This spring the Scottish Budget for 2019-20 secured safe passage through Parliament.

Once again, the debate – at least outside parliament – focussed upon the familiar issues of income tax rates and local government budgets.

But important longer-term trends are starting to emerge which will shape the Scottish budget in new ways. With the next election just over two years away, these issues are likely to increase in importance as the campaign approaches.

In this blog, we set out five key issues to watch out for.

The budget outlook

The spending envelope Mr Mackay had at his disposal for 2019-20 was boosted by additional consequentials from increased NHS spending in England. But there are risks on the horizon which the next administration will need to manage.

Firstly, should Brexit weaken the UK economy as most economists predict, this will hit tax revenues and lower the long-term rate of growth in public spending. A ‘no deal’ might lead to a temporary uplift in spending, but based upon current plans, the next couple of UK spending reviews aren’t likely to be that generous to the Scottish block grant (particularly for non-NHS areas of spend).

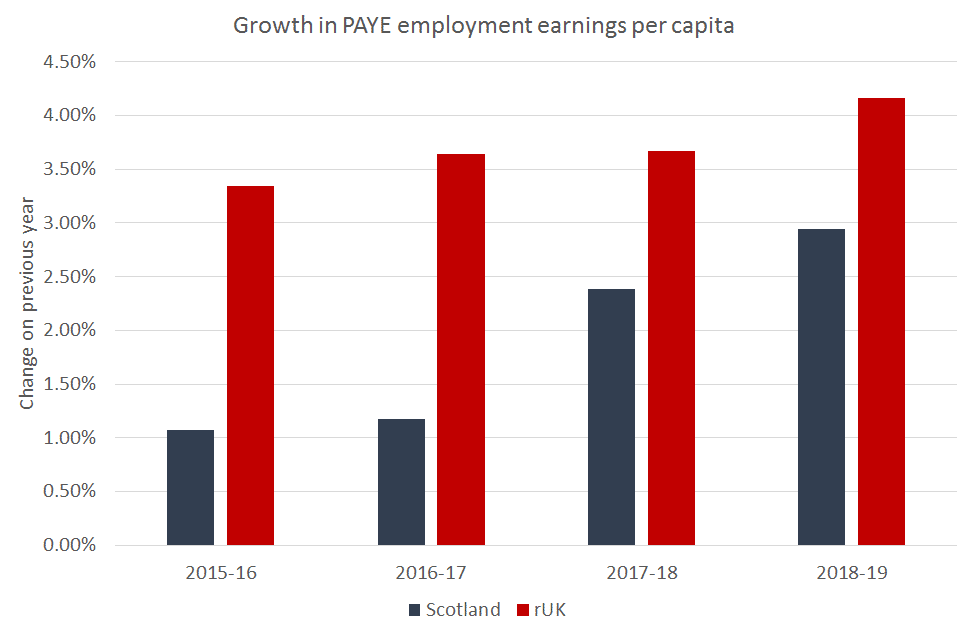

Secondly, of particular concern from a Scottish perspective is the outlook for devolved taxes. As we highlighted in a blog, our earnings growth appears to be lagging the rest of the UK.

Such trends are already feeding through to the budget numbers. Remember tax revenues are a function of both growth in the tax base and changes in the tax rates.

Scottish income tax policy is adding only £180m or so to the budget in 2019-20, despite the fact that Scottish taxpayers are on track to pay more than £500m in income tax relative to a scenario where the government set the same policy as rUK.

Moreover, it is increasingly likely that the tax forecasts for 2017/18 and in 2018/19 were too optimistic. If this turns out to be the case, such monies will have to be paid back. The latest SFC forecasts suggest a gap of nearly £600m.

On capital, the government is showing no signs of slowing down, and is currently planning to borrow its maximum annual limit this year and next. The total borrowing limit will be maxed out by 2023/24.

The fiscal outlook will no doubt open up a debate about the economic track record of the Scottish Government.

But it should also open a wider conversation about the devolution settlement and the accountability of devolved policymakers for factors out with their control. The challenges in the oil and gas sector, an ageing population and Brexit, are all factors that will materially impact Scotland’s economic (and tax) performance but are things that the Scottish Government has little ability to influence.

The pressures on public spending

Since 2010 public spending has increasingly focused on core areas of health, education and social care. Over time, such incremental changes are amounting to a substantial shifts in the distribution of the budget.

The NHS was once again the big ‘winner’ this year, with an additional £700m+ allocated (although this is still just sufficient to keep pace with the government’s estimate of demand growth).

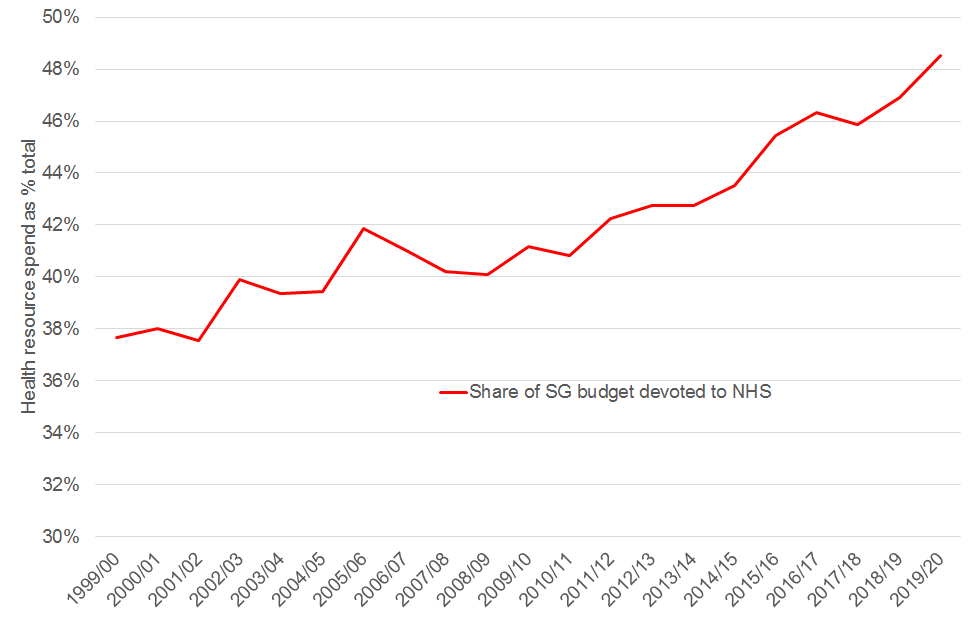

Health spending is likely to absorb around half of day-to-day spending by the end of the parliament if not before.

Local government spending on social care for older aged adults is similarly absorbing a larger and larger share of local government spending.

These trends have profound implications for the quality and extent of public service delivery in a raft of other areas. Even ‘priority’ areas like higher education are facing real-terms cuts of 1.7% in 2019/20, and 5.5% since 2016/17

The next administration will have little room for manoeuvre, unless they are prepared to make radical changes to the way services are delivered or there is a step change in the level of revenues raised.

One reflection is that whilst politicians are happy to set out their spending aspirations, not enough is said about their vision for non-prioritised areas. After a decade of austerity, a strategy is needed for managing reductions in some areas, and not just a strategy for where new money will be spent.

Central to this must also be a return to multi-year budgeting. The lack of forward planning risks undermining the outcomes that the government is trying to achieve, and poses a material risk to the sustainability and effectiveness of non-government service providers.

Future of local government funding

Local government was once again a key tension within the budget. In the context of budget negotiations, such discussions tend to centre upon the level of funding provided to councils and whether or not the settlement is fair.

But the demand for a more fundamental reform of local government finance is on the rise. A focus not just on the amount of funding, but also on issues of local accountability, discretion and transparency is required.

Recent debates over the transient visitor levy (‘tourist tax’) and workplace parking Levy are perhaps early signs of such a debate gaining traction. But given the political risks, whether any party will offer a comprehensive look at local government funding in Scotland – including council tax – is unclear.

The debate on tax

2016 marked the first Scottish election where different tax policies were debated for the first time.

But there is a risk that such debates are increasingly prone to become entrenched on the detail of relatively modest individual tax changes at the expense of a broader assessment of the parliament’s overall approach to taxation and the funding of public services.

In a recent blog, we looked at the tax policies of the Scottish Government and their efforts to make Scotland more fairly taxed than the rest of the UK.

But we as argued, this does not necessarily mean that the tax system as a whole is fair or could not be fairer.

For example, the council tax system is manifestly unfair, being poorly related to both income and property value. Efforts to protect lower paid earners by increasing lower and basic rate income tax bands are juxtaposed against higher than inflationary caps on council tax increases. Efforts to raise additional revenue by increasing income tax rates on higher earners are offset by below inflationary increases in business rates and an expansion of business rates relief.

Some of this results from the government’s objective to frame fairness in a narrow sense of being more progressive than rUK. But there is a clear risk in benchmarking oneself to a tax system that is in itself flawed, rather than considering a bigger picture.

The next stage of devolution

Finally, the next few years will see the final implementation of the final Smith Commission powers.

The addition of VAT assignment to the Scottish Budget will expose the Scottish budget to much greater risk and reward. It will also add in further volatility and uncertainty to public spending, particularly given concerns about how it is measured.

More significant however, are the parliament’s new social security powers. With these powers comes an opportunity to deliver a better welfare system and to link up with existing devolved policies to improve outcomes.

But the administration and delivery of these powers is not straightforward. To ensure a smooth transfer, the Scottish Government has pushed back the delivery dates of a number of important benefits pushed until well into the next decade.

Conclusions

In a couple of months, the government will publish its latest medium term forecasts and plans. This will offer an insight into the current administration’s longer term budget thinking.

But with an election approaching and the next administration facing a number of challenges, it will be incumbent on all political parties to set out their approach too.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.