As we flagged in our blog last week, today sees the publication of the latest Government Expenditure and Revenue (GERS) report.

GERS estimates the contribution of public sector revenue raised in Scotland toward the public sector goods and services provided for the benefit of Scotland. The estimates typically cause significant controversy, and our blog highlighted some of the usual areas of debate.

These arguments are not going to go away, but the GERS figures present the most reasonable approximation to help us understand the nature and extent of public spending and revenue in Scotland in the latest financial year.

What is the headline figure?

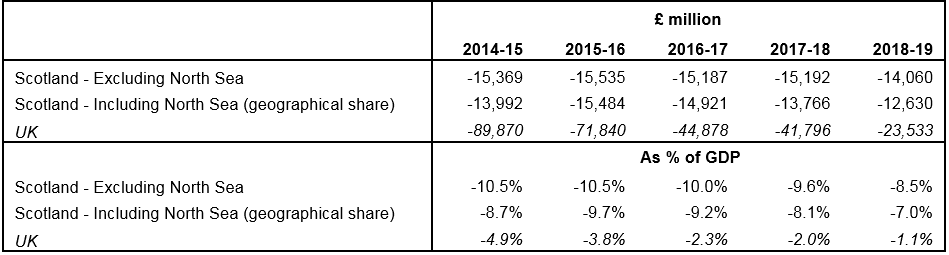

The GERS report shows a net fiscal balance (including a geographical share of North Sea oil) in Scotland of -£12.6bn or –7.0% of Scottish GDP for 2018-19. This compares with a UK balance of -£23.5bn or –1.1% of UK GDP.

This is an improvement on the figures for 2017-18 where Scotland’s net fiscal balance was -8.1%. This improvement has been driven by a larger increase in revenues per head than expenditure per head, which is also largely reflected at the UK level.

Table: Net fiscal balance – Scotland and UK 2014-15 to 2018-19

Source: GERS 2018-19, Table S.1

Source: GERS 2018-19, Table S.1

How does this link to devolved powers?

Most of the today’s coverage will concentrate on the headline numbers and what this all means for the independence debate.

However, there are also some interesting implications from the increased devolution of powers to the Scottish Parliament. As we flagged in our blog last week, new data from HMRC is the last two years has indicated that the number of higher and additional rate income taxpayers in Scotland is lower than was previously estimated using survey data.

This has now been reflected in the most recent years of the GERS figures, leading to a worsening of the income tax revenue figures and in turn the net fiscal balance for 2016-17 and 2017-18 in particular. Interestingly though this data have not been used to adjust earlier years of the GERS estimates. These revisions also feed through to weakening National Insurance Contributions.

These revisions have been offset somewhat to upward revisions to VAT data. A new model has been developed by HMRC as part of the proposed assignment of VAT to the Scottish Budget. Although the approach is similar to previous estimates produced for GERS, it is giving slightly higher estimates of Scottish VAT. Some of the issues with this model, including the potential volality of the results, has led to the Scottish Government requesting a delay to the implementation of VAT assignment.

All of these issues are discussed in boxes 1.1 and 1.2 of GERS.

Overall, Scottish onshore revenues remain at 7.8% of the UK, similar to last year.

Final thoughts

GERS is an annual publication that sparks off a debate about Scotland’s public finances. As we say regularly in our blogs: it is a statistical publication produced by the Scottish Government; it contains some elements which are estimated but that does not mean it should be discredited; and altering any assumption made does not really change the overall picture.

It is always important to remember that GERS takes the current structure of UK Government reserved taxation and spending as given. If the very purpose of independence is to take different choices about the type of economy and society that we live in, then a set of accounts based upon the current constitutional settlement and policy priorities will tell us little about the long-term finances of an independent Scotland.

But GERS does provide a pretty accurate picture of where Scotland is in 2019. So in doing so, today’s numbers set the starting point for a discussion about the immediate choices and challenges that need to be addressed by those advocating new fiscal arrangements.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.