Today the Scottish Government published GDP figures for the final quarter of 2018. Growth for Q4 2018 was 0.3% – below trend but slightly faster than the UK as a whole. This comes on the back of yesterday’s labour market data which showed Scottish unemployment at its lowest rate since the ONS Labour Force Survey was first collected on a consistent basis in the early 1990s.

Today’s figures

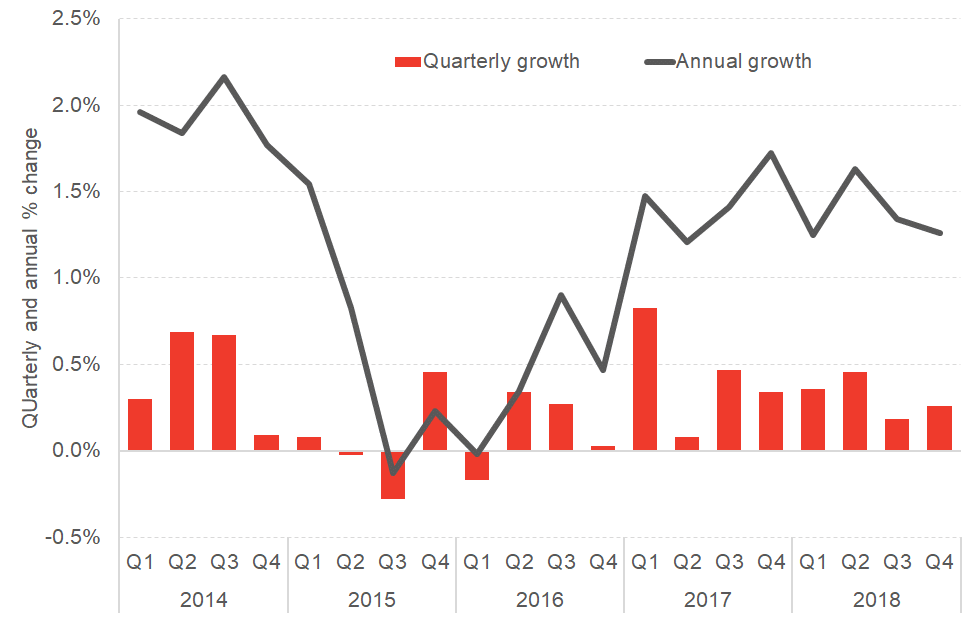

Scotland’s economy continued to grow in the final quarter of 2018, with growth of 0.3%. Over 2018 as a whole, growth was 1.4% (slightly slower than the 1.5% recorded in 2017 and still below long-term growth – see below).

Chart 1: Quarterly and annual economic growth in Scotland since 2015

Source: Scottish Government

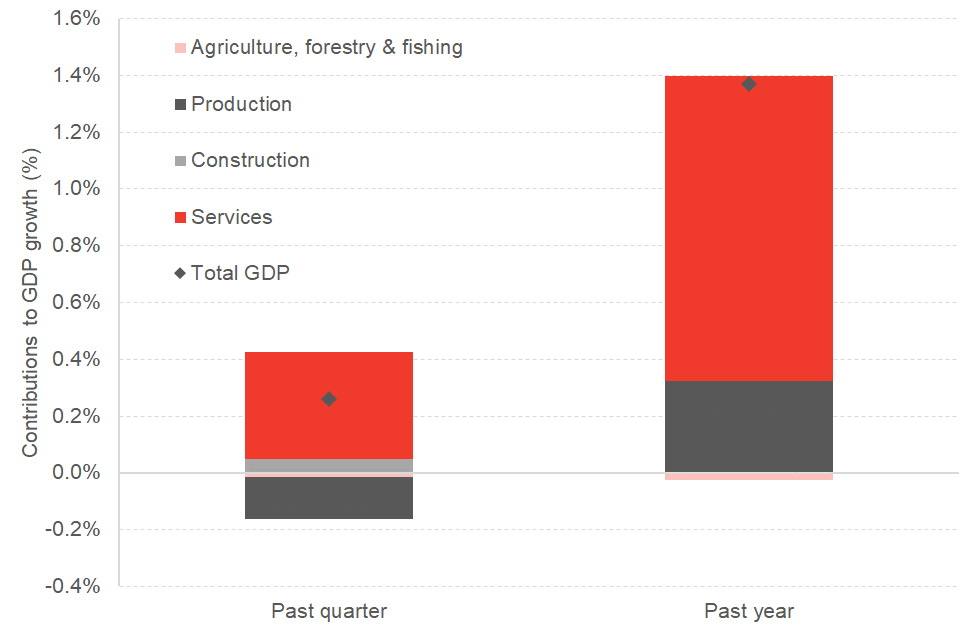

Growth was relatively strong over the quarter in both services (up 0.5%) and construction (up 0.8%). In contrast, production output fell by 0.9%, driven largely by a fall back in electricity and gas supply (note this series can be volatile given movements in renewable energy generation).

The overall growth rate of 0.3% (or 0.26% to 2 decimal places) was broadly in line with our latest nowcast estimates which predicted growth of 0.29% for the final quarter of 2018.

Chart 2: Contributions to GDP

Source: Scottish Government

The growth data for the final quarter of the year, follows yesterday’s labour market data which showed that unemployment in Scotland fell to 3.4%, with employment rising to 75.3% over the 3 months to the end of January. Unemployment is down 0.9 percentage points on a year ago with employment up 0.5 percentage points on the same basis.

The GDP and unemployment figures suggest there is an apparent disconnect between the most up to date key economic indicators and other unofficial measures of confidence and business expectations in the economy.

For example,

- Our own survey of business preparations for Brexit suggested that firms were relatively pessimistic about the outlook over the next six months;

- Earlier this month business confidence hit a 28 month low according to the latest Purchasing Managers Index for Scotland. Scottish order book volumes fell for the third month in a row;

- The Scottish Chambers of Commerce Quarterly Economic Indicator survey for Q4 of 2018 reported that businesses whilst remaining resilient in terms of their day-to-day activities, were reporting levels of optimism slipping across the board; and

- The Scottish Government’s own measure of consumer confidence was the lowest it has ever been since the statistics were first collected in 2013.

There are a number of possible explanations for this. Perhaps the most believable is that a constant message that we have been getting from the businesses that we speak to is that with so much uncertainty around, they are simply getting on with the day job. And that whilst, optimism may be falling and uncertainty rising, actual day-to-day activity is remaining relatively resilient.

We’ll gain further insights on this when we publish our Scottish Business Monitor for Q1 2019 on Monday.

Longer-term trends

Whilst today’s figures are welcome and show continued growth in the Scottish economy, the figures remain below trend.

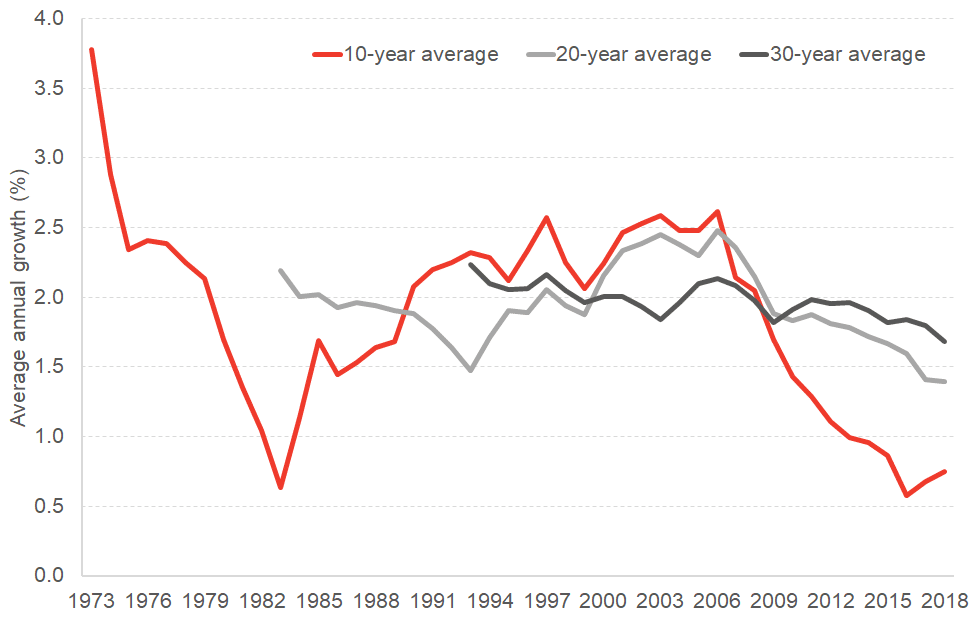

The chart below shows the 30, 20 and 10 year average growth rates in Scotland over recent years.

Chart 3: Annual Average growth rates

Source: Scottish Government

As the chart highlights, there is clearly a downward trend in the core growth rates for Scotland. This is clearly a concern and Brexit certainly won’t help. However, it’s also not the case that Scotland’s sustained weak growth performance in recent years can be pinned on Brexit. These figures should provide a wake-up call to policymakers in both Scotland and the UK.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.