In recent days, you’ll have no doubt seen various headlines predicting hundreds of millions of pounds being wiped off our economy as a result of the bad weather. Other estimates predict that UK growth could fall to 0.2% this quarter, down from trend growth of 0.4%.

But how accurate can these estimates expect to be? And what might it mean for this quarter’s growth figures?

Since last Wednesday, we’ve been asked on a number of occasions about what we think the economic impact could be of the recent bad weather on the Scottish economy. Unfortunately the answer we give is not that exciting. In our view, any impact on the Scottish economy is likely to be much smaller – and temporary – than you may initially believe to be the case.

Firstly, most of the estimates of the potential impact are based on guesswork. Figures suggesting a 20, 30, or 50 percent reduction in activity are very much at the speculative end of the spectrum. In the modern economy, a greater proportion of the workforce is able to work remotely than in the past. Even then, we’re talking about 2 or 3 days of displaced activity out of over 60 working days in a 3-month period.

Secondly, some of the impacts that we hear about are simply displacement of activity. For example, whilst petrol sales will have fallen because of fewer people out on the roads, sales of gas and electricity will have risen as more people stayed at home. Similarly, expect to see a sharp rise in soya milk sales as people bought alternatives to cow’s milk!

Thirdly, a lot of the impacts will be temporary. Output will slow – possibly sharply – over the week of the disruption but then pick-up in the days ahead. But our economy can be remarkably resilient to such short instances of any break in activity. For example, if you had been planning on buying a new TV but didn’t venture out, your purchase is much more likely to be simply delayed than cancelled. Footfall at shops, leisure facilities and theatres may fall but the money saved by many families this weekend will be spent in the future. Similarly, most firms that were forced to close last week will seek to increase capacity over the coming days to make up for lost production or activity.

This is not to say that there will be no impact. The longer any disruption in activity lasts for, the more likely it is to have an impact on supply chains, and this will have a much more sustained negative impact.

For individual firms it could be highly significant. Firms most exposed will be those involved in perishable goods, such as farmers, restaurants and café owners. Small businesses are also likely to be more exposed than larger firms to cash-flow issues if payments have not been made or deliveries not met.

What about last time?

The last time we had severe weather in Scotland was back in the final quarter of 2010.

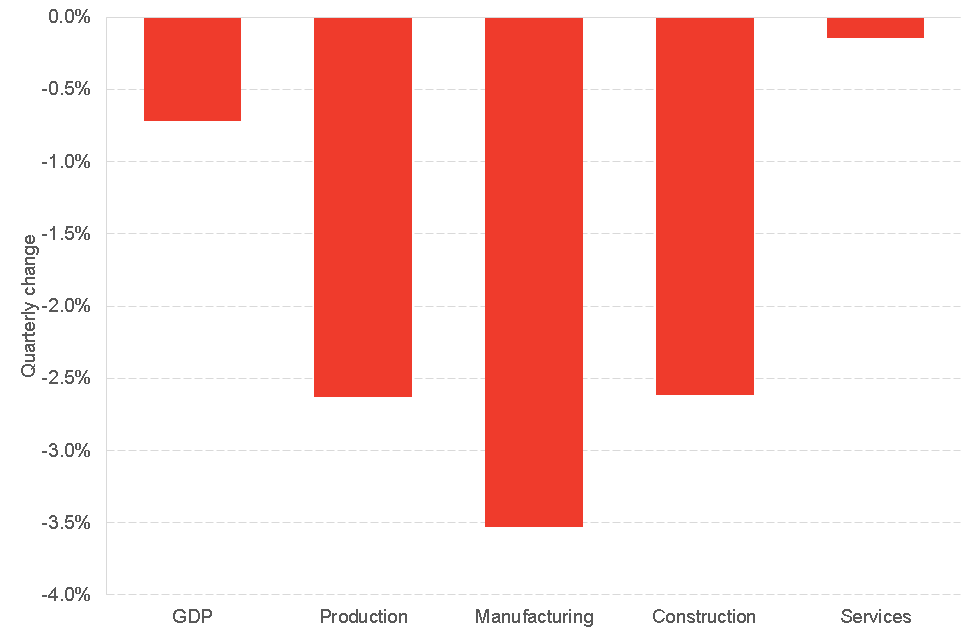

The chart below shows what happened to Scottish GDP during that period.

Change in Scottish GDP and its components Q4 2010

Overall, the Scottish economy contracted by 0.7% during Q4 2010. Unsurprisingly, the biggest falls were in production (of which manufacturing was particularly badly hid) and construction.

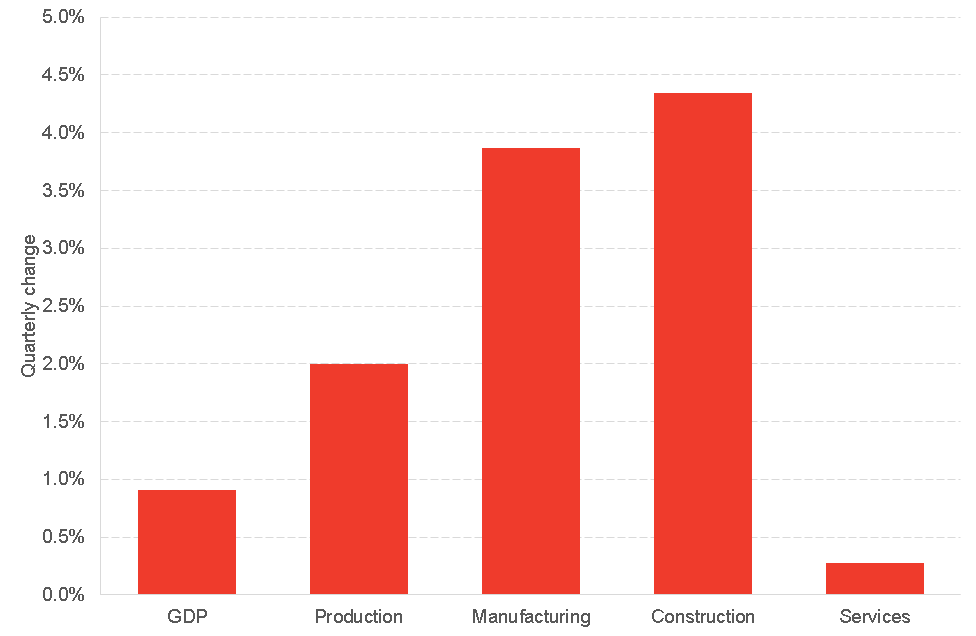

The chart below shows what happened though in Q1 2011.

Change in Scottish GDP and its components Q1 2011

Output grew 0.9% in the first quarter of 2011. Output continued to grow through the remainder of 2011 adding a further 0.9% to Scottish GDP.

So whilst there is no doubt that the recent snowfall will have had an impact, we need to be careful not to overstate the impact or the long-term implications that it may have.

Figures for Q1 Scottish GDP will not be released until July. Should the recent trend of low growth continue then there is a risk that the bad weather could – just as in 2010 – tip the GDP numbers back into negative territory. But if this was to happen, we should be mindful of the impact of the adverse weather and the likelihood that any negative hit will be temporary.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.