Grant Allan and Eleanor Malloy

Fraser of Allander Institute

Are oil and gas firms seeing opportunities in renewables? In this blog, we examine the responses from our latest Oil and Gas Survey, produced along with Aberdeen and Grampian Chamber of Commerce.

In particular, we check to see if the downturn in the oil and gas industry has encouraged firms to consider alternative opportunities which make use of their skills and experience.

We know that developers of low carbon energy technologies have been keen to benefit from Scottish companies experiences of working in oil and gas sector activities.

And that the process of diversification has been encouraged by government – for example, Scotland’s Oil and Gas Strategy notes that capabilities developed in the North Sea over more than 40 years could lead to opportunities in carbon capture and storage, offshore wind and marine energy.

This could have several benefits, including shoring up orders, and developing expertise that could have export potential across the world. The wave and tidal energy market, for instance, has been valued at up to £460 billion between 2010 and 2050.

This is an extensive area of policy focus, however there is little (beyond anecdotal) evidence on the extent to which technical and practical sharing is occurring. This blog attempts to fill that gap by using evidence from the latest 6 monthly Oil and Gas Survey jointly produced by the FAI and the Aberdeen and Grampian Chamber of Commerce – see here for the full report.

Key Results

Since Autumn of 2013 (Survey 19), the Oil and Gas survey has examined if respondents see themselves as being more involved in renewables over the medium term (3 to 5 years).

The results from the latest survey reveal that 54% of all contractors anticipate becoming more involved in renewables, either “Definitely” or “Possibly” in the medium term. This is up slightly from 53% in Autumn 2015, but is only slightly higher than the 51% of contractors who replied when the question was first asked in Autumn 2013.

Below the headlines: change is happening

Despite an almost static picture at the headline level, we find interesting results underneath this.

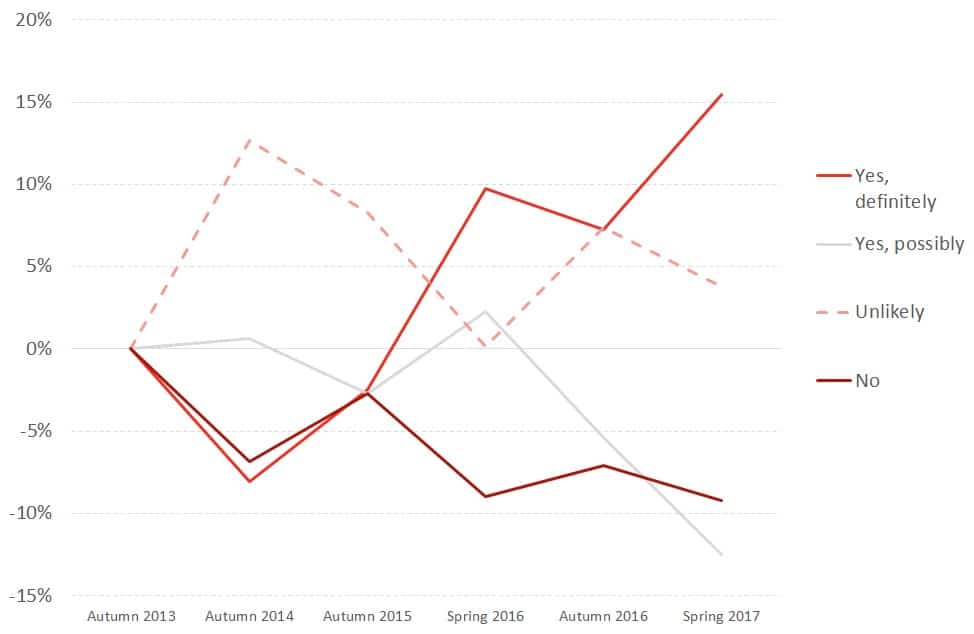

As Figure 1 shows, over the last three and a half years, we see firms unsure about their future interest in renewables. By Autumn 2015, there is a large increase in the share of contractors seeing renewables work as “Unlikely”, with roughly identical falls in respondents either “Definitely” and “Not” working in renewables relative to Autumn 2013.

From Spring 2016 onwards, we see what we have described as companies “making up their minds on renewables”, and moving away from positions of hesitancy towards stronger responses. The latest survey now finds 29% of contractors (up 15% from the first time this question was asked) reporting that expect to definitely be involved in renewables in the medium term. This largely mirrors a fall in those saying they would “Possibly” be involved in renewables. At the same time, only 9% of contractors feel that they will not be involved in renewables (down 10%).

Figure 1: Change in the share of contractors selecting each response, relative to Survey 19 baseline (excluding “Not relevant”)

What firms are interested in renewables?

Table 1 shows that larger firms are more favourable towards renewables. 61% of firms with more than 100 employees report either “Definitely” or “Possibly” working in renewables in the medium term. This compares to 42% of firms with between 21 and 99 employees, and 45% of firms with fewer than 20 employees.

Table 1: “Looking to the medium term, do you think that your organisation will be more involved in renewables?”, % responding by columns

| Yes, definitely | Yes, possibly | Unlikely | No | Not relevant | Total | % responding “Definitely” plus “Possibly” | |

| 1-20 | 21 | 24 | 28 | 10 | 17 | 100% | 45% |

| 21-99 | 19 | 23 | 23 | 19 | 16 | 100% | 42% |

| 100-499 | 47 | 24 | 12 | 0 | 18 | 100% | 71% |

| 500+ | 24 | 29 | 35 | 12 | 0 | 100% | 53% |

Note: Rows may not sum due to rounding. % of all firms.

Table 2 examines the relationship between current levels of activity and attitudes towards renewables.

Of those firms working at below capacity, attitudes towards renewables are more positive: 57% are “Definitely” or “Possibly” involved in renewables, while only 40% and 30% of firms working above or at optimum levels (respectively) share that perspective.

Table 2: “Looking to the medium term, do you think that your organisation will be more involved in renewables?”, % responding by columns

| Yes, definitely | Yes, possibly | Unlikely | No | Not relevant | Total | % responding “Definitely” plus “Possibly” | |

| Above optimum levels | 20 | 20 | 60 | 0 | 0 | 100% | 40% |

| At optimum levels | 17 | 13 | 30 | 22 | 17 | 100% | 30% |

| Below optimum levels | 29 | 28 | 23 | 9 | 11 | 100% | 57% |

Note: Rows may not sum due to rounding. % of all firms.

Comparison to other activities?

Third, we can examine how firms’ attitudes to renewables compare to other activities. In addition to renewables, the latest survey repeated questions about interests in decommissioning and unconventional activities. These serve as interesting comparisons and useful proxies for firms’ openness to broadening the applicability of their technologies.

In this blog, we only compare firms’ attitudes towards renewables and unconventionals from the latest survey, and will explore attitudes towards decommissioning and how these attitudes have changed over time in a piece in the Fraser Economic Commentary later this year.

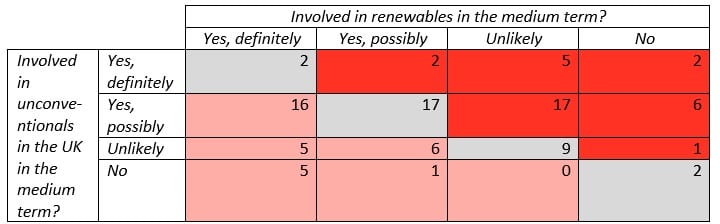

Table 3: Question: “Looking to the medium term, do you think that your organisation will be more involved in renewables?”, shown in columns, while row Question, “Looking to the medium term, do you think that your organisation will be more involved in unconventional oil and gas activity in the UK?”, % of all firms responding to both questions, excluding those indicating “Not relevant”

Note: % of all firms answering both questions. May not add to 100% due to rounding.

Table 3 shows that the most common answer to whether firms would be involved in unconventional oil and gas activity was “Yes, possibly”, with 57% of firms giving this response. Analysing further, we can identify three areas (shaded in different tones). Light Grey firms who had equal anticipation of their involvement in renewables and UK unconventionals. These are on the diagonal and total 31% of all firms.

The lighter red shaded area corresponds to firms whose attitudes are more positive for renewables than for unconventionals. We exclude those who answer not relevant. We identify 34% of all firms to be in this area.

Of the alternative case – i.e. those firms more positive about their involvement in UK unconventionals than renewables – we mark these in the darker red shaded area. This group comprises 35% of all firms.

Our results therefore, suggest that among oil and gas firms there is a similar level of anticipation of involvement in renewables as in unconventional oil and gas work in the UK.

Conclusions

In conclusion, we have used results from the last three years of our Oil and Gas survey to shed light on the prospects for oil and gas companies to move into renewables.

We find a number of interesting results. First, while there has been little movement at the headline level, oil and gas contractors are increasingly making up their mind on renewables, with a recent large increase in the share of respondents expecting to be definitely involved in renewables in the medium term. This would suggest that there is a growing appetite within the sector to take advantages of the opportunities that could exist in a transition to a low carbon economy, through development of, for instance, new marine and offshore energy technologies.

Analysing these responses further, we find that such expectations are greatest among larger firms, and for firms that are currently working below optimum levels.

We find that expectations of being involved in renewables are similar to expectations of being involved in unconventional oil and gas activities in the UK. We will examine further insights from this survey, including how firms’ attitudes towards renewables and both decommissioning and unconventionals, have evolved in a piece in the Fraser Economic Commentary later this year.

Our results suggest some appetite for developing the knowledge from the offshore environment developed over 40 years of activity in the North Sea into real economic opportunities. Providing the right market and policy environment for this to happen both from an energy and supply-chain perspective could have the potential to provide important economic activity in the years ahead.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.