Professor Ross Brown, Department of Entrepreneurship & Small Business Finance, School of Management, University of St Andrews

If you would prefer, you can read or print this article as a pdf

Introduction

This paper highlights the impact of the Covid-19 pandemic crisis on Scottish small and medium-sized enterprises (SMEs). Covid-19 has created an enormous systemic economic shock, potentially surpassing the one created by the global financial crisis (GFC) in 2007/08 (Baker et al, 2020; Brown and Rocha, 2020). Such is the uniqueness of the current crisis some label it a metaphorical “black swan event” for entrepreneurship, as it encompasses virtually every sector, every type of business and every country spanning the global economy (Kuckertz et al, 2020). Indeed, empirical work from around the world shows that as many as half of all small firms have temporarily ceased trading since the lockdown and as many as 60% of SMEs are at risk of running out of their cash reserves (Bartik et al, 2020; Cowling et al, 2020; Giupponi and Landais, 2020).

Public policy attention in Scotland and elsewhere has inevitably, and quite understandably, centred on mitigating the immediate effects of the Covid-19 crisis on SMEs in terms of their ability to maintain staffing levels, avoid cash-flow problems and prevent widespread bankruptcies in the wake of the lockdown (OECD, 2020). In this paper, we reflect on past crisis episodes to help map out the nature of the likely longer-term effects of the pandemic for Scottish SMEs to help appropriate policy responses to be properly constructed and specified. The paper also identifies the likely implications for innovative SMEs owing to their central role in driving longer-term productivity growth (Lee et al, 2015; Haldane, 2018).

The impact of the crisis on Small and Medium-Sized Enterprises

Comprehensive evidence suggests the firms likely to experience the greatest impact from shock events are SMEs (Doshi et al, 2018; Howell et al, 2020). In March 2018 there were 343,535 SMEs operating in Scotland, accounting for 99.3% of all private sector firms[1]. Together they employ around 60% of the Scottish workforce. In other words, SMEs dominate the Scottish business population, so how these firms survive, adjust and adapt to the Covid-19 crisis will have an enormous bearing on future economic and societal welfare in Scotland for years to come.

We now highlight the key transmission mechanisms through which the crisis will affect Scottish SMEs. Extensive research shows that the SMEs are heavily impacted by exogenous shocks owing to their limited capabilities to mitigate these events and withstand the attendant financial instability and uncertainty, resulting in major falls in capital investment (Herbane, 2010; Doshi et al, 2018). Previous unforeseen events such as the GFC and Brexit caused significant damage to SMEs.

During a crisis, SMEs also encounter liquidity problems, which occurs when the cash generating ability of the company fails to pay for their current obligations and liabilities. Liquidity problems often result in cost-minimisation strategies rather than new revenue activities. Indeed, a lack of finance instils a “wait and see mentality” which then leads to a lack of adjustment in SMEs. This then results in a large under-investment in growth-related activities such as innovation, capital investment and international activities (Brown et al, 2019a).

Internal sources of finance are crucial for start-ups and SMEs (Robb and Robinson, 2014). Our recent work shows that many UK SMEs have very limited spare financial resources and only modest precautionary savings (Cowling et al, 2020). This means that many businesses will quite quickly run out of cash reserves thus endangering their continuation and the livelihoods of their dependents. Our preliminary assessment of precautionary cash reserves in UK SMEs suggests that there are potentially 120,000 UK businesses (mostly micro firms with less than 10 employees) at immediate risk of a liquidity crisis if they cannot generate a revenue stream for a few months (Cowling et al, 2020).

Furthermore, it is estimated approximately half a million UK SMEs are already under significant financial distress due to the crisis[2]. This suggests around approximately 8,000-10,000 Scottish SMEs may be at immediate threat of closure due to a lack of cash reserves, with a further 30-40,000 facing financial distress. Faced with extreme liquidity issues some SMEs may seek recourse to non-traditional high cost sources of finance such as credit cards as they attempt to meet their financial commitments (Brown et al, 2019b). However, this could hinder or jeopardise their longer-term sustainability if excessive costly lending is undertaken.

Access to external sources of finance are also critical, especially for growth-oriented SMEs (Brown and Lee, 2019). Research emphatically suggests access to bank finance becomes more problematic for SMEs during crisis episodes such as the GFC (Cowling et al, 2012; Lee et al, 2015; Demirgüç-Kunt et al, 2020). This can result from a combination of reduced supply of lending by banks and reduced demand from SMEs who face chronic uncertainty. Indeed, levels of borrower discouragement can rise rapidly during a crisis episode which can further curtail planned capital expenditure (Cowling et al, 2016). For example, in Ireland (which went into lockdown slightly earlier than Scotland) credit enquiries for new SME loan applications declined by two-thirds between February and April 2020. This will likely translate into reduced loan applications by SMes in the months to come.

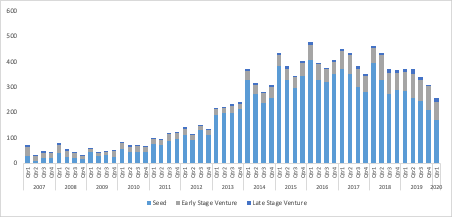

While the vast majority of SMEs use bank finance, innovative growth-oriented start-ups and SMEs often utilise equity finance such as venture capital and business angel finance (Brown and Lee, 2019). Research also suggests that these sources of entrepreneurial finance fall dramatically during crisis and recessionary periods (Howell et al, 2020). Indeed, Figure 1 below shows that the Covid crisis has dramatically reduced these levels of finance in the UK by between 30-40% in quarter 1 of 2020 (Brown et al, 2020). We can see from Figure 1 that this form of funding dropped dramatically following the GFC in 2008, suggesting this decrease is likely to be sustained throughout 2020 and perhaps into 2021 (see Brown et al, 2020).

Figure 1 – Number of UK deals by funding stage (2007 – 2020 Q1)

Source: Brown et al, 2020

This work also shows the deals and firms most negatively affected are seed stage investments in the newest and most nascent start-ups (Brown et al, 2020). In other words, the smallest most innovative and growth-oriented firms may be starved of cash by the crisis with powerful knock-effects on reduced innovation in the longer-term (Howell, et al, 2020). This could mean that Scottish start-ups currently being created may be hindered by a lack of funding opportunities for years to come.

The types of SMEs most vulnerable to the Covid-19 Crisis

We now examine the types of SMEs most vulnerable to the exogenous shock caused by the current pandemic. Inevitably, as with all recessionary periods there will be winners and losers from these unfolding events, irrespective of firm size, age, sector, ownership structure and geographic location. However, there is a strong body of evidence that suggests certain types of SMEs are more at risk from crisis periods than others. Identifying these firms is a crucial first step to enable appropriate policy measures be deployed to ameliorate these malign effects.

While the crisis will undoubtedly result in business closures, it should also born in mind that business churn within the population of SMEs is an inevitable and positive aspect of the Schumpeterian resource re-allocation process which occurs within economies during recessions. For example, as some conventional retailers/restaurants go bust due to lockdown measures resulting in job losses, others online retailers and food delivery companies will grow and thrive creating new employment opportunities elsewhere. This process will likely remove a sizeable proportion of the long-tail of low productivity SMEs in the UK (Haldane, 2018).

Without question the firms facing the most immediate threat from the lockdown are the smallest and least resilient micro-firms employing between 1-9 employees. These are the firms with the weakest cash reserves and lowest capacity to access to external debt finance to ease their liquidity constraints. Importantly, research also strongly suggests they often face crisis events by becoming discouraged from borrowing as they fear they will be rejected by banks (Cowling et al, 2012).

Start-ups are also heavily impacted by crisis periods (see Kuckertz et al, 2020). This important pipeline of the business stock often need external finance to get their business ventures off the ground. For some conventional start-ups, many rely on their own sources of capital and savings to finance their ventures. However, for more innovative and capital intensive start-ups this self-funded route may not be feasible or indeed practicable. It would appear highly likely that start-ups will be credit rationed during the crisis owing to the likely contraction of both debt and equity finance noted above.

A shortage of finance for new ventures is of crucial importance because research shows that start-ups born during recessions are not only start smaller, they stay smaller in subsequent years even when macro-economic conditions recover (Sedláček and Sterk, 2017). This means that the future levels of innovation in the Scottish economy are also likely to be negatively impacted. This is also likely to decrease entrepreneurial entry as studies have already noted. Data on new business applications from the US from the last week of March show that applications were down 40% compared to the same week one year earlier, a contraction that is even sharper than that during the Great Recession[3].

Funding problems are especially acute for very small and innovative SMEs (Lee et al, 2015). Our research strongly shows that problems accessing bank finance are particularly acute for innovative SMEs who often have limited collateral, intangible IP and unstable cash flows which make banks unwilling to lend (Lee and Brown, 2017). Innovative firms are also those most likely to self-ration finance for fear of rejection, thereby becoming so-called “discouraged borrowers” (Brown et al, 2018). Given their importance to economic development, enabling access to finance for innovative firms is a crucial policy objective during recessionary periods to enable such firms to undertake these strategic investments.

Geographic location also determines a firm’s ability to access finance. In the UK it has been shown that SMEs located in rural and remote parts of the UK face greater challenges accessing bank finance (Lee and Brown, 2017). This is due to fewer bank branches in these locations and low levels of competition between banks. SMEs often prefer close relational engagement with banks but are often too small to be given access to account managers. Furthermore, following the GFC many banks have heavily reduced their customer-facing employees to reduce costs, further exacerbating the problems faced by rural SMEs. Therefore, rural and peripheral SMEs in Scotland could be especially hampered by the crisis, especially as many are highly dependent on the travel and tourism sector which has been massively impacted due to the lockdown and the stop to travel by tourists. Remote and peripheral areas of Scotland with low levels of local demand could be very badly impacted.

Turning to sectoral impacts, it would appear that localised service-based firms are being most heavily impacted due to the lockdown of large swathes of the service sector such as retailers, hospitality (pubs and restaurants), tourist-related firms, taxi firms, personal services (hairdressers, nail-bars etc.) estate agents, sports clubs and so on. This has resulted in a quarter of UK businesses temporarily closing their business. It is hoped the UK’s job retention scheme can alleviate the immediate problems of paying staff salaries. However, some of these firms are unlikely to be able to continue trading without sustained levels of support over the short-to medium term given a reduced level of consumer demand caused by social distancing measures.

These types of SMEs may also attempt various forms of financial bootstrapping to minimise expenditure to endure a fallow period, such as foregoing management salaries, using credit cards, coming to agreements with suppliers, renting rather than buying equipment and using personal savings to run a business. However, while potentially crucial to maintain a firm’s existence during a crisis period, this form of financial bootstrapping can often result in firms becoming seriously under-capitalised and at risk of closure in the longer-term.

It appears that some of the winners from the crisis could be in high-tech, digitally enabled sectors such as life sciences, medical equipment, online delivery-based firms, software firms and app-based firms. Even during crisis periods, high growth firms will adjust and grow rapidly (Brown and Lee, 2019). Some of these firms may be in receipt of venture capital or business angel finance and already have sufficient funding to ease liquidity constraints. Others may have funding models which make them resilient to shocks such as computer games companies where they get up-front funding from customers to develop new games. Other winners may just be good, well run SMEs with strong cash reserves and a good management team. More prosaic SMEs can also potentially thrive if they adopt new business models and organisational reconfiguration. For example, a traditional local restaurant may reconfigure and become a manufacturer providing ready meals to their local market.

The Focus for Policy Support

From the preceding discussion we can see certain types of SMEs may be particularly vulnerable to the Covid-19 crisis with the potential for debilitating consequences in terms of their future viability and future growth potential. We now set out the main firms to be targeted for policy support, the nature of that support and then highlight some specific recommendations for interventions to mitigate the impact of the Covid-19 crisis.

We highlight above, it is the smallest SMEs, micro-firms and start-ups that are likely to be the most heavily impacted. These very small firms also have the least resources and levels of entrepreneurial resilience to absorb the shock. Innovative firms are also susceptible to these problems owing to their difficulties obtaining finance. Similarly, rural and peripherally located SMEs also face additional challenges.

The sectoral effects are harder to precisely discern but it appears that locally-focused non-tradeable service-sector SMEs are also particularly susceptible to being impacted by the upheaval from the lockdown and the problems associated with social distancing. Sectors like tourism (and hospitality more generally) will be particularly impacted given the lockdown commenced at the beginning of the tourist season and will effectively wipe out the summer season as well. In a nutshell, these types of firms may need to be considered when constructing policy support interventions with additional targeted support measures.

In terms of the nature of policy support there seems to be two key dimensions how policy should operate. In the short-term, there is a need for a very rapid responses to ensure SMEs can continue operating, to ease liquidity constraints and ensure continuity of employment (OECD, 2020). This has been the main focus of the main UK government policy measures enacted to date such as the furlough sick pay scheme and the Covid-19 Business Interruption Loans scheme. In the longer-term, policy support is going to have to focus on a different set of more growth-enhancing measures rather than business survival objectives. Going forward, assisting start-ups, increasing innovation, fostering high growth firms and aiding business internationalisation will be core objectives to help build the recovery process. The types of support instruments emerging in this respect are the UK’s Future Fund. In recognition of the potential impact of the Covid-19 crisis for start-ups, the government’s Future Fund has a (modest) budget of £250m and provides matched funding of between £250,000 to £5m for UK start-ups[4].

We wish to offer a series of key short-term policy recommendations for alleviating the deleterious impact of the crisis for Scottish SMEs based on the issues examined above. Below are seven key policy recommendations:

First, the Coronavirus Job Retention Scheme is probably the single most successful policy instrument enacted by the UK government to mitigate the harmful effects of the crisis. If the scheme ends abruptly for Scottish SMEs in October 2020 as planned, it could lead to extensive business closures thereafter. Consideration should be given to extending the scheme for SMEs in certain predominantly service-based sectors of the economy such as independent restaurants, pubs, personal service firms and tourism-related business until at least the end of the year. Large companies should be excluded from the scheme from but SMEs in those sectors should be given extended access (perhaps at lower rates) to the scheme given the likely reduced levels of demand for these type of local services due to social distancing measures. Being a UK-wide scheme the Scottish Government would need to campaign for this step to be implemented.

Second, during the post-crisis period, while many SMEs will shrink and cease trading many others will grow rapidly. To ensure that these high growth firms help absorb those made redundant, there needs to be a better connection between labour market policies and enterprise support policies. To this end, some economists have advocated hiring subsidies to help encourage increases in new employment hires during crisis periods. Cahuc et al. (2019) provide empirical support that a temporary non-anticipated hiring subsidy in France deployed during the GFC had substantial positive employment effects. This could take the form of a reduction (or cessation) of social security contributions paid by the employer in relation to their new hires for a period of time. It could be targeted at SMEs and offered to promote employment expansion in growing firms. Additional incentives could be offered to SMEs hiring young unemployed people rather than people within the workforce to increase opportunities for newly redundant workers.

Third, while the supply of finance is crucial so is the need for demand. Plus, many SMEs simply do nothing as a consequence of extreme uncertainty. This means firms refrain from seeking external finance because they fear rejection, leading to firms becoming heavily under-capitalised. Therefore, the Scottish government should undertake a major marketing campaign to highlight the range of different support instruments available to SMEs to encourage them to access funds and help alleviate the anticipated increases in discouraged borrowers during the post-crisis period.

The new Scottish National Investment Bank will have a key role to play in this post-crisis environment in promoting new capital investment by SMEs. In the short-term, there is probably a need for a targeted loan instrument operated by the new investment bank for growing firms in badly impacted sectors. Some have also suggested the new bank could insert productivity clauses in the form of loan covenants into their loans to SMEs (Brown, 2020). This could include measures to stipulate training initiatives for young unskilled disadvantaged people most negatively impacted by the crisis[5].

Another approach would be to offer SMEs free financial advice on different funding sources and financial products which are often difficult to comprehend by time-constrained entrepreneurs. This could be targeted towards innovative SMEs who are often entrenched discouraged borrowers and the main focus for the new investment bank (Scottish Government, 2019). Access to information about external sources of finance for start-ups and SMEs can be helpful for enabling entrepreneurs to access the right type of financing for their ventures (Wilson et al, 2015).

Fourth, most of the support offered by the UK government and the British Business Bank has focused on access to finance for SMEs such as the Coronavirus Business Interruption Loan Scheme[6]. This has also been the most common approach across most advanced countries (OECD, 2020). However, survey evidence strongly suggests that during crisis situations, SMEs are highly reluctant to take on additional debt for fear that they will default on loans. This policy focus on providing government backed loans is therefore often a flawed approach for SMEs. Plus, very few micro-firms employing fewer than ten employees, have precautionary funds to help them adapt during a crisis situation (Cowling et al, 2020). This lack of funding to undertake adaptation during a crisis situation is crucial.

To encourage entrepreneurial adaptation policy must focus on changing behaviours. For example, a recent survey by the Federation of Small Business found that a fifth of Scottish small businesses had introduced new online offerings since the crisis[7]. Therefore, the Scottish government should consider offering small grants to SMEs who wish to undertake these types of new revenue-generative activities similar to the Brexit grant provided by Scottish Enterprise[8]. The scheme could offer fast turnaround small grants of less than £5,000 to SMEs who wish to undertake new innovative business practices such as business model adaptation or other forms of product or process innovation.

Providing the right type of incentivesis crucial to help SMEs adjust to the new realities they confront to enable them to remain solvent during a prolonged recessionary period. Often small amounts of grant funding can generate significant behavioural changes for small companies to aid their revenue generating capabilities. Longer term, the government may need to increase tax deductions on capital investment to mitigate falls in capital investment caused by a reluctance to borrow during the crisis.

Fifth, in terms of support for equity finance, the UK government has already implemented the aforementioned Future Fund. It appears from the initial reactions of equity investors that the seed finance deals are likely to be those most affected which predominantly involve investments for start-ups. Owing to the nature of these funding sources, social distancing could result in financial distancing as entrepreneurs and investors cannot meet up and interact (Brown et al, 2020; Howell et al, 2020). One novel approach would be for Scottish policy makers like the new Scottish National Investment Bank to facilitate online engagement between entrepreneurs and private equity investors (i.e. angels) through a secure online meeting place similar to private equity crowdfunding platforms. This novel form of online brokerage could help alleviate the informational problems associated with financial distancing during a crisis such as the Covid-19 crisis.

Sixth, the Scottish Government is a vast purchaser of goods and services across the Scottish economy. Through expenditure on vital public sector services like schools, hospitals, prisons, local authorities and public sector infrastructure, the government has the ability to have a huge impact in terms of its procurement budget. However, often it is larger firms who benefit the most from these public sector contracts owing to the fact smaller firms have less ability to compete on cost with big firms or access to the tendering process of these public sector bodies. Take catering for example, all these bodies spend a vast sum on catering but most contracts are with large UK or multinational firms.

Giving SMEs greater access to these public sector contracts could provide a vital lifeline for smaller food, drink and hospitality firms which are experiencing reduced demand due to the crisis. Enabling SMEs to access new sources of demand could be a vital way of injecting liquidity into these firms. The UK’s departure from the EU will give the UK public sector greater room for manoeuvre in terms of public sector tendering process. Therefore, the Scottish Government should commission work to see how these tendering procedures could be better accessed (and signposted) for Scottish SMEs, perhaps giving incentives to local authorities to commit more expenditure to buying locally from SMEs.

Finally, given the rapidly changing landscape facing Scottish policy makers, they will have to monitor their interventions using real-time data (RTD) sources rather than relying on official backward looking government data sources such as official surveys. RTD sources are often unofficial data which provide up-to-date information on various phenomena like business loan enquiries. Using RTD, countries can also help track the effectiveness of such policy interventions by monitoring future changes in the market for entrepreneurial finance following a crisis period (Brown and Rocha, 2020). Therefore, it can enable real-time policy evaluation to ascertain how effectively entrepreneurial actors respond to policy measures implemented to address crisis situations such as that experienced by SMEs right now as a consequence of the current Covid-19 pandemic.

Conclusion

This paper has highlighted the likely impact of the Covid-19 crisis for Scottish SMEs in terms of identifying the types of firms most at risk and the key transmission mechanisms through which these firms will be impacted. The overarching aim of the paper is to inform Scottish policy makers how to help mitigate the likely negative effects of the crisis for many small firms. It does so by offering a list of detailed key policy recommendations to help inform the Scottish Government during this time of crisis.

This kind of detailed analysis is crucially important as the current Advisory Group on Economic Recovery has largely (and surprisingly) neglected the crucial issues facing SMEs at the present time (Scottish Government, 2020). This is probably of no great surprise given the lack of formal representation on the group from the small business community such as the Federation of Small Business. Much like the similarly vague (so-called mission-led) plans for the new Scottish National Investment Bank (Brown, 2020), it offers abstract goals such as a green, inclusive and investment-led recovery. It is also oddly devoid of academic evidence of how different types of firms respond to unforeseen shock situations. Consequently, the report is woefully inadequate in articulating the main problems facing the economy or providing policy makers with a strategic road map of how to help the vast majority of the business sector recover from the crisis[9].

While offering some potentially useful recommendations to aid the recovery such as a proposed Scottish Jobs Guarantee Scheme to help younger workers in the labour market, the report offers a series of very odd policy suggestions such as the Scottish Government taking ownership stakes in failing firms. Policy makers are frequently lambasted for poor decision making when trying to “pick winners” in terms of selecting the SMEs with strong growth potential for support. Picking losers could be even more hazardous given the politicised nature of such decisions. This type of policy intervention is likely to be fraught with huge levels of moral hazard and adverse selection. Plus, given their strong desire for operational autonomy and control, most entrepreneurs would baulk at the prospect of such intervention. Similarly, the recommendation banks should benignly develop new products to help incubate companies is another very unrealistic and somewhat far-fetched idea, especially given the manner in which banks responded to smaller firms during the GFC.

Overwhelmingly, small firms are those most heavily and negatively impacted by the chronic uncertainty caused by crisis situations for the multiple reasons elaborated within this paper. Just as the Scottish Government has admirably assembled expert medical evidence to help control the spread of the virus given the specific nature of the Scottish context, it is incumbent on them to respond quickly using the best available evidence to help avert the crisis wreaking further economic and societal devastation across the small business population in Scotland. The Scottish Government therefore needs to produce a sensible set of imaginative measures based on the latest evidence to quickly address and alleviate the profound problems confronting SMEs. While SMEs are the firms most heavily impacted by this crisis, they will also be a crucial vehicle to enable a sustained economic recovery.

[1] https://www.gov.scot/publications/businesses-in-scotland-2018/

[2] https://www.ft.com/content/f9537538-d7a0-44e3-8e86-5cb9a984aae4

[3] https://voxeu.org/article/startup-employment-calculator-covid-19

[4] https://www.businessinsider.com/uk-250-million-future-fund-explained-2020-4?r=US&IR=T

[5] https://www.ilo.org/global/about-the-ilo/newsroom/news/WCMS_740893/lang–en/index.htm

[6] https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-scheme-cbils-2/?gclid=EAIaIQobChMIifbRko2G6gIVme3tCh3VNwr_EAAYASAAEgK8-fD_BwE

[7] https://www.eveningexpress.co.uk/news/scotland/small-businesses-in-scotland-innovate-to-keep-going-through-pandemic/

[8] https://www.scottish-enterprise.com/support-for-businesses/prepare-for-brexit

[9] The so-called Higgins report mentions SMEs once (see Scottish Government, 2020, pg 39).

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.