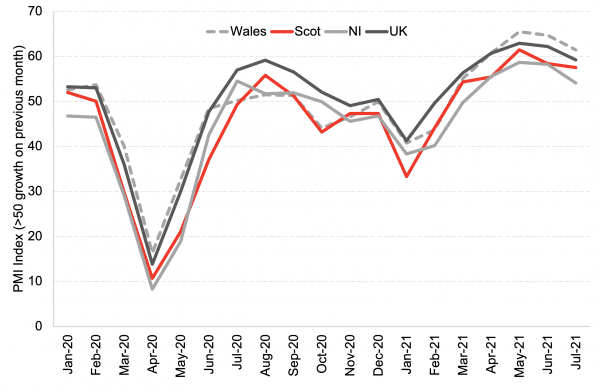

One month on from Scotland moving away from tiered restrictions and the economy continues to grow.

Most indicators tracking economic activity in real time have improved since our last update in August.

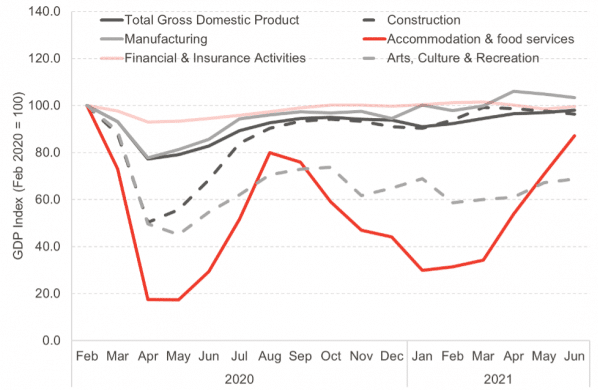

The latest GDP data for Scotland suggests that in June the economy had grown by 0.9% month-on-month, but still remained 2.1% below pre-pandemic levels.

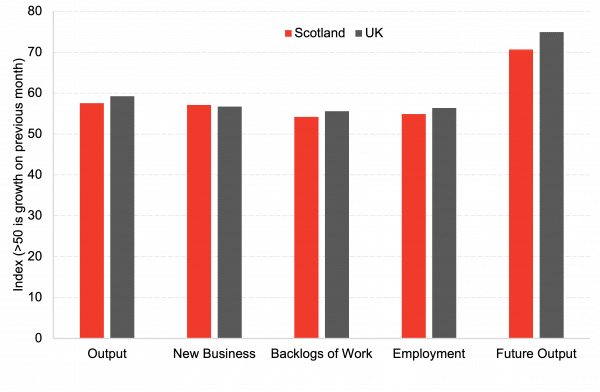

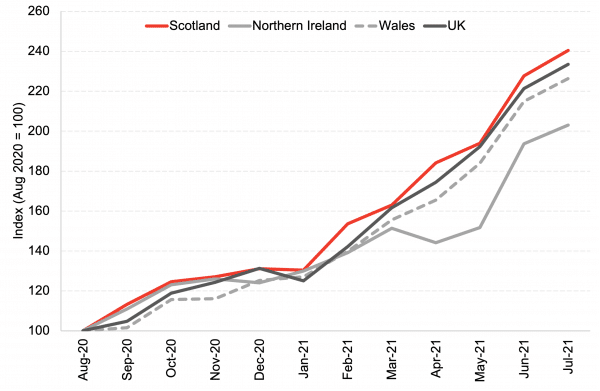

Scottish vacancies have grown faster than the other nations of the UK, but overall levels of business activity and wages have been slower to recover. The ONS also estimate that around 4% of businesses expect to make redundancies in the coming 4 months.

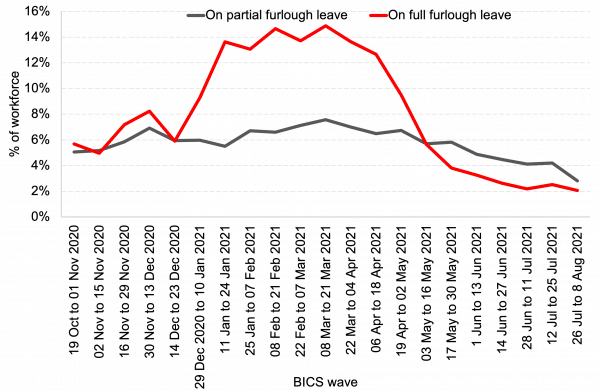

The share of workers on furlough also continues to fall. However, with a large share of jobs still supported, and the end of the government furlough scheme looming at the end of September, there remains a high degree of uncertainty in the labour market.

Furthermore, research into the knock-on effects from the end of furlough by the IFS predict that those individuals with either a high earning spouse or high levels of savings; or those with middle to high earnings, are most at risk given higher financial support under the furlough scheme but lack of eligibility for universal credit once furlough ends.

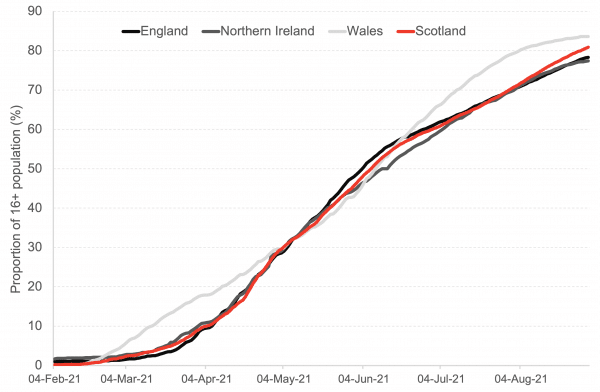

The recovery however continues to be made possible by the increasing number of individuals receiving their Covid-19 vaccination. As of 31st August, 91.1% of Scotland’s adult population had received their first dose of the vaccine, with 82.7% having received both doses.

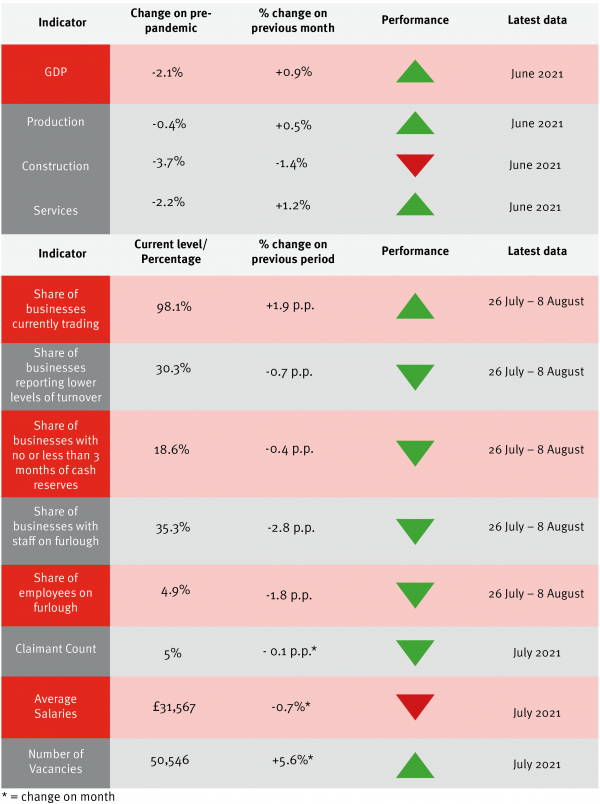

Table 1: Real time indicators dashboard

Source: Scottish Government Monthly GDP, Scottish Government BICS, ONS (NOMIS), Adzuna

Chart 1: GDP across different sectors, Scotland, February 2020 – June 2021: Scottish GDP grew by 0.9% in June, primarily driven by the continued recovery in the services sector. Accommodation and Food services continues to contribute the most growth in the services sector and gets closer to returning to pre-pandemic levels. The construction sector also continues to contract, for the third month in a row, and is now below its pre-pandemic levels.

Source: Scottish Government

Source: Scottish Government

Source: Adzuna Labour Market Stats

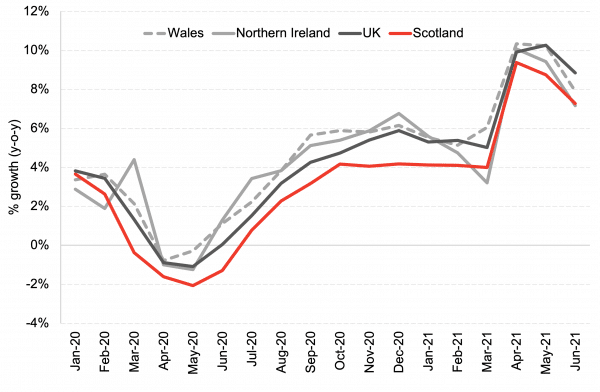

Chart 6: Average year-on-year wage growth from HMRC RTI, UK and devolved nations, January 2020 – June 2021: The increase in demand for labour and higher profitability of firms have put upward pressure on wages. Wage growth in Scotland peaked in April 2021 but has slowed in subsequent months. Furthermore, wages in Scotland have also grown at a slower pace than the other devolved nations.

Source: ONS

Chart 7: Proportion of 16+ population who have received both doses of Covid-19 vaccination: The number of individuals fully vaccinated against Covid-19 continues to grow with 88.4% of individuals receiving their first dose and 78.7% of people fully vaccinated in the UK. Wales has the highest proportion of its population fully vaccinated against the virus, followed by Scotland.

Source: UK Government

We review newly available data each month and provide a regularly updated snapshot of indicators that can provide information on how the economy and household finances are changing. Each month we investigate new sources from known data sources and use publicly available data.

Authors

Ben is an economist at the Fraser of Allander Institute working across a number of projects areas. He has a Masters in Economics from the University of Edinburgh, and a degree in Economics from the University of Strathclyde.

His main areas of focus are economic policy, social care and criminal justice in Scotland. Ben also co-edits the quarter Economic Commentary and has experience in business survey design and dissemination.

Frantisek Brocek

Frank graduated from the University of Strathclyde in 2019 with a First-class BA (Hons) degree in Economics. He is currently studying on the Scottish Graduate Programme MSc in Economics at the University of Edinburgh.

He has experience from a variety of economic policy institutions including the European Commission in Brussels, the Slovak Central Bank and the Ministry of Finance.