Boosting Scottish exports has been a goal of all Scottish administrations whatever their political make-up.

Back in 2011, the Scottish Government set a target to grow international exports by 50% by 2017. This was an admirable target, and growing our international exports has taken on even greater significance with Brexit.

Nevertheless, if you set targets you also need to measure progress against them. And today’s Export Statistics Scotland figures provide an opportunity to do that.

In short, without unprecedented growth in 2017 – which seems unlikely – Scotland is on track to miss its 2011 export target by a relatively wide margin.

Today’s figures

The Scottish Government’s Export Statistics is the key source of information on Scottish sales to the UK and internationally.

As is well known, estimating Scottish exports is one of the most challenging aspects of compiling economic statistics for Scotland.

Firstly, unlike the ONS or indeed the Northern Ireland Executive, the Scottish Government lack the ability to compel firms to respond to their request for information on export activities. This means that the response rate to the sample is low.

Secondly, not all firms know the exact destination of their final exports. This gives comparisons of market destinations a higher degree of sampling error than the industry estimates.

Thirdly, given the close links many firms have across the UK it is highly possible that some exports to the rest of the UK are subsequently re-sold (or are processed and then sold) to an international buyer. In such cases, only the initial sale from Scotland is counted as an international export. That being said, the Scottish Government statisticians “believe the figure will be small as over half of Scottish exports to the rest of the UK are services (such as financial services) and are unlikely to be re-exported abroad. Also, many of the goods exported to the rest of the UK are in sectors where re-exporting is unlikely (utilities, construction and retail and wholesale).” Page 38 Export Statistics Scotland

Trends in Scottish exports

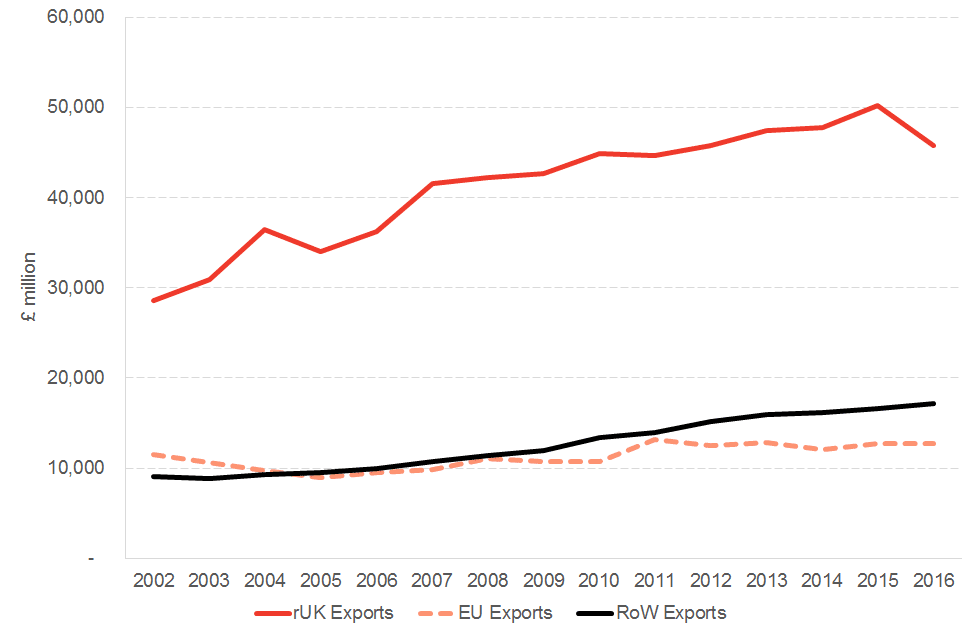

International economists will tell you that most countries tend to trade relatively more with their nearest neighbours than they do with anyone else. And this is borne out by the Scottish data.

Trade with the rest of the UK accounts for around 61% of total Scottish exports (£45.8bn).

Chart 1: Growth of Scottish exports by RUK, EU and ROW markets since 2002.

International exports account for the remaining 39% of total exports (£29.8bn).

In 2016, exports to the EU were worth £12.7bn. This is equivalent to 43% of all international exports or 17% of total Scottish exports (international and rUK).

Growth in exports to the EU have been relatively flat since 2002 (up around 11%) – particularly in comparison to growth in non-EU international exports (which are up nearly 90%). A key reason for this was the decline in electronics exports in the early/mid 2000s.

This year’s results

Between 2015 and 2016, Scottish exports were down around £4bn.

A fall in RUK exports of £4.4bn (or nearly 9% on 2015 RUK exports) was the big driver. This is the greatest fall since the stats were first collected in 2002.

The decline in exports was relatively widespread – indeed virtually all services sub-sectors saw their exports to the UK decline in 2016 (the exception was ‘other services’).

But over a third of the decline can be attributed to the utilities sector – primarily the export of electricity to the rest of the UK. Remember this includes the year that Longannet power-station closed, so this is not surprising.

Other sectors seeing quite large declines in RUK exports include wholesale and retail, transport equipment and mining and quarrying. The final two are likely to have been impacted by the decline in activity in the North Sea. The North Sea is counted as a separate region in UK national accounts. That means that sales from Scottish companies to the North Sea – even those that are to locations in Scottish waters – are counted as an export to the rest of the UK (and not activity within Scotland). As we’ve pointed out before, this seems a rather odd way of looking at things.

Exports to the EU also fell – by around £100 million between 2015 and 2016. In contrast, exports to countries outside the UK and EU rose by £565 million. This was largely driven by rising exports to North America.

Progress against target

Any growth in international exports is welcome and there are clearly examples of Scottish firms performing exceptionally well in overseas markets.

But it’s hard not to be disappointed with today’s figures.

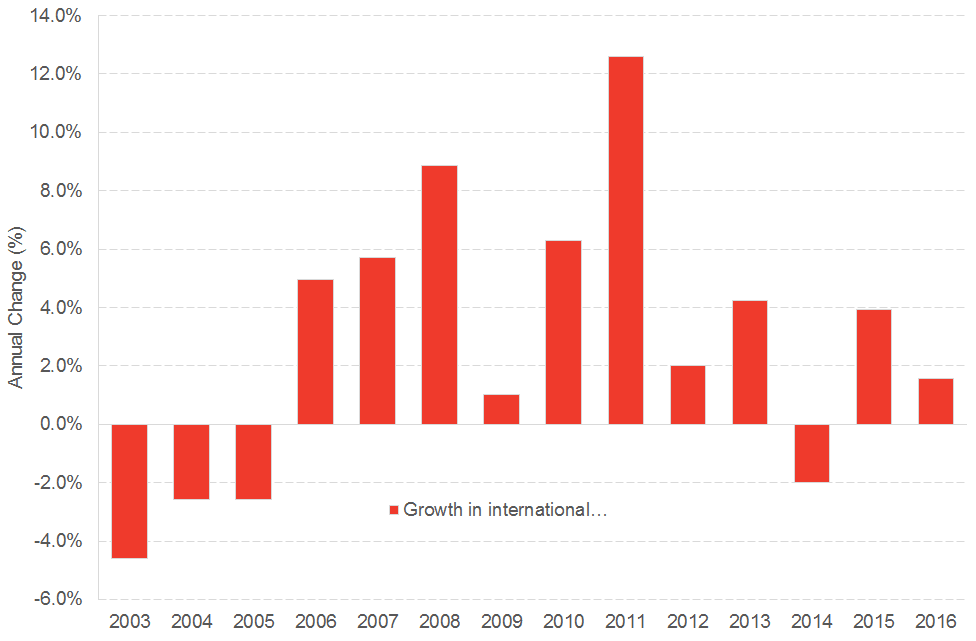

Growth of just 1.6% in international exports over the year is below historical growth rates which have averaged 2½% – 3% (see Chart 2).

Chart 2: Annual change in Scottish international exports

And remember, these statistics are in cash terms so the real-terms growth will be even weaker.

Of course, exports are hugely determined by what is happening in external markets. 2016 was an ok year for the world economy with growth above 3%. It was also the year of the EU referendum (which may have increased uncertainty but may also have helped make Scottish exports more competitive in the short-term given the sharp fall in Sterling).

Of course, the Scottish export series can be volatile so changes from one year to the next need to be viewed with caution.

But what will be of greater concern to the government will be the longer-term trend. And the fact that there seems to be little evidence that Scotland has stepped up its level of export performance.

The Scottish Government’s target to boost exports by 50% in nominal terms, whilst set in 2011, takes 2010 as a baseline. Based upon today’s data, Scottish international exports have grown by 24% between 2010 and 2016 (and by 10% between 2011 and 2016).

This implies that we need growth of over 20% (or £6.3 billion) next year if Scotland is to meet the 2011 target (based on a 2010 baseline – and an even larger increase on a 2011 baseline).

It seems highly likely that the target is going to be missed.

What can be done about this – either by policymakers or businesses – remains elusive.

But with Brexit only likely to be an additional headwind for Scotland’s export outlook, without a fundamental change in policy and/or ambition amongst Scottish businesses, Scotland’s track record on exporting shows no sign of changing anytime soon.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.