Today we published our latest Economic Commentary – for a quick summary of its findings please see this quick video. The full Commentary can be found here.

- Uncertainty continues to act as a drag on Scotland’s economic performance

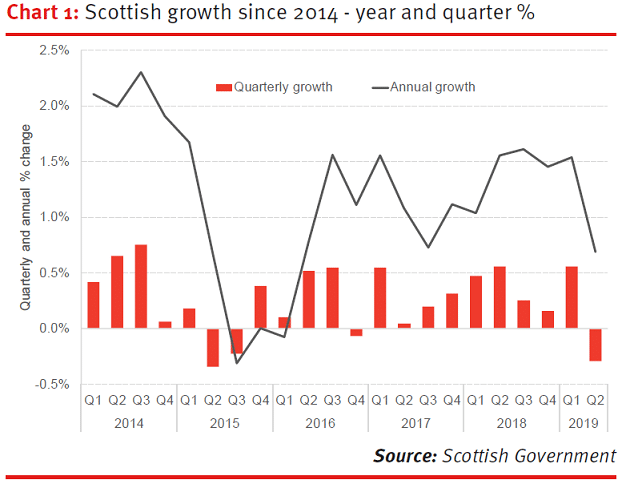

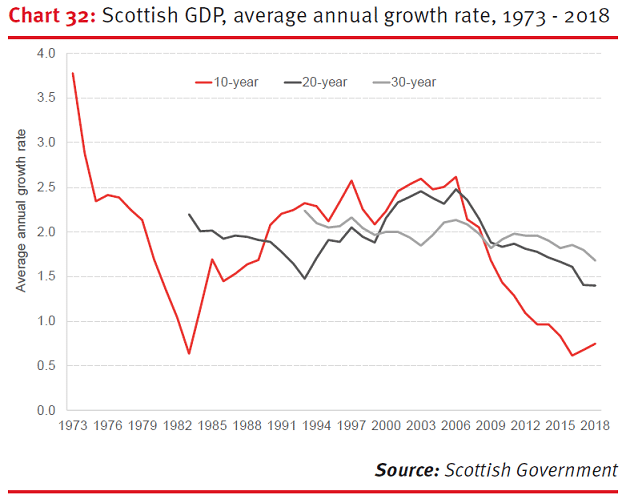

Scotland’s annual growth rate has slipped once again to just 0.7%. UK growth – whilst faster than in Scotland – is also well below trend at 1.2%

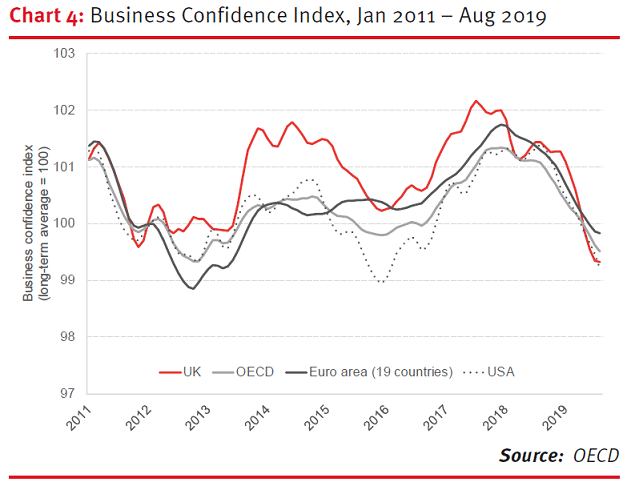

Consumer confidence and risk appetite amongst businesses remains weak.

Business investment in the UK has now been negative in 5 of the past 6 quarters.

Shortly before our June Commentary, figures for Scotland showed economic activity in Q1 of 2019 rising at its fastest rate in almost five years.

At that time, we cautioned that such figures were likely to be impacted by firms stockpiling in the run-up to the first Brexit deadline of 31st March.

Consistent with this, the latest figures now show that the economy contracted by 0.3% in Q2.

- But talk of an immediate recession is wide of the mark with most indicators pointing to growth returning over the summer as the effects of stockpiling are unwound

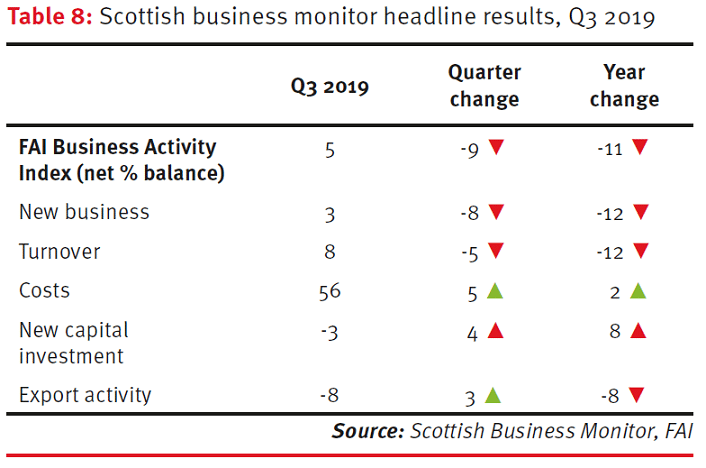

On balance, a majority of Scottish businesses are reporting that activity and new business remains positive, but costs are rising and investment intentions remains negative.

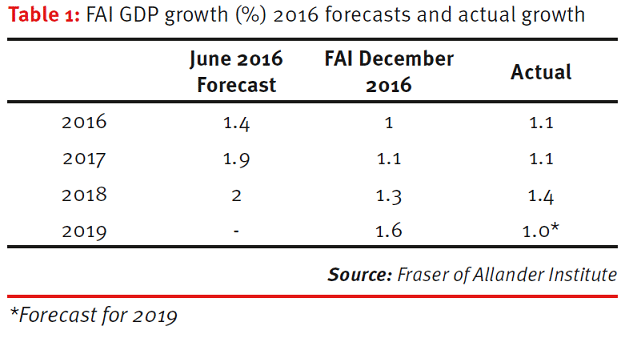

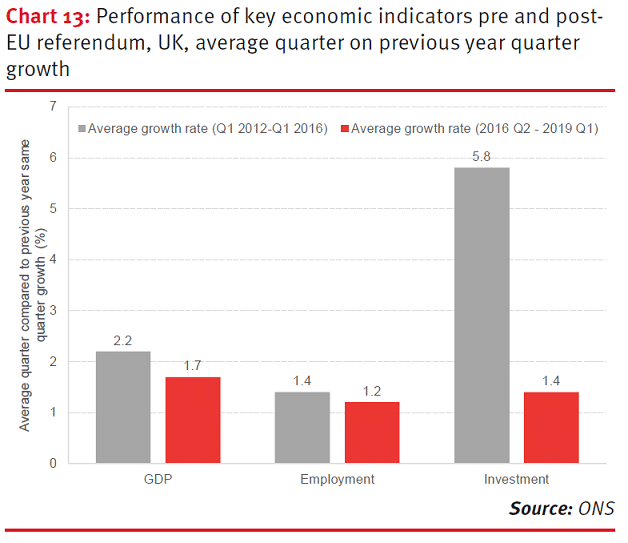

- Whilst some of the more extreme predictions for how the economy would react to a ‘leave’ vote have proved to be wide of the mark, it is clear that there has been an impact

We estimate that – based upon forecasts prior to the EU referendum – our economy is around 2% smaller (equivalent to £3 billion) smaller than we expected.

- Possibility of a ‘deal’ should help boost growth in the short-run and help us recoup some of that lost activity.

Securing a deal will help lift some of the fog of uncertainty that has hung over the Scottish and UK economies in recent times.

As a result, in the short-run, the economic outlook should improve, with businesses more likely to invest and unlock postponed demand.

But even if a deal is reached – or a further extension is put in place – much of the UK’s future relationship with the EU will remain unresolved. So a period of uncertainty is here to stay.

There may also be a trade-off between short-term uncertainty and longer-term growth.

For example, Boris Johnson’s new plan is for a ‘harder’ Brexit than that put forward by Theresa May. As a result, whilst demand may pick-up if there is an agreement, the longer term challenges may be more negative if the end-result is greater trade barriers and less integration with our key export partner.

So short-term gain may be traded-off for longer-term pain.

- All this comes at a time when the outlook for the global economy looks much less rosy than it has done for a number of years…..

Early last year, the consensus forecast for world growth in 2019 was over 4%. The latest predictions are for growth of just below 3%.

While relatively broad-based, the slowdown has been particularly acute in a number of countries.

Europe’s largest economy – Germany – is teetering on the brink of recession. Italy formally entered recession in late 2018.

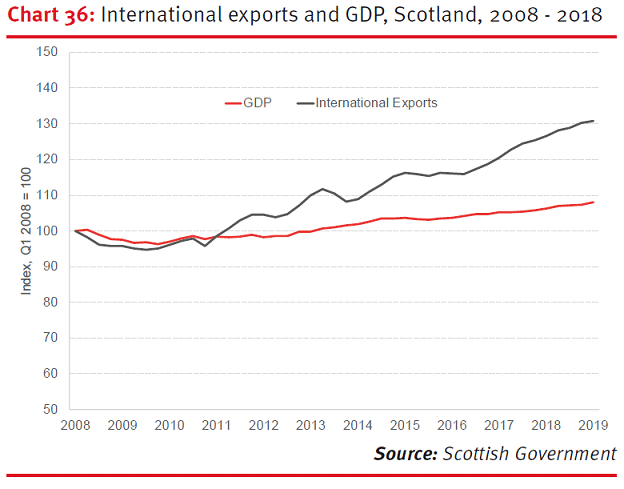

- …..but despite this, Scottish exports have performed strongly in recent times

In May, the Scottish Government published a new strategy which was much bolder in its approach to supporting businesses to grow their international footprint than we have perhaps seen in the past.

In recent times, Scottish exports have actually grown more quickly than the domestic economy.

Indeed, since 2016, international exports have grown by 9% in real terms, compared to 4% growth in GDP.

- Whilst Brexit has clearly had an impact, economic growth in Scotland has been weak for some time

It remains surprising that the performance of the economy does not feature more permanently in the policy debate.

Too often, discussions are dominated by soundbites (‘the Scottish economy is resilient’ or ‘the Scottish economy lags the UK’). And most of the time, debates get no further than simply asserting that higher tax rates are to blame (despite little evidence to back this up) or that the solution is to spend more money (with no explanation of where such monies will come from).

Similarly, it is increasingly commonplace to divert attention from the growth debate by arguing for ‘wellbeing’, blaming Brexit or asserting that further constitutional change will solve all our challenges.

Brexit will usher in the greatest shift to our economy in over a generation. A more open discussion, not just of the risks and opportunities that Brexit will bring, but the underlying growth dynamics of the Scottish economy more generally, is needed.

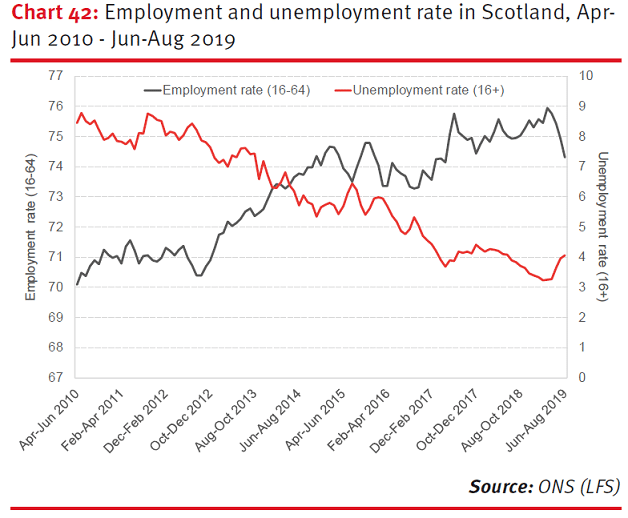

- Scotland’s labour market continues to perform strongly – at least on aggregate indicators – compared to historical trends with high numbers of people in work

That being said, Scottish unemployment jumped 0.8 percentage points, and employment fell 1.4 percentage points, in the most recent data covering the three months to August.

This means that relative to earlier in this year, 20,000 more people are unemployed in Scotland, and nearly 60,000 fewer people are in employment.

- In December, the Scottish Government will publish their budget for 2020-21 – where Mr Mackay will be balancing a weaker outlook for devolved tax revenues alongside a much higher block grant

In July, we had outturn data for how Scottish tax receipts had performed in 2017/18 – the first full year of tax devolution. This confirmed that a gap has opened up between outturn revenues and the forecasts that were used to determine the 2017/18 budget.

As a result, the Scottish Budget for 2020/21 will be adjusted by just over £200 million to cope with these reconciliations.

The better news for Mr Mackay is however that the new Chancellor – Sajid Javid – has announced a significant uplift in spending across the UK (up 4.1% in real-terms). Via the Barnett Formula, this spending will be passed on to the Scottish budget.

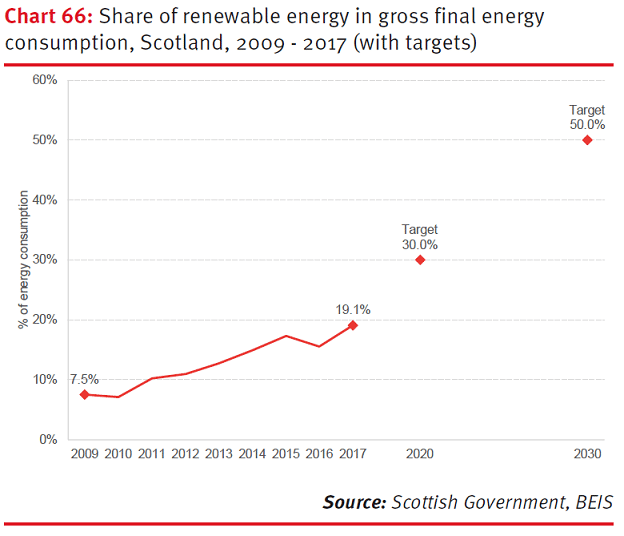

- The Scottish Government is setting a bold agenda on climate change, with a consistency of approach, visibility of leadership and commitment to action that sets it apart from the rest of the UK

In this quarter’s policy section of the commentary we discuss the target of achieving ‘net zero’ by 2045.

But the scale of the challenge – in both Scotland and the UK – should not be underestimated. Achieving such significant reductions in CO2 emissions will require a fundamental change within nearly every aspect of day-to-day life, including the way we heat our homes, the locations and types of new building stocks, the sources of our food supply and the transport systems we depend upon. It is not clear that the true scale and pace of this change required is yet fully appreciated.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.