New labour market data and an update on statistics relating to the social security system were released this morning, with updates on the UK Government schemes for those on furlough or receiving self-employment support out yesterday.

This article gives a summary of these data, and what they tell us about the labour market right now.

Headline labour market data

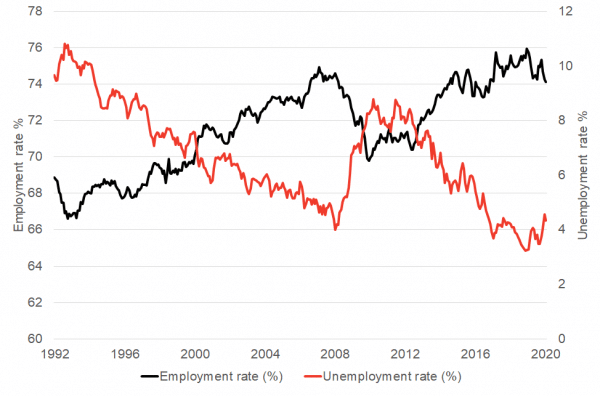

The data today show that the headline unemployment rate in Scotland stayed relatively low by historical standards at 4.3%, although the number of people unemployed is up 28,000 on a year ago. Meanwhile the employment rate remained at a high rate of 74.1%, although employment is 53,000 lower than a year ago.

Source: ONS, Labour Force Survey

UK Government employment support schemes

That said, and even with the recent falls in employment and rise in unemployment, we know that these numbers are not a full reflection of the employment situation facing workers in Scotland at the moment or are likely to face in the coming months.

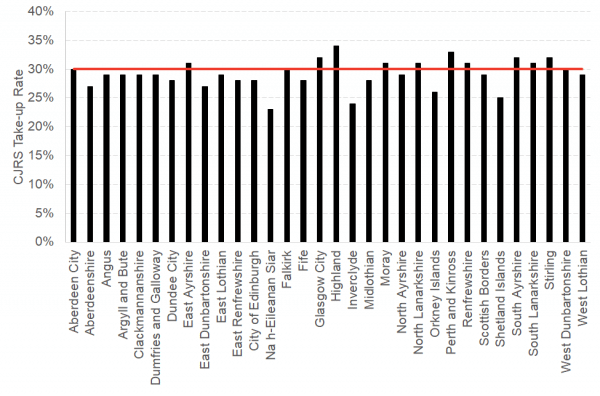

Data released yesterday (covering the period to the end of June) show that in Scotland 30% of employments, translating to 737,000 jobs, have been furloughed by businesses using the UK Government’s Coronavirus Job Retention Scheme, and 155,000 claims have been made by self-employed workers to a similar initiative.

| Country / Region | Employments furloughed | Eligible employments | Take up-rate |

| England | 7,600,900 | 25,577,800 | 30% |

| North East | 329,500 | 1,115,000 | 30% |

| North West | 974,500 | 3,281,400 | 30% |

| Yorkshire And The Humber | 711,700 | 2,403,800 | 30% |

| East Midlands | 654,600 | 2,206,100 | 30% |

| West Midlands | 820,200 | 2,580,400 | 32% |

| East | 830,800 | 2,892,000 | 29% |

| London | 1,291,600 | 4,331,300 | 30% |

| South East | 1,216,600 | 4,250,700 | 29% |

| South West | 771,400 | 2,517,100 | 31% |

| Wales | 378,400 | 1,311,700 | 29% |

| Scotland | 736,500 | 2,471,300 | 30% |

| Northern Ireland | 240,200 | 791,100 | 30% |

| Unknown | 417,700 | 201,200 | * |

| UK Total | 9,373,900 | 30,353,200 | 31% |

Source: CJRS Statistics, UK Government

The take up rates across local authorities are generally not that different from the Scotland average (red line in the chart below). The standout for their low uptake rate, excluding the Island local authorities, is Inverclyde at just 24%.

Source: CJRS Statistics, UK Government

Social Security system data

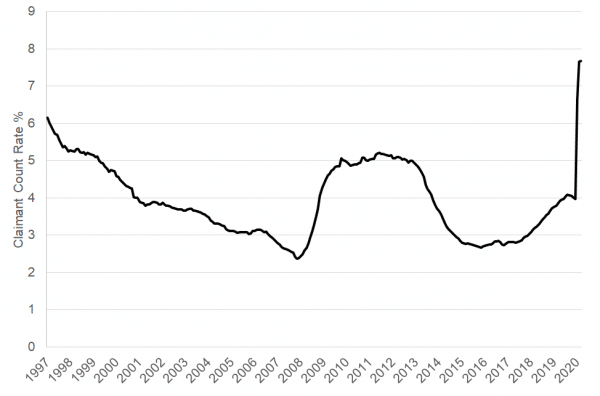

The emerging data from the social security system is an early warning of the scale of the challenge ahead, with a doubling in the claimant count rate since this time last year.

Source: ONS, DWP

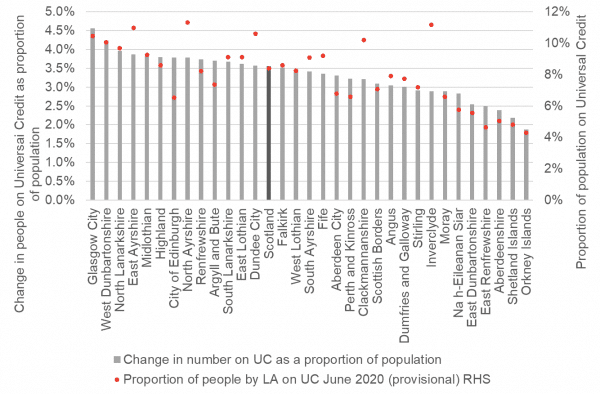

Looking in more detail at the Universal Credit statistics that were released today, we again see some interesting trends by local authority.

Source: ONS, DWP

Usually, during a recession, areas that are already economically fragile, and have high levels of Universal Credit, usually take the largest hit reflecting the low quality and precariousness of many of the jobs that predominate in these areas.

So far, this hasn’t been the case across the whole of Scotland. This reflects the fact that certain sectors have been shutdown whilst others have not – notably the accommodation and food services sector. This would explain why Inverclyde, with a relatively low exposure to this sector, has seemingly been less affected than other areas and has relatively lower take-up with regards to the Job Retention Scheme.

This is not to imply that people in Inverclyde have not been affected – and indeed as a region that has had longstanding economic problems, the financial resilience of households and communities in the face of this crisis may well be lower than in other harder hit parts of Scotland.

However, it is a reminder that so far, the economic impacts of Coronavirus are not being felt in the same way in all parts of Scotland.

Outlook

As businesses restart, and the furlough and self-employment support schemes begin to wind down, there will be a reassessment of the workforce needs of businesses. With many starting back up at a fraction of their pre-CoVid capacity. When this happens we expect a substantial jump in unemployment and drop in employment.

To give an idea of the scale here, it will take less than 20% of those on furlough to lose their jobs for the unemployment rate to more than double – and that is before factoring in what might happen to those who are self-employed and currently receiving government support.

With vacancies in short supply, it will take some time for people to get back in to work, and we know that for workers even relatively short periods of unemployment can have very persistent effects on their future, particularly so for the young.

It is crucial that a plan is put in place to support those who do lose their job, or who exit education and cannot access a job, to receive training and support opportunities.

We may also see economic malaise spread more widely to some of the sectors currently less exposed to the crisis as businesses reassess their longer term future in the light of high uncertainty and knock-on effects across supply chains. As we have said before, many of the implications of Covid-19 on the economy and the labour market are yet to be understood.

Authors

Head of Research at the Fraser of Allander Institute

Emma is Deputy Director and Senior Knowledge Exchange Fellow at the Fraser of Allander Institute