This blog discusses research in progress by David Comerford & Alessandro Spiganti, entitled “The Energy Trap”, which was presented at the Royal Economic Society conference at the University of Sussex on 27th March 2018. The presentation slides can be found here. The purpose of this blog is to describe this early stage research, which is at the stage of being presented to an academic conference, to a non-technical audience.

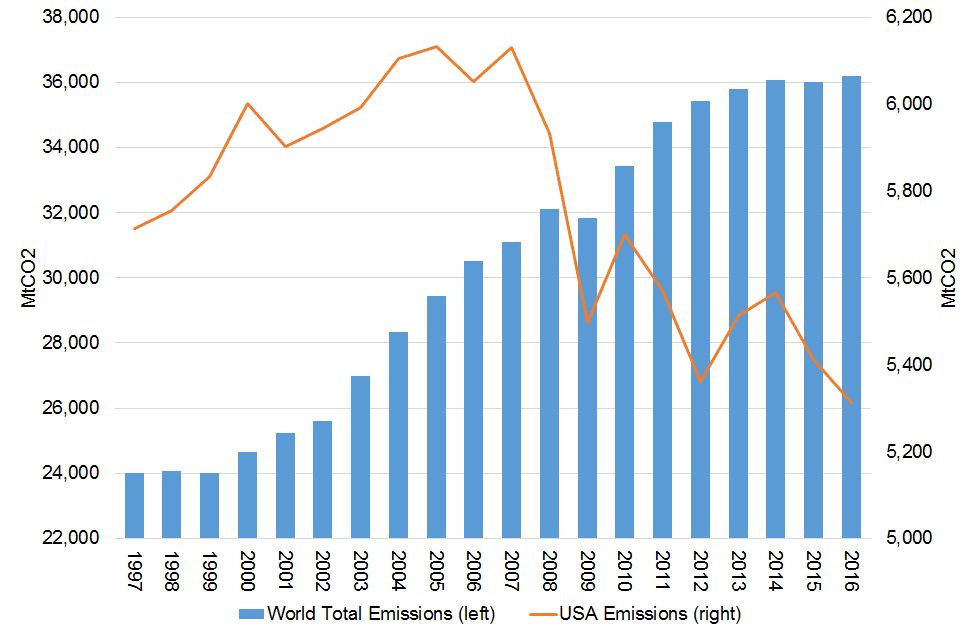

Global emissions fell in 2009 during the Great Recession, though they have since grown, while US emissions peaked in 2007 and have continued to fall (albeit more slowly recently).

However, most of the emissions reductions seen over the Great Recession are explained by demand induced changes in consumption – this is not a story of an energy transition towards zero carbon technologies. Indeed, there may be reasons to suspect that economic downturns could impede the structural transformation towards a zero carbon energy infrastructure.

Low carbon energy infrastructure, like renewables and nuclear, tends to be characterised by large up-front capital costs, with minimal on-going costs (e.g. wind and solar have no fuel costs). This means that, for a fossil fuel and a renewable energy project which have the same net present value and which produce the same energy output, the fossil fuel project will have lower initial investment funding requirements.

Economic downturns, i.e. GDP falls, usually feature falls in consumption expenditure which are lower than the fall in GDP, but falls in investment expenditure greater than the fall in GDP. We prefer to keep our consumption smooth and in bad times this means reducing investment expenditure to maintain our consumption. This is equivalent to becoming more “present biased” and discounting the future more highly. One implication of this is that if we want to create a certain amount of energy generating capacity, in bad economic times we are more likely to go for the project with the lower initial investment funding requirement. It may be the case that, even if the zero carbon energy project would have been chosen in normal economic times, a recession can lead the fossil fuel project to now be preferred.

Furthermore, this same feature of low carbon infrastructure investment (high up-front costs repaid with future revenues which are to a large extent not offset by future costs for e.g. fuel) means that the value of such a renewable energy project is a more volatile function of interest rates than an equivalently valued fossil fuel project. This extra volatility means that such projects are viewed as higher risk. This extra exposure to interest rates is in addition to low carbon energy projects more generally being viewed as riskier because they are newer technology and less familiar to investors with a smaller overall market share. In bad economic times risk aversion generally rises. So again, it may be the case that, even if the zero carbon energy project would have been chosen in normal economic times, a recession can lead the fossil fuel project to now be preferred.

There are then other channels through which economic downturns can damage the prospects for a structural transformation in the energy industry, such as the impact upon technological progress in the low carbon energy industry. If technological progress is generated through learning by doing, and the economic downturn means less “doing”, then this technological progress will be damaged.

It remains to be seen exactly what the data tell us here: what exactly is the impact of recessions on carbon emissions measured over the medium to long term? Through the mechanisms outlined above, do recessions delay the structural change which will eventually reduce emissions to zero? And if so, does this more than offset the emissions reductions that are caused by reduced demand during the recession itself?

Authors

David Comerford

Post-doctoral researcher in economics