As we get deeper into Autumn, the named storms are starting to turn up, Glasgow’s characteristic horizontal rain is drenching us again and the fiscal horizon isn’t free from a smattering of dark clouds either.

Forecasting season has begun

With the UK Budget date set for 26 November, the Office for Budget Responsibility is now producing its first round of fiscal forecasts. This follows on from the first run of macroeconomic forecasts, which will have been produced in the last couple of weeks, and in which the OBR will have updated its view of economic conditions.

You might have read about the productivity downgrade that OBR is expected to include in these forecasts. This is in line with what we discussed in our blog in late August, and involves essentially recognising what we can all see is true: that productivity growth has greatly slowed down since the 2008 financial crisis.

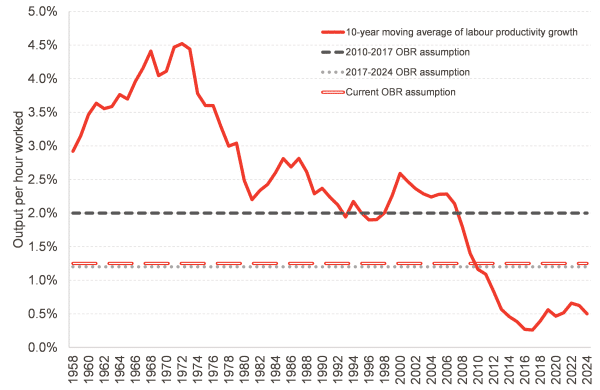

Chart 1: Long-term averages of productivity growth compared with the OBR’s assumptions

Source: FAI analysis of OBR, ONS and BoE data

The OBR’s current medium-term assumption is for productivity (measured as output per hour) to grow at 1.25% a year. All the briefing points to a 0.2 percentage point downgrade, which would bring it to just over 1% a year.

Eagle-eyed observers will notice that 1% is still twice the rate that productivity growth has averaged for the past 10 years. So this downgrade goes some way towards bringing official forecasts in line with what the data shows us, but it could still be argued that it is still much too optimistic about the path of UK GDP.

But a small downgrade is enough to blow an exposed Chancellor off course

The Chancellor’s buffer against meeting the fiscal rules is very small, as we have mentioned before. But more than that, remember than even today’s fiscal rules are significantly looser than those that governed fiscal policy up to March 2024.

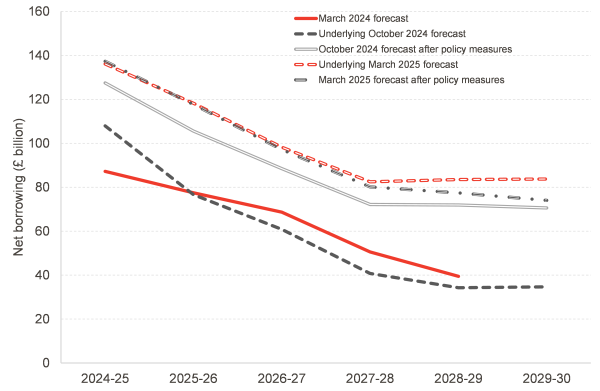

Chart: Public sector net borrowing forecasts since March 2024

Source: OBR, FAI analysis

In fact, when we look at forecasts for net borrowing, it’s clear just how much higher they are relative to March 2024. The borrowing forecasts were slightly improved in the medium-term before Rachel Reeves’ policy decisions in the Autumn of last year, which loosened fiscal policy by around £30 billion a year.

The Spring Statement’s cuts to welfare reduced borrowing – or would have done if implemented – but even then it would have still been higher than forecast in the Autumn.

What does this tell us? Broadly, that the Chancellor’s decision to finance so much of the additional public spending announced last year by borrowing rather than increased taxes have left her with little room for manoeuvre when it comes to reacting to a downgrade in projected revenues. Borrowing more seems out of the question – not just because of the fiscal rules, but much more so because of the bond markets – and with the spending review just set, it seems inevitable that higher taxes will be needed to square the circle.

Happy (?) New Year! We know the Scottish Budget date (roughly)

We now know that the Scottish Budget will not be squeezed in before the Christmas recess, but rather is likely to take place in mid-January.

Shona Robison proposed 15th January in a letter to the Finance and Public Administration Committee. She said –

“While I considered a December publication date, existing arrangements with the Scottish Fiscal Commission (SFC) would leave the Scottish Government with only four working days to decide how to respond to any tax or social security policy changes announced by the UK Government on 26 November.”

As well as meaning that Christmas is cancelled for the poor officials at the Scottish Exchequer and Scottish Fiscal Commission, this will significantly constrain the ability of the parliament to scrutinise the Draft Budget put forward by the Scottish Government. In response, the FPAC proposed that the Budget should be presented by 13th January at the latest. Whatever the exact date, the legislative timeline (and the related negotiations with opposition parties) will be happening in a truncated timeline compared to last year.

The current written agreement between the SG and the parliament says that the Scottish Budget will be presented within three weeks of the UK Autumn Statement. This was possible (just) with a 26th November UK Budget to achieve a pre-Christmas presentation to the Scottish Parliament. If the Scottish Government feel that this is not a sensible timescale, then it may be that the Written Agreement needs to change in the next session to realign the expectations of the parliament.

Authors

João is Deputy Director and Senior Knowledge Exchange Fellow at the Fraser of Allander Institute. Previously, he was a Senior Fiscal Analyst at the Office for Budget Responsibility, where he led on analysis of long-term sustainability of the UK's public finances and on the effect of economic developments and fiscal policy on the UK's medium-term outlook.

Mairi is the Director of the Fraser of Allander Institute. Previously, she was the Deputy Chief Executive of the Scottish Fiscal Commission and the Head of National Accounts at the Scottish Government and has over a decade of experience working in different areas of statistics and analysis.