Earlier this week, the Scottish Government announced a new ‘National Mission’ to tackle poverty. The announcement appeared to be tied to a call for further powers, but at the very least it stirred a renewed debate on child poverty in Scotland.

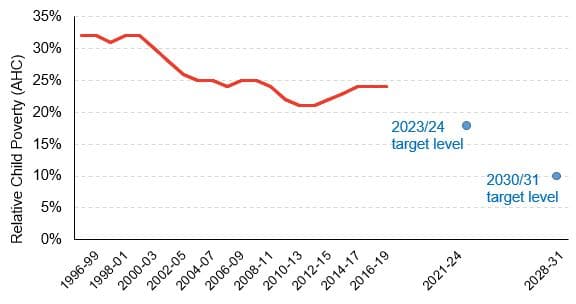

It is nearly four years since the passing of the Child Poverty (Scotland) Act which set ambitious targets for child poverty in Scotland. It mandated that by 2023/24 fewer than 18% of children should be in relative poverty[1], and that by 2030/31 this should be the case for fewer than 10% of children.

In recent years the child poverty rate in Scotland has actually been increasing. Although policies often take time to feed through into statistics, the most recent estimates suggest it is around 26% (Chart 1).

Chart 1 – The relative child poverty rate over time in Scotland

Source: Family Resources Survey, DWP. Note: 3-year averages are used to calculate poverty rates.

These targets are already set in legislation, with cross party support, so the key question is what polices would need to be in place to make progress towards them, and at what scale? The Fraser of Allander Institute recently carried out some work for the Poverty and Inequality Commission to develop modelling tools to better understand this.

In this article we describe this work and discuss what more has to be understood in order to inform effective policy on reducing poverty. With the next Scottish Government child poverty delivery plan is due to be published in the Spring of 2022, and we hope this and future work can help build the requisite modelling tools to build evidence-based policy – something that has been openly acknowledged as having been lacking from the design of the last delivery plan.

How did we approach this project?

As well as building capacity, we also wanted to shine some light on the scale of the challenge posed by these targets, as well as some of the potential trade-offs in using different policy levers to make progress toward them. We focussed on a simplified policy simulation, maximising three potential channels for increasing household incomes:

- increasing social security income to low income families through the Scottish Child Payment;

- reducing housing costs for low income families by subsidising rents; and

- boosting earnings for low income families by simulating an increase in hours (assumed to be brought about via removing barriers to increasing hours of paid work).

For all three channels, we analysed the effects of potential policy changes in two stages. Firstly, how they would impact on household income (e.g. how much more money does it put in families’ pockets)? Secondly, what would be the potential impact on the wider economy (e.g. what would happen if this extra money was spent in the economy and what would happen if there were any unintended consequences, such as adverse impacts on work incentives?).

We used a variety of assumptions to look at different outcomes. Therefore, we were looking at a best guess at what might happen, rather than what will actually occur if similar policies were implemented.

What did we learn?

We wrote on the results from our analysis in our March post on the latest poverty statistics. In terms of child poverty rates, Table 1 below summarises them for the most effective “policies” for each of the three channels we described above.

Table 1 – Summary of the micro-simulation results attempting to meet the intermediate and final child poverty targets

| Interim target (18% by 2023/24) | Final Target (10% by 2030/31) | |

| Increasing the Scottish Child Payment | An increase to £40 a week per eligible child would meet the interim target. | An increase of £165 a week per eligible child would meet the final target. |

| Setting rents to zero for Parents in Poverty | The maximum impact (all rents set to zero for families in poverty with children) would not achieve the interim target (maximum achievable is a 2 percentage point fall). | The maximum impact would again fail to achieve the final target (maximum achievable is a 2 percentage point fall). |

| Increasing Hours Worked by Parents in Poverty | If all parents in poverty worked 20 hours a week, the interim target would be met (assumes either minimum wage or current hourly wage for those already in work) | The 2030/31 target could not be met, even if all parents in poverty worked 35 hours a week (an assumed full-time threshold). Maximum impact achievable is a 6 percentage point fall. |

Our modelling was based on a simplified set of policy levers, but even at this simplified level, there were some useful insights.

The interim target can be met using current powers. Given that the interim targets are due in only 2 years from now, the Scottish Child Payment may be an obvious lever to use to meet it. However, this would be a large undertaking: based on our modelling it would require the Scottish Child Payment to increase to £40 a week. This is £30 a week higher than its current level, and £20 more than that proposed ahead of the recent election.

As things stand, meeting the final target will be extremely difficult. This might merit further discussion as to whether having more control over certain currently reserved policy areas (for example, the minimum wage) might increase the number of tools available to do so. But our modelling does show that the three channels we modelled (which are within current devolved competence) could each have an impact on poverty, and combining these channels could have significant poverty reducing potential. There may be interactions between these policy levers that need to be better understood, however, on the face of it, currently devolved powers can be used to make progress towards to meet the final targets if this is what the Scottish Government choose to prioritise.

In making these decisions, the Scottish Government will need to be aware that large scale policies might have wider economic effects. We found that reducing child poverty by putting money in the pockets of households could increase consumption, and provide an overall boost to the economy. However, policies have to be funded, either by raising or diverting revenue from elsewhere, and this can have economic implications. For example, we found that raising taxes would reduce income, and so spending, for some households. There might also be effects on individuals’ work choices (a point we will return to below) or on wages that would offset the positive economic effects increasing the income of parents in poverty.

This is not to say these economic trade-offs are undesirable given, in our modelling, the other side of the coin is a large scale reduction in child poverty which could have long term benefits to the economy – for example, through improved educational attainment. However, weighing up the costs and benefits of any policy is an important aspect of its development. Although simplified, the modelling we carried out provided a first step towards building an understanding of these trade-offs.

What would help inform future policy in this area?

Over the course of the recent Scottish election, all political parties expressed a desire to enact policy aimed at reducing child poverty. Our work also highlighted what factors need to be better understood to inform effective policies. The most obvious of these were the constraints faced by parents in poverty.

For example, is it childcare, access to adequate work, hours and pay, rising housing and utilities costs, or opportunities for training that hold people back? Similarly, which of these factors co-occur most often, and where? These are all questions that might help inform the design of a future delivery plan.

Relatedly, and as we mentioned above, there is relatively little evidence on what effects policies like the Scottish Child Payment might have on work decisions. An often cited negative of these types of payments is that they might disincentivise work. Whether or not this is an overall economic negative depends on how the extra time and money is spent. On the other hand, some parents might be unable to work as much as they’d like due to the imbalance between their wage and childcare costs. Extra money from the social security system might be used to pay for these services and work more.

How any policy affects incentives will of course depend on individual circumstances, but more work could be done to understand the incentives at play in different situations. This would help with building effective policies to make progress towards the targets.

The work we describe in this article was a first step towards building capacity and evidence on analysing and understanding the challenge posed by the Scottish Government’s child poverty targets. It is clear that meeting the child poverty targets would require large scale policy change. In future work we hope to build more evidence on the effective policy channels through more detailed modelling of policy options, their feasibility, and the trade-offs they might involve.

Our full report is available here.

Endnotes

[1] Being in relative poverty is defined as living in a household with income below 60% of the population median.

Authors

Mark Mitchell

Mark Mitchell is a former research associate at the FAI. In 2021, Mark moved to a post in the Competition and Markets Authority. His research area is applied labour economics, focussing on the causes and effects of human capital accumulation over the lifecourse.

Emma Congreve is Principal Knowledge Exchange Fellow and Deputy Director at the Fraser of Allander Institute. Emma's work at the Institute is focussed on policy analysis, covering a wide range of areas of social and economic policy. Emma is an experienced economist and has previously held roles as a senior economist at the Joseph Rowntree Foundation and as an economic adviser within the Scottish Government.