The forthcoming election is taking place against a backdrop of huge economic and policy uncertainty. But one thing we do know about is the UK Government’s plans for income tax policy over the coming years.

The UK personal allowance and higher rate threshold will be frozen at 2021-22 levels for the following four years – up to and including 2025-26. Compared to standard uprating policy, this is anticipated to raise an additional £8bn for the UK Government in 2025/26.

Options and constraints

Of course, UK income tax policy does not apply in Scotland. The Scottish Government has the powers to set all rates and bands for Scottish Income tax. Furthermore, although the setting of the Personal Allowance is technically reserved to Westminster, the Scottish Government could, if it wanted, set a higher effective tax-free amount of income tax by creating a zero-rate band of income tax in Scotland.

So, in principle, when it comes to Scottish income tax policy in the next parliament, anything is possible. But in reality, the UK policy will frame the scope for manoeuvre.

The Scottish Government’s current tax policy in 2021/22 is estimated to raise around £500m in revenue, relative to what would be raised if the UK policy was implemented in Scotland. If it wishes to maintain that revenue differential in future years, the Scottish Government in effect needs to maintain the existing levels of divergence between the Scottish and UK income tax systems.

If the Scottish Government ‘followed’ the UK Government in freezing thresholds over the coming years, then it could continue to claim that its divergent policy was raising at least £500m each year. Its budget would increase at around 2% per annum in real terms (reflecting the implications of UK Government spending plans on the Barnett formula), with Scottish tax decisions providing an annual £500m boost each year on top.

On course for a significant increase in Scottish higher rate taxpayers

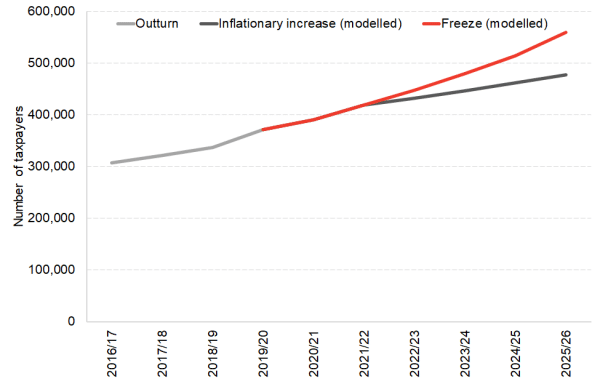

One implication of freezing thresholds in cash terms would be a rapid growth in the number of taxpayers in Scotland subject to the higher rate. In January, the SFC forecast that, even under standard uprating policy, the number of higher and additional rate taxpayers in Scotland would increase from 366,000 in 2020/21 to 484,000 in 2025/26.

If the higher rate threshold were in fact frozen, we estimate that the number of higher and additional rate taxpayers in Scotland could be closer to 550,000 in 2025/26 – representing 12% of adults in Scotland.

Considering that in 2016/17 only 305,000 Scottish income taxpayers (7% of adults) paid tax at the higher and additional rates, this would represent a remarkable evolution in effective tax rate for a sizeable number of people (Chart 1).

Chart 1: Modelled and outturn number of higher and additional rate taxpayers under an inflationary increase / freeze in income tax thresholds, Scotland, 2016/17 – 2025/26

Source: FAI calculations using HMRC SPI data

Note: Both modelled policies assume a freezing of the additional threshold of income tax at £150,000 per annum over the forecast horizon.

It would also mean that around 130,000 Scottish taxpayers would be liable to a combined income tax and employee National Insurance Contribution marginal tax rate of 53%. These are working age individuals with earned income between the Scottish and rUK higher rate thresholds for income tax and liable for both the Scottish higher rate of income tax at 41% and the 12% employee NICs rate.

Other choices are possible

This then is the starting point, the point from which the parties’ actual tax policies will need to build. What they will propose is not for us to guess.

But, by way of illustration, what would happen if the next Scottish Government did decide to increase income tax thresholds – and the effective tax-free amount, i.e. the personal allowance – in Scotland in line with inflation (effectively following ‘normal’ uprating procedures)?

The answer is that it would have significant revenue implications.

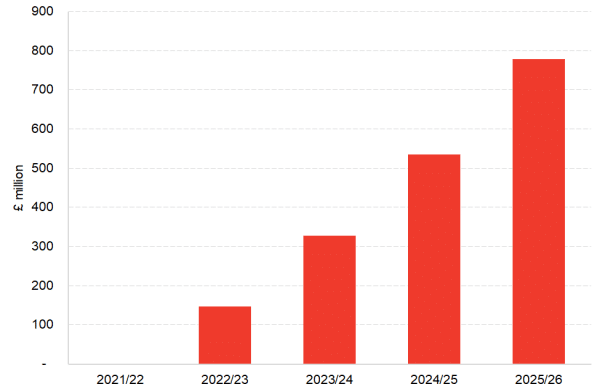

In fact, those revenue implications would increase each year. If Scottish income tax thresholds were increased in line with inflation, then the median Scottish income taxpayer would pay around £195 less in tax in 2025/26. But the Scottish budget would be worse off in 2025/26 by over £700m (Chart 2).

It cannot be reiterated enough – freezing bands might not sound like a big deal, but over time it can make a big difference to liabilities and revenues. This is one reason that freezing thresholds, relying on “fiscal drag” to pull more people into higher bands, can be quite an effective way to raise more revenue over a number of years – without the level of political backlash that can come with an overt tax rise.

Faced with this backdrop, it will be interesting to see what the Scottish parties propose in their manifestos in coming weeks.

Chart 2: Modelled difference in revenue raised from income tax between a freeze and inflationary increase in income tax thresholds, Scotland, 2021/22 – 2025/26

Source: FAI calculations using HMRC SPI data

Authors

Frantisek Brocek

Frank graduated from the University of Strathclyde in 2019 with a First-class BA (Hons) degree in Economics. He is currently studying on the Scottish Graduate Programme MSc in Economics at the University of Edinburgh.

He has experience from a variety of economic policy institutions including the European Commission in Brussels, the Slovak Central Bank and the Ministry of Finance.

David Eiser

David is Senior Knowledge Exchange Fellow at the Fraser of Allander Institute