Frantisek Brocek is an undergraduate economics student at the University of Strathclyde. This post summarises some of his recent research on demographic trends, and the implications for fiscal sustainability.

It is widely understood that Scotland, like the rest of the UK, faces a challenging demographic outlook. Rising life expectancy combined with declining fertility rates mean that the ratio of Scotland’s population of pension age relative to its working age population is increasing.

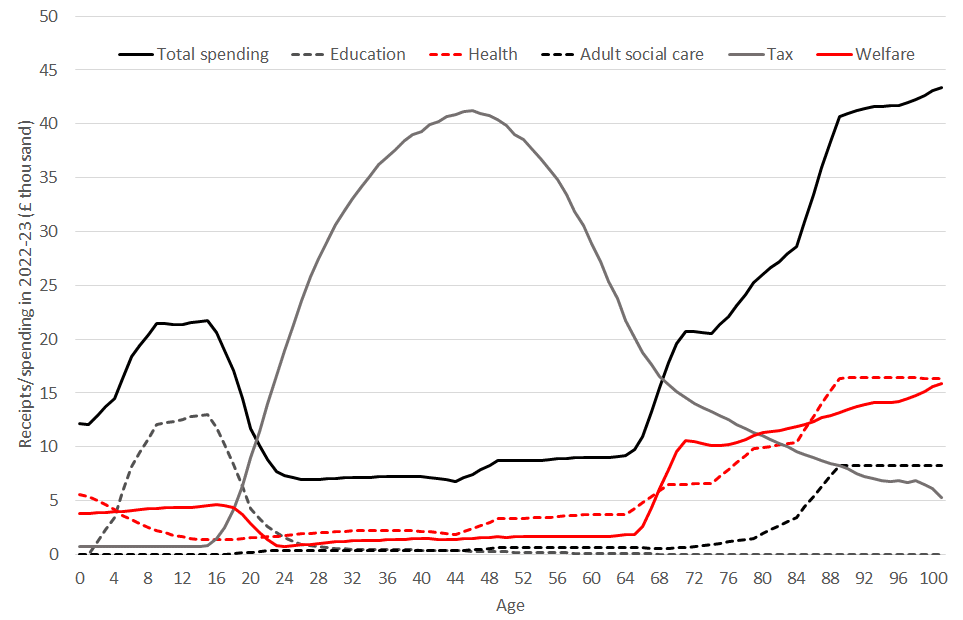

One of the big challenges that this creates is in terms of the outlook for the public finances. People above the state pension age tend to have lower incomes and expenditure than those of working age, and hence pay less tax per person. But at the same time, levels of public spending on this group are substantially higher than for the population of working age. Chart 1 shows the profile of public spending and tax receipt over the lifetime for a typical individual. (The profile is based on UK data but is not substantially different for Scotland).

But how does the demographic pressure facing Scotland in the coming decades compare to the effects of population in the recent past? How does Scotland’s demographic challenge compare to the outlook for the UK as whole, or other European countries? And what can or should the Scottish Government do?

Chart 1: Representative profiles for tax, public services and welfare spending

How do Scotland’s demographic prospects compare to the UK?

The old-age dependency ratio is used as a headline indicator of the age composition of the population. This indicator is the ratio between the number of people aged 65 and over (age when they are generally economically inactive) and the number of people aged between 15 and 64. The value is expressed per 100 people of working age (15-64).

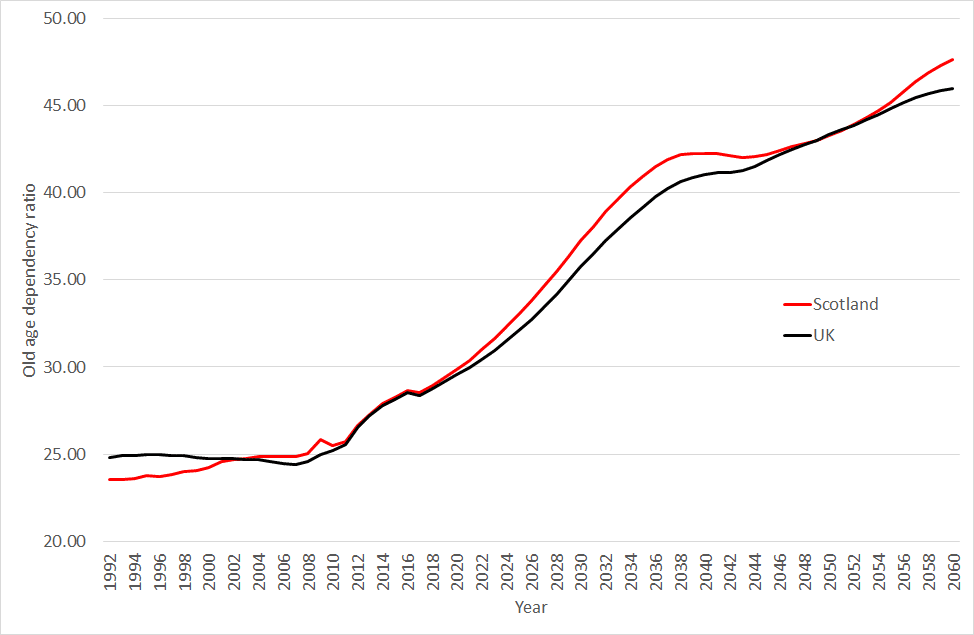

Between 1992 and 2010, the old-age dependency ratio increased slowly in Scotland, and remained broadly constant in the UK (Chart 2). Since 2010, the dependency ratio has been increasing more rapidly in both Scotland and the UK. The rate of this increase is striking, and helps explain why the period since 2010 has felt so tough fiscally speaking – fiscal consolidation (‘austerity’) began just at the point when the dependency ratio started to increase.

But the change in the dependency ratio since 2010 puts the next 20+ years in context – we really are just at the beginning in terms of demographic change.

Currently the old age dependency ratio in Scotland is the same as it is for the UK, although it is expected to increase somewhat faster in Scotland. By 2041 the Scottish dependency ratio is expected to reach 43.07 in comparison to 41.96 for the UK as a whole. A higher fertility rate and higher net inward migration in rUK relative to Scotland drives these differences.

Chart 2: Historical and projected old age dependency ratios in Scotland and the UK – ONS principal projections

How might reductions in inward migration affect the dependency ratio?

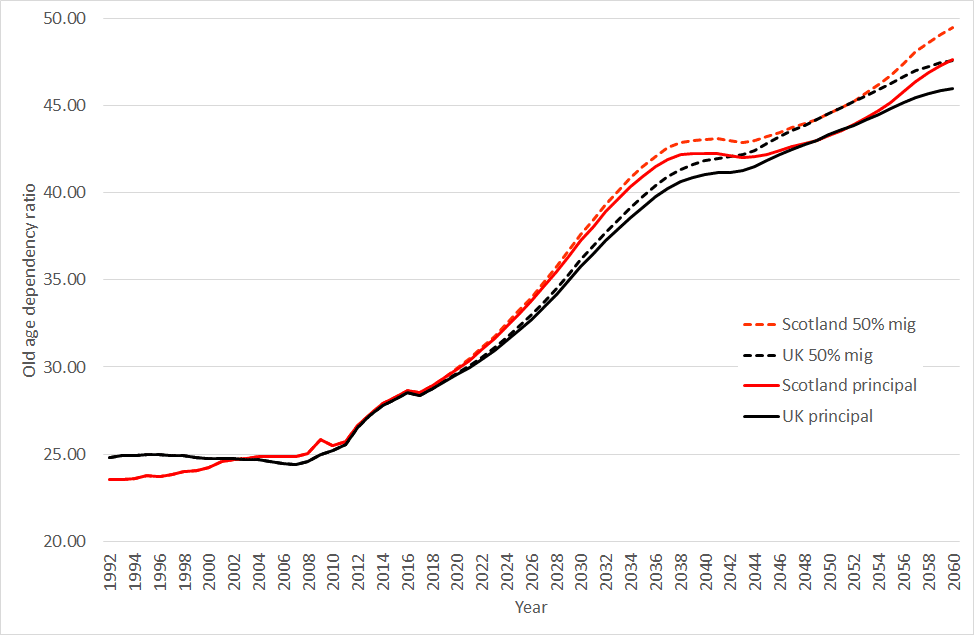

The dependency ratios presented above are based on the ‘principal’ population projections. But other scenarios might be realised. The dependency ratios for both Scotland and the UK will look more challenging if net immigration from the EU falls. Assuming that net inward migration from the EU falls to 50% of the current levels from mid-2019, the dependency ratio for Scotland is expected to be 49.45 in comparison to 47.58 for the UK (Chart 3).

Chart 3: Historical and projected old age dependency ratios in Scotland and the UK – ONS 50% migration scenario

How will planned increases to the State Pension age change the picture?

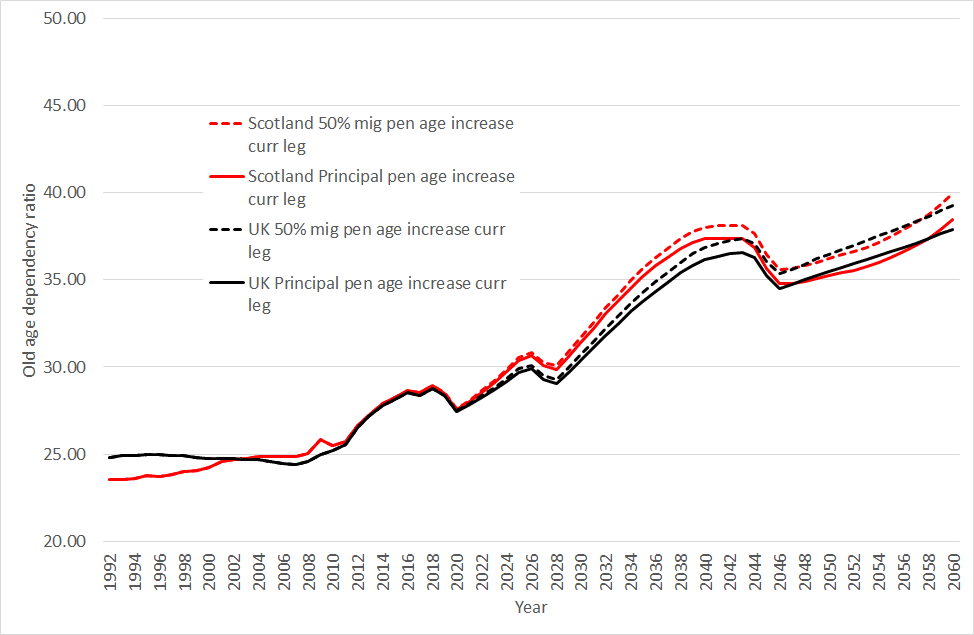

The UK government aims to relieve some of the fiscal pressures of an ageing population through increases in the state pension age. Under the current legislation three gradual increases in the state pension age are expected in the next 40 years: from 65 to 66 in 2019-2020, from 66 to 67 in 2026-2027, and from 67 to 68 in 2044-2045 (Department for Work and Pensions, 2017). These will reduce the scale of the increase in the dependency rate slightly, but are certainly not a ‘solution’ in themselves (Chart 4).

Chart 4: Historical and projected old age dependency ratios in Scotland and the UK – with state pension age increases under the current legislation

How does Scotland compare to other European countries?

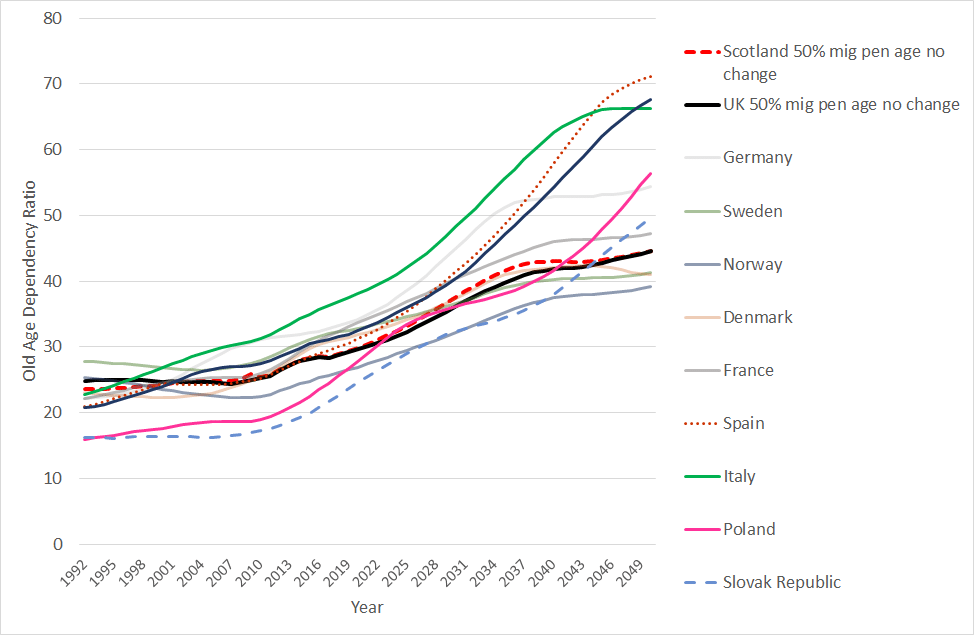

Chart 5 shows that despite the marked increase in the dependency ratio over time, Scotland and the UK together with the Scandinavian countries are still forecasted to have one of the lowest dependency ratios in Europe by 2049. Southern EU economies face the biggest demographic challenges, suggesting that substantial increases in retirement ages will be necessary to achieve fiscal sustainability. Central European countries such as Poland and Slovakia are enjoying a demographic dividend from the pre-1989 communist era in in the form of the lowest dependency ratios amongst the EU. However, over time, the populations of these countries are expected to age faster than the rest of the EU, exceeding the Scottish and UK dependency ratio by 2049. This increase is partially driven by policy choices of very low immigration which are inconsistent with long-term fiscal sustainability.

Chart 5: Historical and projected old age dependency ratios across the EU

Choices for government

In summary, Scotland and the UK are facing substantial long-term demographic challenges. For the UK, the OBR (2018) estimates that public spending will increase from 36.4% of GDP today to 44.6% in 2067 if policy is unchanged, driven by increases in spending on health, social care and the state pension. Of course there is uncertainty around these figures – the extent to which health spending increases with increases in life expectancy is unclear.

What should the Scottish Government do? Clearly, the demographic challenge is a UK as much as a Scottish one, and many critical decisions will rest at the UK Government level – from immigration policy to the state pension age, and the sustainability of public sector net debt.

But there will also be important decisions for the Scottish Government. These will include how much revenue to raise from devolved sources of tax, potentially including the Government’s powers to ‘introduce new taxes’. They will also include important decisions around how to mitigate increases in spending on healthcare by adopting preventative programmes in public health, social care, and through the use of new social security powers that are being devolved.

References

Department for Work and Pensions (2017). State Pension age review. [online] Available at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/630065/state-pension-age-review-final-report.pdf [Accessed 6 Jun. 2018].

NRS. (2017). Projected Population of Scotland. [online] Available at: https://www.nrscotland.gov.uk/files//statistics/population-projections/2016-based-scot/pop-proj-2016-scot-nat-pop-pro-pub.pdf [Accessed 30 May 2018].

OBR (2018). Fiscal sustainability report. [online] Available at: http://obr.uk/fsr/fiscal-sustainability-report-july-2018/ [Accessed 31 Aug. 2018].

ONS. (2017). Calculating State Pension age: Pensions Act 2014 – Office for National Statistics. [online] Available at: https:/www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationprojections/datasets/tableofstatepensionagefactorspensionsact [Accessed 6 Jun. 2018].

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.