In our last update back in November, the number of businesses trading and the outlook for business activity remained fairly stable. However, with restrictions tightening over the Christmas period, many businesses finished off 2020 with more uncertainty than hoped. The latest GDP data released this morning shows that the UK economy shrank by 2.6% in November – the first monthly decline since April.

With Scotland now in a national lockdown, similar to what we saw in March, all non-essential businesses are now closed with many employees back on furlough and all schools closed.

Again, the accommodation and food services sector, as well as the arts, entertainment and recreation sector continue to be the hardest hits sectors. Further lockdown measures, effective from tomorrow, in Scotland, will include tightened restrictions on click and collect services; takeaways; alcohol consumption; working from home; home maintenance; and, essential travel. All of which will impact businesses and workers across the country.

There is also added pressure on parents, carers and guardians working from home whilst juggling homeschooling.

With this new lockdown extremely similar to that of spring last year, there will be important implications for children and the education that they receive and there is a real risk that this lockdown could widen educational inequalities. Earlier this month, the Economics Observatory published an article on the impact of school closures on social mobility.

The impact of the pandemic on inequalities extends beyond education. This week, the Joseph Rowntree Foundation published their annual UK Poverty Report 2020/21 which highlighted that part-time workers, low-paid workers, lone parents – particularly women -, private renters and BAME households have been the hardest hit by the economic and health impacts of the ongoing Coronavirus pandemic.

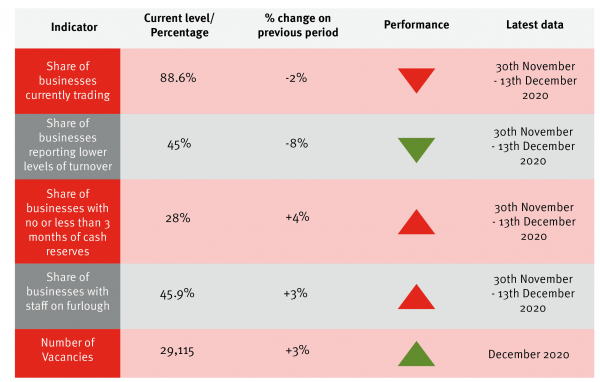

Table 1: Real-time indicators dashboard

Source: Scottish Government, BICS, Adzuna Labour Market Stats

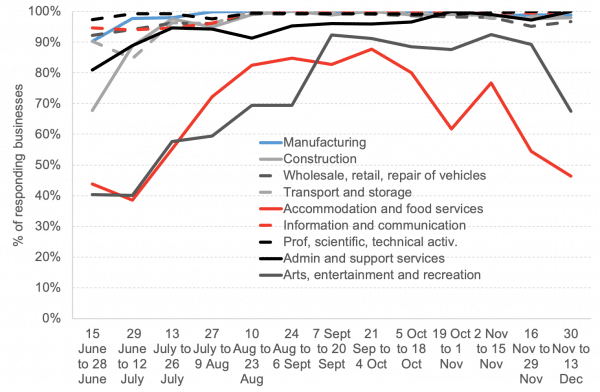

Chart 1: Estimated share of businesses that are currently trading, broken down by industry, Scotland, 15th June – 13th December 2020: A large share of businesses across most sectors in Scotland are continuing to trade at normal levels however, the accommodation and food services, and, arts entertainment and recreation sectors continue to lag behind. Only 46% of businesses in the accommodation and foods services sector were trading at the beginning of December. With new restrictions, effective from tomorrow, on takeaway services, the outlook for this sector remains poor.

Source: Scottish Government, BICS

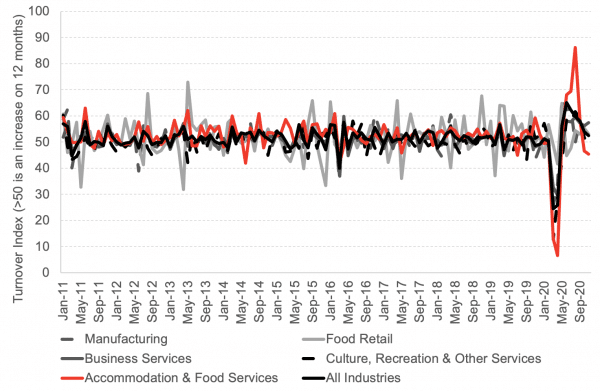

Chart 2: Business turnover index by sector, Scotland, January 2011 – November 2020: Most sectors are continuing to report an increase in turnover compared to the same time last year. However, the growth in turnover experienced in the accommodation and food services in Q3 of last year was short-lived, with negative growth returning in the final months of 2020.

Source: Scottish Government

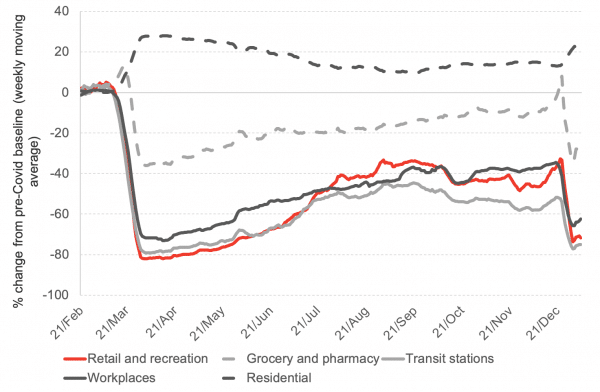

Chart 3: Mobility to different venues, Scottish cities, 21st February 2020 to 5th January 2021: It comes as no surprise that mobility to most venues is down given the ‘stay at home’ guidelines issued by the government since Christmas day. With all non-essential shops closed and nationwide travel restrictions, lower numbers travelling to retail centres and transit stations is expected for the duration of the current lockdown.

Source: Google Mobility

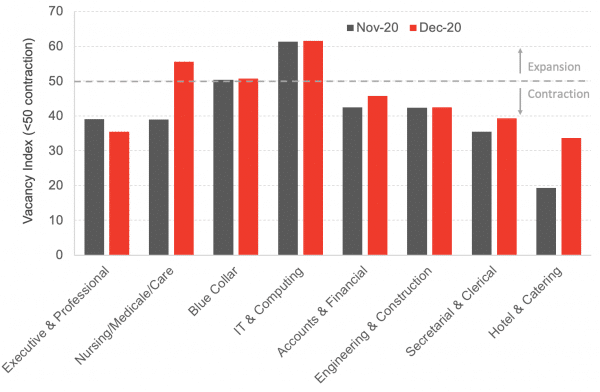

Chart 4: Index of permanent vacancies by sector in Scotland, November, and December 2020: The number of permanent vacancies reported by recruitment consultancies continued to contract across sectors, however, the reductions were smaller in comparison to the September to October data we highlighted in our last update. Nursing and medical care, blue-collar and, IT & computing sectors all experienced expansions in the number of vacancies.

Source: Royal Bank of Scotland Report on Jobs

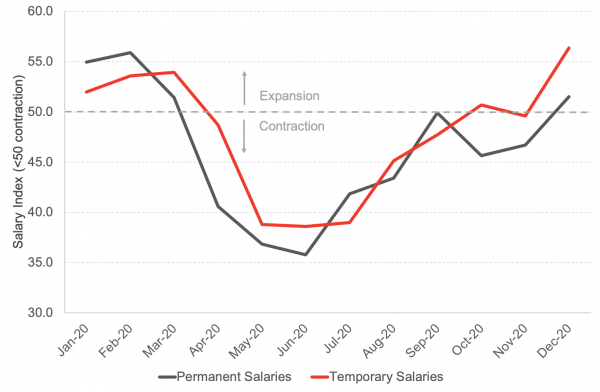

Chart 5: Salary Index in Scotland, January – December 2020: After a poor performance for both permanent and temporary salaries growth, both saw a gradual pick up into the last two months of 2020. The expansion of permanent salaries was also the first expansion experienced since March, a positive note for the labour market.

Source: Royal Bank of Scotland Report on Jobs

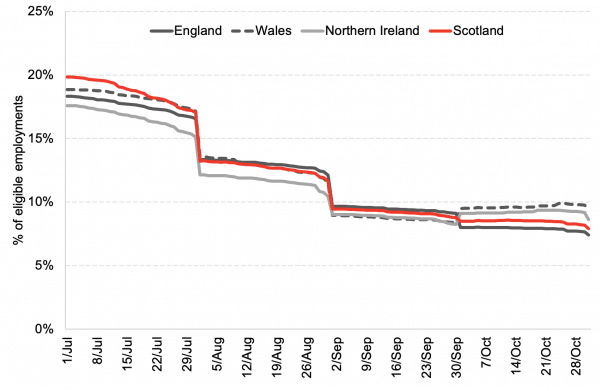

Chart 6: Share of eligible employments furloughed, UK nations, 1st July – 31st October 2020: The share of furloughed jobs continued to fall in England and Scotland during October. As of the end of October, Scotland had 7.9% of all jobs on furlough. However, reflecting the differences in the timing of new restrictions across devolved nations, Wales and Northern Ireland saw a slight increase in the share of furloughed jobs during October.

Source: HMRC

Note on our real-term indicators analysis:

We review newly available data each fortnight and provide a regularly updated snapshot of indicators that can provide information on how the economy and household finances are changing. This allows us to monitor changes in advance of official data on the economy being released and also to capture key trends that will be missed by measures such as GDP. Each fortnight we investigate new sources from known data sources and use publicly available data.

Authors

Ben is an Economist Fellow at the Fraser of Allander Institute working across a number of projects areas. He has a Masters in Economics from the University of Edinburgh, and a degree in Economics from the University of Strathclyde.

His main areas of focus are economic policy, social care and criminal justice in Scotland. Ben also co-edits the quarter Economic Commentary and has experience in business survey design and dissemination.

Adam McGeoch

Adam is an Economist Fellow at the FAI who works closely with FAI partners and specialises in business analysis. Adam's research typically involves an assessment of business strategies and policies on economic, societal and environmental impacts. Adam also leads the FAI's quarterly Scottish Business Monitor.

Find out more about Adam.

Frantisek Brocek

Frank graduated from the University of Strathclyde in 2019 with a First-class BA (Hons) degree in Economics. He is currently studying on the Scottish Graduate Programme MSc in Economics at the University of Edinburgh.

He has experience from a variety of economic policy institutions including the European Commission in Brussels, the Slovak Central Bank and the Ministry of Finance.