The Scottish economy remains, in effect, in significant lockdown even as we edge toward the end of the second week of Phase 1 of the Scottish Government’s route-map for lifting the COVID-19 restrictions. The data shows that outdoor mobility of people has increased during Phase 1, but this has translated only into a limited improvement in economic activity. England opened parts of its economy earlier than Scotland and this has allowed economic activity to start recovering faster than in Scotland.

Scottish businesses continue to face a challenging outlook, but glimmers of hope are beginning to appear on the horizon after the First Minister’s announcement earlier this week that the country could move into Phase 2 of lockdown easing on the 18th June and the gradual re-opening of the tourism sector on the 15th July. However, we are probably yet to see the full impact of the shutdown of the economy on jobs.

Business activity

First, a reminder of the impact of lockdown before it started to be eased. Today GDP estimates for April for the UK were released showing a 20.4% contraction in the UK economy, completely expected due to the decision to close large parts of the economy to combat the spread of CoVid-19. Coupled with a fall in consumer demand due to heightened uncertainty this resulted in a fall in turnover for most businesses.

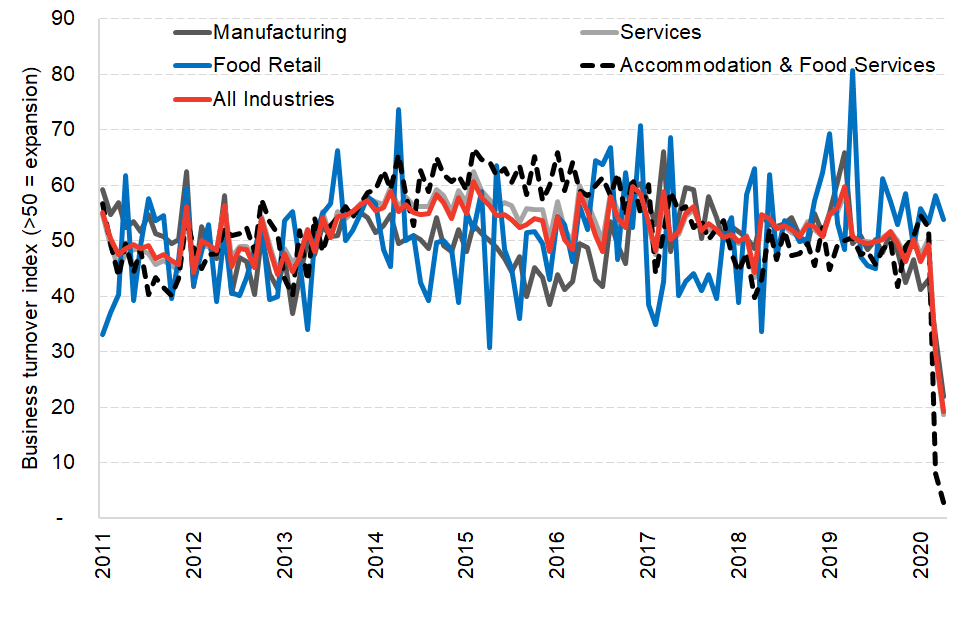

An update to the Scottish Government’s Monthly Business Turnover Index was released on the 5th June and can be used to track the impact of the economic slowdown on different sectors of the economy. The index shows the net balance of firms reporting increasing or decreasing turnover, in real terms, compared to 12 months ago. Values below 50 indicate that more companies are showing decreased turnover than increased turnover.

Chart 1: Monthly business turnover index in Scotland

Source: Scottish Government

The index shows that all sectors of the economy – with the one exception of food retail – experienced lower turnover in March and April 2020 compared to the same months last year. The accommodation & food services sector was the hardest hit part of the economy.

The decline in turnover has resulted in a lower cash-flow for most businesses and many have had to rely on their cash reserves and government support schemes in order to meet their fixed costs.

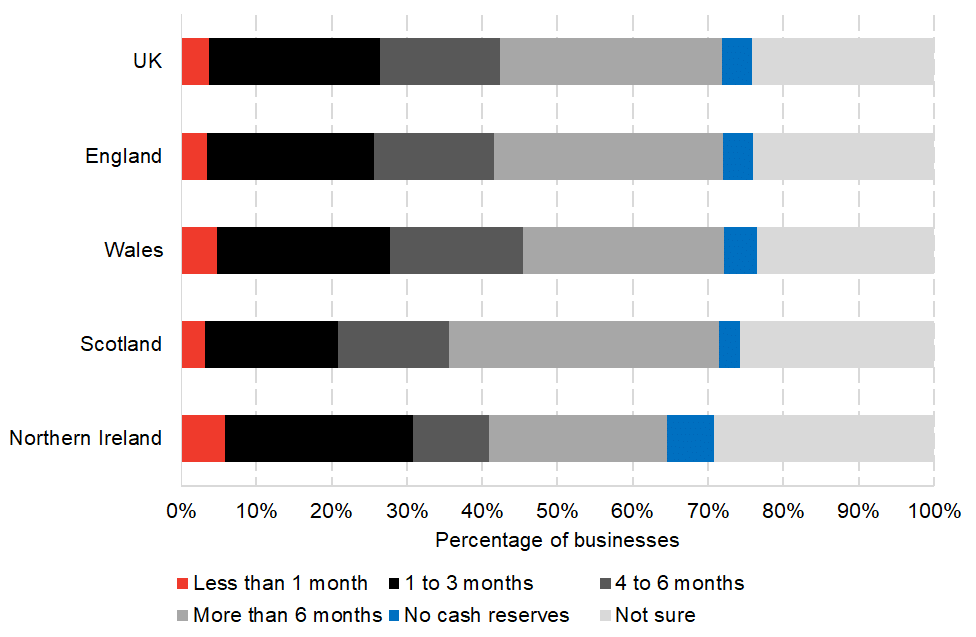

Chart 2: Cash reserves of businesses across UK regions, 4th – 18th May (surveyed between 19th – 31st May)

Source: ONS Business Impact of Coronavirus Survey

The latest ONS BICS survey continues to show the precarious position that many businesses are in, with limited reserves. The data does appear to show Scottish businesses in a slightly more favourable position in terms of cash-flow compared to other UK regions. Between 4th and 18th May –

- 36% of Scottish businesses had cash-flow reserves for more than 6 months compared to 31% in England.

- 21% of Scottish businesses have cash-flow reserves which can last only for less than 3 months (25% in England).

It should be noted that there are some important caveats with this survey, which means that the results for Scotland need to be taken with a degree of caution.

- The survey is weighted at medium to large size businesses (and not the vast majority of small enterprises in Scotland where issues such as cashflow and reserves are likely to be particularly important).

- UK headquartered businesses that have a presence in Scotland – even just an outlet or shop – will have their ‘response and score’ allocated in full to Scotland (and to each of the other nations where they have a presence) under the methods used here. As an illustration, out of the 500+ plus large businesses ‘responding in Scotland’, only around 130 (25%) were actually headquartered here. The remaining 75% are allocated the UK-wide response and score. This is likely to dilute the figures for ‘actual activity’ in Scotland and limit the survey’s ability to capture differences in sentiment in Scotland.

- Like most ONS business surveys, the survey doesn’t cover all sectors, for example it excludes agriculture and financial services. In general, the ONS use other sources to estimate the performance of these sectors, but they have not been included in the BICS data.

Government restrictions on the mobility of people have forced many businesses to temporarily close or pause trading. Over time, the easing of lockdown measures began, and this has allowed some firms to reopen again. However, lockdown easing has started at a different pace across UK regions and there are some tentative signs that this is beginning to cause some divergence in developments.

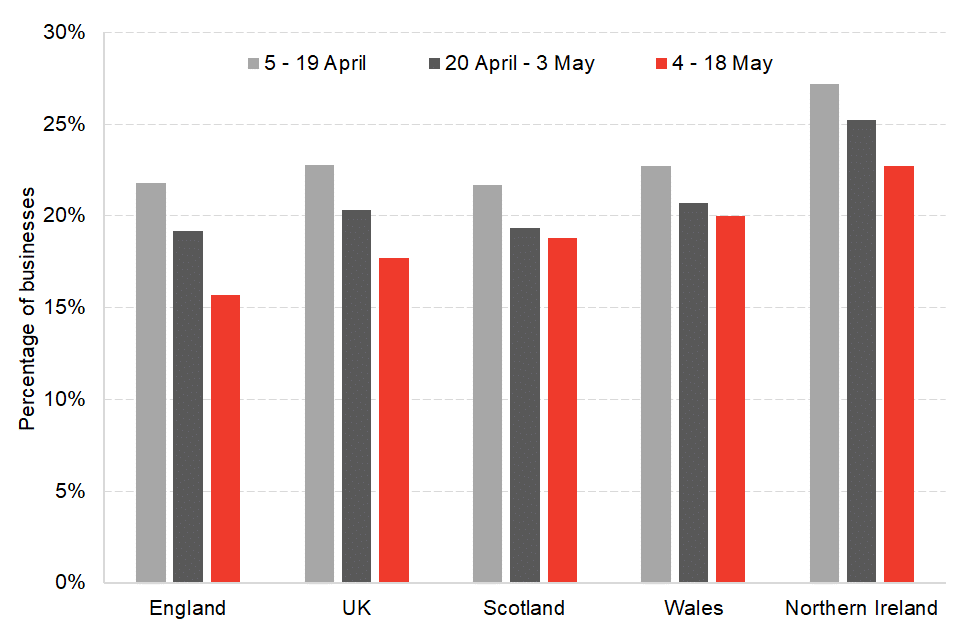

Chart 3: Percentage of businesses which have temporarily closed or paused trading across UK regions

Source: ONS Business Impact of Coronavirus Survey

England started easing restrictions on the movement of people earlier and this has allowed more businesses to resume their operations compared to Scotland and other parts of the UK. Between the 4th and 18th May circa 19% of all Scottish businesses in the survey remained temporarily closed compared to 16% in England.

Consumer demand

As we reported last week, consumer sentiment has taken a hit since the start of the lockdown as people face uncertainty about future incomes and many sectors such as hospitality or retail remain closed.

As lockdown measures are becoming more relaxed, we’re beginning to see some tentative signs of greater retail activity (or at least interest) across some sectors.

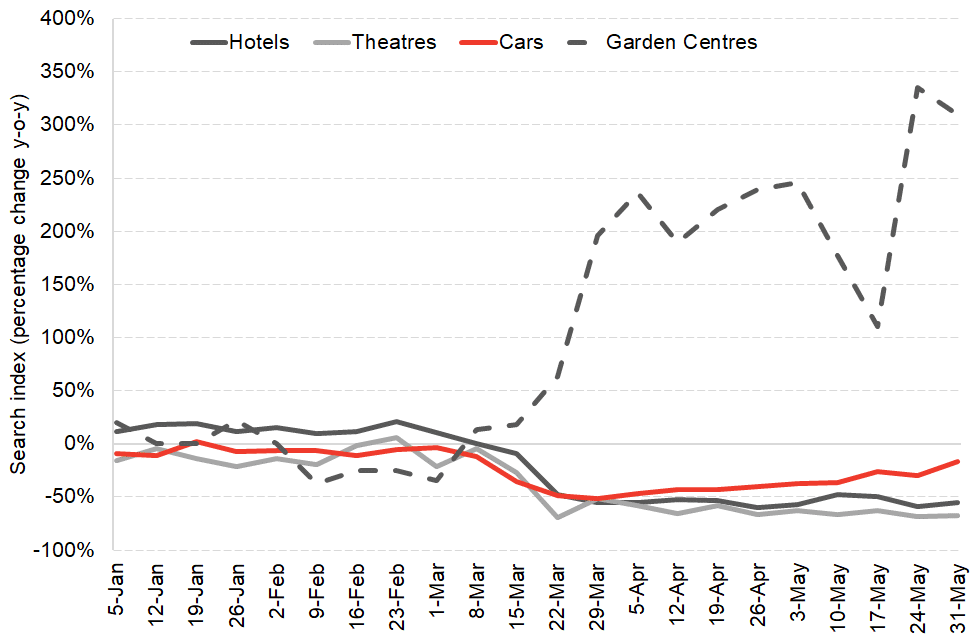

Chart 4: Google searches for products and services in Scotland

Source: Google Trends

In the week commencing 31st May, interest in hotels and theatres remained 60% and 70% below the levels seen during the same time last year. It will be interesting to see how hotel interest changes following this week’s announcement of a gradual return for tourism.

Interest in cars saw the largest weekly increase since the start of the lockdown, but it remained 16% below the levels recorded during the same week last year. Showrooms in England re-opened on 1st of June and dealerships in Northern Ireland re-opened on the 8th June. A further recovery in this sector in Scotland is likely if Scottish dealerships re-open on the 18th June.

Unsurprisingly, garden centres saw a large increase in interest since the beginning of the lockdown as people sought to use their time home to cultivate their gardens. Interest in this area peaked to more than 3 times the normal levels in week commencing 24th May when the Scottish Government announced their reopening.

Mobility

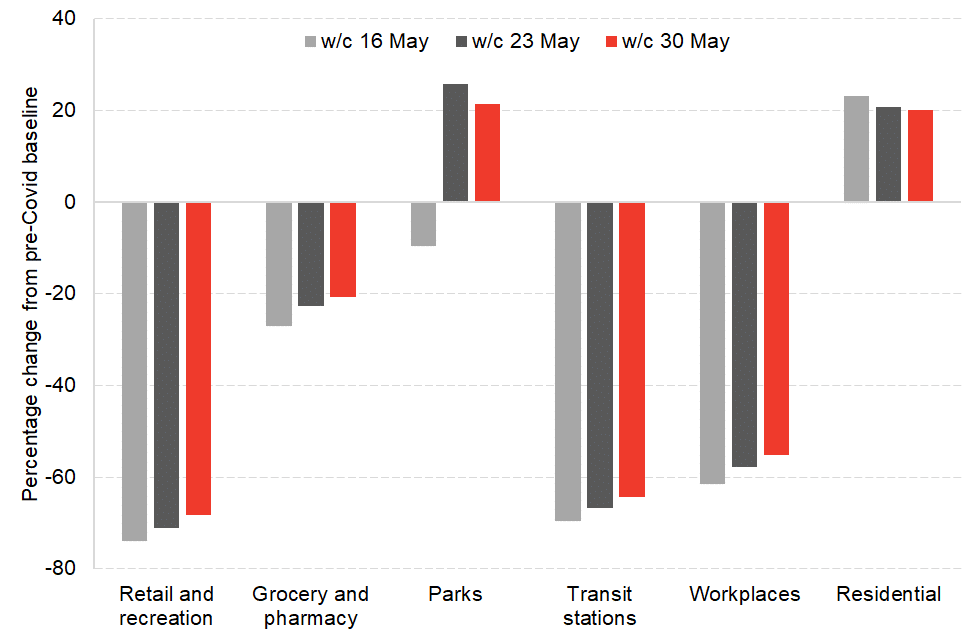

In last week’s article we highlighted the fact that mobility in the UK as a whole has been recovering slightly faster compared to Scotland. This gap has remained in place during the past week, but the data shows that outdoor mobility in Scotland has increased substantially in the two weeks since the country entered Phase 1 of lockdown easing.

Chart 5: Mobility of people in Scotland

Source: Google Mobility Trends Data

Note: The reported values are an average of the mobility index for Scotland’s largest cities (Edinburgh, Glasgow, Aberdeen, Stirling, and Dundee).

The number of people going to parks rose sharply in the two weeks since 23rd May and was more than 20% higher compared to the period before the lockdown. Mobility to retail venues, grocery and pharmacy stores, transit stations, and workplaces remained significantly below trend. However, slight increases can be observed week on week across all categories.

Labour market

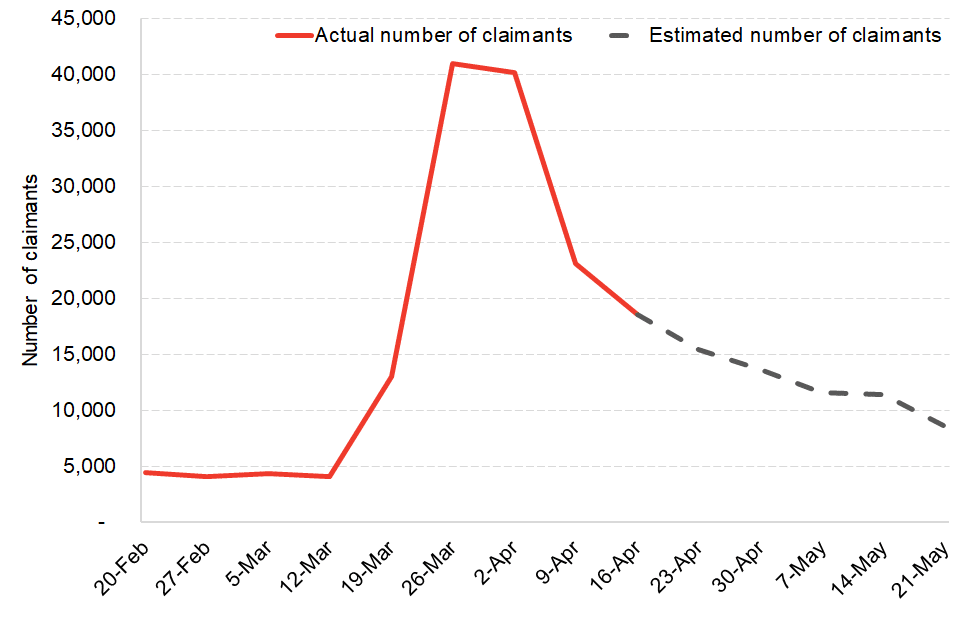

Lower revenues and the inability to meet all fixed costs has led some businesses to reduce staffing numbers. This has fed through to a sharp increase in the number of universal credit claims at the end of March and beginning of April. Since then the number of new claims has been falling every week.

Chart 6: Number of new universal credit claims in Scotland

Source: DWP

Note: The estimated number of Scottish claims is based on applying the average share of claims made in Scotland from the DWP outturn data to the weekly DWP management information published for the UK.

We have estimated that in the week commencing 21st May there were roughly 8,500 new claims made in Scotland, which is circa 3,000 less than in each of the previous two weeks. This shows that through the help of government support schemes most employers have found ways to not further reduce staffing levels. This trend is also backed up by analysis from the Citizens Advice network which shows that the weekly number of site visits for advice on benefits in the week commencing 25th May fell close to levels seen back in February.

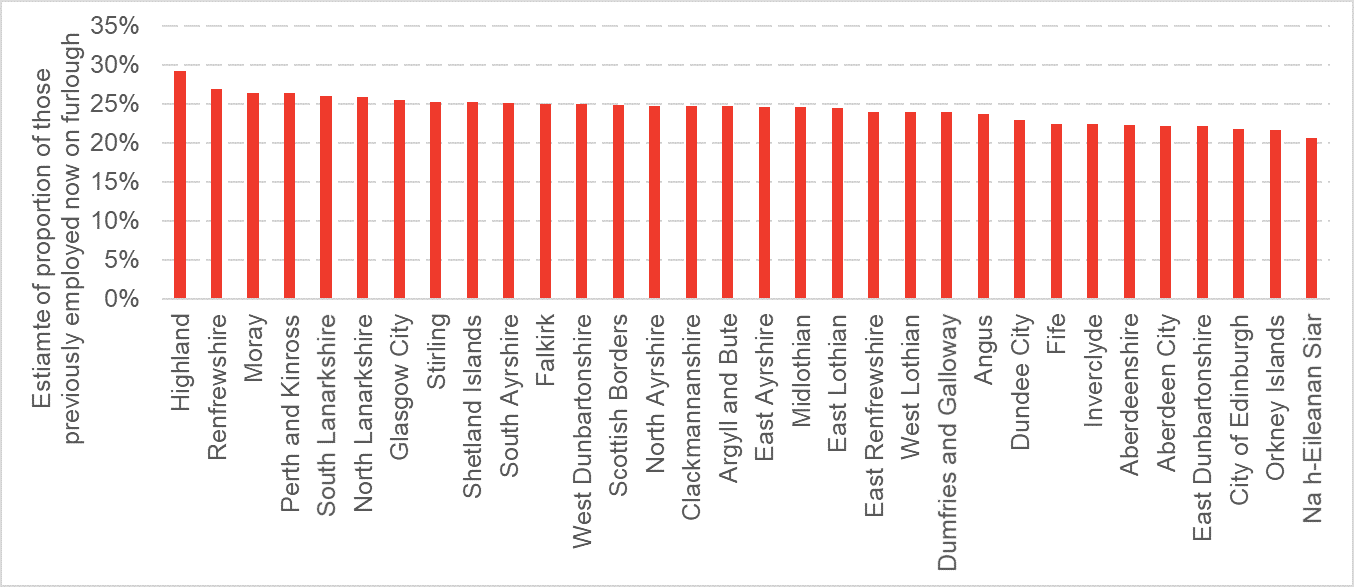

As we highlighted in an article last week, we’re clearly nowhere the bottom of this crisis. Sadly, it will only be when we start to open the economy back up that we will see many of the risks and jobs losses crystallise. Already, firms are responding as they look ahead to future demand and the gradual unwinding of various government support schemes. From August, the rules of the furlough scheme are changing, and firms will be required to start paying a portion of wages. According to experimental statistics released by HMRC on the 10th June, 628,000 employees in Scotland have been furloughed through the scheme.

Chart 7: Proportion of workforce on furlough across Scottish local authorities as of 10th June

Source: HMRC & NOMIS (note this chart replaces and corrects an earlier version)

The proportion of workforce that has been put on furlough varied between 21% and 29% across Scottish local authorities. The Highland, Renfrewshire, and Moray local authorities have the highest share of workers on furlough. On the other hand, Edinburgh, Orkney Island and Na h-Eileanan Siar had the lowest share of furloughed workers.

We are starting to see a number of businesses announcing potentially large redundancies and we should expect a number of furloughed jobs to translate into Universal Credit Claims over the next few months. How many is uncertain.

Summary

The Scottish economy continues to operate at levels significantly below capacity. Consumer interest is beginning to spark-up in anticipation of the lockdown easing.

But the nature of this crisis is that the full effects of the economic crisis will only start to become clear when the economy begins to re-open. The longer the lockdown lasts for, the greater the risks.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.