What a difference a year makes.

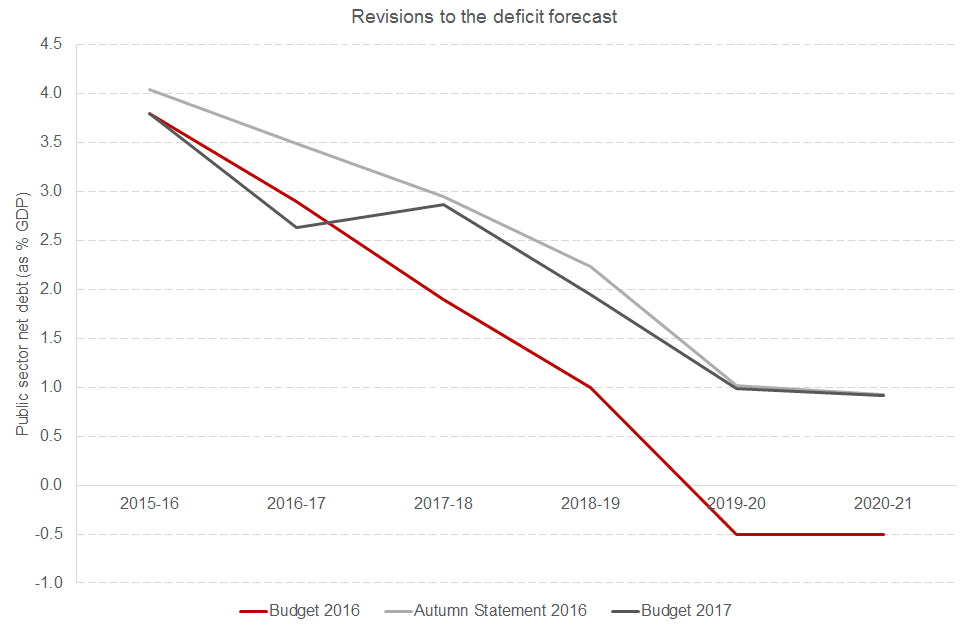

Delivering his Budget in March 2016, then Chancellor George Osborne set out plans to deliver a fiscal surplus – revenues higher than spending – by 2019/20. Growth was forecast to be 2.2% in 2017.

By the time of the Autumn Statement in November, the forecast for growth in 2017 had been cut to 1.4%. The forecast for public sector net borrowing over the course of this parliament had been revised up by £100bn, largely (but not entirely) due to the anticipated impacts of Brexit on the economy and public finances. Any hope of a budget surplus had long been extinguished.

Was today’s Budget able to offer good news? And what are the implications for the Scottish Government’s Budget?

A better economic outlook?

On the one hand, yes.

Today Phillip Hammond was able to point to a boost to both his economic and budget outlook – at least relative to what he had announced in November. Supported by buoyant consumer spending in 2016, the OBR’s forecasts for growth in 2017 have been revised back up to 2%. The government will borrow £16.5bn less in 2016/17 than had been forecast in November.

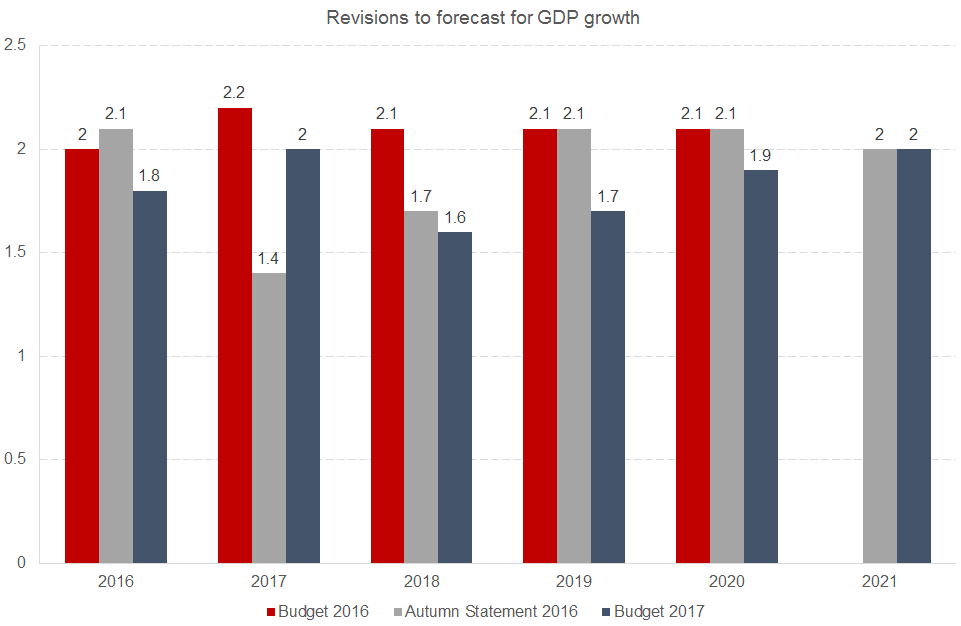

But these improvements in the outlook are short-term and largely superficial. Although growth forecasts have been revised up for 2017, they have been revised down for 2018, 2019 and 2020 (see chart). As a result, the level of national income is forecast to be essentially unchanged in 2020 than had been forecast in November.

Despite recent media attention on the positive economic performance of the UK economy post EU referendum (relative to forecast), the underlying picture painted by the OBR’s economic and fiscal outlook remains fairly dismal. Per capita GDP growth is forecast to average around 1.2% over the coming years, well below its post-war historic average. Faster inflation is likely to erode the impact of positive wage settlements – this time last year, the OBR forecast average real earnings would return above their 2008 peak by 2020, but it now expects real earnings to fall in 2017, and not return to the 2008-peak until 2021.

The government is still forecasting to be borrowing £30bn per year more in 2020/21 than it was in March last year – and it is still forecasting to borrow around £100bn more over the course of the parliament than when George Osborne delivered his last budget (see chart).

With public sector net borrowing (PSNB) forecast to be around 1% of GDP by 2019/20, the Chancellor has some ‘wriggle-room’ to meet his fiscal target (which is to reduce cyclically adjusted PSNB to no more than 2% of GDP by 2020/21). He may well need this wriggle room. The OBR’s forecasts are predicated on an improvement in productivity growth to 1.6% in 2017 and beyond – some way above the trends of the recent past.

Why does all this matter? The economic outlook determines the extent to which the chancellor can afford to borrow in future. The debate continues however as to the extent to which the chancellor should allow himself to borrow more now in order to improve the longer-term economic prospects.

Policy announcements

The Budget was relatively thin on specific tax or spending announcements.

The main revenue raising measures included changes to the tax treatment of the self-employed, a reduction in the tax free dividend allowance, and new measures to tackle tax avoidance.

On the spending side, the Chancellor announced an additional £2bn spending on social care in England over three years; some additional spending on grammar and selective schools; and moderate further increases in capital spending on top of the relatively large increases set out in the Autumn Statement.

Implications for Scotland

These spending increases – together with some additional business rates reliefs for business in England – will generate Barnett ‘consequentials’ which will feed through to the Scottish Government’s Budget.

These consequentials amount to £350 million over the course of the parliament, including £260 million revenue and £90 million capital.

It’ll be up to the Scottish Government to decide how to spend this additional money.

The profile of these consequentials in cash terms and as a percentage of the Scottish Government’s total resource and capital allocations from the Autumn Statement are shown below.

The announcements in Budget 2017 amount to a half percentage point increase in the Scottish Government’s 2017/18 resource allocation and a 0.7 percentage point increase in its capital allocation.

The announcements at Autumn Statement 2016 implies that the Scottish Government’s resource budget from Westminster would fall by around £800m in real terms (i.e. adjusted for inflation) between 2016/17 and 2019/20. In this context, and additional £260m in cash is not an insignificant boost, but spread over three years it does not alter the conclusion that the Scottish Government will face challenging real terms funding reductions over the course of this parliament.

If the government maintains its ambition to return the public finances to surplus in the next parliament, further cuts beyond 2020/21 are highly likely – taking the period of ‘austerity’ to well over a decade. Of course some will question the necessity of aiming for a surplus on the public finances, particularly when the economy remains relatively weak.

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | Total | |

| Consequentials announced in Budget 2017 | |||||

| RDEL | 124 | 85 | 51 | n/a | 260 |

| CDEL | 21 | 22 | 24 | 23 | 90 |

| Consequentials as % Scottish Government totals (Autumn Statement 2016) | |||||

| RDEL | 0.47% | 0.32% | 0.19% | n/a | 0.33% |

| CDEL | 0.68% | 0.67% | 0.68% | 0.63% | 0.66% |

The Chancellor also announced a review of North Sea tax rules, with the aim of encouraging further investment in the industry, and spreading the costs of decommissioning between government and industry. Oil revenues are forecast to ‘peak’ at £1 billion in 2019/20, confirming that the sector’s days as a large tax generating source for the Exchequer are over.

A boring budget?

Overall, Phillip Hammond’s first and last March Budget was, as expected, relatively straightforward (if not boring!)

For all the recent upbeat talk about the performance of the economy in 2017, the economic and fiscal outlook over the parliament has not really changed since November, with forecasts for relatively slow growth underpinned by ongoing economic uncertainty, weak global growth, and the effects of inflation on consumer spending. Moderate spending increases are funded through moderate tax rises, with the medium term outlook for public sector borrowing remaining unchanged.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.