Despite a tumultuous referendum result, huge revisions to economic and fiscal forecasts, and a revised fiscal target, one thing that has so far barely changed in the last 18 months is the government’s plans for departmental spending.

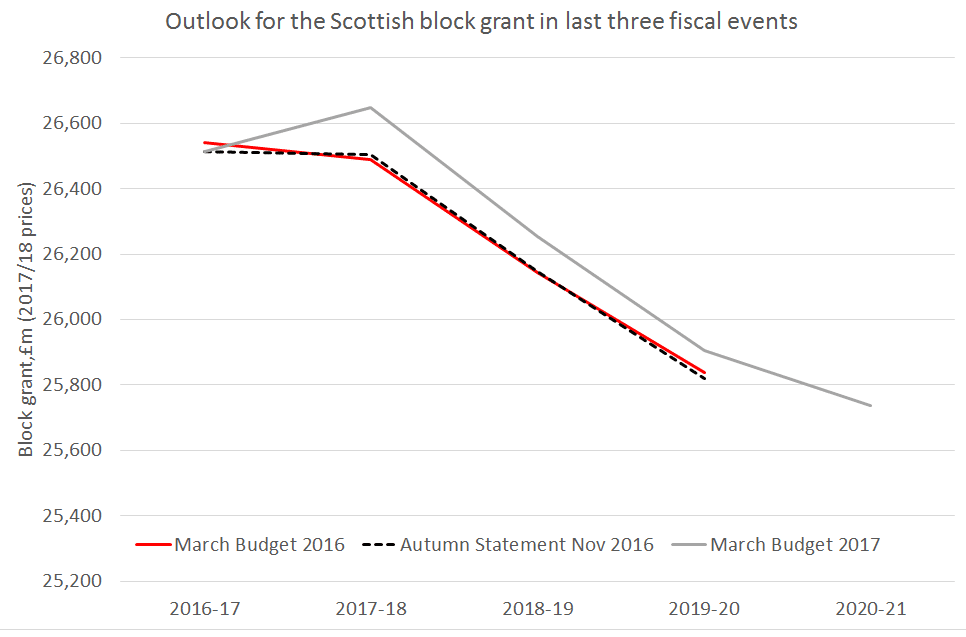

As a result, the outlook for the Scottish Government’s block grant for discretionary day-to-day spending has not (yet) changed significantly since Osborne set his last Budget in March 2016. The outlook for 2018/19 and 2019/20 has always looked challenging with cuts to the block grant of just under £400 million in each year.

Will this outlook improve much later today?

Regardless of the economic rationale for the fiscal target the Chancellor set himself 12 months ago, he is now politically wedded to it. And whilst – theoretically – he could meet his target by raising revenues to fund increased spending, his party’s commitments and ambitions severely constrain his ability to do so.

Nonetheless it is possible that the Chancellor will be able to find himself sufficient headroom – through a combination of lower than expected borrowing in 2016/17, low-key tax rises and accounting wheezes – to increase his plans for departmental spending somewhat.

If he goes some of the way towards finding extra money to pay for relaxing the public pay cap, and some of the way towards meeting NHS England’s demands for an extra £4bn a year, it is just about possible that the Scottish block grant could end up seeing no real terms decline next year, rather than the 1.8% fall currently pencilled in. But don’t count on it.

The Scottish Government’s block grant for capital is, based on March Budget plans, due to increase in real terms by around 5% in the next two years. Additional spending announced by the Chancellor (on house building for example) will generate further consequentials.

On the other hand, an expansion of Help to Buy in England – the provision of loans to first time house buyers – will generate ‘Financial Transactions’ consequentials for the Scottish Government. The Scottish Government can use these to provide loans within Scotland, although it is not constrained to provide loans to housebuyers necessarily.

Finally a note of caution. The OBR will revise down forecasts for Scottish income tax revenues. This does not necessarily mean the Scottish budget in 2018/19 or after is worse off. As long as the rUK income tax revenue forecast is similarly revised down, the Scottish budget is protected through the operation of the ‘block grant adjustments’. In this context, what is far more important than the OBR’s Scottish forecast is the forecast that the Scottish Fiscal Commission makes on 14th December, and how this forecast interacts with today’s OBR forecasts for rUK.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.