Duncan Whitehead is the EY Lead for Economic Advisory in Scotland – DWhitehead2@uk.ey.com.

He is also a visiting researcher at the Fraser of Allander Institute.

The views expressed in this blog are those of Duncan. The blog summarises the latest findings from the EY Scotland Attractiveness Survey 2018 report.

Scotland continues to build on its recent strong FDI performance…

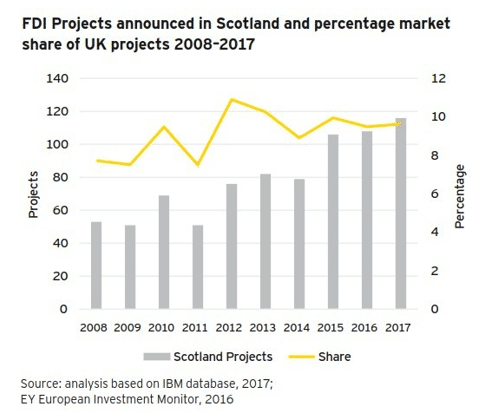

The latest findings from EY’s FDI attractiveness programme shows that Scotland recorded a 7% increase in the number of FDI projects secured, rising from 108 in 2016 to a 10-year high of 116. This means the number of inward investment projects in Scotland has reached new records in each of past three years.

…with projects into Scotland increasing at a higher rate than the UK as whole

Scotland’s percentage market share of projects within the UK rose fractionally, from 9.5% to 9.6%. In relative terms, this is Scotland’s fourth highest UK market share of projects – above Scotland’s long-term average share of UK projects at 9.3%.

However, the market for inward investment remains highly competitive

Looking at the wider European and global market for inward investment, both the UK and Scotland were outpaced by the growth of secured FDI projects into Europe as a whole. In 2016, one in 50 FDI projects investing in the whole of Europe are selecting Scotland as their location. Although largely still the case, Scotland’s market share of European FDI projects fell back to 1.7% in 2017 from 1.8%.

On the jobs front, 2017 looks to have been a positive year for Scotland

Jobs created through FDI can vary significantly depending on the nature and size of the investments. Additionally, not all projects report employment generated. Nevertheless, employment impacts can be estimated on a project-by-project basis. In 2017, Scotland secured 6,374 jobs through FDI – more than double that in 2016, and the highest number of FDI jobs created in any year in the past decade.

…with jobs secured increasing with the growing scale of Scottish projects

This increased scale of Scottish FDI projects is in contrast with recent trends where, since 2011, Scotland has tended to secure a large number of small projects generating fewer job. In 2016, six projects were recorded which exceeded 100 jobs. However, 10 projects recorded 200 jobs or more in 2017 – the largest, an offshore investment plus 4 large projects each in Edinburgh and Glasgow.

Scotland continues to hold its own in attracting FDI as Brexit approaches…

However, the UK’s overall attractiveness is seen to have declined relative to our European competitors. Amongst global investors, the UK now sits third behind Germany and France in the top three counties for FDI in Europe. While the UK may be seeing a decline in perceived attractiveness, perceptions of Scotland as location for UK operations has held steady at 3%.

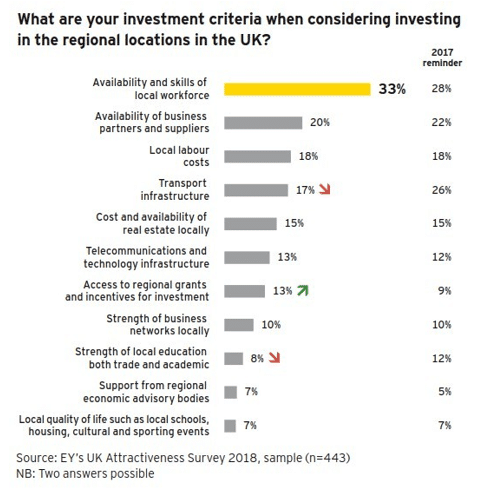

…but there are clear messages on which attributes Scotland should focus on

Building on survey finding in 2017 – the availability and skills of the local workforce has extended its lead as the most important factor when choosing an FDI location in the UK, up from 28% to 33%. However, and against a Brexit uncertainty backdrop, there has been a noted rise in the importance attributed to support from regional economic bodies and access to incentives to invest in the UK.

To stay competitive in these uncertain times, the work must continue

In my view, there are many positives: Scotland has maintained it run of annual FDI record, consolidated its position as the most attractive region outside London, and has seen perceptions of Scotland as an FDI location fold firm. However, in these uncertain times, with Brexit looming large on the horizon, nothing can be taken for granted. The strong performance to date is no reason to relax these efforts – but rather an incentive to redouble them.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.