As of today (Friday 29th May) Scotland is starting to emerge slowly from its enforced spring hibernation. Whilst easing of the restrictions allowing households to meet at a 2m distance outside will be welcome news for many, we are unlikely to see any immediate big changes in economic indicators. More outdoor work will be allowed with construction allowed to restart site preparation, garden centres will be reopened and we can expect to see more drive through food outlets reopening. However, other business premises are being asked to remain closed.

The fact that England was a couple of weeks earlier to start relaxing restrictions means that wider UK data may give us some indication of what is to come although we should note that, in England, more people have been encouraged back to work than will be the case in Scotland just now. Even so, in England there hasn’t been any sign of a mass ‘return to work’, with the park the only place that people seem to be going to in any great numbers.

There are some, very limited, signs of activity starting to re-start in the UK data. However, it’s clear that expectations for a quick economic recovery are low, and people remain worried about how they will cope financially. This loss of confidence could impact on the economy as well. This will be a slow and uncertain recovery.

Economic activity

Previous results from the ONS Business Impacts of Coronavirus survey showed that between 20 April and 3rd May, 72% of export businesses who are continuing to trade reported a fall in their exporting activity, with 2% having to stop completely. At the UK level (Scotland not available) Coronavirus related travel restrictions were the main challenge cited by exporters who were seeing activity fall.

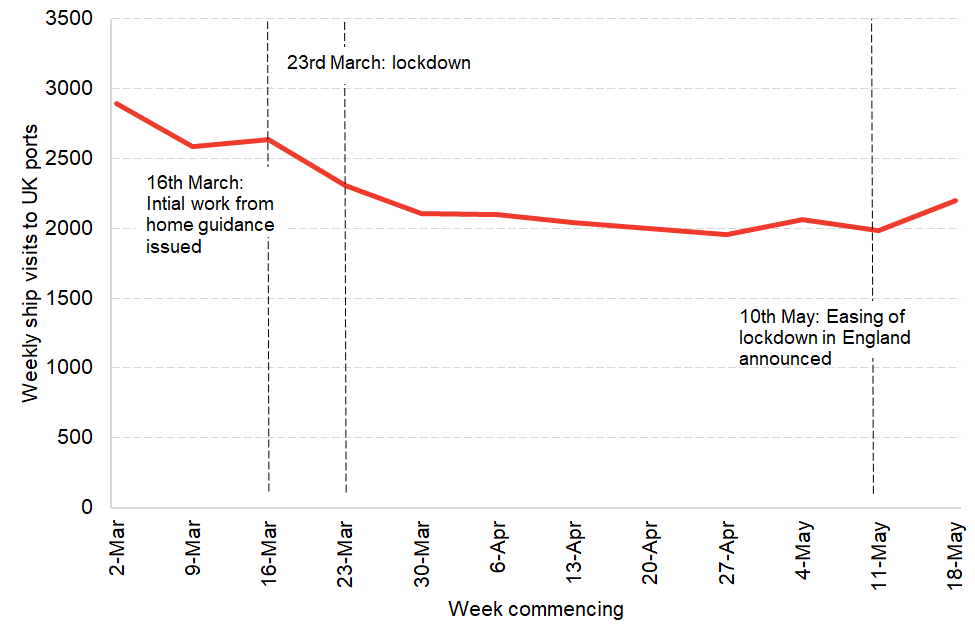

The ONS compile statistics on shipping for the UK as a possible indicator of import and export activity. Severe falls in March are nowhere close to being reversed, but there appears to be some slight improvement improvement in the most recent week’s data (covering 18th to the 24th May).

Chart 1: Visits of ships to UK ports

Source: ONS Faster Indicators

Mobility

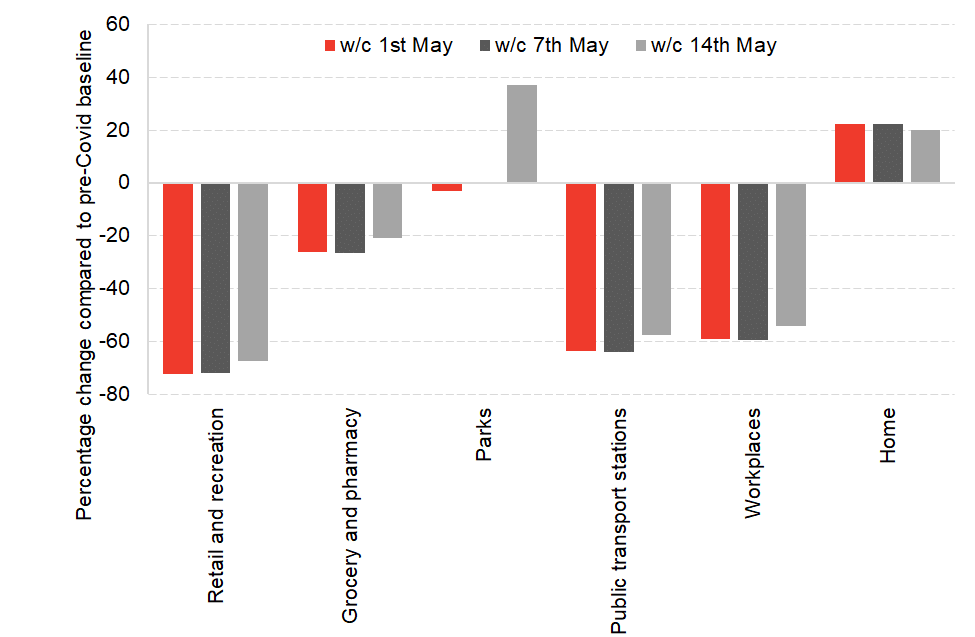

In terms of where people are spending their time, the only significant change is a recent large increase in the number of people spending time in parks as restrictions on time spent outdoors for leisure purposes was eased in England.

The final week of this data includes the week following the guidance being issued in England which hoped to encourage those that can’t work from home, and work in businesses that are allowed to operate, to return to their workplace. As yet, there are only very limited indications of this translating to a significant increase in visits to workplaces or on public transport (which continues to be advised against) according to this data.

Chart 2: Data on UK mobility

Source: Google mobility data

Business reopening

Initial analysis by ONS of their most recent Business Impact of Coronavirus Survey (BICS) for the period 4th May to 17th May (full datasets not yet released so no Scotland data) showed that 8% of UK businesses who said they were trading had restarted in the last two weeks. This compares to 6% who answered yes to this question in the previous BICS survey for 20th April to 3rd May.

24% of UK businesses that have currently paused trading say they expect to start trading in the next four weeks (with 14% saying they will restart within 2 weeks), compared with 31% who expect to start trading in more than 4 weeks’ time. The remainder do not know when they will reopen.

Impact on household finances

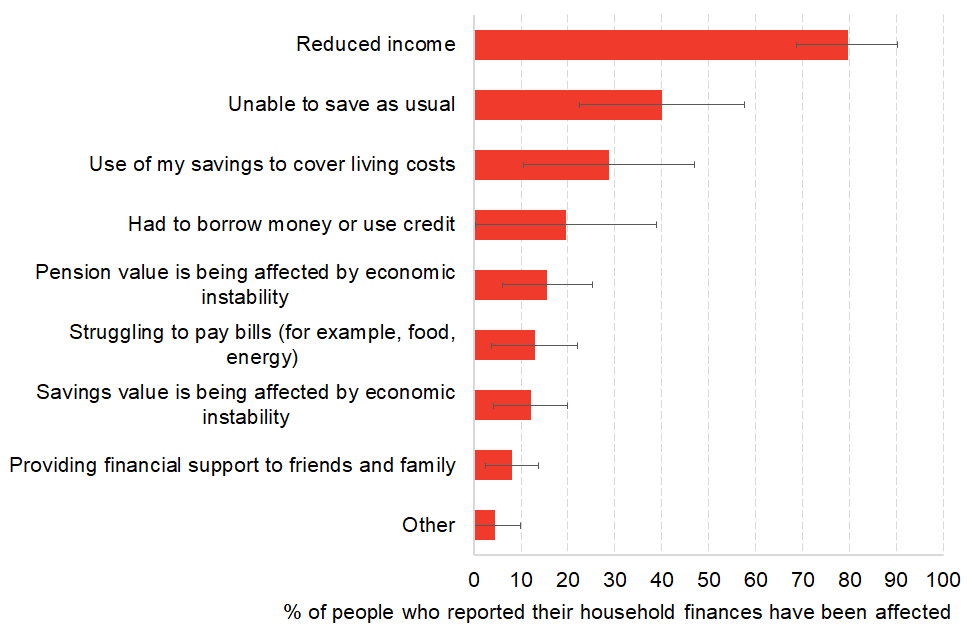

Data on the negative impact of the pandemic on household incomes continues. Data published, again by the ONS, for the period 3rd April to the 3rd May found that 17% of people in Scotland have seen a deterioration in household finances.

Chart 3: Main reasons for deterioration in household finances in Scotland, surveyed between 3 April to 3 May 2020

Source: ONS Opinions and Lifestyle Survey

Amongst the households whose finances have been affected the most common reason, reported by circa 80% of people, has been a reduction in regular income. As a result, approximately 40% of all people have been unable to save as usual and approximately a third have had to draw on their savings to cover living costs. A fifth of all people have had to borrow money or use credit and 13% were struggling to pay their bills.

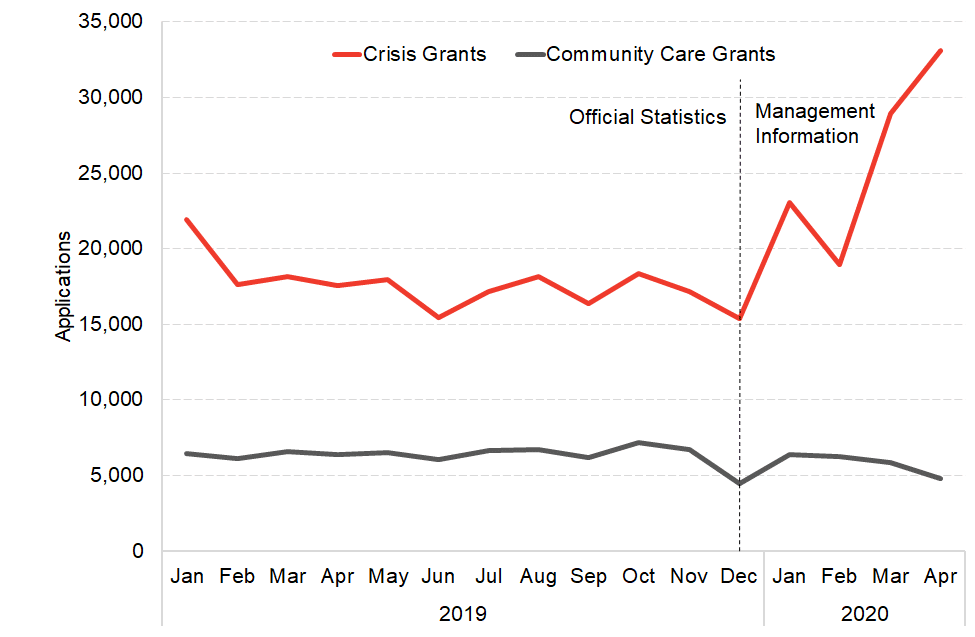

New Scottish government data on applications to the Scottish Welfare fund were released this week, showing large increases in demand for crisis payments. This highlights the severity of the financial crisis facing an increasing number of households.

Chart 4: Applications to the Scottish Welfare Fund

Source: Scottish Government

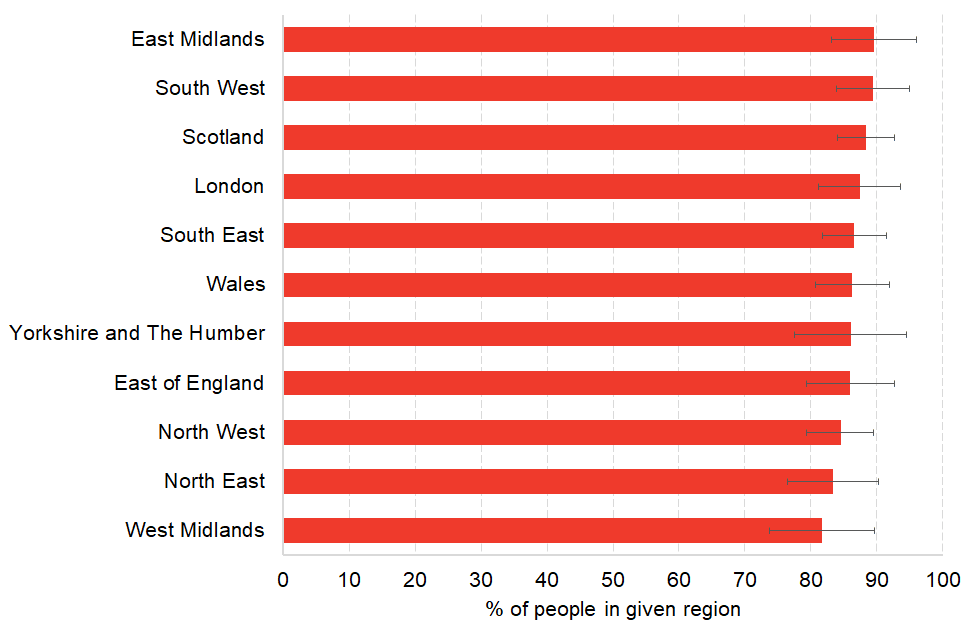

The fall in regular income coupled with other factors such as self-isolation and the uncertainty about the future have led to higher levels of anxiety and worsened mental health across all parts of the UK. According to the ONS, in Scotland, 88% of respondents have felt stress and anxiety as a result of the coronavirus. The share has varied between 80 – 90% across different UK nations and English regions.

Chart 5: Percentage of people who reported that their well-being had been impacted by stress or anxiety as a result of the coronavirus, country or region, surveyed between 3 April to 3 May 2020

Source: ONS Opinions and Lifestyle Survey

Confidence in the economy

BBC Scotland this week published results of a survey that IPSOS MORI carried out. 72% of people reported that they felt that the economy would “get worse” over the next 12 months. Around 60% of people felt concerned about the impact of the pandemic on their personal finances, with worries highest in the 35 – 54 age group.

The survey also asked a question on whether people would “go back to doing all the things you did before lockdown” once allowed. There was a 50:50 split between yes and no responses, although it is unclear over which time horizon this relates to.

Concluding thoughts

Whilst still early days, the first stage of easing of lockdown in England has not had dramatic effects on economic indicators so far. Given that we are taking a slightly more cautious approach in Scotland we therefore aren’t likely to see the Scottish economy coming on leaps and bounds in the next couple of weeks.

Understandably, a lot of people are very concerned and anxious – both for health and financial reasons. This loss of confidence in ‘normal life’ may not go away for some time yet, and this will have consequences in turn for the economy (particularly parts of our economy that rely upon social spending, such as retail and hospitality).

Given that a threat of a second wave of the pandemic will never be far from people’s minds, we may be left in this confidence limbo for quite some time. It will only be as people start to remerge from their homes that we will see how people adapt and what kind of economy we have to start to rebuild.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.