In addition to providing an overview of key issues facing the upcoming Scottish budget, each year our annual Scottish Budget report includes an in-depth analysis of specific fiscal policy issues. In this year’s report, one of the topics we looked at was higher education.

Our analysis did not make any recommendations, contrary to some media reports, but instead sought to:

• Consider the implications for Scottish graduates of recent changes to the terms of maintenance loans in Scotland;

• Understand what constraints the Scottish Government faces in determining how much loan it can offer to Scottish students, and on what terms; and

• Quantify the opportunity costs of the government’s current approach to funding higher education tuition.

Brief background

As is well known, the approaches to funding higher education differ significantly in Scotland compared to England.

In England, students are liable to pay tuition fees, which are set by universities and capped at £9,250 per annum. Most students (over 90%) take out a loan to enable them to pay fees, and most also take out loan to support living costs. Loan repayments are linked to graduates’ incomes, and written off by the public sector after 30 years – with the implication that higher education in England is not costless to the taxpayer.

In Scotland, students are not liable to pay tuition fees. The costs of tuition for fulltime, first time Scottish domiciled students are wholly funded by the Scottish Government. When it comes to maintenance (or living) costs, students from relatively low income households can receive maintenance grants of up to £1,875. But the majority of Scottish students are expected to fund their own maintenance costs in full – and most do so by taking out a maintenance loan.

Where the Scottish Government chooses to fund HE through grants – whether these are grants to students to pay fees or support living costs, or allocations directly to universities via the Scottish Funding Council – this is funded from the Scottish Government’s resource allocation. It necessarily follows that the more that the Scottish Government allocates to HE, the less it has available to allocate to other areas of public spending.

The provision of student loans has no impact on the Scottish Government’s resource budget (the constraints are discussed below).

Recent changes to maintenance loan terms in Scotland

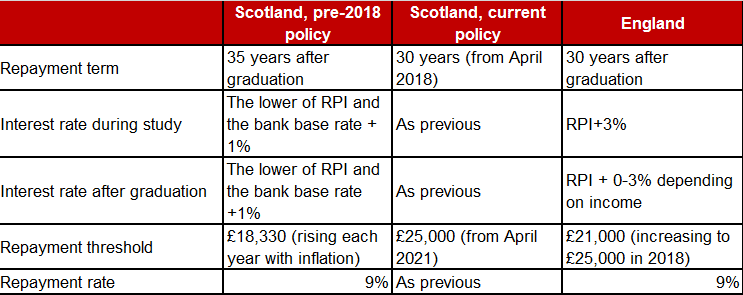

The loan repayment terms facing English and Scottish students differ. Until recently, Scottish students loans were written off after 35 years, compared to 30 in England, and Scottish students were liable to start making repayments at a lower level of income than those in England.

However, changes announced by the Scottish Government in summer 2018 – following a review of student financial support – will see the loan term reduce to 30 years, and the repayment threshold increase to match the English threshold (£25,000, up from £18,000 currently). However, the interest rate on Scottish loans will remain significantly lower than is charged on English loans (Table 1).

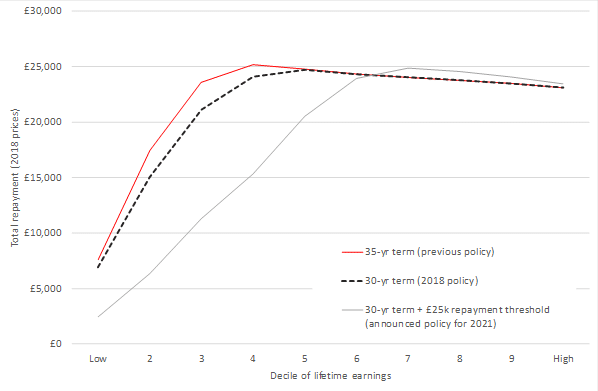

The changes announced mean that Scottish graduates with loan debt, who earn less than the median lifetime graduate income, will repay less of that debt than they would previously have expected to (Chart 1).

Chart 1: Loan repayments by decile of lifetime income under different policy arrangements

Source: FAI Loan Repayments Model. Notes: Loan per graduate of £21,000. Graduate repayments are expressed in 2018 prices deflated by CPI, but no government discount rate is applied.

Table 1: Loan repayment terms, Scotland and England compared

Constraints facing the Scottish Government in determining loan policy

What constraints does the Scottish Government face in changing loan terms like this? In short, there are no specific fiscal rules that determine the total amount of loan that the Scottish Government can issue, or the repayment terms. The UK Government provides the Scottish Government with the budget necessary to cover loan outlay, and an accounting term for loan impairment (i.e. loan write-off).

However, although there are no specific fiscal rules, the Scottish Government’s capacity to issue loan and vary loan repayment conditions is constrained by a looser sense of what is considered equitable in terms of loan issue and repayment conditions across the UK. In principle the Scottish Government could propose a further loosening of loan repayment conditions on maintenance loans in Scotland – for example, a reduction in the repayment rate. Whether this would be countenanced by HM Treasury remains to be seen, although HMT may well point out that loan terms are already on track to be more generous in Scotland than those in England, given the lower interest rate.

Opportunity costs of ‘free’ tuition policy

On average, the tuition costs associated with a full-time, first time, Scottish domiciled undergraduate are £7,000 per annum, or £28,000 for a typical four year undergraduate degree. These costs are met from the Scottish Government’s resource budget, and are channelled to universities partly through the Student Awards Agency for Scotland, and partly through the Scottish Funding Council.

The Scottish Government could – in principle – introduce an element of tuition fee payable by students with the support of loan. Fee waivers could be provided to some students if desired (e.g. those from less well-off backgrounds, or those studying particular disciplines). The burden of funding HE would shift to students themselves (through loan repayments) and the UK government (through loan default).

At one extreme, replacing the publicly funded element of the £7,000 tuition cost entirely by a tuition fee could ‘save’ the government around £800 million per year once it was rolled out across cohorts. However, a fee at this level would imply substantial loan write-off given planned loan repayment conditions and the four year nature of most undergraduate Scottish degrees, and would probably not be countenanced by the UK Government (at least without more stringent loan conditions being put in place).

Of course, the government could decide to introduce fees at a lower level.

Conclusions: the ongoing HE funding debate

The changes to Scottish maintenance loan conditions announced recently will reduce the lifetime repayments of Scottish graduates in the lower half of the income distribution, at no direct cost to any other part of the Scottish budget. However, they raise at least two questions:

• First, why does the increase in the repayment threshold in Scotland to £25,000 have to wait until 2021, when it has already increased to that level in England?

• Second, to what extent did the Scottish Government consider alternative ways to vary loan repayment conditions? Analysis in our report suggests that maintaining the repayment threshold at a relatively low level but reducing the repayment rate from 9% to 4.5% would have similar distributional implications, but would arguably have less pronounced effects on work incentives*.

The notion of introducing a tuition fee for HE in Scotland is not high up the political agenda. But that does not weaken the case for trying to understand the opportunity costs of the free tuition policy.

The experiment with full fees in England has undoubtedly failed in many respects – it has failed to create an effective ‘market’ for higher education, and some argue that it has created perverse incentives for universities to compete for students (and fees) through grade inflation. Some students may be deterred from participating in HE by the high level of debt incurred.

Nonetheless, some will argue that a moderate fee could be introduced alongside a loan repayment system that ensures that loan repayments are progressive with respect to lifetime income; and fee waivers could of course be granted to those from less advantaged backgrounds.

To the extent that higher education delivers both public benefits and benefits to the individuals who participate in it, a case can be made for its costs to be shared between the state and individual beneficiaries.

Ultimately, higher education has to be paid for somehow, whether through reduced spending elsewhere, by higher taxes on the population as a whole, or through some form of fee backed by income-contingent loan (with the latter effectively operating as a form of time-limited graduate tax).

It is arguably worth us having a more open debate about this funding choice in Scotland. But the debate can only take place with a bit more information than has previously been available about the funding constraints and implications of the current policy choices. We hope our report provides some of this information – for those who want to consider the evidence in those debates**.

* In the debates about differential income tax liabilities faced by Scottish taxpayers, it is perhaps surprising that the Scottish Government does exploit more explicitly the implications of the English HE funding regime. Graduates in England and Scotland who have loan debt will repay that debt at 9% of earnings, above the repayment threshold, in addition to their marginal tax rate on income tax and National Insurance Contributions. But this 9% surcharge on marginal rates of earning taxation will apply to a greater proportion of English students for a greater proportion of their working lives than is the case for Scottish students.

** A final caveat is that the ONS is expected to announce imminently changes to the way in which student loans are accounted for in the UK national accounts. Although any proposed changes are unlikely to take affect for several years, the changes could have implications for the capacity of the Scottish Government to issue loans and grant to Scottish students. It is possible that these changes could result in the Scottish Government’s existing free tuition policy becoming more affordable, although this will depend on the outcome of the ONS review.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.