Sam MacArthur is a fourth year undergraduate economics student at the University of Strathclyde and had a summer internship in the Fraser of Allander Institute supported by the Carnegie Trust. This blog summarises some of Sam’s research from last summer into some of the issues around land value tax.

The Scottish Government recently released their Programme for Government 2017-2018, ‘A Nation with Ambition’, which reiterated their commitment to land reform.

Consequently, the newly formed Scottish Land Commission have been tasked –among other things- with carrying out and commissioning research into “a range of radical options for further land reform in Scotland, including the potential for a land value tax”.

In recent years, calls for a land value tax (LVT) have moved into the mainstream of political debate in Scotland, driven by perceived criticisms of the current system of local taxation, the Council Tax. One concern with fundamentally reforming the existing system is a concern about the potential impact of this change on different household types across Scotland. The lack of detailed analysis on this point is hindering fuller debate.

This blog reports on some work I undertook while completing a Carnegie Vacation Scholarship at the Fraser of Allander Institute this summer. It begins by briefly reviewing some conceptual issues in implementing local taxation, before moving to consider how (in principal) we might produce some estimates of land values.

Local Tax Issues

The current system of local taxation, the ‘Council Tax’, was implemented as a quick political solution to replace the short-lived and hugely unpopular Community Charge (or ‘Poll Tax’ as it was better known), and has remained almost untouched since 1991.

Whilst there is consensus in the Scottish Parliament that the current policy has shortcomings, there is far less consensus on what should go in its place.

In 2015, the Commission on Local Tax Reform published its findings after considering the options for reform. Following this, the Scottish Government modified the existing Council Tax system by changing the multiplier values on properties in the higher bands. But more fundamental reform was postponed.

Two of the most criticised aspects of the Council Tax are its perceived unfairness (with higher priced homes paying a smaller proportion of their property value in tax compared to lower valued homes) and its arbitrariness: the tax values all properties in terms of their value (or imputed value for newer properties) in 1991 – in spite of the substantial changes in the housing stock since this time.

Two main ‘types’ of alternative have been put forward. A ‘property tax’ based upon the value of a home and, a ‘land tax’ where the value of the land that a property is built upon is the subject of tax.

Those in favour of a land tax argued that it has many desirable features: it is more progressive given the unequal distribution of land ownership, and it can avoid the distortionary behavioural effects that traditional approaches have on an individual’s incentive to work or improve their property value. Land is in fixed supply, unlike labour or property development whose supply may be inefficiently reduced to avoid higher taxes. A land tax – it is argued – could promote equality, higher economic activity, and a more efficient property market.

With its inclusion in the Programme for Government – albeit in terms of ‘to be considered’ rather than ‘to be implemented’ – Land Value Taxation appears to be among the front-runners to replace the Council Tax. However, it is still uncertain whether the decision will actually be made to replace the Council Tax. A barrier to change is undoubtedly the lack of evidence on the impact of such a change.

Approximating Property Prices

The big challenge in understanding the impact of a land value tax for Scotland is to disentangle the intrinsic value of the land from what we observe: the transaction values when people buy/sell a property.

The transaction value implicitly incorporates a value for the land that the structure (building) is on and another value for the structure that is on the land. If we are to tax these separately –as a LVT implies- we need to separate these components out.

To implement this, we need to be able to identify the overall value of the transaction, something which is relatively easily done from official data, and estimate the value of the structure on the land. The latter component is the more difficult to capture.

One way to get at the cost of the structure on the land is to use data provided by surveyors, and this is what I do here, as I explain below.

To gain a greater understanding of how a land value tax may look, I estimate –for each datazone– the value of the housing stock in that datazone using “rebuild costs”. I then compare these rebuild costs with market prices (from transactions data) which incorporate the value of the land and the value of the structures on that land.

I use a rebuild cost calculator from the Building Cost Information Service (BCIS) of the Royal Institution of Chartered Surveyors (RICS) to do this. The calculator sampled flats, terraced, semi-detached and detached homes from 50 regions across Scotland.

This analysis is done at the level of statistical datazones, these are statistical geographies based on the 2011 census. There are 6,976 datazones in Scotland, each with somewhere between 500 and 1,000 households within it. Although we only have rebuild cost variation for 50 geographies, we have housing stock information and market value information for all 6,976 datazones.

This level of spatial disaggregation is likely to be unsatisfactory for more detailed understanding of variations in land value, given variations in land quality within datazones, however it does provide a first look at this issue.

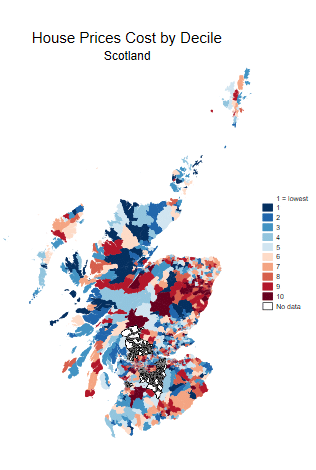

Transactions data- Median House Prices by Decile

The obvious place to start in this review is to look at variations in transaction value across Scotland. We do this using data available through the www.statistics.gov.scot website on the median property price in each datazone. The figure below presents these values, grouped by decile. Note that some datazones do not report transactions values given a lack of transactions (an issue that a more detailed analysis of LVT has to address). Focusing in on the major cities reveals similar variation within cities in median transaction values.

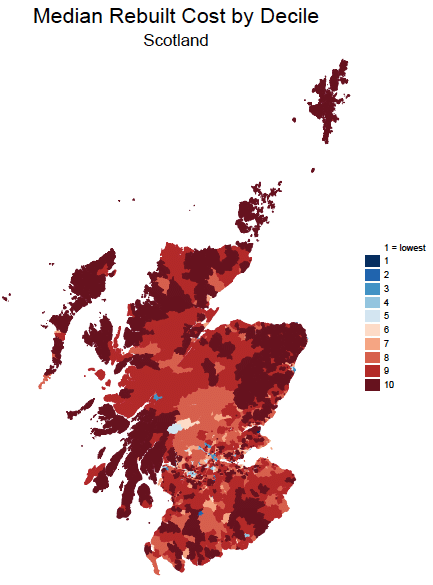

Median Rebuild Costs by Decile

Next, I looked at the estimates of the median rebuild cost of the housing stock in each datazone, which I created. These are shown in the figure above.

There is a clear urban-rural pattern to these results, with higher rebuild costs being associated with more rural datazones. I believe that this is being driven –in large part– by the housing composition across datazones (i.e. rural housing is –on average– larger).

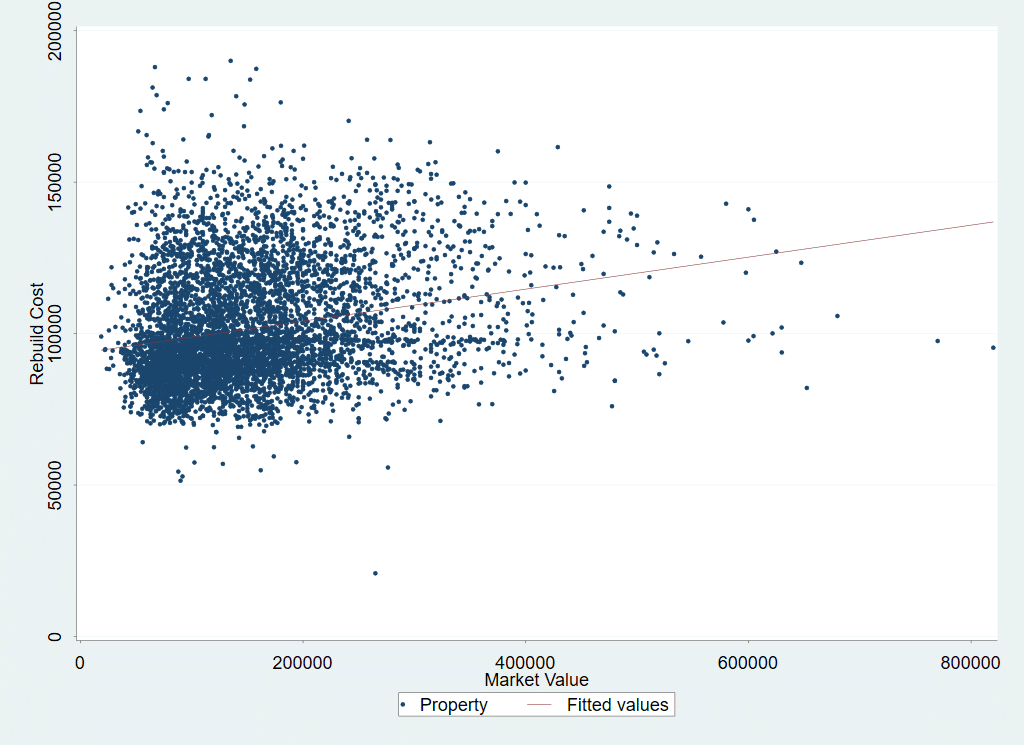

Median Market Values vs Median Rebuild Cost

An interesting thing to look at –finally- is how our rebuild cost deciles compare to the transactions value deciles from the official statistics data. A scatter plot of these values is reported below.

This scatter plot shows that there is a positive correlation (+0.23) between our estimated rebuild costs and reported house prices.

In general, this is what we would expect, with areas with more expensive houses being areas with higher rebuild costs. However within these estimates there will be significant variation as the scatter plot shows.

Unpicking this variation will be key to getting a reliable measure of land values on which to base a local tax to replace the current system of local taxation in Scotland. It may be, for instance, that Datazones are too diverse a geography on which to do this analysis.

Conclusions

This project is very much a work in progress, but I have outlined the first steps in developing the evidence base needed to analyse the potential consequences of a LVT in Scotland. I have identified an approach to deriving an estimate of land values, as distinct from transactions values, and have illustrated some of the initial data results from this analysis. Much more needs to be done, but hopefully this blog helps illustrate some key issues that need to be considered in this ongoing debate.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.