Yesterday, the latest Royal Bank of Scotland Scottish Business Monitor (SBM) was published.

2018 marks the 21st year the SBM has been run by the Fraser of Allander. The survey provides a snapshot of activity in the Scottish economy well in advance of official data. It also acts as a gauge of future activity levels by monitoring the optimism level of firms.

The latest results

This latest Scottish Business Monitor covers activity up to the end of Q2 2018 and provides expectations to November 2019. The results support our latest Economic Commentary forecasts of cautious optimism in Scotland’s growth prospects for this year. Overall, they suggest that the Scottish economy will pick up through 2018 recording faster growth than 2017, though growth is anticipated to remain below trend.

The upswing in business activity and exports is clearly welcome, particularly given the heightened uncertainty around the terms of the UK’s exit from the EU. However, the declining investment trend in the survey does offer some evidence that such uncertainty could be affecting firms’ investment plans.

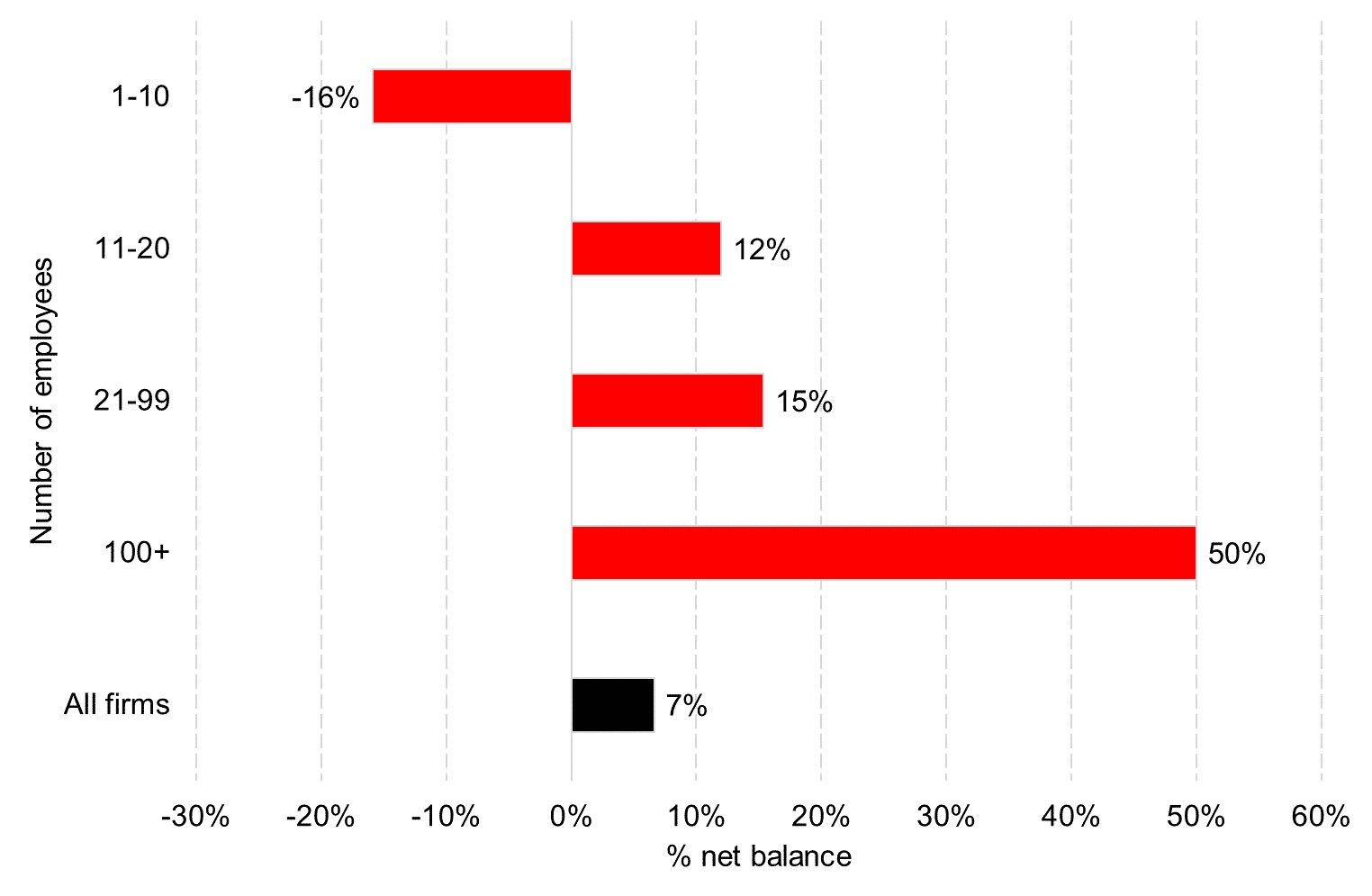

Although many companies across the country have reported a pick-up in activity during the last three months, and with expectations of further growth in activity in the remainder of the year, this is not the case across all of the size bands within the survey. Overall, it would seem that small firms are finding trading conditions more difficult than medium and larger sized firms.

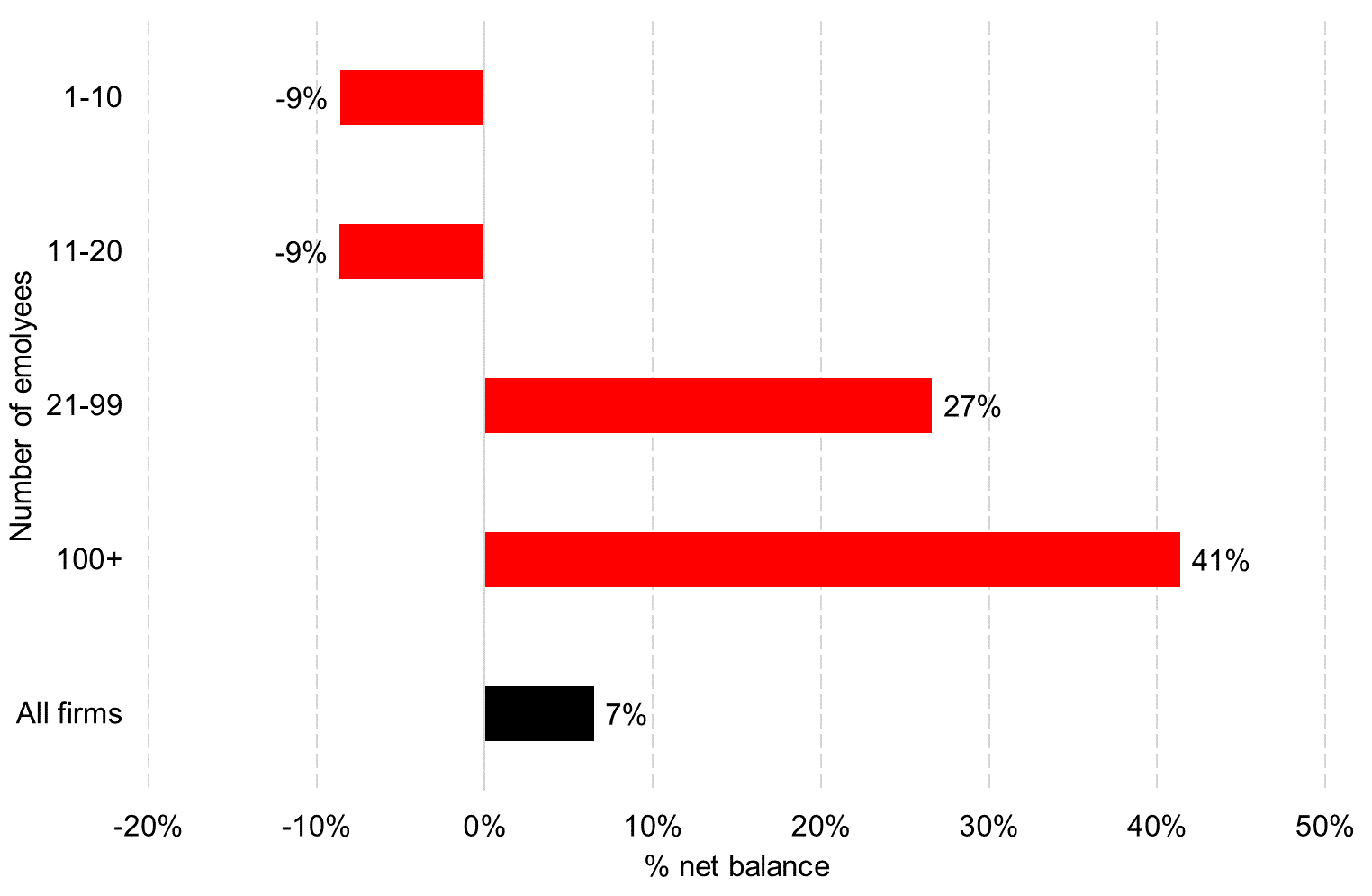

Just over a third (35%) of all firms reported an increase in the total volume of business during Q2/18, and that 29% reported a fall – this balance of +7% is up six points since the previous quarter. However, only a quarter of firms with fewer than 10 employees reported an increase in the total volume of business, compared to more than 60% of firms with more than 100 employees – see Chart 1.

Chart 1 Total volume of business by firm size (%net balance)

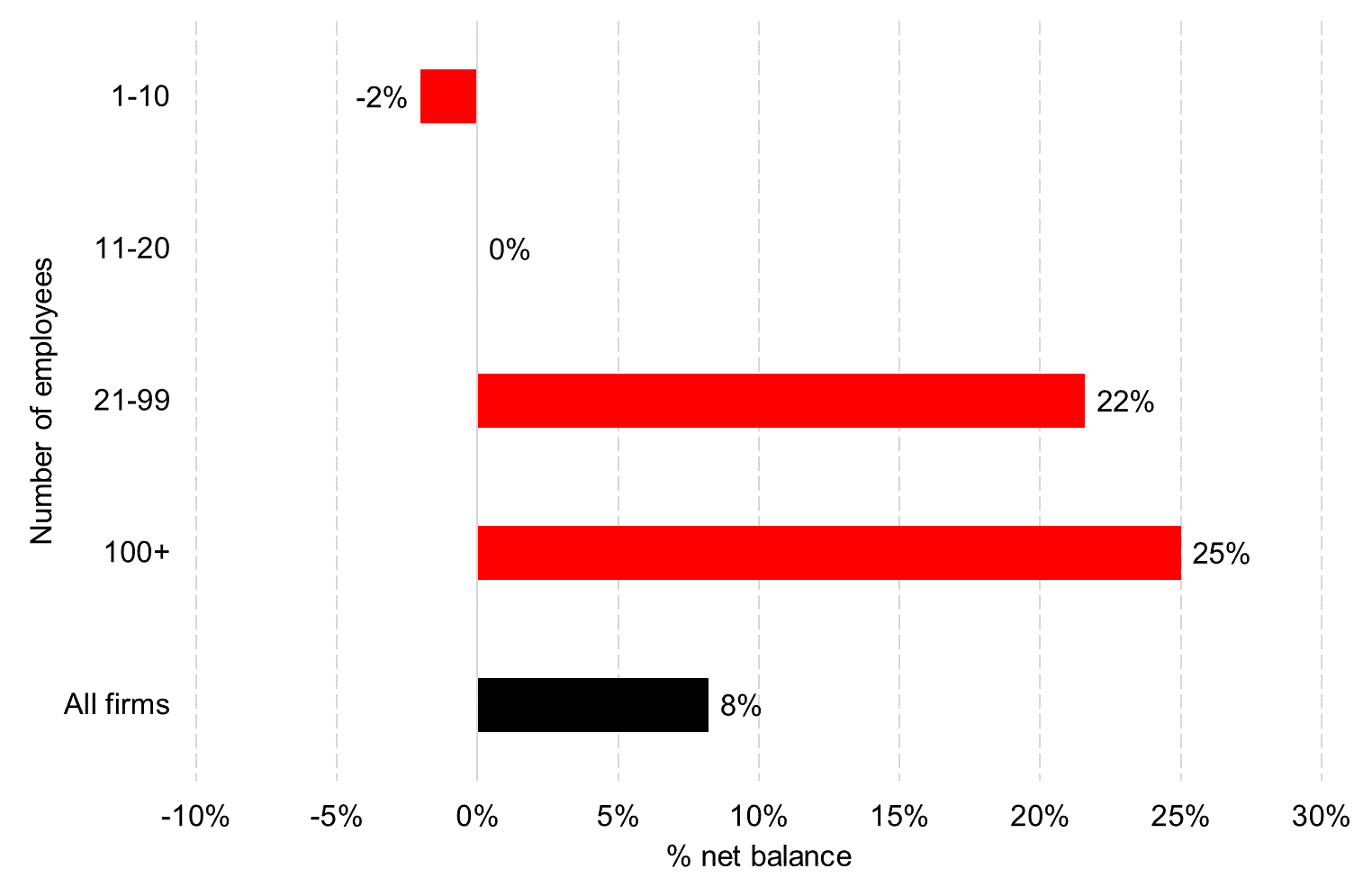

Overall, the trend in new business continued to rise for a net balance of +9% of respondents.

This builds a little on the previous quarter (+8%).

Once again, new business volumes grew more strongly in larger firms.

Chart 2 Volume of new of business by firm size (%net balance)

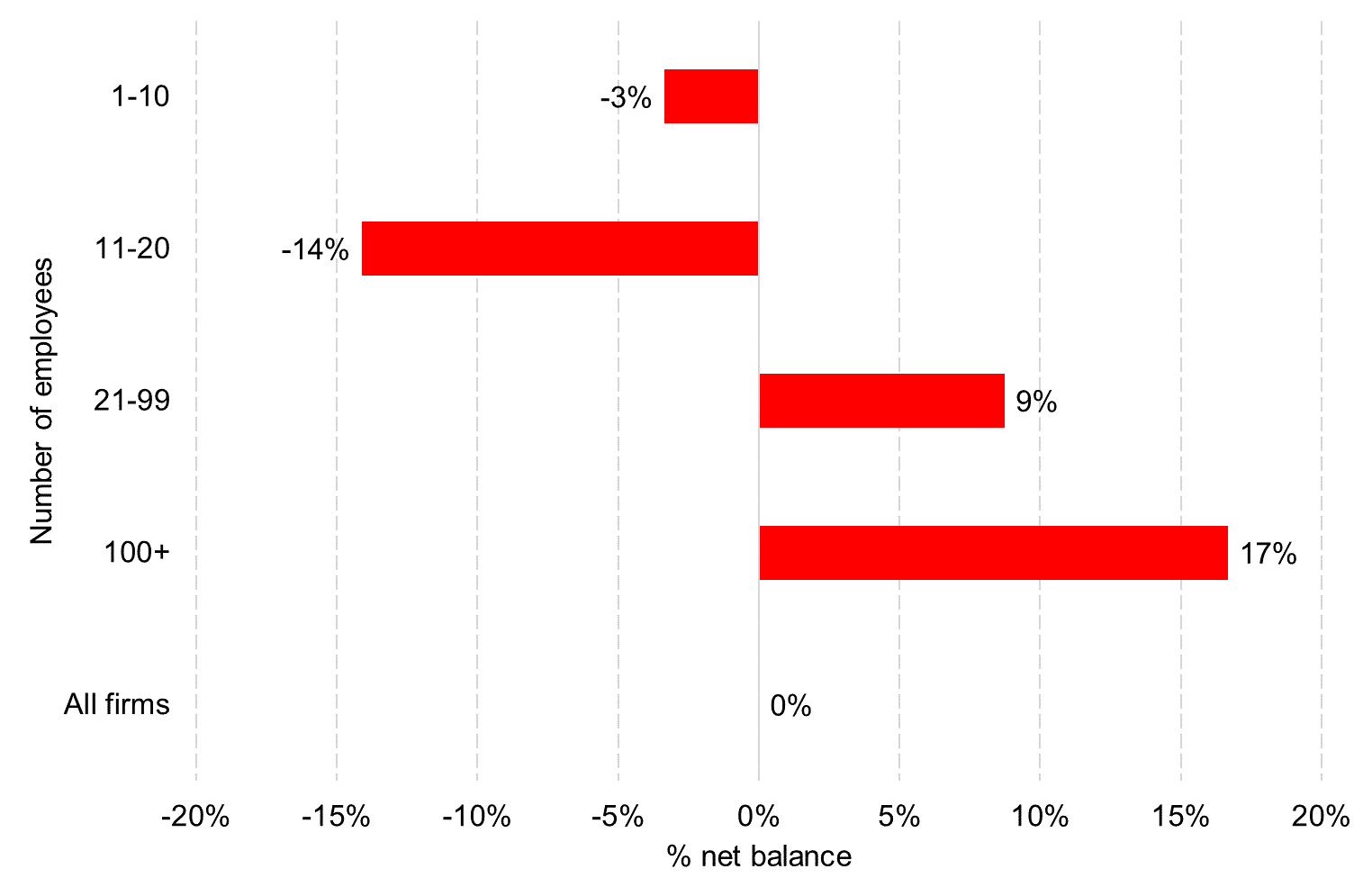

Almost two thirds of firms in the survey (64%) reported that repeat business remained flat during Q2; 18% reported an increase while 18% reported a fall resulting a net balance of zero. Encouragingly a net balance of +8% of firms anticipate a rise through the remainder of 2018.

Similar to the trends outlined above we see that smallest firms reported net declines in repeat business while those with more than 20 employees, on balance, reported net increases.

Chart 3 Volume of repeat of business by firm size (%net balance)

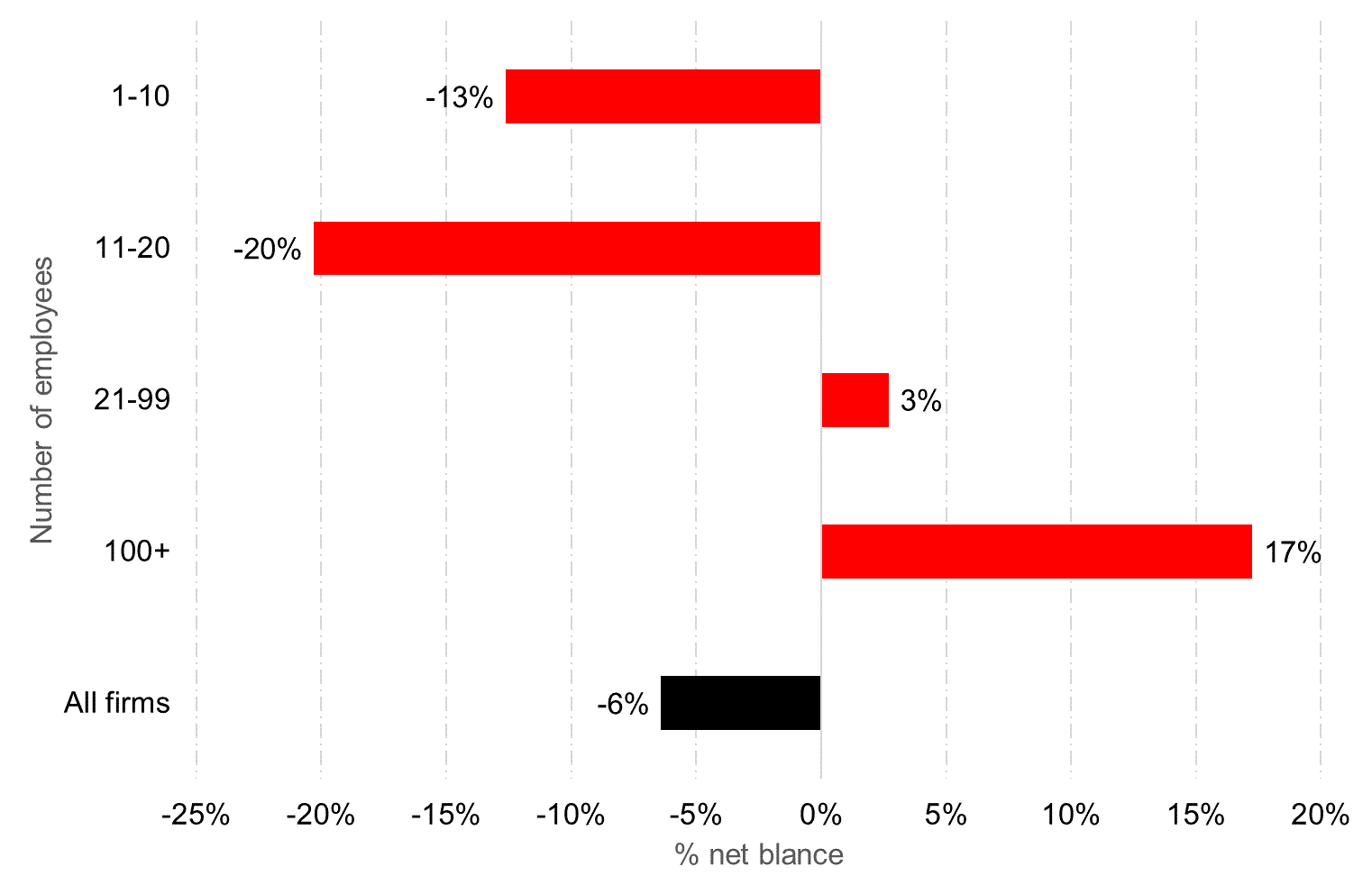

Half of all firms in the survey reported no change to capital investment plans although a net balance of -6% reported falling capital investment. This is similar to results from the last 18 months. This declining investment trend in the survey suggests that the current uncertain environment is affecting firms’ investment plans and is making business planning difficult.

When examining the investment trends in relation to firm size, these latest results show that smaller firms were less willing to invest. Only one in ten firms with 11-20 employees, and only two in ten firms with 1-10 employees reported an increase investment plans.

Firms with more than 20 employees, on the other hand were slightly more willing to revise investment plans upwards with a net of +9% of firms with 21-99 workers and +17% of firms with more than 100 respectively recording a rise in investment plans.

Chart 4 Capital investment by firm size (%net balance)

Amongst exporters responding to the survey, 23% said sales improved whilst 16% reported a fall (+7%). This was a welcome recovery from the -5% reported in the Q1 survey and a net balance of +11% expect export to continue to rise throughout the second half of 2018.

Chart 5 Exports by firm size (%net balance)

From Chart 5 we see that trends in export activity also improved in relation to firm size. Indeed only 16% of firms employing less than 10 reported an increase in export activity compared to half of firms employing more than 100. During the 6 months to the end of 2018 only those firms employing few than 10 anticipate export activity to continue to fall.

This latest Scottish Business Monitor supports our cautious optimism about the outlook for Scotland’s growth prospects this year; the findings are consistent with our view that the Scottish economy will pick up through 2018, although growth is still expected to remain below trend.

But should we be concerned that the net balances for the smallest firms are negative? It is often assumed that big businesses form the bedrock of our economy, but that’s not quite true. In reality, small businesses are just as important, if not more so. More than 15% of UK workers are employed in firms with less than 10 workers and around 40% work in firms with fewer than 20 employees.

We await with interest the results from the next few surveys to tell us whether small firms are also becoming more optimistic.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.