On Wednesday, the Scottish Government will publish its first estimate of economic growth for Q4 2017.

As always, their publication is likely to attract significant comment. Unfortunately, the immediate political debate is likely to be dominated by whether or not the figure is higher or lower than the equivalent number for the UK.

Whilst understandable, as we have argued on a number of occasions, the Scottish series can be volatile and rather than looking at one quarter’s results in isolation a longer-term perspective (of at least a year) is needed.

In this blog, we highlight some things to watch out for and what may drive the results (up or down).

Recent performance

As we outlined in our latest Economic Commentary, Scotland’s recent economic growth performance has been relatively fragile.

Over the year to Q3 2017, Scottish GDP grew by 0.6%. This is below trend (before the financial crisis annual growth was around 2%) and behind that of the UK over the year to Q3 2017 was 1.7%.

The Scottish figures for 2017 thus far, are also lower than we forecast.

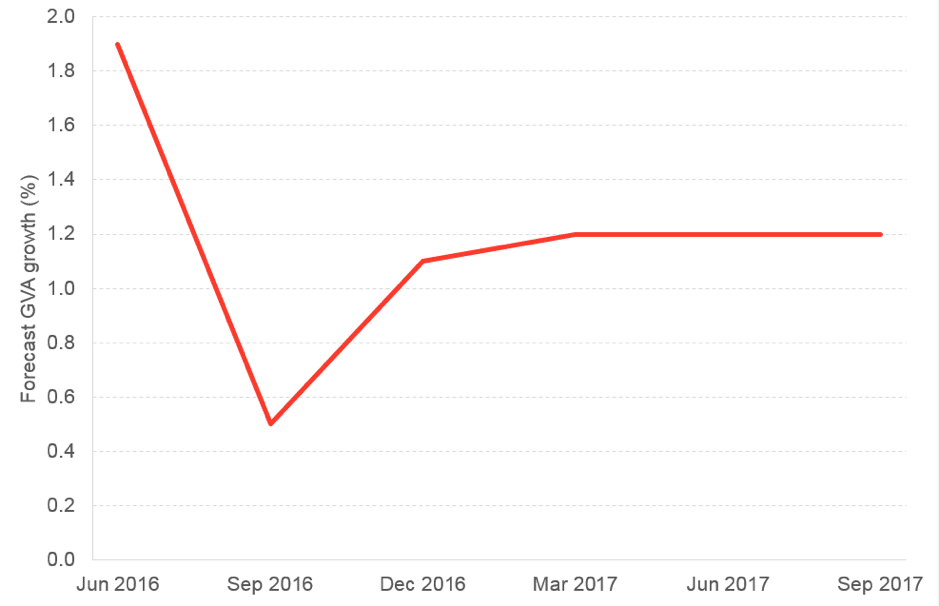

Chart 1 summarises how our 2017 forecasts have evolved over time – even back in September we were predicting growth of 1.2% for the year as a whole. Even if Q4 data comes in slightly above Scotland’s long-term trend, then the annual figure is likely to come in at around 1%.

Chart 1: FAI Headline forecasts for Scottish growth in 2017

Source: FAI

What explains this weaker than expected performance?

Following the fall in the oil price, sectors tied to the North Sea supply chain – most notably manufacturing – entered a sharp recession. However, we have started to see some encouraging signs in these sectors. Manufacturing is up nearly 3% over the year.

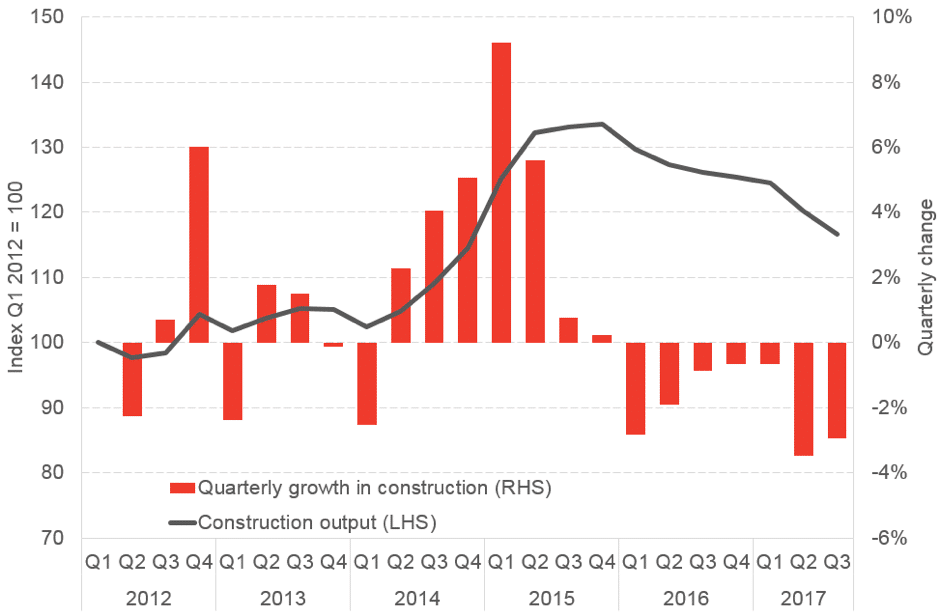

The key reason that our forecasts have proven to be over-optimistic has been because of the slowdown in construction (which has fallen now for 7 consecutive quarters).

Chart 2: Performance of Scottish construction sector

Source: Scottish Government

As we have discussed, the Scottish construction series has been displaying some odd characteristics in recent times.

There was strong growth during 2014 and early 2015 with construction output up 30%. Since then, the series has fallen sharply as it returns to more normal levels.

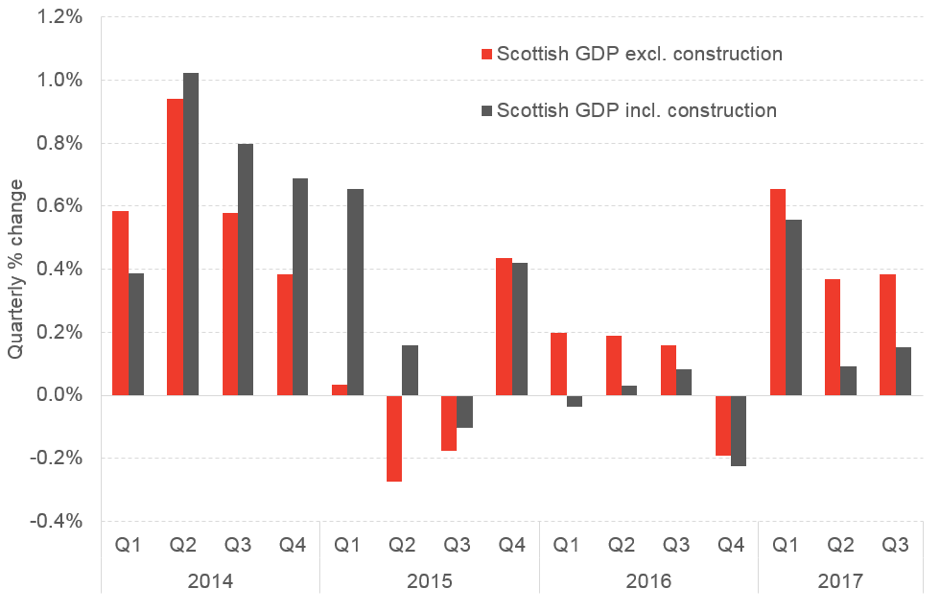

As we set out in last week’s commentary, if we strip out construction from the headline GDP series, growth in the Scottish economy has not been as bad as the headline figures suggest.

We think that ultimately the construction series may be revised somewhat and this will bring back-up the Scottish growth number for 2017.

Chart 3: Scottish economic growth (including and excluding construction)

Source: Scottish Government and FAI calculations

What are recent indicators telling us?

The most up to date economic data for Scotland has remained relatively mixed.

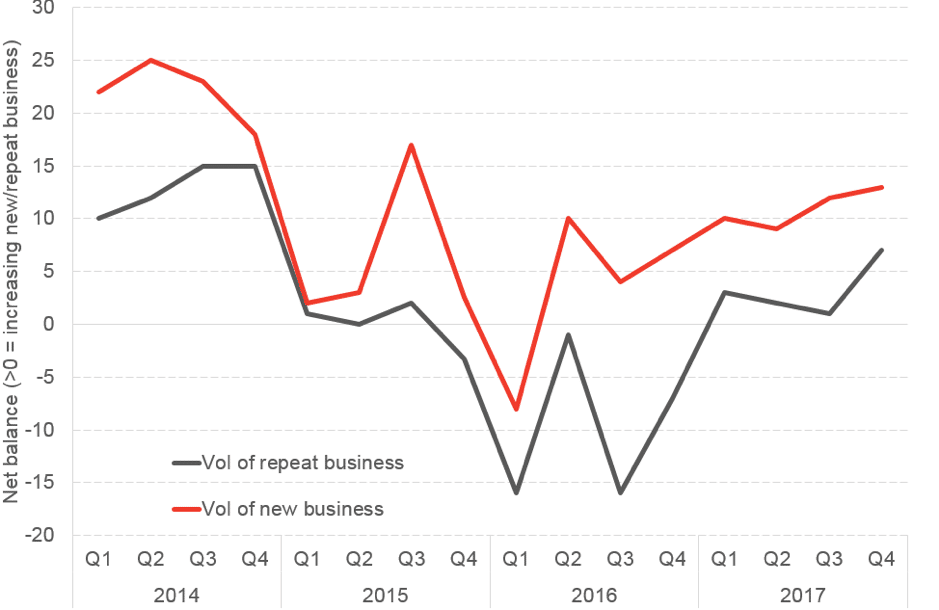

On the one hand, our own FAI-RBS Business Monitor for Q4 2017 showed an increase in the net balance of firms reporting a rise in new and repeat business. Indeed, the figures for new business are the highest since 2015. Exports have also continued to grow strongly.

Chart 4: FAI-RBS Scottish Business Monitor (net balance in activity: > 0 = growing; < 0 = falling)

Source: FAI

At the same time, Scotland’s headline labour market data remains positive with employment and unemployment rates comparing favourably to their long-term averages.

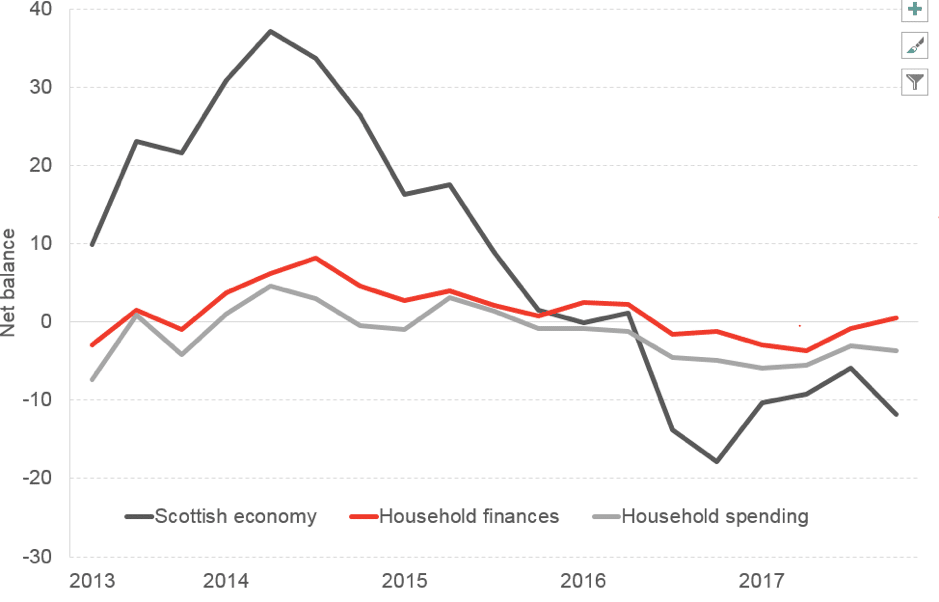

On the other hand, the Purchasing Managers Index for Scotland has slipped back and the Scottish Government’s own measure of consumer confidence remains negative.

Chart 5: Scottish Government’s consumer sentiment indicator

Source: Scottish Government

On balance, and taking all this information on board, our own nowcasts are predicting that the Scottish economy has grown by around 0.4% in Q4 2017.

Our nowcasts tend to give a good picture of underlying growth in the economy. They are less good at picking up one-off or temporary factors that may appear in the official GDP series (which are much better at tracking individual movements in sectors and companies).

And as with any quarterly release, a number of one-off factors could also have a significant bearing on this week’s release.

We saw this back in July when the re-opening of the Dalziel steel plant – combined with a number of one-off factors in petroleum and pharmaceuticals – led to a jump up in Scottish GDP for Q1 2017, only for growth to slip back in the following two quarters.

It’s not possible to second guess all possible factors which will impact on this week’s GDP figures, but here we summarise some key things to watch out for in the data.

Reasons why GDP may surprise on the downside

There are a number of reasons why GDP may be relatively weak again this quarter.

Firstly, the latest official statistics on retail sales show zero growth in 2017 Q4.

Secondly, recall that the Forties pipeline was shut down in December for emergency repairs. Whilst oil production does not enter the Scottish GDP series (but does enter the UK series and therefore reduced UK growth in Q4), it is possible that it caused a knock-on effect to the supply chain. But this effect was temporary and if it had an impact on the numbers, we should expect to see a bounce back in Q1.

Thirdly, the latest ONS construction data continues to show a further decline during Q4 2017. As mentioned above, we do find this series puzzling – but setting that aside, this suggests a further weakening in construction GDP.

Reasons why GDP may surprise on the upside

But there are also some good reasons why GDP may surprise on the upside.

Firstly as indicated in our December commentary, there are some signs that confidence has stabilised in the oil and gas sector – in part driven by the higher oil price. This should continue to feed through to a recovering manufacturing sector.

Secondly, as highlighted in a recent blog renewables output spiked significantly in Q4 2017. The scale of the increase – driven by new capacity coming online but also high wind speeds in the final three months of 2017 – is so large that this will undoubtedly have a positive impact on the Scottish GDP numbers.

Thirdly, we remain somewhat surprised at how weak the GDP figures have been for Q2 and Q3 of 2017. It is possible that this might simply reflect some timing issues in the reporting of the series and the Q4 could be higher as a result.

Summary

Whilst it is understandable that the focus this week will be upon the individual point estimate for Scottish GDP growth in Q4, we’d urge caution in attempting to read too much into one data release.

Scotland has a strong and prosperous economy. But the last couple of years have clearly been challenging. The next set of data on will offer some further insight on whether or not these recent trends have continued.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.