Today, the Scottish Government published economic growth figures for Q1 2019.

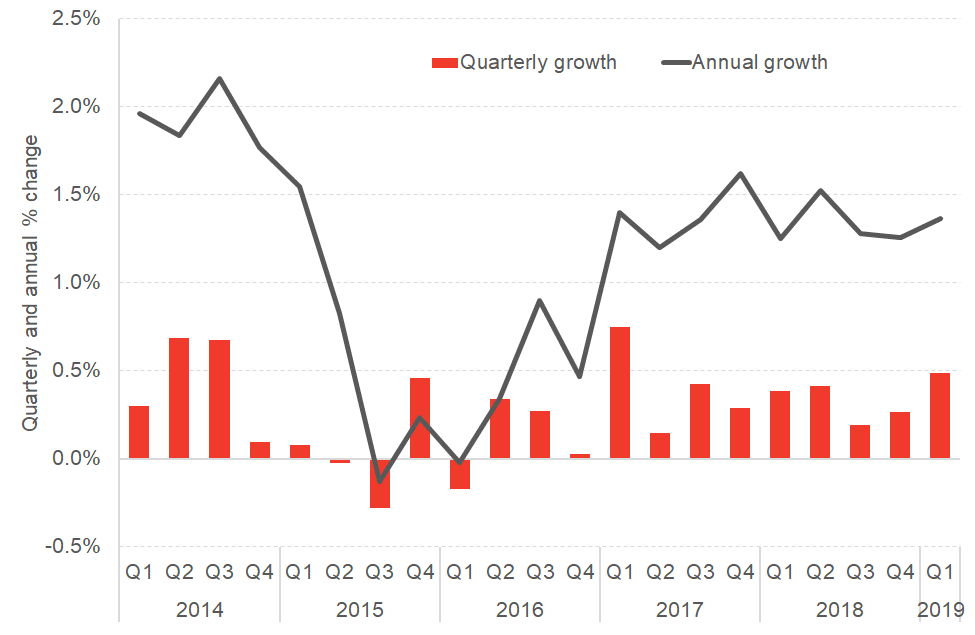

Growth of 0.5% is the fastest Scottish growth in two years.

Before anyone gets carried away that this is somehow a signal that the Scottish economy is benefiting from a pre-Brexit bounce, today’s numbers are likely to be heavily influenced by temporary stockpiling by some firms – particularly in manufacturing – as the uncertainty over a possible ‘no deal’ scenario played out in the Spring.

More up to date data from the UK – which is running ahead of the Scottish publication series – shows that after their Q1 figures were boosted for the same reason, growth has slipped back as firms unwind their ‘no deal’ contingencies.

It’s likely that the Scottish series will display a similar pattern.

Latest figures

Today’s figures show growth of 0.5% across the Scottish economy in the first three months of 2019.

Despite this, growth over the year remains relatively constant at 1.4% (still below Scotland’s long-term average growth rate).

Scottish economic growth since 2014

Source: Scottish Government

Over the quarter, economic growth in Scotland matched that of the UK as a whole.

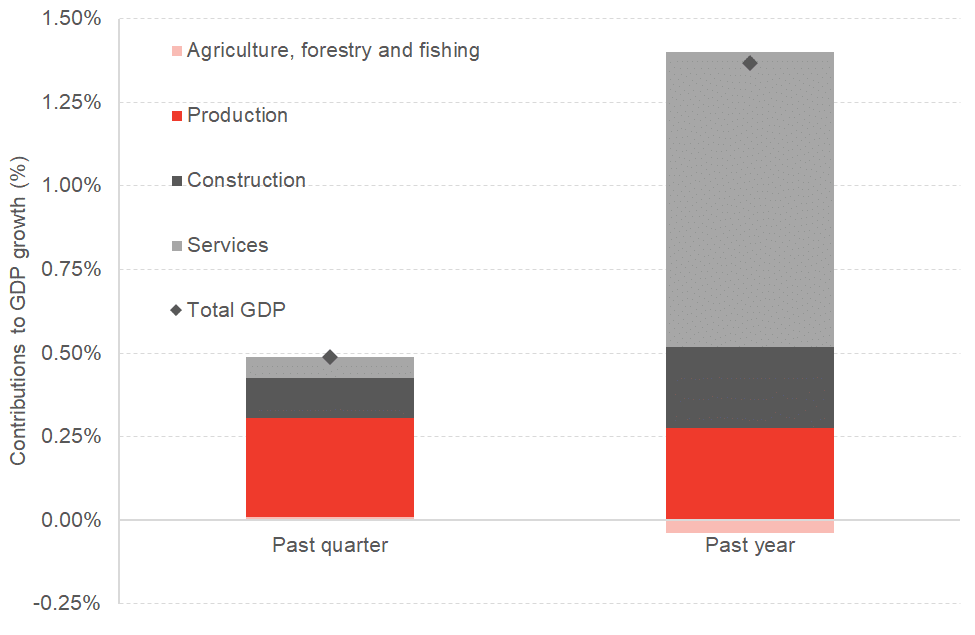

Growth over the year was – as was to be expected – driven by the performance of the services sector (which makes up around 75% of the Scottish economy).

Over the most recent quarter, however, growth was driven by the production sector – and in particular, manufacturing.

Composition of economic growth in Scotland over the quarter and over the year

Source: Scottish Government

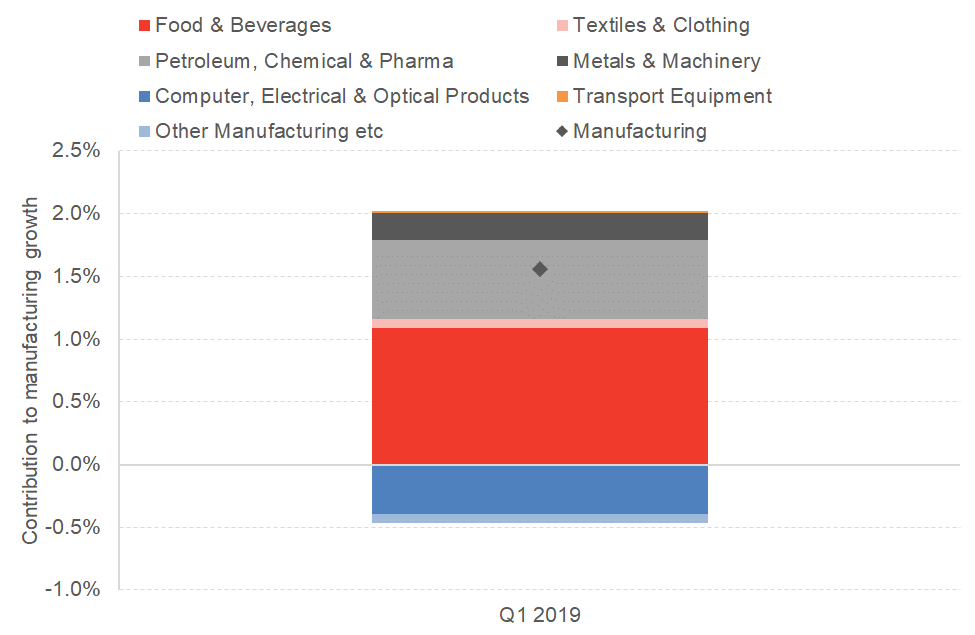

Around 87% of the production sector growth this quarter was from manufacturing sectors. And in the manufacturing sector, the largest contributions come from the food & beverages sector and the refined petroleum & pharmaceuticals sector.

These two sectors make up less than 5% of the economy but generated over half of Scotland’s Q1 GDP growth.

Manufacturing growth by key sub-sector

Source: Scottish Government

The impact of stockpiling

The strong growth in manufacturing is – in large part –explained by firms stockpiling in advance of a ‘no deal’ Brexit. (NB: Given the data measures activity rather than the causes of activity, it is not possible to know with certainty how much of this quarter’s boost was from stockpiling or other factors).

Manufacturing output in Scotland rose by 2.6% in the first three months of 2019 – on a par with what would be seen as healthy growth over an entire year.

Throughout most of the early part of the year, the failure of the UK Government to secure support for its negotiated settlement with the EU created the very real risk that the UK could have crashed out on March 29th without a deal. At the 11th hour a delay was secured, but not before many firms had taken contingencies – either through stockpiling goods in Europe, or building up stocks of finished goods in the UK.

The effect of stockpiling on GDP is to boost activity in the short-run, but for it to then slip back as firms run down their stocks later.

The effect of this is that GDP will be higher than otherwise one quarter, and then suppressed the next. (This very outcome was discussed in October’s State of the Economy report by the Scottish Government’s Chief Economist).

We’ve seen this already happen at the UK level.

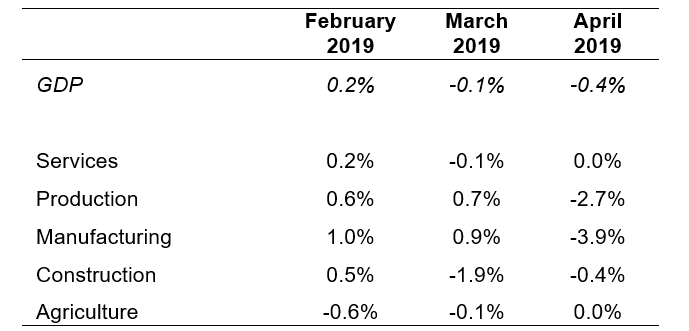

Manufacturing output increased by 1.0% in February and by a further 0.9% in March. But it fell back by 3.9% in April.

UK economic growth

Source: ONS

As a result, UK output fell by 0.4% in the month of April.

We have seen some people comparing this UK figure to the Scottish data released today. They should not.

This 0.4% figure for the UK refers to a completely different data series (i.e. this number is a monthly statistic and the Scottish data today are a quarterly series) and different point in time (i.e. the Scottish data refers to Jan-Mar and therefore does not include April).

Wider evidence on the economy

Of course, it is welcome that the Scottish economy continues to grow in the most recent data. But part of the reason undoubtedly reflects the impact of uncertainty on the economy. So whilst output is up, some of the growth is for less positive reasons.

Indeed, this wider uncertainty is clearly having an impact on both Scotland and the UK’s longer-term economic performance.

Our latest FAI Scottish Business Monitor showed that whilst Scottish businesses were remaining relatively resilient to the uncertainty in terms of their day-to-day activities, investment continues to suffer. The longer that this continues the more likely it is that such plans are not simply postponed but are cancelled entirely.

In the UK, business investment has declined for 4 consecutive quarters – the first time since the financial crisis.

In summary, the data today suggest more normal levels of growth (i.e. closer to longer-term trend growth rates) but it’s important not to get too carried away. There are specific reasons, e.g. Brexit related stockpiling, which explain why the figures this quarter are slightly better than recent quarters. These reasons also suggest that next quarter’s data may be weaker. As a result, the risks to Scotland’s economy remain exceptionally high.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.