We are in the midst of a flurry of announcements and releases from the UK and Scottish Governments. Earlier in the week, we responded to the Welfare Green Paper, looked ahead to next week’s child poverty statistics release for Scotland, and highlighted historical parallels of the UK Government’s single-minded commitment to hitting the fiscal rules.

What to expect in the Spring Statement

As we get closer to the weekend, the rumour mill has picked back up. All numbers (including Government policy) will be locked down today, although we have been at this for long enough to know that the Government will portray itself as musing on the final details of what they’ll announce.

What those announcements are is mostly clear, if leaks are to be believed. On top of the cuts to disability and incapacity benefits, the Chancellor looks set to further erode departmental budgets going forward. But the increases announced in October were already heavily frontloaded, and with defence going up – and presumably health as well, which successive governments have always protected – it’s hard to see how this will amount to anything other than severe reductions in real-terms budgets for other areas.

The Chancellor looks set to cling on to the promise to not raise taxes further… Mostly. The Prime Minister was non-committal on maintaining the planned indexation of income tax and National Insurance thresholds from 2028-29. Freezing thresholds is a pretty underhanded way of raising taxes, but raising taxes it is nonetheless. We’ll be on the lookout for any claims that would contradict that on Spring Statement day.

Putting disability and incapacity benefits in the context of UK welfare spending

The UK Government’s Green Paper on welfare repeatedly asserted that disability and incapacity benefits were due to rise to an unsustainable level. In our reaction, we discussed why it isn’t always helpful to think about specific areas as being sustainable in and of themselves – especially when they clearly are responding to higher need in the population.

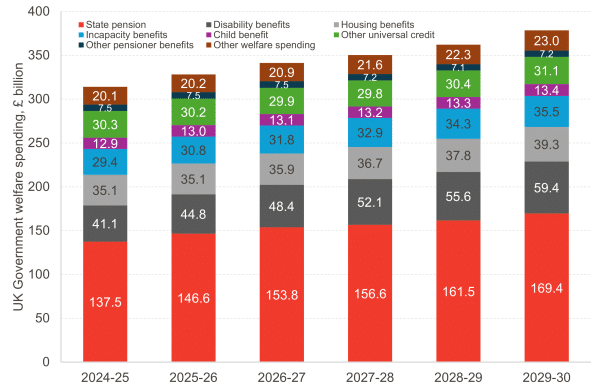

But the other issue that has struck us is how the whole conversation has failed to put the overall size of welfare spending. Disability and incapacity benefits do represent significant spending (second and fourth highest categories in the chart below), but they are far from being the main streams of expenditure on welfare. Together they were forecast to reach £95 billion in 2029-30 prior to the reforms announced on Tuesday – merely a quarter of the £380 billion forecast for that year.

Chart 1: Breakdown of UK Government welfare spending

Source: DWP, OBR, FAI analysis

By far and away, the largest element of welfare spending in the UK is the state pension. Not only is it large – approximately 5% of GDP – but it is also forecast to grow as the population ages and as the triple lock ratchets up spending faster than that on benefits unprotected by it.

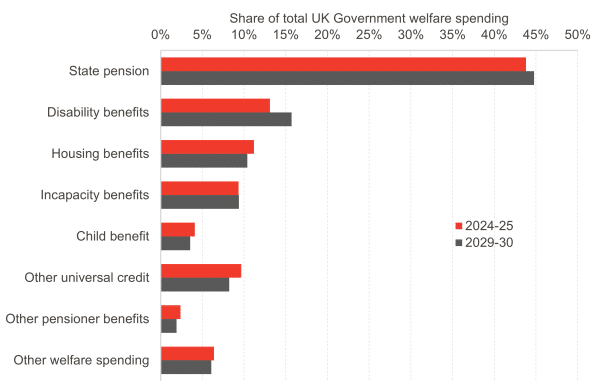

Chart 2: Share of welfare spending by category

Source: DWP, OBR, FAI analysis

This means that the share of welfare spending going on state pension was already forecast to grow by the end of the decade, even as disability benefits were forecast to show strong growth. Spending on the state pension is forecast to be £32 billion higher in 2029-30 than in 2024-25, much higher than the £18 billion increase in disability benefits spending.

Preview of our learning disabilities research

The changes to disability and incapacity benefits announced this week make our upcoming findings around learning disabilities particularly timely. Funded by the Robertson Trust, we have been working to understand the financial security of adults with learning disabilities and their families since October 2023. We wanted to understand whether people with learning disabilities and their families in Scotland are financially secure, and the impacts of both the social security system and the social care system on their financial security.

In short, we found that our 24 participants often had a lack of financial security, with some facing material deprivation. The social security system was causing confusion and worry for many families, and disincentivising career progression for others. We also found a correlation between adequate social care and financial security, which showed that financial security is not just about finances – it’s also a case of ensuring support across a range of public services is sufficient.

We will release our findings on Tuesday 25th, with a webinar on Thursday 27th. An easy read version of the findings will also be released on Thursday. You can sign up for the webinar here.

This research also acted as a pilot study: we wanted to trial collecting data from marginalised groups who are not well-represented in Scotland’s national surveys. We used a combination of quantitative data collection similar to those in national surveys, and qualitative interview methods. For those interested in digging into methods more, we will have a technical report out next week too.

Child poverty statistics are out next week

Yesterday we wrote about the legislated interim targets on child poverty, and how likely it is that they will be met. It looks unlikely that the interim targets will be met (we hope we are wrong) so we await the release of the statistics on Thursday next week.

We’ll have reaction to the statistics on the day. There are also some interesting (though quite technical!) issues about how the Scottish Child Payment is captured in the data, on which we’ll publish a report on Thursday as well.

On Monday, we’re also publishing a technical report looking at the potential effect of different policy levers on poverty rates, offering insight into what action would be required to reach the full 2030-31 targets.

The changes announced in the UK Government Green Paper will have an impact on household incomes, but it’s going to be some time before we know what those are. In Scotland, the uncertainty over how eligibility for the health element of UC will operate (given PIP is being replaced by a different benefit, ADP, in Scotland) makes things more complicated.

The statistics out next week relate to the financial year 2023-24 so these changes won’t affect these numbers, but it could alter projections of poverty rates for 2030-31. We’ll update on this in due course.

Stay tuned for more

Keep checking our website and socials for updates next week – we have lots going on! A policy report on Monday on the levers at the Scottish Government’s disposal to meet the child poverty targets; the full report on the financial security of people with learning disabilities and their families on Tuesday; reaction to the Spring Statement on Wednesday; a technical report and reaction to the child poverty statistics on Thursday; and we’ll round up any other news on Friday.

Authors

João is Deputy Director and Senior Knowledge Exchange Fellow at the Fraser of Allander Institute. Previously, he was a Senior Fiscal Analyst at the Office for Budget Responsibility, where he led on analysis of long-term sustainability of the UK's public finances and on the effect of economic developments and fiscal policy on the UK's medium-term outlook.

Chirsty is a Knowledge Exchange Associate at the Fraser of Allander Institute where she primarily works on projects related to employment and inequality.

Emma Congreve is Principal Knowledge Exchange Fellow and Deputy Director at the Fraser of Allander Institute. Emma's work at the Institute is focussed on policy analysis, covering a wide range of areas of social and economic policy. Emma is an experienced economist and has previously held roles as a senior economist at the Joseph Rowntree Foundation and as an economic adviser within the Scottish Government.