The latest real time indicators reflect that of an economy gearing to open back up.

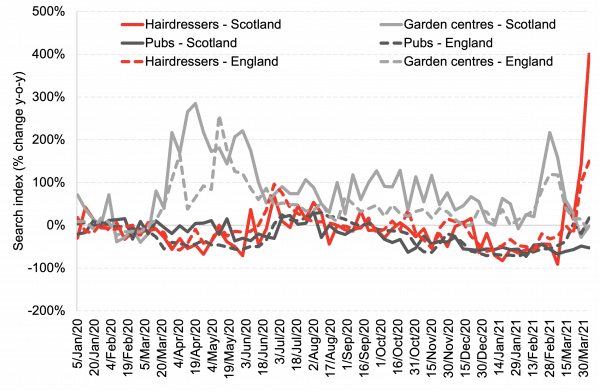

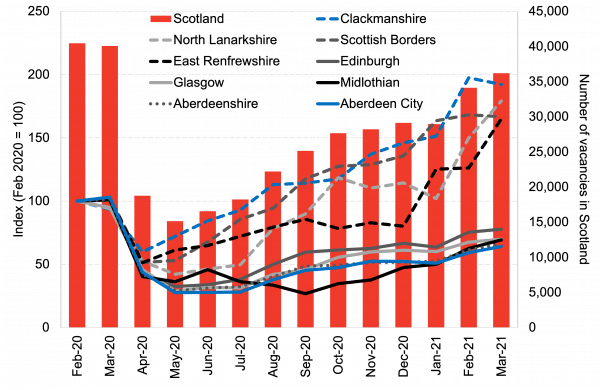

Google searches for hairdressers and pubs are growing across the UK and the number of vacancies across Scotland is continuing to recover from its trough last May.

Despite these improvements, 21% of the Scottish workforce are still furloughed. A significant number of employees in the accommodation and food services sector remain on furlough. Recently the Joseph Rowntree Foundation published a report on the impact of the first COVID-19 lockdown on people in insecure and poor-quality work.

The latest GDP data for the UK shows that economic activity grew by 0.4% in February, following a fall of 2.2% in January. This was driven mostly by growth in services. UK GDP remains 7.8% below pre-pandemic levels.

Scottish GDP data for February is expected to be published on Wednesday.

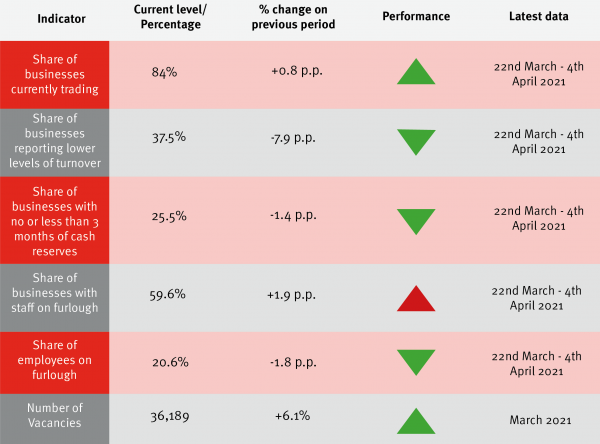

Table 1: Real time indicators dashboard

Source: Scottish Government; Adzuna

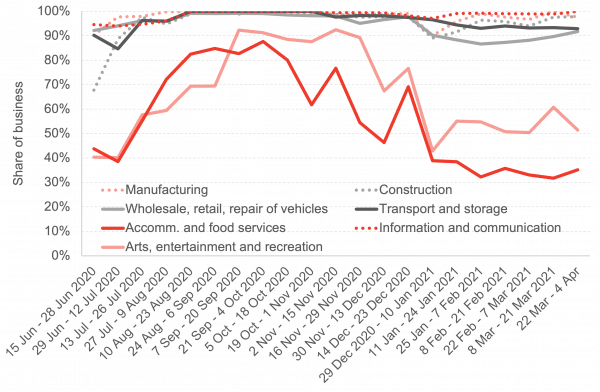

Chart 1: Estimated share of businesses that are currently trading, broken down by industry, 15th June 2020 – 4th April: The share of businesses currently trading in the Scottish economy continues to improve. The share of businesses trading in the accommodation and food services sector has improved slightly, and with a clearer route map out of lockdown and more easing of restrictions this week, the outlook for the hardest-hit sectors is beginning to improve.

Source: Scottish Government

Chart 2: Google searches for different products and services, week commencing 5th January 2020 – 4th April 2021: Searches for hairdressers rose almost fourfold, year-on-year, as the opening of salons grew closer. Searches for hairdressers in England are following a similar trend but are slightly slower to recover due to the difference in reopening times. On the other hand, searches for pubs remain below last year’s levels in Scotland but have now risen above last year’s levels in England.

Source: Google Trends

Chart 3: Number of vacancies, ‘best’ and ‘worst’ performing Scottish local authorities, February 2020 – March 2021: The number of vacancies in Scotland grew by more than 2,000 in Scotland between February and March. However, there remains a varied recovery in terms of vacancies growth across Scottish local authorities.

Source: Adzuna Labour Market Stats

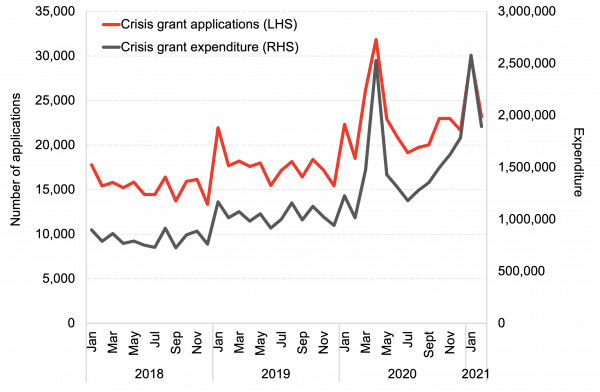

Chart 4: Expenditure and applications for crisis grants from the Scottish Welfare Fund, January 2018 – February 2021: The number of applications for crisis grants has decreased by 6,700 from January to February and expenditure fell by £685,000. However, expenditure and applications are still higher compared to February 2020.

Source: Scottish Government

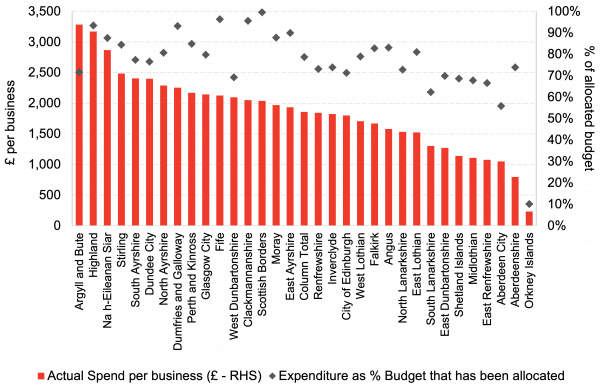

Chart 5: Expenditure Business Grants under the Strategic Framework, Scottish local authorities, 2nd November 2020 – 22nd March 2021: Argyll and Bute, Highland, and Na h-Eileanan Siar had the highest expenditure per registered business. Scottish Borders, Fife, and Clackmannanshire had the highest expenditure as a share of the allocated budget under the Strategic Framework.

Source: Scottish Government, ONS NOMIS, FAI calculations

Note on our real-term indicators analysis:

We review newly available data each fortnight and provide a regularly updated snapshot of indicators that can provide information on how the economy and household finances are changing. This allows us to monitor changes in advance of official data on the economy being released and also to capture key trends that will be missed by measures such as GDP. Each fortnight we investigate new sources from known data sources and use publicly available data.

Authors

Ben is an Economist Fellow at the Fraser of Allander Institute working across a number of projects areas. He has a Masters in Economics from the University of Edinburgh, and a degree in Economics from the University of Strathclyde.

His main areas of focus are economic policy, social care and criminal justice in Scotland. Ben also co-edits the quarter Economic Commentary and has experience in business survey design and dissemination.

Adam McGeoch

Adam is an Economist Fellow at the FAI who works closely with FAI partners and specialises in business analysis. Adam's research typically involves an assessment of business strategies and policies on economic, societal and environmental impacts. Adam also leads the FAI's quarterly Scottish Business Monitor.

Find out more about Adam.

Frantisek Brocek

Frank graduated from the University of Strathclyde in 2019 with a First-class BA (Hons) degree in Economics. He is currently studying on the Scottish Graduate Programme MSc in Economics at the University of Edinburgh.

He has experience from a variety of economic policy institutions including the European Commission in Brussels, the Slovak Central Bank and the Ministry of Finance.