This blog includes highlights and key points from the article “Innovation and Business Performance (Turnbull, Slow and Richmond, 2019)”.

The link between innovation and business performance has been well documented, with innovation being a crucial factor in determining an economy’s competitiveness with much of the long term rise in living standards attributed to innovation[1].

Studies have shown a large and increasing share of economic growth and living standards in recent decades is derived from innovation, which leads to increased productivity and the creation of new products, services, processes and industries[2].

Evidence also shows a positive relationship between competition, innovation and productivity, with product and process innovations having the potential to lead to increased efficiency, quality and reduced costs, or to open-up new markets[3].

Further evidence also suggests that innovative businesses grow twice as fast as non-innovative businesses. It is estimated that, on average across UK regions, a one per cent increase in the percentage of innovating firms is associated with an increase of £749 pa in GVA per person[4].

Innovation can take a variety of forms including product, process, marketing and business organisation[5], with a business said to be Innovation Active if it has undertaken one or more of the activities 1-3 below, and as a Broader Innovator if it has engaged in one or more of 1-4:

- Introduced a new or significantly improved product (good or service) or process.

- Engaged in innovation projects not yet complete or abandoned.

- New and significantly improved forms of organisation, business structures or practices and marketing concepts or strategies.

- Investment activities in areas like internal research and development, training, acquisition of external knowledge or machinery and equipment linked to innovation activities.

The paper, therefore, examines the effects of different types, and combinations, of innovation activity on business performance in terms of turnover, employment and labour productivity growth using the 2015 UK innovation survey.

The aim is to help inform policy to support innovation in businesses, for example prioritising innovation interventions likely to maximise outcomes and stimulate business growth.

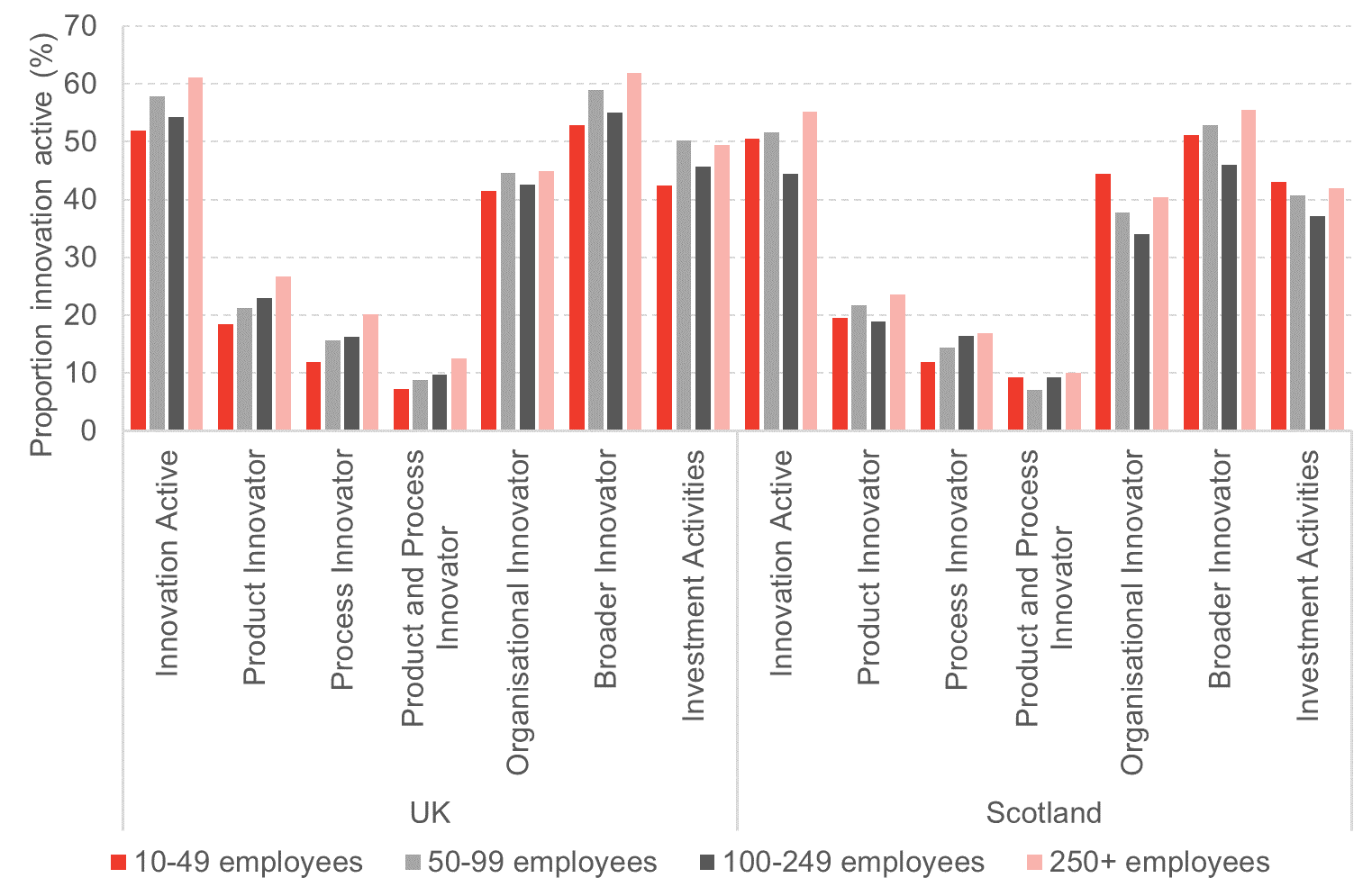

Chart 1: proportion of businesses engaging in different innovative activities for Scotland versus the UK.

Survey results

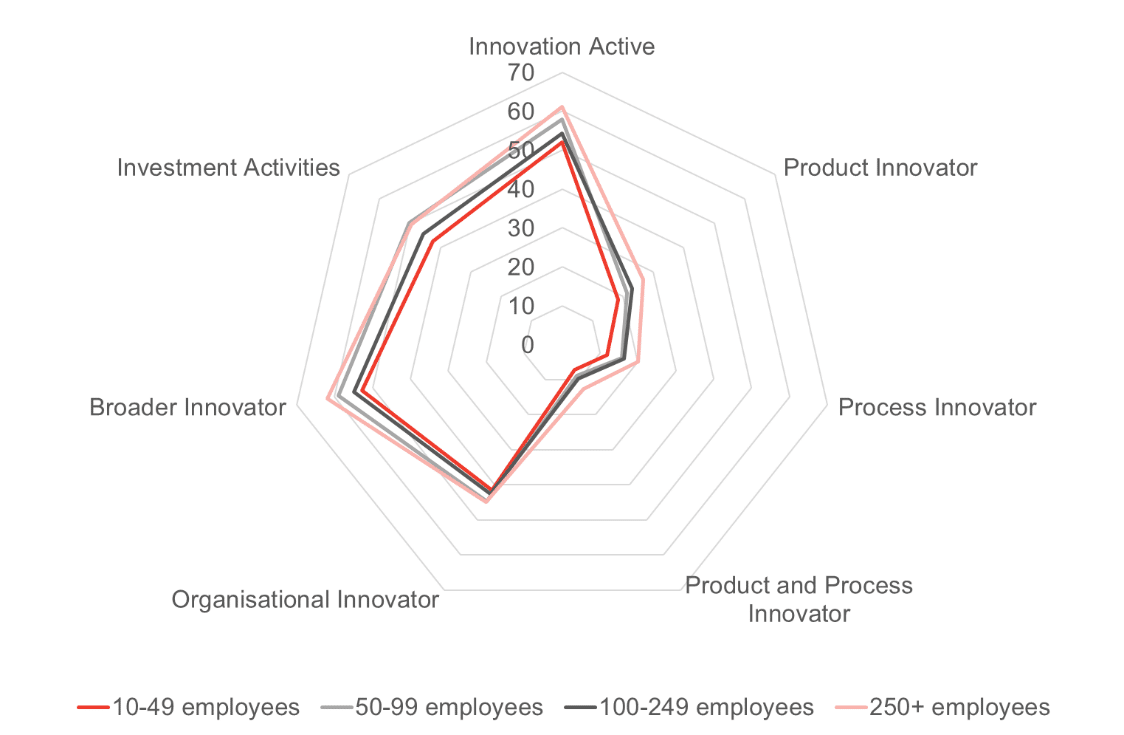

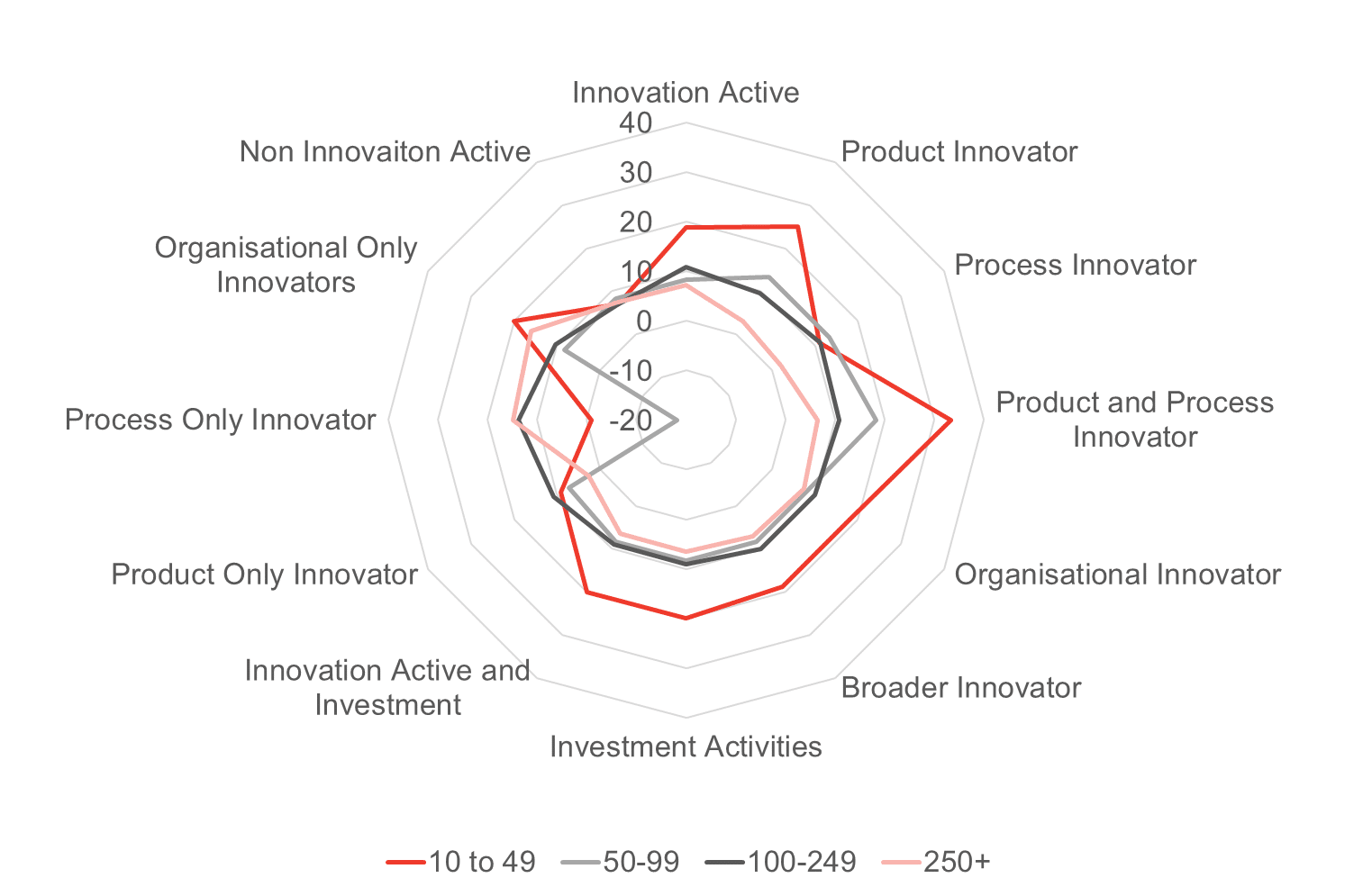

Chart 2 shows that innovative activity varies by the size of the business and type of innovation activity. Generally, a higher proportion of large businesses are innovation active than smaller businesses for each type of innovation, except organisational-only innovators[6]. Regardless of size, most innovation active businesses engage in more than one type of innovation.

Chart 2: Proportion of Innovation Active, UK and Scotland

It also suggests that many businesses are organisational innovators but relatively few are product or process innovators. Most innovation active businesses also undertake innovation investment activities e.g. investment in internal R&D, training, acquisition of external knowledge or acquiring machinery to support innovation activities.

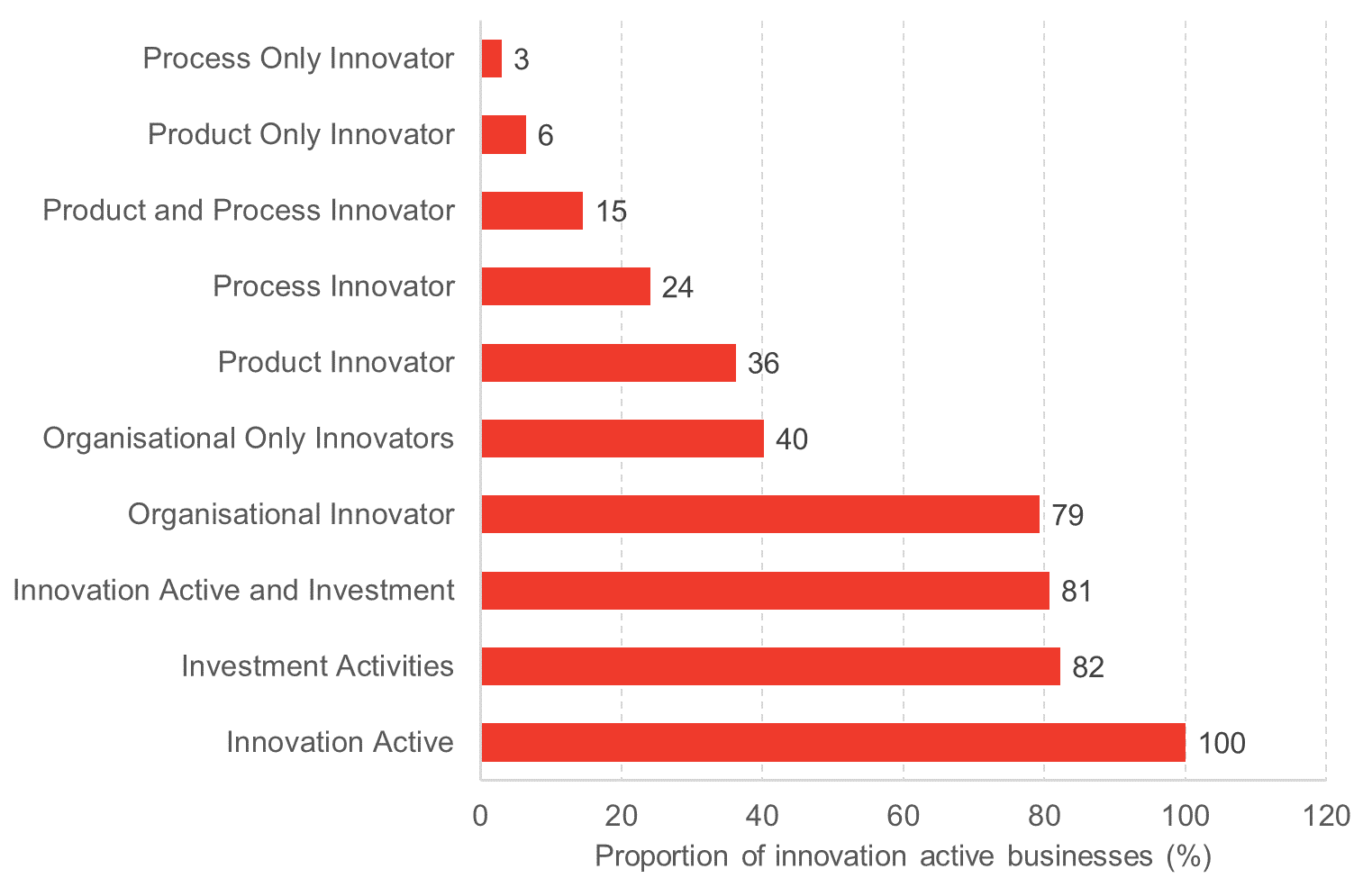

Chart 3 highlights the small proportion of innovators that undertake product and process innovation. Only 36% of UK innovators undertook product innovation only, 24% process innovation only while 15% were both product and process innovators (the equivalent figures for Scotland were 39%, 25% and 18%).

Most innovation active businesses undertook wider organisational innovation in both Scotland (86% of innovation active businesses) and the UK (79%). Interestingly, almost half of organisational innovators did not undertake any other type of innovation.

Chart 3: proportion of innovation active businesses by type of innovation

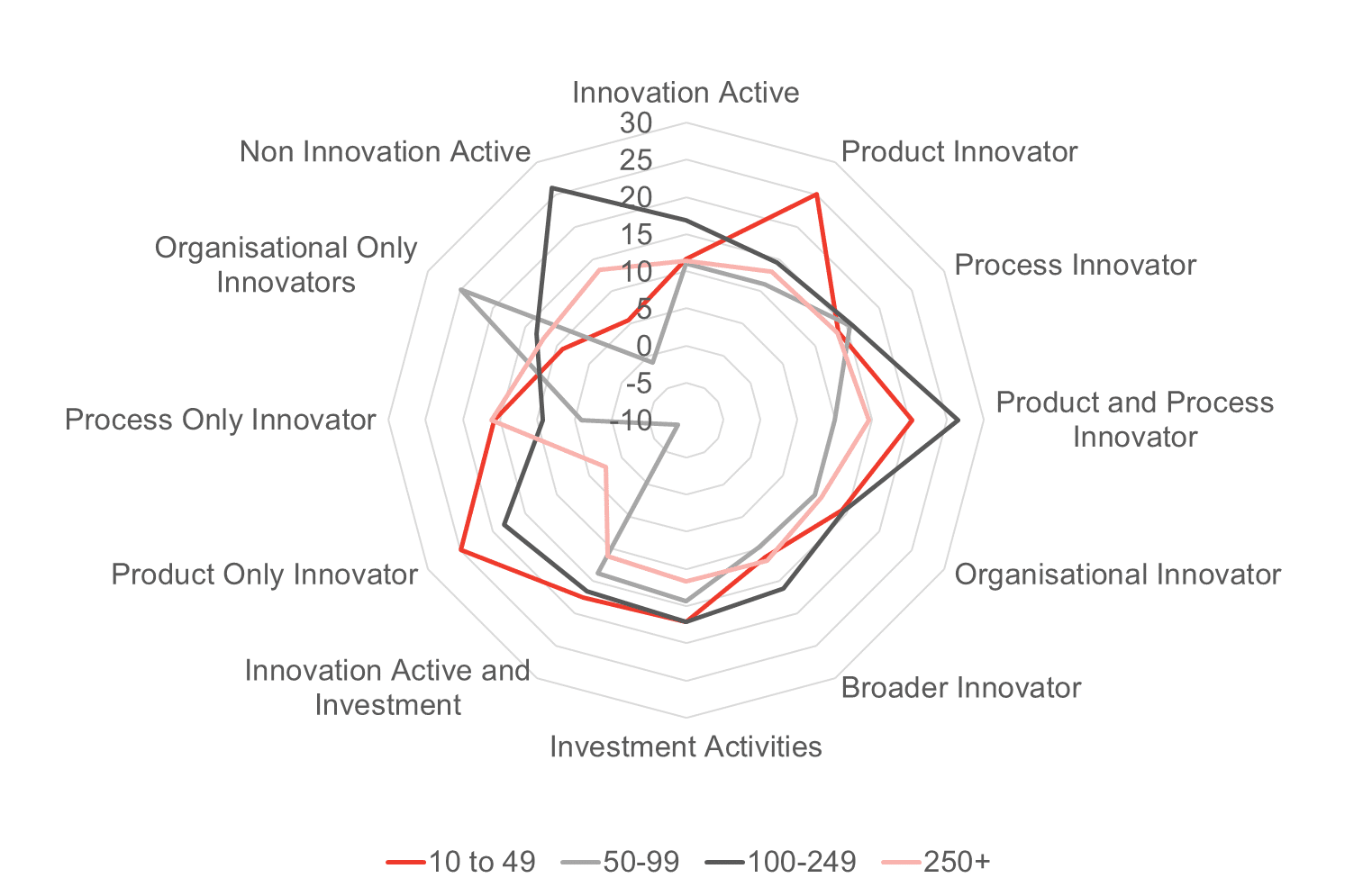

Turnover growth by type of innovation activity and by business size band

Chart 4 shows that in large and medium-large businesses, median turnover growth rates were relatively consistent across all types of innovation, while in smaller businesses the highest median turnover growth was associated with product and organisational innovation. It may also be that more ‘radical’ types of innovation are more generally linked to faster growth in smaller businesses[7].

Chart 4: Turnover Growth by size band and type of innovation

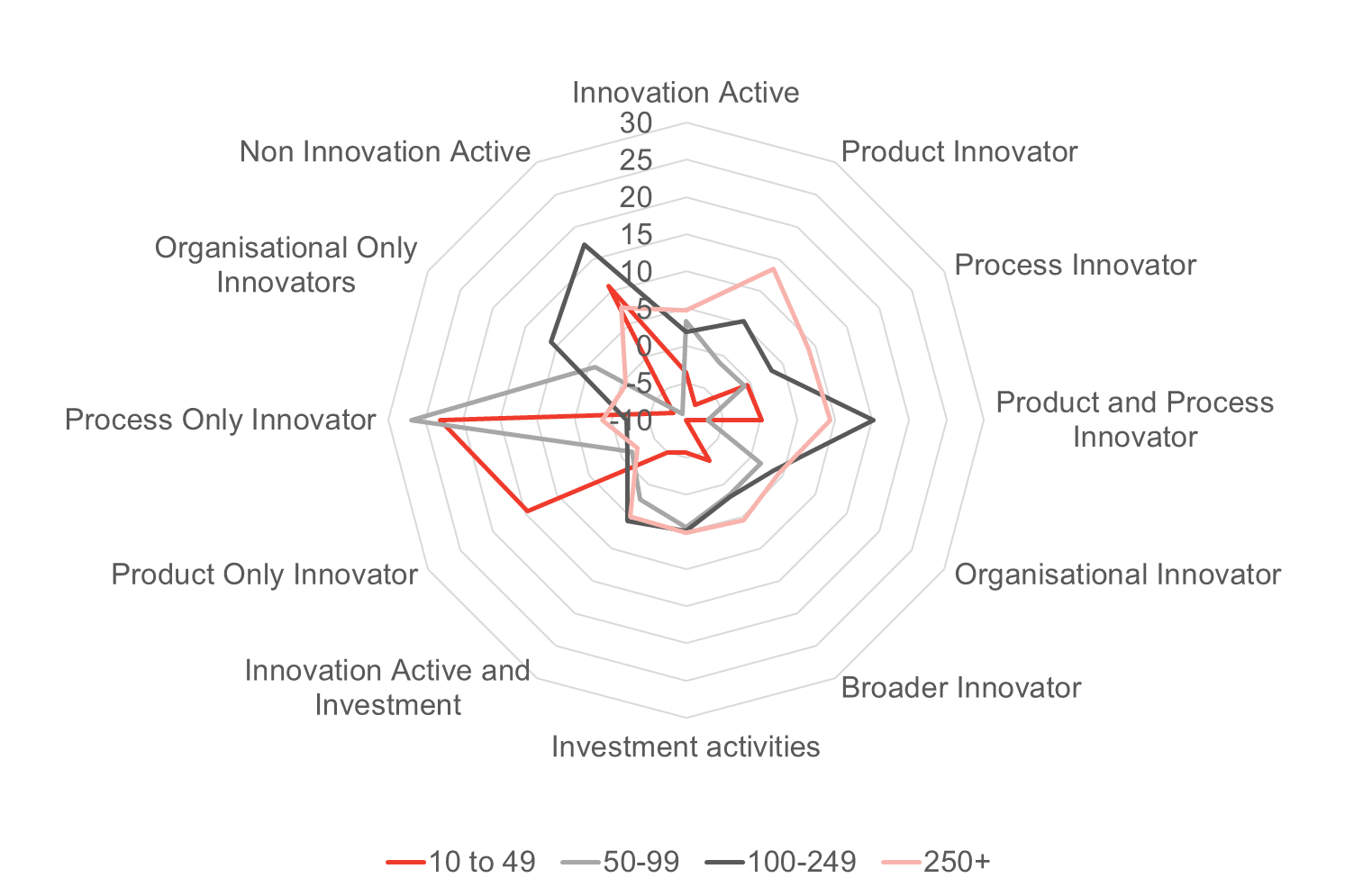

Employment growth by innovation activity type and business size band (%)

Chart 5 shows employment growth varying by type of innovation activity and business size band. As with turnover growth, employment growth rates are highest for product and process innovation and their combinations. Employment growth rates are also higher in small businesses with innovation investment activities.

Chart 5: Employment Growth by size band and type of innovation

Generally, large innovating businesses have lower employment growth rates than small businesses; this may be due to their greater use of capital and higher productivity levels (lower employment growth rate may be because they can, more easily, exploit economies of scale). It could also simply reflect that it is easier for small companies to have higher growth rates because they are starting from a lower employment base level. The reality is likely to be a combination of the two.

It is also worth noting that for businesses in the 50-99 size band undertaking process innovation only their employment fell in this period. This may be for a variety of reasons but could reflect a specific focus on processes that deepen capital and therefore increase efficiency and productivity[8]; this is also seen to some extent in small companies where employment growth for process only companies is flat.

Productivity growth by business size band and innovation activity (%)

We can see that productivity growth rates also vary by type of innovation activity in Chart 6. In all business size bands, productivity growth rates were highest for product and/or process innovation. This is perhaps to be expected: the more radical nature of these innovation activities suggests they are more likely to translate into larger productivity returns through increased sales or efficiency (possibly a key objective of innovating for many businesses).

Chart 6: Productivity Growth by size band and type of innovation

In medium-small[9] and medium-large size businesses, productivity growth rates were also high for innovation investment activities and organisational-only innovation, suggesting that businesses in this size band are perhaps undergoing structural change as they grow, and such innovation is necessary to enable them to achieve ongoing growth.

Innovation and business performance: Key points

Large businesses (250+ employees): the biggest growth in turnover and productivity comes from product and process innovation[10]. Employment growth tended to be concentrated more in businesses that changed their organisational structure or just undertook process innovation. Generally-speaking, the resources available to large businesses suggests a greater ability and resources to innovate successfully.

Medium-large businesses (100-249 employees): A similar outcome is also seen for medium-large businesses. However, the role of innovation investment (in equipment, training, etc., which is not included in the innovation active definition) features heavily in productivity and turnover growth and might suggest that as they grow towards becoming large businesses, they may already have the product/service portfolio to achieve this (as discussed below) but need to invest in other activities in order grow to become a large business.

Medium-small businesses (50-99 employees): For medium-small businesses the picture appears a little different. Productivity levels fell for product, process, and product only innovators. However, excepting product-only innovators, they did experience turnover growth. It seems that these businesses may be growing employment to support their innovation activities, which impacts negatively on productivity. The decline in turnover for product-only innovation might reflect that these businesses do not yet have the scale to simultaneously innovate and grow the business. Once those businesses do reach scale, their turnover may be more likely to grow.

Small businesses (10-49 employees): Small innovating businesses are, on average, growing rapidly as can be seen in the high levels of turnover growth. However, depending on the type of innovation being undertaken, they are also increasing their employment, which will have a negative impact on productivity growth if employment increases faster than turnover. It seems that small businesses able to focus on either product-only or process-only innovation are able to rapidly grow turnover and productivity. For small businesses that are changing their organisational structure there seems to be a substantial growth in employment which leads to decreased productivity. It could be that small businesses undertaking this kind of innovation only might be on a slower growth trajectory since faster growth generally comes from product and process innovation. More generally, small businesses may still be building their overall portfolio of products and services and experimenting with the best ways of developing and selling them.

Overall, the general picture that emerges across all size bands is that product and process innovation (combined with, or without, other types of innovation activity) tend to have the highest turnover and productivity levels and higher growth rates, while smaller businesses do not seem to be able to achieve the same level of gains. Where organisational-only innovators have higher growth rates, this tends to be from a lower initial turnover or productivity base.

The results suggest, therefore, that engaging in any type of innovation is beneficial to businesses, but the best performance is by businesses with product or process innovation combined with other innovations such as marketing and/or organisational innovation or investment activities. There may potentially be an optimal combination of innovation activities that produces the highest turnover, productivity levels and growth, however, that would require further detailed data analysis.

The results of the analysis suggest that the best performance is in businesses with product or process innovation combined with other innovations such as marketing and/or organisational innovation or investment.

Overall, Scotland needs more not only more innovation active businesses but also more undertaking, at least, product and/or process innovation.

You can read the full article here.

[1] Innovation and Growth: Rationale for an Innovation Strategy, OECD, 2007

[2] Innovation and Growth: How Business Contributes to Society, Ahlstrom, D, Academy of Management Perspectives Vol 24, 3

[3] Productivity and Competition: A Summary of the Evidence, Competition and Markets Authority and UK Innovation Survey 2017, Department for Business, Energy & Industrial Strategy, 2018

[4] Enterprise research Centre, 2019

[5] Productivity Handbook – Office for National Statistics

[6] Organisational innovators are also referred to as ‘Wider’ innovators. Wider innovators are businesses that have engaged in point 3 above: New and significantly improved forms of organisation, business structures or practices and marketing concepts or strategies.

[7] SMEs’ internationalisation: When does innovation matter? Journal of Business Research 96 (2019) Pages 250-263

[8] We should also note that sample sizes are smaller for the process only category

[9] 50-99 employees

[10] Those businesses also tend to have the highest levels of turnover and productivity

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.