The UK economy grew by 2.1% in March, bringing the UK’s quarterly GDP contraction in Q1 2021 to -1.5%.

Services – which has driven most of the growth across the economy in the latest month – grew by 1.9% in March as schools reopened and the economy geared up for its recovery. Education services and retail were the greatest contributors to the growth in services.

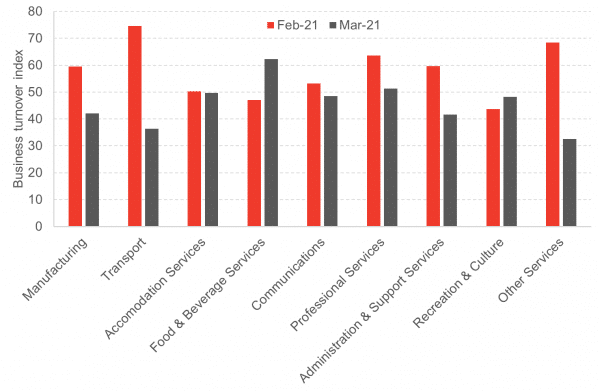

Interestingly, Scotland’s monthly business turnover index was down in March, indicating a contraction of business activity. However, the performance of this indicator does not directly translate to Scotland’s GDP estimates; which will be published on the 26th May.

As of today, mainland Scotland and Islands not moving into level 1 have moved into level 2 of Scotland’s COVID-19 protection levels, with the notable exceptions of Moray and Glasgow.

In terms of what this means for the hospitality sector – the hardest hit industry in the economy -, 6 people from up to 3 separate households can now meet indoors and 8 people from 8 different households can meet outdoors at a restaurant, café, pub or bar. Whilst there are still earlier licensing limits in place and nightclubs are to remain closed, these more relaxed restrictions will help this sector on its road to recovery.

Last week we published an article on how CGE modelling can capture the consequences of COVID-19 on Scotland’s tourism industry – this is a part of a project running until September 2022. You can read more about this project by clicking here.

Additionally, the Economics Observatory recently published an article on the sectors most impacted by the COVID-19 pandemic.

Finally, a few days ago the Resolution Foundation published their first report on their research into the labour market and mental health impact of COVID-19 on young people.

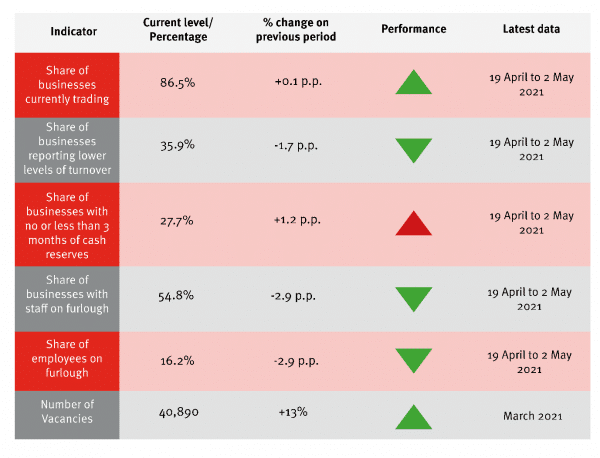

Table 1: Real time indicators dashboard

Source: Scottish Government; Adzuna

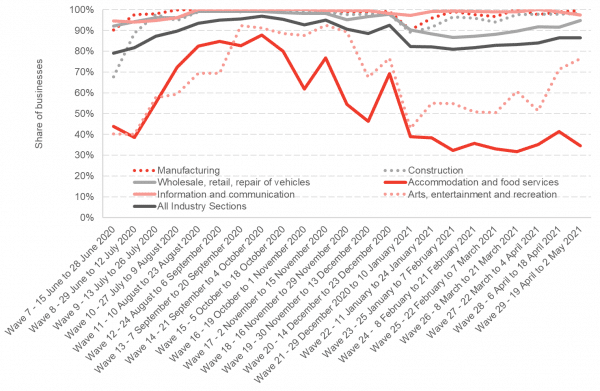

Chart 1: Share of businesses currently trading, Scotland, 7 June 2020 – 2nd May 2021: 87% of businesses across Scotland were currently trading in mid-April to early May. The share of businesses trading in the accommodation & food services sector continued to decline into early may, with a 7-percentage point (p.p.) decline in businesses trading. Information and communication services also experienced a decrease in trading however, not by the same severity.

Source: Scottish Government

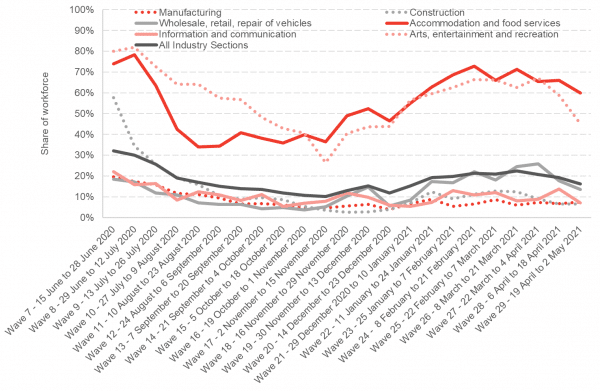

Chart 2: Share of workforce furloughed, Scotland, 7 June 2020 – 2nd May 2021: The arts sector experienced a significant decline in furloughed staff into May. Whilst this sector remains one of the hardest hit by the ongoing pandemic, the latest data shows some signs of improvement as Scotland eases restrictions. The accommodation and food services sector continues to have the largest share of its workforce on furlough.

Source: Scottish Government

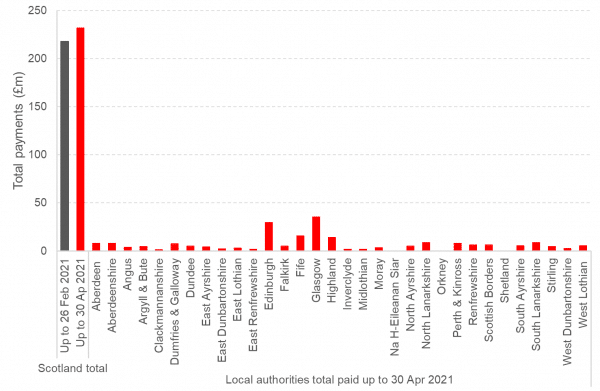

Chart 3: Hospitality, retail and leisure top-up payments in Scotland as of 30 April 2021: Additional government-funded support for the hospitality, retail and leisure sector has been made available, given that this has been one of the worst-hit industries throughout the pandemic. This chart shows the allocation in Scotland by local authority area and indicates that almost all of the funds had been spent before March 2021.

Source: Scottish Government

Note: Na h-Eileanan Siar, Orkney, and Shetland do not receive this funding and are instead paid under the Island Equivalent Payment top up.

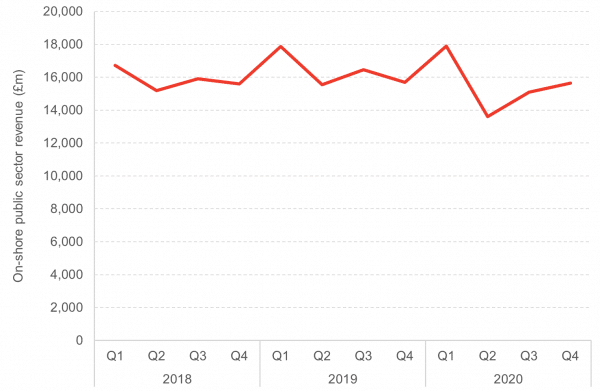

Chart 4: On-shore public sector revenue, Scotland 2018 – 2020: The impact of the Covid-19 pandemic on public finances might be one of the lasting legacies of the crisis, as governments have supported their economies while restrictions limited economic activity. As well as large and sudden increases in spending, another side to this is a fall in tax receipts. This chart shows that year-on-year on-shore revenue in Scotland only came close to pre-pandemic levels in Quarter 4 of 2020. Given that Scotland went into another national lockdown at the start of Q1 2021, the outlook for public sector revenue in the first quarter of this year is poor.

Source: Scottish Government

Chart 5: Business turnover index March 2021 – net balance of firms reporting increased turnover compared to one month previously: Last week saw the release of updated business turnover index figures, which provides insight into whether economic activity is picking up. For all industries, the index score was 46.3 in March 2021, which indicates falling revenue versus the previous month, as Covid-19 restrictions continued. There were some bright spots, however, as food & beverage services and recreation & culture – industries that have been struggling throughout the pandemic – saw their score increase.

Source: Scottish Government

Note: Figures > 50 indicates increasing turnover on the previous month, < 50 indicates falling turnover.

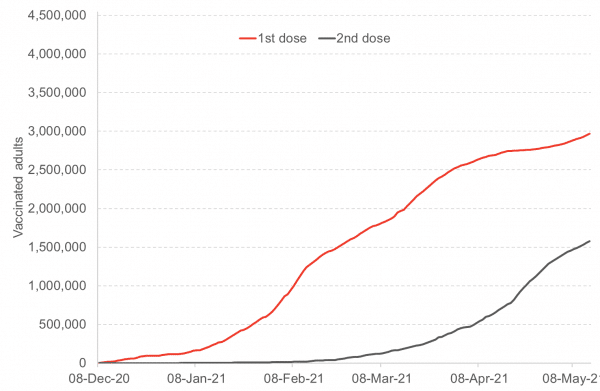

Chart 6: Cumulative Covid-19 vaccine doses in Scotland: In a telling sign of how health and economics have become interlinked throughout the pandemic, vaccine data now provides some indication of future economic activity. Businesses and governments alike will be pleased to see that, of the roughly 4.5 million adults in Scotland, nearly 3 million have now received their first dose of the Covid-19 vaccine and half of those have received both doses.

Source: Scottish Government

Note on our real-term indicators analysis:

We review newly available data each fortnight and provide a regularly updated snapshot of indicators that can provide information on how the economy and household finances are changing. This allows us to monitor changes in advance of official data on the economy being released and also to capture key trends that will be missed by measures such as GDP. Each fortnight we investigate new sources from known data sources and use publicly available data.

Authors

Adam McGeoch

Adam is an Economist Fellow at the FAI who works closely with FAI partners and specialises in business analysis. Adam's research typically involves an assessment of business strategies and policies on economic, societal and environmental impacts. Adam also leads the FAI's quarterly Scottish Business Monitor.

Find out more about Adam.

Rob Watts

Knowledge Exchange Associate at the Fraser of Allander Institute