Today the Scottish Government published Export Statistics Scotland, the key source of information on Scottish exports.

In light of the ongoing Brexit uncertainty and the potential risks to Scottish trade patterns, today’s publication offers some interesting insights into the different markets that Scotland sells to, the sectors that are doing well (and those less so) and Scotland’s export performance over the longer-term.

Headline numbers

International exports from Scotland rose by £1.9 billion – or 6.2% – between 2016 and 2017. Note that this is in nominal terms; in real terms the growth was just 0.5%.

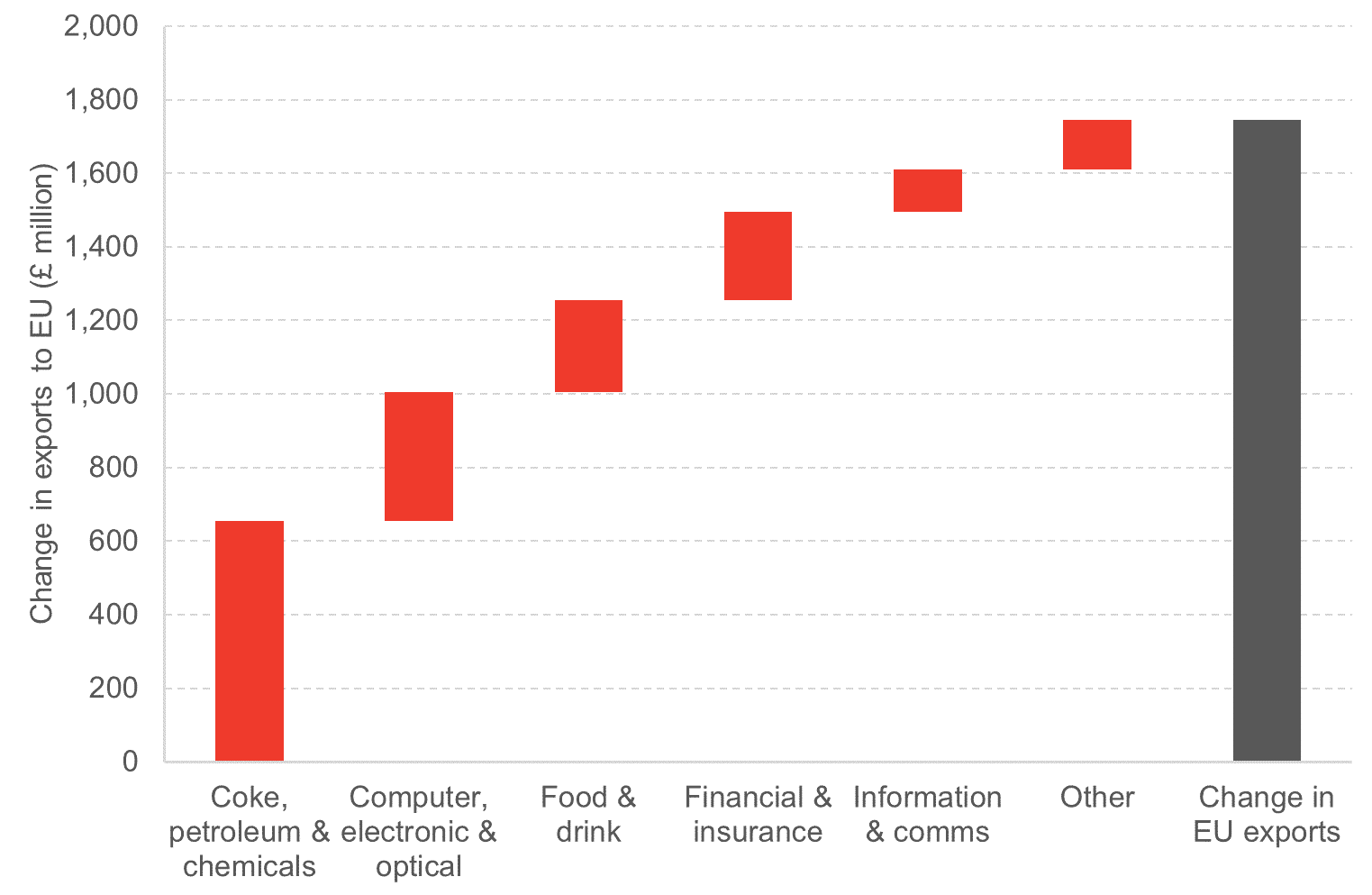

Boosted by the competitive value of the pound and strong growth on the continent in 2017 – where the Euro Area economy grew at its fastest rate since 2007 – the improvement in Scottish exports was driven by a £1.7bn increase in exports to the EU. This was equivalent to a 13.3% rise between 2016 and 2017.

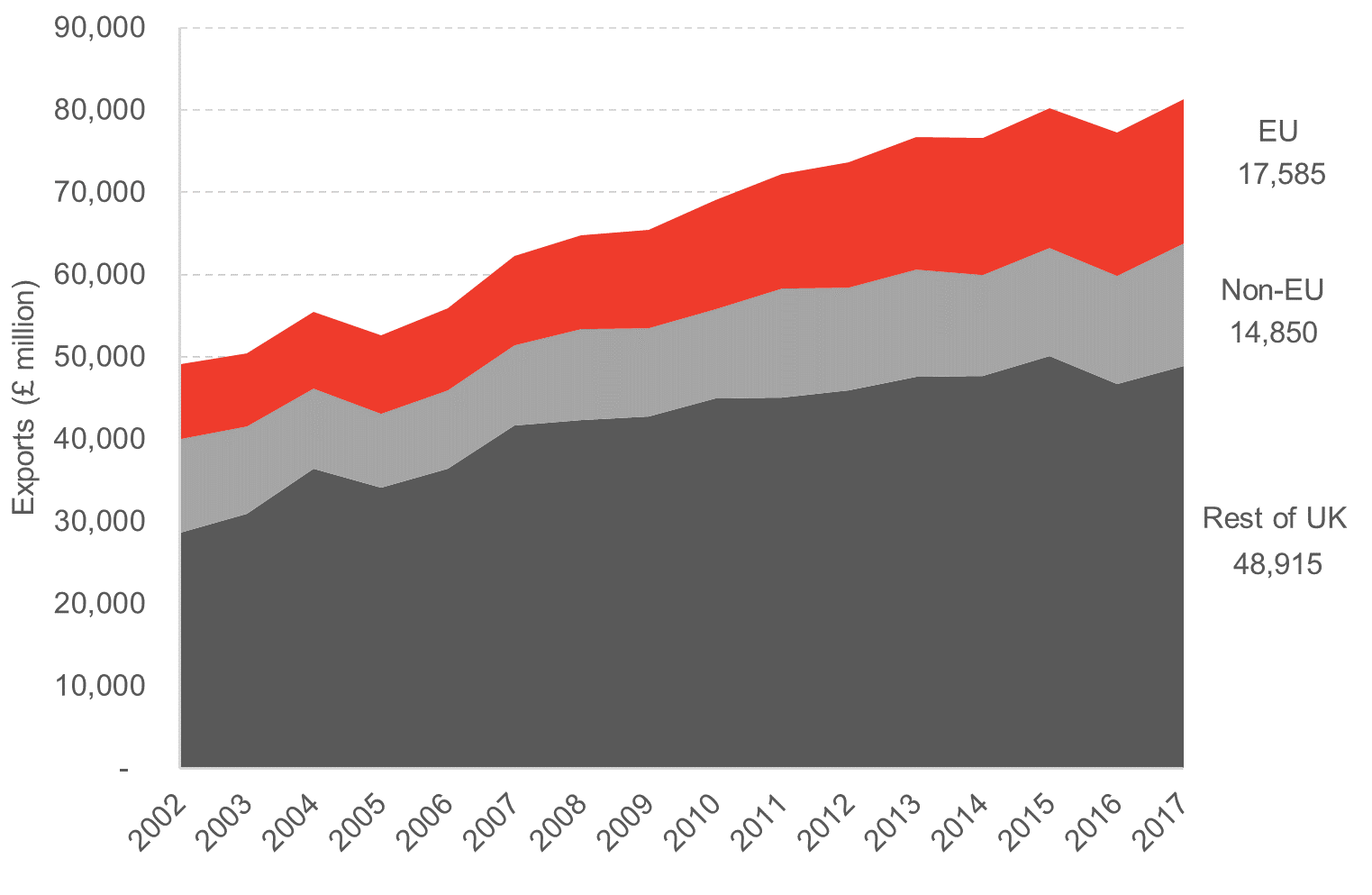

Scotland’s exports to the rest of the UK also increased in 2017, up £2.2 billion (4.6%).

The Scottish Government’s Economic Strategy had a target to grow Scottish international exports by 50% by 2017 (on a 2010 baseline). Despite today’s uplift, the figures confirm that this target has been missed, with international exports up by around 35% since 2010.

Who are Scotland’s main markets?

International economists will tell you that countries tend to trade relatively more with their nearest neighbours than they do with anyone else – the so-called ‘gravity effect’. And this is borne out by the Scottish data.

Trade with the rest of the UK accounts for around 60% of total Scottish exports (£48.9bn to the UK; £32.4bn to the rest of the world).

Chart 1: Growth of Scottish exports by RUK, EU and ROW markets since 2002.

Source: Export Statistics Scotland

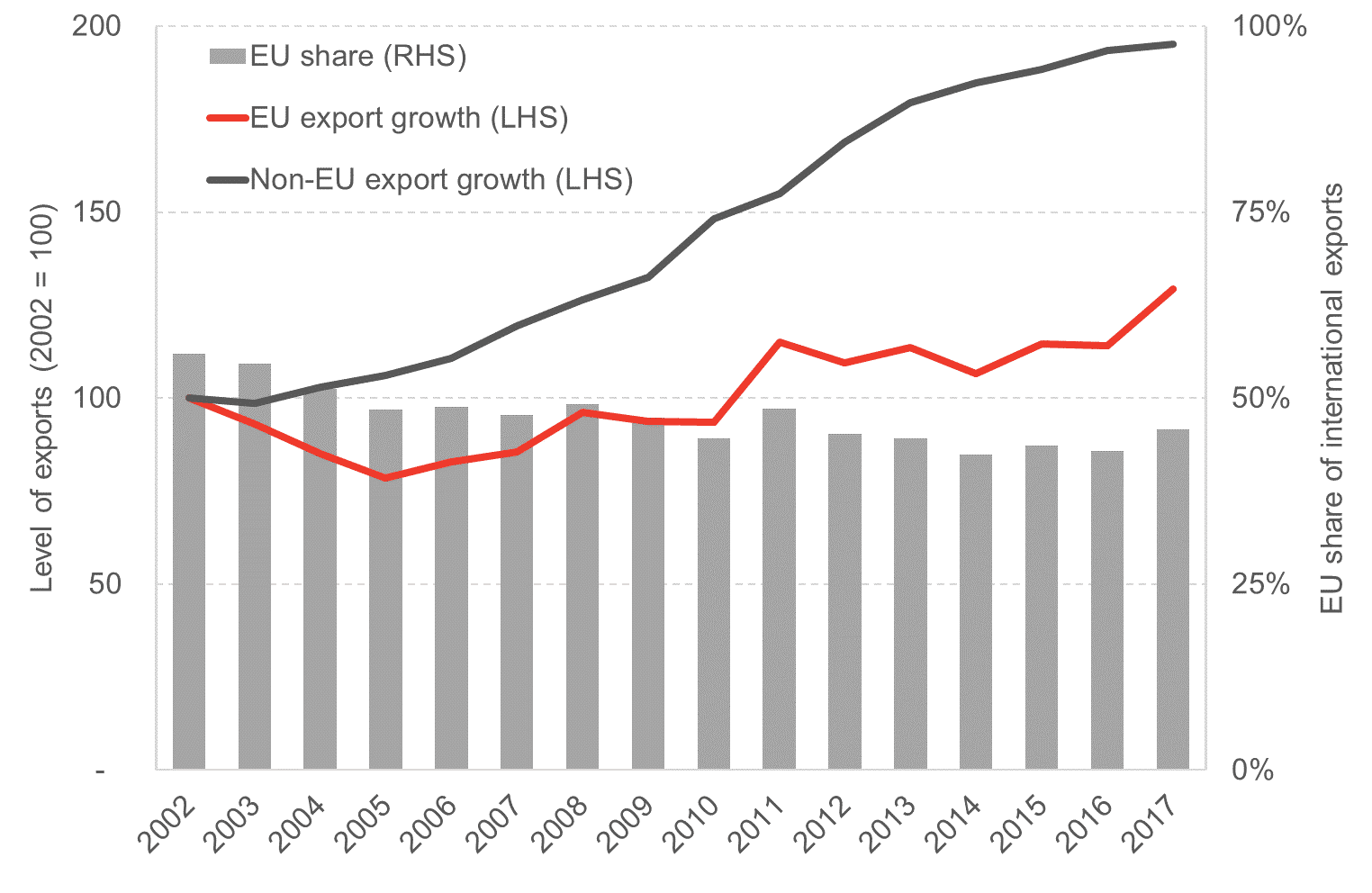

The uplift in EU exports somewhat reverses a trend we had been seeing in recent years where the growth in international exports had been driven by markets outside the EU.

Chart 2: EU and ROW exports since 2002 & share of ROW exports destined for the EU.

Source: Export Statistics Scotland

Back in 2002/03, Scottish exports to the EU were around 56% of total international exports, today the figure is 46%.

Sector performance

Despite manufacturing only accounting for around 11% of Scotland’s economy, the sector punches well above its weight in exporting. In 2017, around 54% of Scottish international exports were in manufacturing (£17.6bn).

“Distilling, rectifying and blending of spirits” – i.e. whisky – is by far the most successful sector, adding around £4.8bn to Scotland’s export total.

Table 1: Scotland’s top 5 international exports in 2017

| Sector | 2017 Rank | Exports | 2002 Rank | Real growth since 2002 |

| Food & drink (including spirits) | 1 | 5,855 | 2 | 35% |

| Professional, scientific & technical | 2 | 3,670 | 4 | 118% |

| Coke, petroleum & chemicals | 3 | 3,485 | 3 | 27% |

| Mining and Quarrying | 4 | 1,940 | 12 | 469% |

| Wholesale & retail | 5 | 1,890 | 5 | 43% |

| Manufacturing | 17,610 | -12% | ||

| Services | 12,010 | 82% | ||

| Total | 32,440 | 23% |

Source: Export Statistics Scotland

In contrast, other areas of manufacturing have found trading conditions more difficult. Following the collapse of the electronics sector in the early 2000s, “Computer, electronic and optical products” now exports a fraction – just 34% – of its 2002 level.

Overall, growth in manufacturing exports is up 19% – in cash terms – on 2002 levels, but down 12% in real terms.

In contrast, services (whilst exporting smaller amounts – £12bn) have grown more strongly. Services exports are up around 148% in cash terms (82% in real-terms). Areas like professional and financial services have grown particularly strongly.

The risks from Brexit

The importance of the EU to Scotland’s trade cannot be overstated.

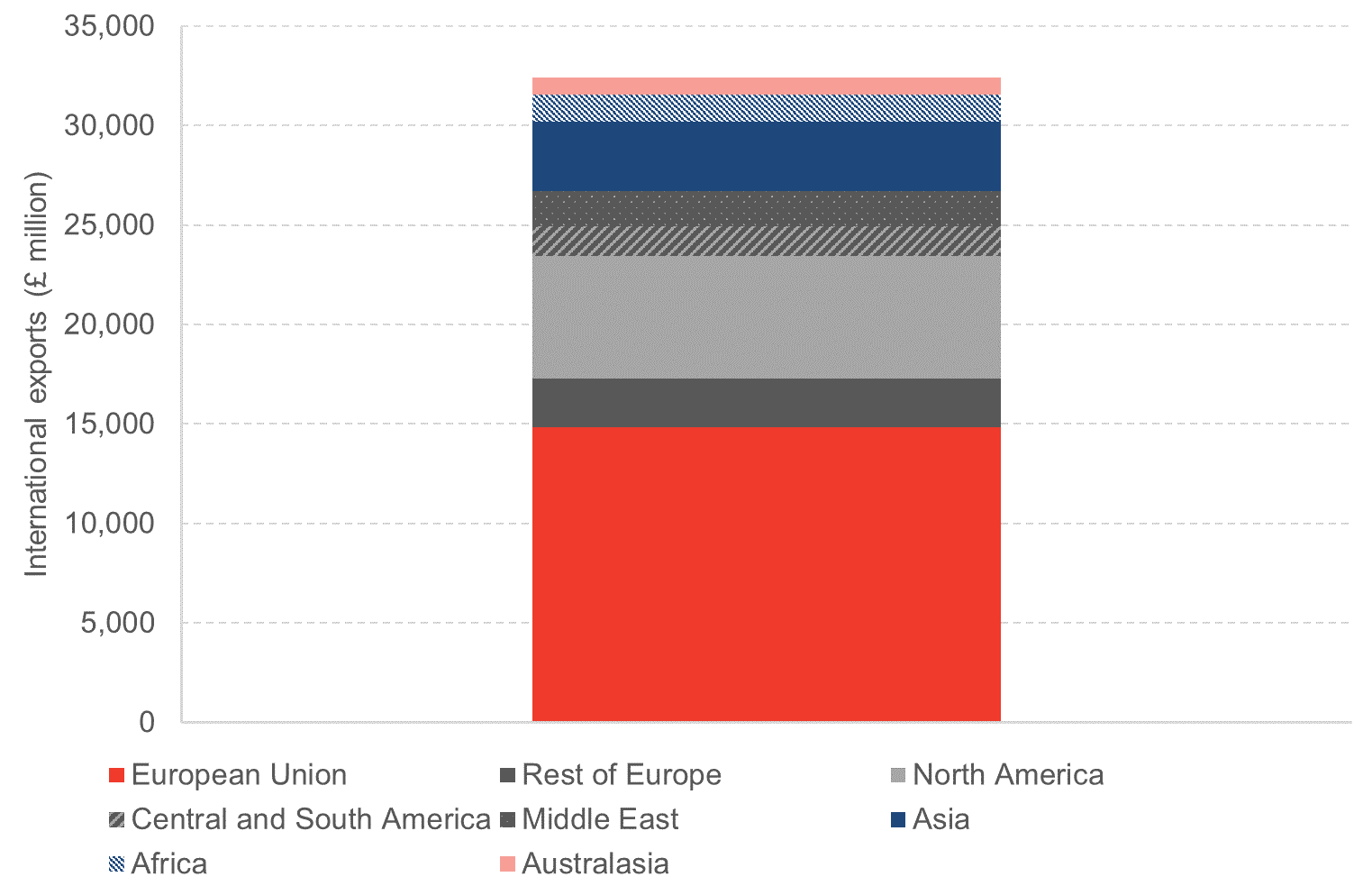

The latest figures show that for 2017, over 45% of Scotland’s international exports are to EU markets.

Indeed, EU exports of £14.9bn are – on their own – nearly as much as Scotland exports to North America, Central and South America, the Middle East, Asia, Africa and Australasia combined (£15.1bn).

Chart 3: International exports by market size, 2017

Source: Export Statistics Scotland

And of Scotland’s Top 10 export destination countries, 8 are in the EU and a further country – Norway – is part of the European Economic Area and therefore the Single Market.

Table 2: Scotland’s top 10 export destination countries, 2017

| Rank | Destination | Exports (£ m) | % of Total |

| 1 | USA | 5,545 | 17.1 |

| 2 | Netherlands | 2,475 | 7.6 |

| 3 | France | 2,425 | 7.5 |

| 4 | Germany | 2,345 | 7.2 |

| 5 | Ireland | 1,470 | 4.5 |

| 6 | Norway | 1,015 | 3.1 |

| 7 | Belgium | 990 | 3.1 |

| 8 | Denmark | 875 | 2.7 |

| 9 | Spain | 850 | 2.6 |

| 10 | Italy | 760 | 2.3 |

Source: Export Statistics Scotland

Interestingly, growth in EU trade over the last year has been driven by chemicals, food & drink and financial services amongst others. These three sectors were deemed to be at ‘high’ risk in a recent EY report on the implications for Scotland of leaving the EU.

Chart 4: Composition of EU trade growth 2016 to 2017

Source: Export Statistics Scotland

Of course, the exact scale of risk to Scottish exports remains uncertain. Exports will still continue but on what scale? Will the impact be minimal or significant? And Brexit could – depending upon the final deal – provide opportunities to explore new trade deals with other countries.

But we must be realistic. It’s simply not possible to unwind integrated trading patterns overnight. For many countries, the imposition of tariffs or non-tariff barriers will mean the difference between being able to sell and compete in EU markets and not. Trade deals with other countries are possible, but little can match the scale or accessibility of the EU Single Market.

In short, today’s statistics confirm that putting up barriers with our largest international trading partner is only likely to weaken Scotland’s growth prospects.

Note:

The Scottish Government’s Export Statistics is the key source of information on Scottish sales to the UK and internationally.

As is well known, estimating Scottish exports is one of the most challenging aspects of compiling economic statistics for Scotland.

Firstly, unlike the ONS or indeed the Northern Ireland Executive, the Scottish Government lack the ability to compel firms to respond to their request for information on export activities. This means that the response rate to the sample is low (around 25%).

Secondly, not all firms know the exact destination of their final exports. This gives comparisons of market destinations a higher degree of sampling error than the industry estimates.

Thirdly, given the close links many firms have across the UK it is highly possible that some exports to the rest of the UK are subsequently re-exported (including as part of other products. That being said, the Scottish Government statisticians “believe the figure will be small” as much of Scotland’s exports to the rest of the UK comprise services and utilities where re-exporting is low. Perhaps of more significance will be supply chains, with Scottish goods often just one part in a much wider global value chain. At the same time, many Scottish exporters are likely to also rely on inputs from elsewhere in the UK. These statistics are not designed to capture such effects.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.