Today’s GDP data shows the Scottish economy grew by 0.3% in the last three months of 2017, bringing headline growth in 2017 in at 1.1%. This blog unpicks some of these numbers in more detail and explains the two different measures used to describe annual GDP growth.

In summary:

- These data show that the Scottish economy grew by 0.3% in Q4 2017 (compared to 0.4% for the UK as a whole).

- This makes growth relative to the same quarter the year before 1.1% (compared to 1.4% for the UK as a whole).

- Or on a 4Q-on-4Q basis growth in 2017 in Scotland was 0.8% (compared to 1.8% for the UK as a whole).

While this is slower than the growth of the UK economy over the same period, growth in much of the Scottish economy was actually slightly better than the headline figure suggests.

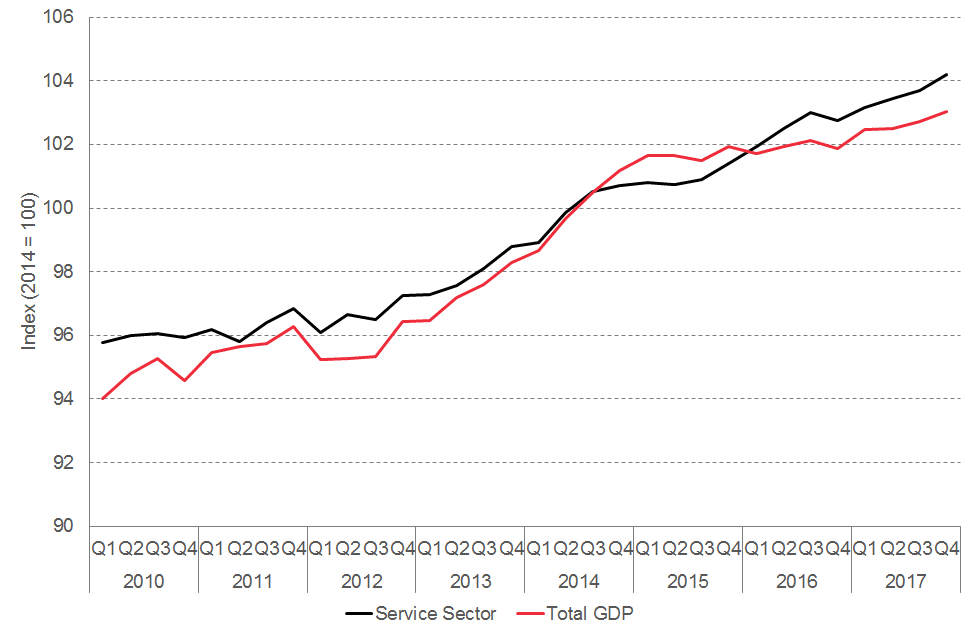

Growth in the services sector, which comprises over three quarters of the economy, was a more robust 0.5% in the final three months of 2017. Indeed, the services sector has outperformed the overall Scottish economy over the past year, growing by 1.4% compared to the same period the year before.

Growth in overall Scottish and Service sector GDP

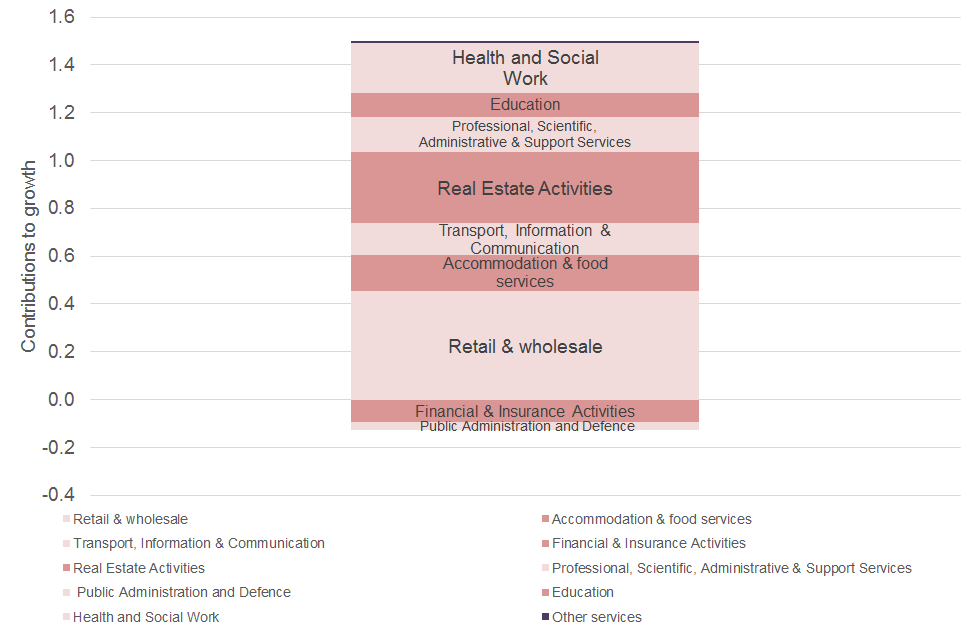

We can break this overall growth in the services sector down into which sub-sectors contributed the most to this growth as we do in the chart below.

Contributions to service sector GDP growth (Q4 2017 relative to Q4 2016)

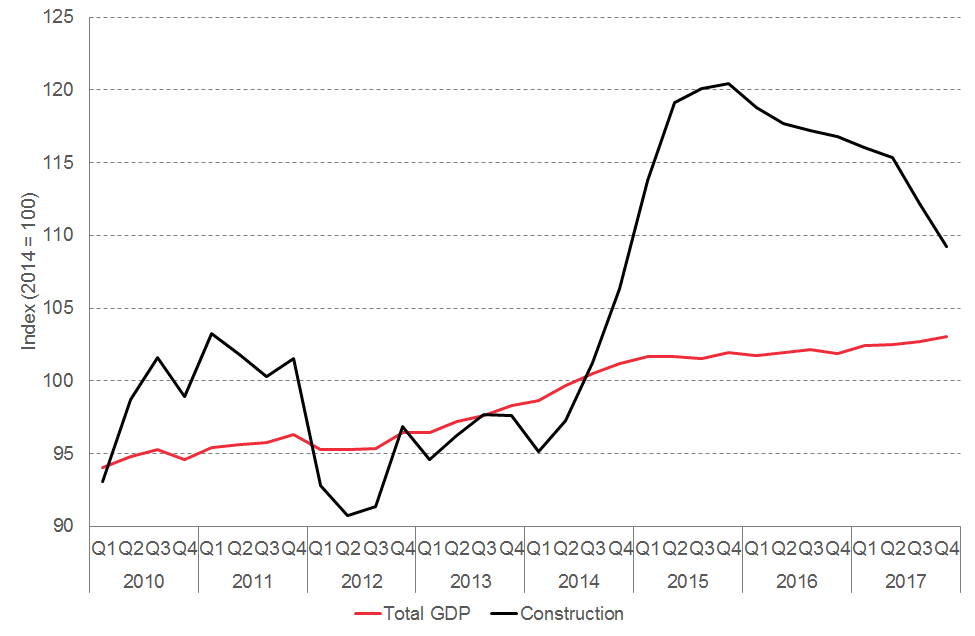

What is driving much of the overall weakness in growth in the Scottish economy is the large drop in the activity of the construction sector, down -2.6% on a quarterly basis. This continues a trend of weakness in the construction sector since 2016, following spectacular growth in the sector in 2014-2015. Activity in the construction sector is now down -6.5% relative to the same period in 2016.

Growth in overall Scottish and Construction sector GDP

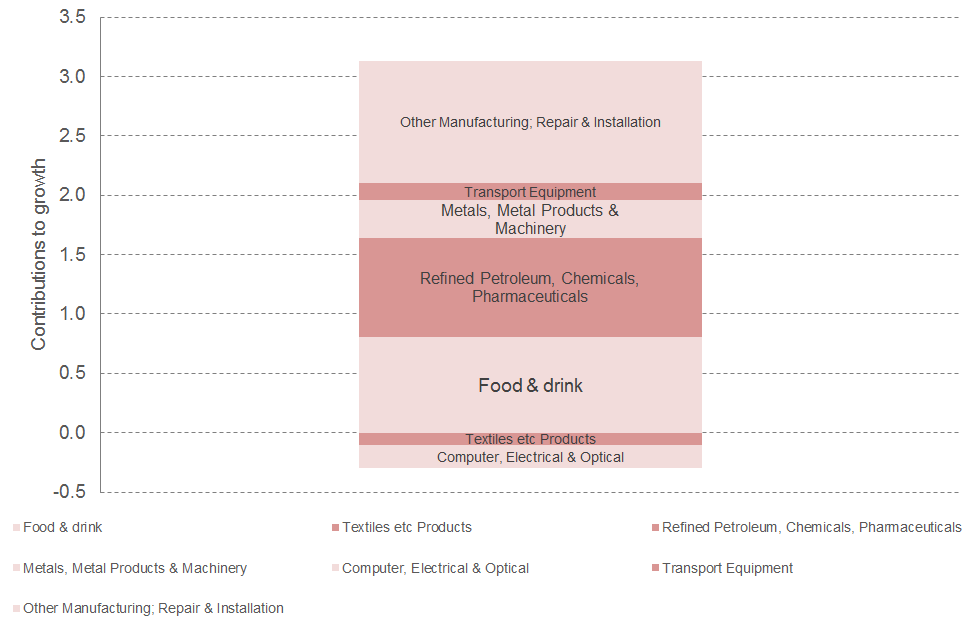

While weak headline growth in the Scottish economy remains a significant concern, as does the decline in activity in the construction sector, other sectors have grown strongly since last year including the manufacturing sector which has seen activity grow by 2.9%.

The chart below shows the composition of this growth in manufacturing. We can see a big part of this growth has been driven by improvements in activity in the refined petroleum, chemical and pharmaceutical sector (+7.1%). Similarly, the food and drink sector has seen its activities grow substantially over the past year (+3.1%). Other manufacturing activities are also up 4.2% on last year.

Contributions to manufacturing sector GDP growth (Q4 2017 relative to Q4 2016)

In addition, the strong growth in renewable electricity output in Scotland at the end of 2017, highlighted in our recent blog, has pushed activity in the electricity and gas supply sector up 9.5% relative to the same quarter in 2016.

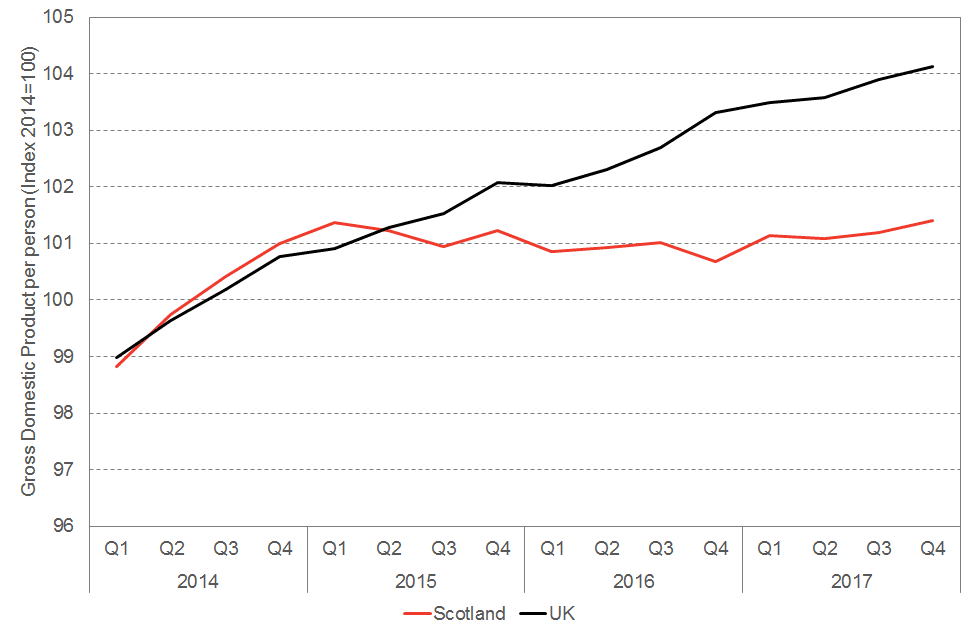

GDP per person

Abstracting from the sectoral detail of the data released today, one other emerging trend which will be causing concern is the apparent divergence in the growth of GDP per person between the UK and Scotland.

UK and Scottish GDP per person

While there are admittedly a range of challenges with using GDP per person as a proxy for economic prosperity, it is nevertheless the case that this measure provides at least some insight into how average standards of living may be changing over time.

On this basis, having tracked UK growth pretty closely for most of the period for which we have data (i.e. since 1998), Scotland appears to be diverging quite substantially from improvements (at least on this measure) seen in the UK as a whole.

A note on different GDP measures

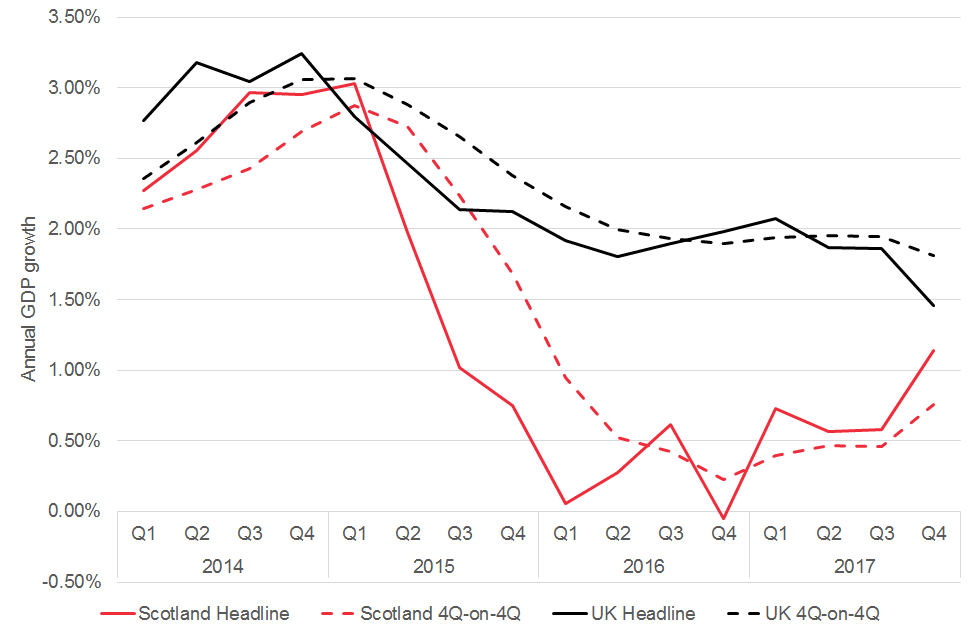

Users of GDP data often get confused by the two different measures of annual GDP growth which are reported.

One approach, and the headline measured used in the Scottish Government’s GDP statistics is to compare the value of output today with the value of output 12 months ago. For 2017, comparing 2017 Q4 with 2016 Q4 gives a growth rate over the year of 1.1%.

This is the most common way of thinking about annual growth, and makes sense: we’re usually interested in whether the economy using the latest quarterly data is larger than it was a year previously.

The alternative measure is to take a so-called 4Q-on-4Q approach. This is effectively a rolling annual measure – which compares the most recent four quarters to the previous four quarters. On today’s data, this methodology gives a much weaker growth rate of 0.8% in 2017.

We highlighted (see here) the explanation of this measure by a previous National Statistics publication released alongside Scottish GDP data:

“An alternative measure of change compares the average of the most recent four quarters with the average of the four previous quarters. This figure is less affected by short-term fluctuations, but the trade-off of this is that it is a less sensitive measure of short term change.”

The chart below shows that for longer term comparisons of economic performance, which measure is used matters little. For shorter term measures of activity, which measure is used can have some bearing on the narrative that one can support.

Conclusions

While headline economic growth in Scotland continues to disappoint, there are signs of strong growth within some parts of the economy.

Growth in the services sector, which comprises over three quarters of the economy, was a respectable 0.5% this quarter. In addition, some manufacturing and production sectors recorded particularly strong growth including food and drink, refined petroleum and electricity supply.

Nevertheless, ongoing weakness in growth in the construction sector – after admittedly spectacular growth in the sector in 2014-2015 – continues to drag headline growth in Scotland down.

Comparisons with growth in the UK as a whole are inevitable, and at the moment these don’t make for easy reading for policymakers in Scotland. This is particularly true of comparisons of GDP per person as outlined above.

Nevertheless, it is important to note that relative to the UKs international competitors, UK growth is itself rather weak. This means that benchmarking our economic performance against international competitors makes for grim reading for policymakers right across the UK.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.