The Scottish Government’s 2018/19 Budget is the 2nd of 5 budgets to be set this parliamentary term.

It contained allocations for 2018/19 only (the last time a Scottish Budget provided anything beyond single year allocations was 2014/15).

However, the government’s new Five Year Financial Strategy, published last month, provides a steer on how the pattern and distribution of Scottish resource spending (day-to-day public services) is likely to evolve over the next few years.

The Strategy contains forecasts of the Scottish budget for five years, based on forecasts for devolved tax revenues and the outlook for the block grant. It also sets out broad spending commitments.

Government spending priorities

The most obvious spending change during this parliament results from the devolution of ten social security benefits. The first of these, an enhanced Carer’s Allowance, will come on stream in summer 2018.

At face value the resource budget will be over £3bn higher, at £30.5bn, than it was in 2016/17. However, if we strip out the resources being transferred to pay for these new benefits and consider the Scottish budget on a like-for-like basis, the resource budget – based on the Scottish Government’s latest scenarios – is expected to be around half a percent lower in real terms by the end of this parliament compared to the end of the preceding parliament.

How will the government prioritise its declining resource budget? The Five Year Strategy identifies six key commitments ‘that support the Government’s social contract and require significant investment’. These are:

- Health: to increase NHS resource spending by £2bn over the parliament.

- Police: to protect the resource budget of the Scottish Police Authority in real terms over the parliament.

- Early learning and childcare: to increase resource funding to local authorities to £567m annually by the end of the parliament to support 1,140 hours per year of childcare.

- Attainment: to allocate £750m to the Attainment Scotland Fund over the parliamentary term.

- Higher Education: to continue to allocate £1bn each year to the sector.

- Social Security: to deliver a more generous Carer’s Allowance Supplement from 2018 and a new Best Start Grant (replacing Sure Start Maternity Grant) from 2019. These policies imply costs of £35m in 2018/19, rising to £56m in 2019/20 and more thereafter.

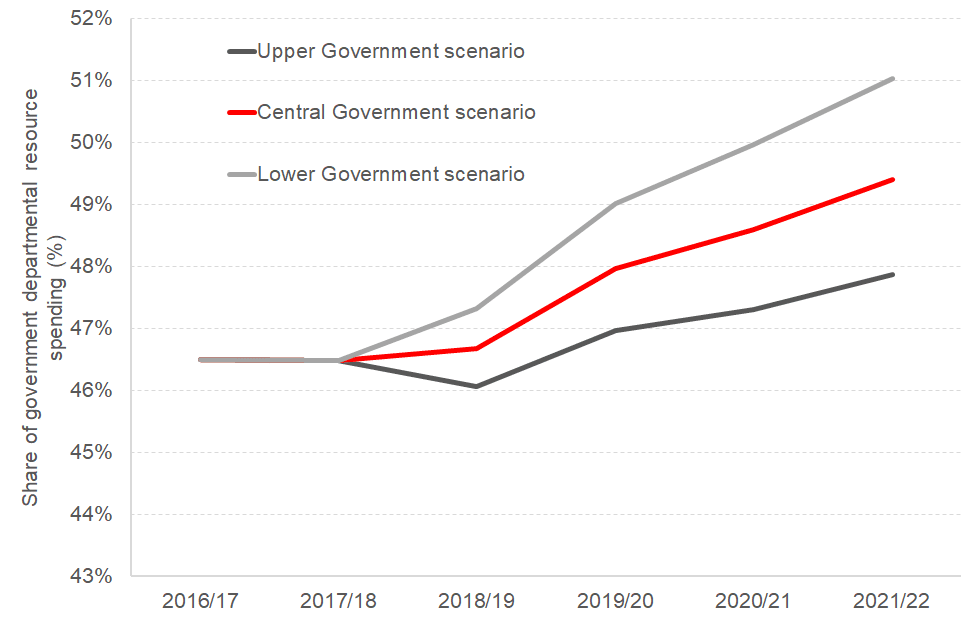

Chart 1: Resource spending on health as a share of departmental resource budget, 2016/17 to 2021/22

Source: Fraser of Allander Institute

Implications for non-priority spending

But if the government’s overall resource budget is falling in real terms, what is the impact on the government’s ‘other’ areas of spend (those that are not mentioned as a specific priority)?

The Five Year Strategy identifies a ‘central scenario’ – based on the latest forecasts for the block grant and Scottish tax revenues – as well as an ‘upper range’ and a ‘lower range’ scenario around that. The upper and lower range scenarios are developed by considering historic variation in tax revenues that have been transferred to Scotland.

Under the government’s ‘central scenario’, the resource budget available for these other areas will fall by around 10% in real terms between 2016/17 and 2021/22.

The areas included in this catch-all ‘other’ category include local government (including schools outwith the ring-fenced Attainment Fund), enterprise, the environment, tourism and culture.

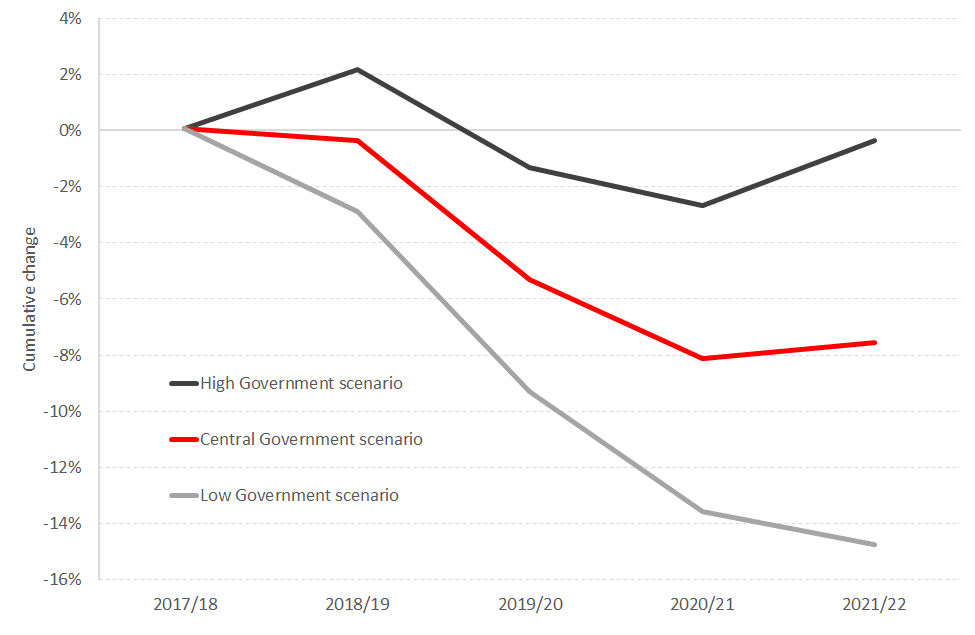

However, the outlook for local government is unlikely to be as bleak as this. The analysis up until this point does not include Non-Domestic Rate Income (NDRI). Including forecasts for NDRI, the resources available for ‘other’ spending areas will fall by around 8% over the course of the parliament in real terms, under the central scenario. (Chart 2)

Chart 2: Cumulative real terms change in spend on ‘other’ policy areas

Source: Fraser of Allander Institute

Of course, within these aggregates lie other commitments. Some of these are legally binding – for example £1bn of repayments per year to fund historical PFI and NPD capital programmes. Others are policy related – for example, the government has pledged to introduce some form of ‘Income Supplement’ for low income families. And there will be ongoing costs from the implementation of the new fiscal powers, particularly in establishing the Social Security Agency.

Uncertainty and alternative scenarios

As noted in the Five Year Strategy, there is significant uncertainty around the Scottish budget outlook. The Five Year Strategy considers upside and downside risks around the central scenario, and the implications for spending on ‘other areas’ if these upside or downside risks materialise.

If there was additional departmental spending for Whitehall, and if devolved revenues perform better than forecast, then the Scottish Government’s more positive budget outlook could be realised. Under this scenario, spending on ‘other’ areas would fall by slightly less than 3% over the period 2016/17 – 2021/22.

On the other hand, there are also downside risks. Under the government’s ‘lower scenario’, spending on ‘other’ areas of the budget will fall by 17%, even if buoyant NDR income is taken into account.

Arguably, the downside risks in the Strategy are less likely to be realised than the upside risks. This is partly because it has been clear for some time that the UK Government likely to announce additional NHS spending at the UK level, which will generate consequentials for Scotland. But it is also partly because the central scenario is based on the latest forecasts for tax revenues and the block grant adjustment, which envisage an unprecedented divergence in relative wage growth (and hence tax revenue performance) between Scotland and rUK over the next two years.

Indeed, in the end the UK Government announce substantial additional funding for the NHS in England on 18 June. It will be up to the Scottish Government to determine how it might distribute any consequentials across its portfolio responsibilities. In its Five Year Strategy however, it indicates that it will pass on any consequentials arising specifically from health spending in England to the Scottish health budget. This would suggest that ‘other’ areas of the Scottish budget will face no less of a squeeze as a result of the consequentials arising from the increase in UK Government health spending.

Another question is whether or not the government is or might consider making further changes to tax policy over the remainder of the parliament – something that Cabinet Secretary for Finance Derek MacKay refused to rule out when giving evidence to the parliament’s Finance and Constitution Committee.

Of course, if the expected increase in health spending by the UK Government is funded at least in part by an increase in rUK income tax – which would not apply in Scotland – this would pose some interesting tax setting dilemmas for the Scottish Government in its December budget.

Conclusions: Scotland’s fiscal outlook

The publication of ‘Scotland’s Fiscal Outlook: the Scottish Government’s five year financial strategy’ establishes the government’s policy priorities over the remainder of this parliament (and beyond), and the financial implications of those commitments.

The Five Year Strategy is not a budget document however, and it says little about the plans for portfolios or policies that are not explicitly mentioned in the strategy itself.

Over the course of this parliament, spending on ‘other’ areas could fall slightly or much more substantially, depending on how the government’s budget evolves. Either way, the clear conclusion is that the funding settlement is likely to be tight.

The Five Year Strategy says little about how the government’s plans might change if (and when) the financial outlook evolves. If the budget outlook improves will ‘other’ policy priorities be allocated additional resources, or might existing priorities be allocated more?

The publication of the Government’s Five Year Strategy means we are a little clearer about the fiscal priorities of the government, but there remains significant uncertainty around the budget outlook. The three remaining Scottish budgets of this parliament will be keenly watched.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.