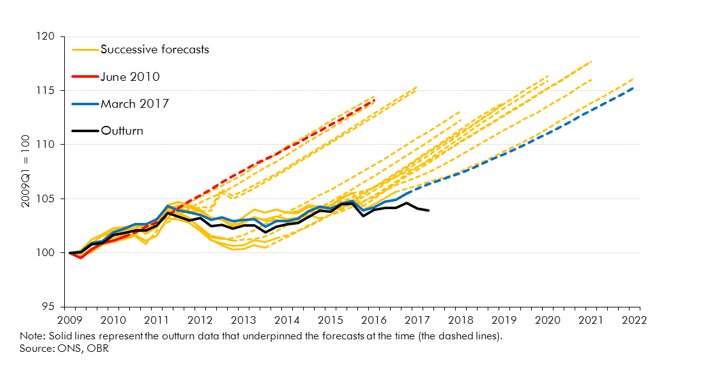

Over the years, the OBR had been predicting that productivity growth would return to its long-run average. But on each occasion, they have been disappointed.

OBR productivity forecasts and outturn

It now seems likely that the OBR will move away from assuming that productivity will return to its historical trend at least in the immediate term – indeed they have already said that they “anticipate significantly reducing our assumption for potential productivity growth over the next five years in our forthcoming November 2017 EFO.”

So we should expect to see a corresponding downward revision in the revenues the Chancellor will have at his disposal over the next few years. In terms of numbers, productivity growth of just 1% per year, rather than current forecasts of 1.6%, could add around £10 billion to forecasts for the UK deficit by 2020-2021.

Of course, there is a risk that we’ve now become overly pessimistic about productivity growth in our economy – new technologies and innovation arguably are creating unprecedented opportunities for growth.

The key challenge facing all forecasters therefore is the lack of confidence about how productivity may evolve in the years ahead (good or bad).

We will have to await until the 14th December for the SFC’s take on productivity in Scotland and how this will impact on their devolved tax and economy forecasts.

All else being equal, should they be more optimistic about Scottish productivity than the OBR is for the UK, then the Scottish budget will be relatively better off. Of course, the opposite will be true if they take a more pessimistic view.

Scottish productivity growth has done better than the UK as a whole since the late 1990s. But with Scottish productivity slipping back in 2016 and the start of 2017, weak business investment, Brexit, and structural challenges in key high productivity sectors like oil and gas, closing the remaining gap – and more importantly the gap with key international competitors – is likely to require a step change in effort and focus.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.