Today the Scottish Government published a new Export Action Plan, with targets to improve Scotland’s export base over the coming years.

Those with a memory of economic policymaking will recall that this is not the first time the government has set out ambitions to improve Scotland’s export performance.

The most recent target – to grow international exports by 50% between 2010 and 2017 – was missed.

What is refreshing about this Action Plan is the level of analysis that has clearly gone in to informing the decisions that Mr Mckee has taken. This stands in contrast to many past action plans or strategies.

Of course, people will no doubt agree or disagree with the specific policies/priorities put forward. There are also big questions about the level of investment required to meet the outlined ambitions and targets.

But everyone should welcome the new analysis and evidence provided. It marks a significant step forward in our understanding of the challenges and opportunities that Scotland faces in its efforts to boost international trade.

In this blog, we highlight some of the interesting new tools that the action plan includes.

Scotland’s export performance

Firstly, a quick recap.

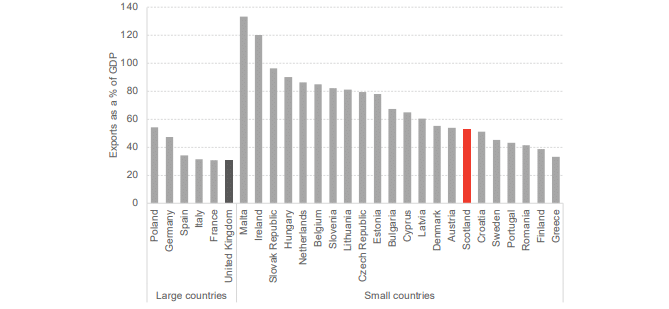

As a share of our economy, Scotland exports less than many comparable countries within the EU.

Chart: EU28 exports as a percentage of GDP, excluding Luxembourg, 2017

Source: Scotland in 2050: Realising Our Global Potential

Including UK exports, Scotland has a ratio of exports to GDP of just over 50%. But this falls to 20% when looking only at international exports, compared to EU and OECD averages of 45% and 28% respectively.

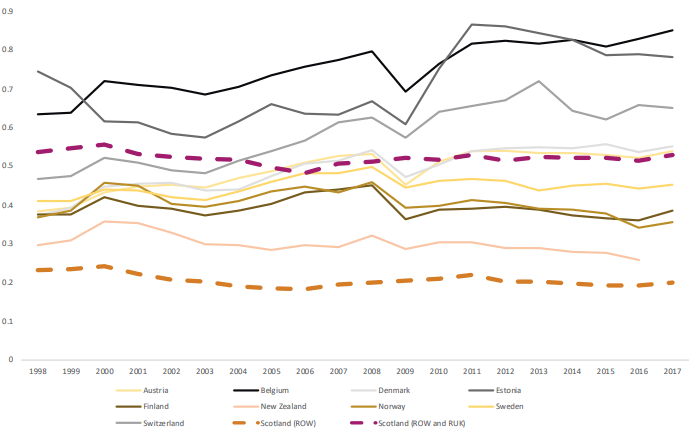

If anything, today’s report shows that performance has – at best – flat-lined since devolution.

Chart: Exports as a percentage of GDP, selected small economies, 1998 to 2017

Source: A Trading Nation: Export Action Plan, Scottish Government

Moreover, our export base is relatively concentrated in a small number of sectors and firms. For all our strengths, just five sectors account for over half of all Scottish international exports, with whisky accounting for a significant proportion of that.

We’re also heavily dependent upon a small number of markets.

It is not unusual for small countries to have their export potential consolidated in a small number of firms, sectors or markets. But it does seem that it is a particular challenge for Scotland.

Evidence based policy choices

With this in mind, today’s report seeks to identify where government support should be targeted.

In the past, the approach could be characterised – perhaps a little unfairly – as i) set high level targets, ii) announce a range of initiatives across all firms, all sectors and all markets, and iii) wait for an improvement.

What is interesting is that the government are now much more up-front about the choices that will have to be made with regard to what sectors to support, what businesses to focus upon and what markets to target if we are truly to have a step-change in Scotland’s export performance.

In this regard, it’s similar to the analysis we undertook – and the feedback we received from businesses – as part our Scotland in 2050: Realising Our Global Potential report with Shepherd and Wedderburn.

The clear message from that report was that it is simply not possible, particularly given Scotland’s starting position and the resources available, to target every firm, every sector and every market.

A Trading Nation therefore rightly focuses upon four areas:

- What are the export strengths the Scottish Government should promote?

- Where should we promote these strengths and when should we step up our presence in these markets?

- Who should we work with most intensively to boost our export performance?

- How do we best configure government and wider support to deliver our export goals?

This clarity of focus is a significant step forward. And it is here where the interesting analysis comes in.

The government has developed – alongside its Action Plan – two new tools for monitoring Scottish exports which help inform our understanding of the opportunities and challenges in growing Scotland’s exports base.

The first tool is a new statistical publication, the Export Performance Monitor (first published in November 2018) which provides more granular information on Scotland’s export figures by sector and by country than has been made available in the past.

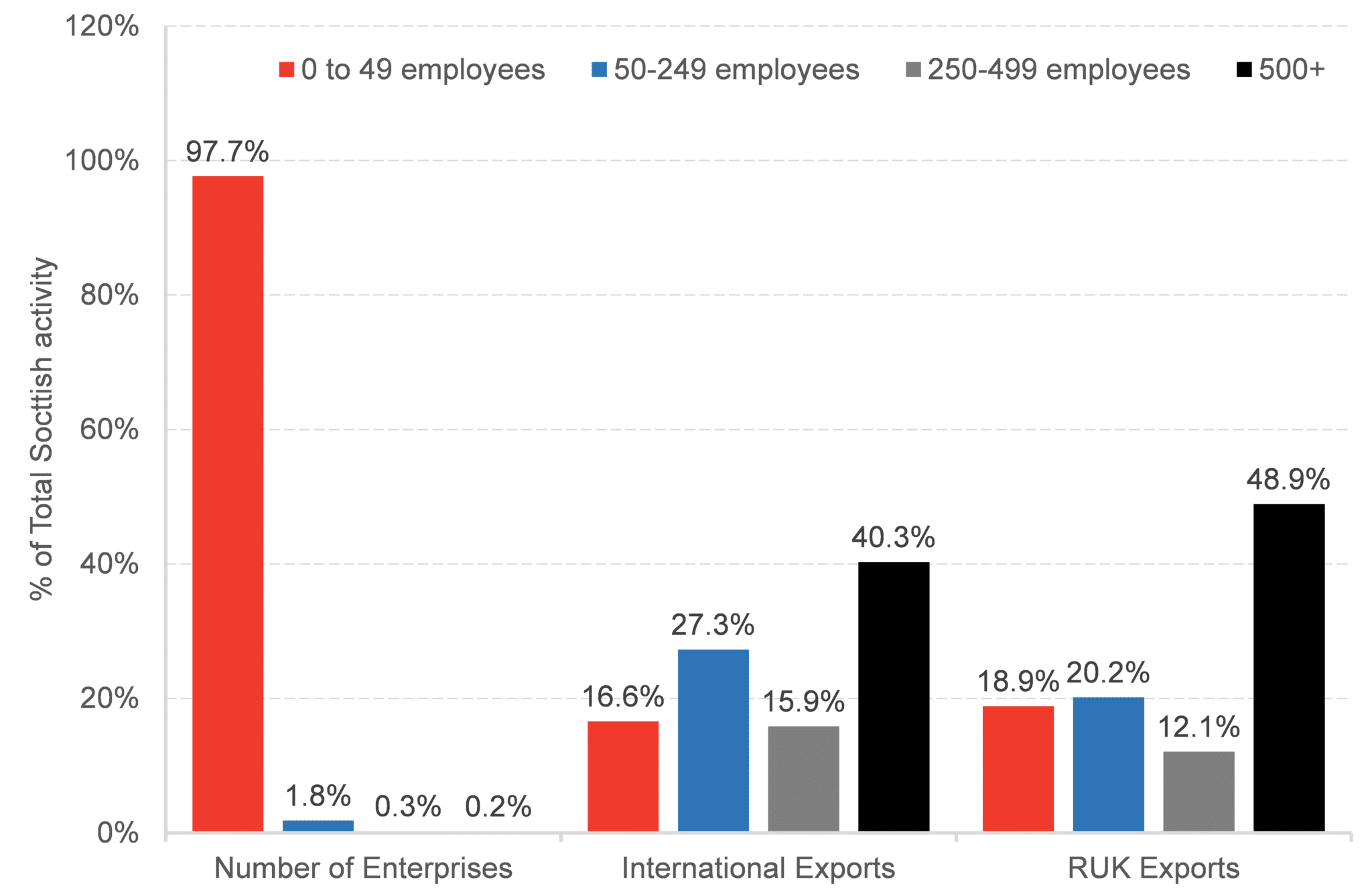

This provides new ways to look at the export base in Scotland. For example, whilst less than 0.2% of firms in Scotland employ more than 500 people, they account for over 40% of all Scottish international exports and nearly 50% of Rest of UK exports.

Chart: Shares of business and export activity in Scotland

Source: Export Performance Monitor

At the moment the statistics are provided in summary form. Hopefully in the future this matching exercise will identify exporting firms, their employment and turnover levels and productivity at a more granular level.

The second new development is an Export Value Gap tool.

The aim of this analytical exercise is to identify sectors where Scotland may have the potential to boost exports in the future. It does this by benchmarking Scotland’s current levels of exports sector-by-sector, with comparable countries.

The ‘value gap’ is the additional value that could be achieved if Scotland were to improve its export performance to that of the competitor in that sector.

In doing so, it identifies where Scotland has key export strengths, and where we are lagging behind.

There are a number of challenges with such an exercise. These include the quality of data, the classification by sector vs. product, the challenges of measuring intra-industry trade & supply chain exports and capturing non-economic factors such as the presence of a ‘land border’ (which the modelling adjusts for) and wider cultural and historical linkages (which it does not).

And of course, all that it does is identify potential, rather than spell out how to succeed.

But that being said, what it does do is help provide at least an insight into what sectors to focus upon initially, scope out opportunities and target resources where necessary. It would be a welcome addition to the analytical landscape in Scotland if the government was to publish the detail of this new tool.

These two new methods add important insights into Scotland’s trade performance, and will make it easier to identify future risks and opportunities.

Summary

In summary, and whether or not you agree or disagree with the government’s policy approach, the analysis and information provided in today’s report is welcome. It marks a significant step up in the use of evidence to inform policymaking.

In this regard it stands in contrast to past approaches, such as the Economic Action Plan which when published last year was a scatter of initiatives with little analytical underpinning. Hopefully this sets a benchmark for future work.

Of course, an important piece in the jigsaw – missing from this report but hopefully to become embedded in the future – is the role of evaluation.

Today’s report uses evidence to help inform what, where and how government and its agencies should target their interventions in the future.

Going forward, it is vitally important that the same amount of effort goes into monitoring and evaluating whether or not the particular interventions and delivery mechanisms they now implement have the impact they hope for.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.